According to Messari’s State of Polkadot Q1 2025 report, transaction activity within the Polkadot ecosystem slowed in the quarter, dropping 36.9% quarter-over-quarter to 137.1 million. The drop is attributed to more efficient transaction processing by Neuroweb, which was introduced in the first quarter. Despite the quarterly decline in transactions, three Polkadot-based networks — namely Moonbeam, Mythos, and Peaq — all maintained positive momentum.

To illustrate, the Messari report indicates that Moonbeam processed 16.7 million transactions during the quarter, up 6.5% quarter-over-quarter. That made up 12.2% of all transactions across the ecosystem. On the other hand, transactions on Mythos increased 12% quarter-over-quarter to 12.3 million during the quarter, accounting for 9% of all ecosystem activity. Peaq increased 84% quarter-over-quarter to 10.1 million in Q1 2025, representing 7.4% of ecosystem transactions.

However, the data shows total monthly active addresses across the Polkadot ecosystem declined from 610,000 to 529,900, a 13.1% quarter-over-quarter decrease. Developer activity, on the other hand, was mixed with the number of average weekly active core developers rising to 122, a 1.5% increase. In contrast, average weekly active ecosystem developers “fell 5.7% to 421, while average weekly ecosystem commits dropped 14.4% to just over 3,000.”

During the quarter, several steps were taken to improve developer experience and onboarding new contributors, including the launch of the PAPI Console, a new interface for developers to interact with chains more easily. The UX Audit Grants Program, designed to help Polkadot projects identify and resolve usability issues through professional UX audits, was also launched during the quarter.

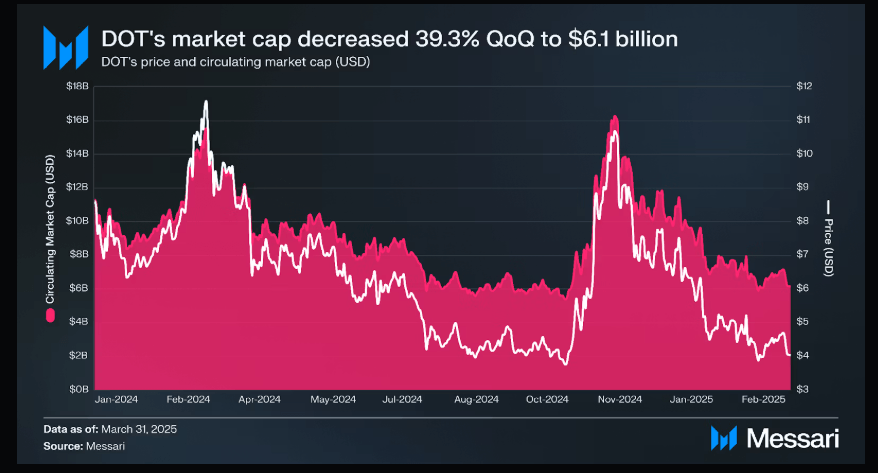

These efforts, nevertheless, failed to stem a worrying trend which is also discerned from the performance of Polkadot’s native token in the same period. As shown by data, DOT commenced the quarter with a market capitalization of just below $8 billion, but this had dropped to $6.1 billion by the end of March. At the time of writing (June 28, 11:47 a.m. EST), DOT’s market capitalization stood at $5.14 billion.

Although Polkadot’s performance in Q1 (and indeed for much of the year to date) mirrors that of the broader market, critics believe it does not match the hype and funding it has raised. One social media user and crypto trader, Nonzee, brands the network crypto’s biggest bet that faded into a ghost chain.

Slamming what he calls Polkadot’s “hype without traction,” Nonzee pointed to DOT’s decline from its peak of $55 to its current price of around $3.30. The social media user also highlighted Polkadot’s most ambitious governance models could not stop whales from hijacking it. The user claims that of the over $129 million spent by treasury, “most of it had no clear ROI.”

While admitting that Polkadot’s tech got better, Nonzee argues that this is pointless without users or narrative.

“Polkadot proves tech doesn’t equal traction. It built the chassis of a Web3 supersystem — but with few users, slow adoption, dev drop-off, market freeze, it feels like a ghost town. If a real-world killer app arrives, it could return from the dead. Until then? $DOT remains a top-tier tech engine nowhere built into,” the social media user warned.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。