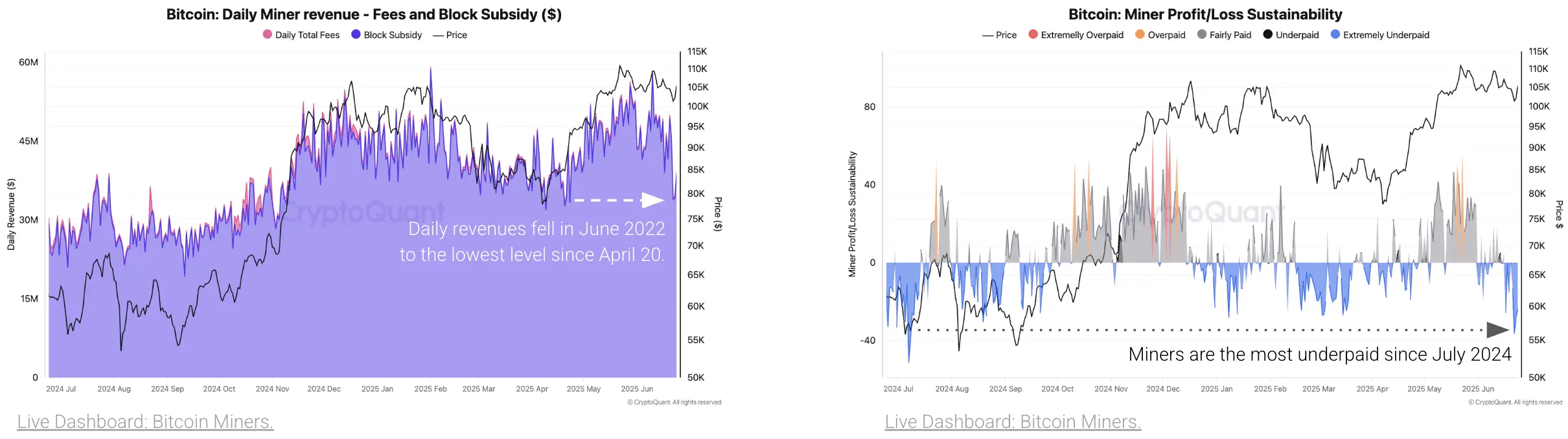

Miner revenue slid to $34 million on June 22, the weakest since April 20, as lower transaction fees and a softer bitcoin price squeezed earnings, cryptoquant.com data shows. Researchers attribute the slump to fading Ordinal inscription activity that inflated fees earlier in the quarter. The firm’s Miner Profit/Loss Sustainability metric now flags miners as “extremely underpaid.”

The report notes that lower income is already nudging network activity: Bitcoin’s hashrate has slipped 3.5% since June 16, the steepest pullback since an 8.4% post-halving drop in July 2024, according to Cryptoquant’s dashboard. Researchers warn that prolonged computational weakness could herald broader miner capitulation if BTC prices fail to rebound.

Despite thinner rewards, miners are not capitulating. Outflows have fallen from a 23,000-bitcoin daily peak in February to about 6,000, and direct transfers to exchanges remain subdued, the report notes. The Cryptoquant analysis calculates operators still enjoy a 48% margin and says miners plan to ride out volatility rather than dump current inventory.

Long-dormant Satoshi-era wallets have sold only 150 bitcoin this year, compared with thousands of coins in 2024, easing fears of legacy supply hitting the market, according to Cryptoquant researchers. Such light selling from early adopters often aligns with continued bull-market conditions, the analysts say.

Meanwhile, miner addresses holding 100 to 1,000 bitcoin have lifted reserves from 61,000 coins on March 31 to 65,000 in total, the most since November 2024, signaling accumulation as revenue pressure mounts, the cryptoquant.com analysis concludes. Such reserve growth often precedes price recoveries, though researchers warn rising energy costs and regulation could squeeze margins at present.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。