Author | Wu Says Blockchain Aki Chen

The content of this article is a compilation of publicly available information and does not represent the views of Wu Says. It does not provide any investment advice. Readers are advised to strictly comply with the laws and regulations of their location and not to participate in illegal financial activities.

Event Review

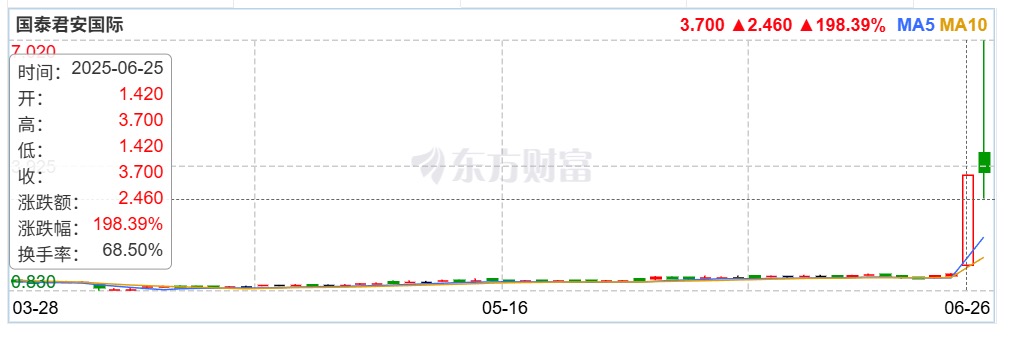

On June 24, Guotai Junan International (01788.HK) announced that it had obtained a virtual asset license in Hong Kong, leading to a stock price surge of over 80% and attracting market attention to the sector. According to statistics, among listed companies, only four hold the Hong Kong Virtual Asset Trading Platform (VATP) license, including OSL, Guotai Junan International (01788.HK), Futu Holdings (FUTU.US), and Tiger Brokers (TIGR.US). Among them, the Hong Kong-listed companies holding the VATP license are mainly OSL and Guotai Junan International, while Futu Holdings and Tiger Brokers are in the U.S. stock market. The licensing of Guotai Junan International has further heightened market interest in related concept stocks.

According to the official announcement, Guotai Junan International has been approved to upgrade its "Type 1 Securities Trading License" to provide virtual asset trading services. The scope of services includes: providing direct virtual asset trading services (such as BTC, ETH, and stablecoin USDT), offering advice during the virtual asset trading service process, and issuing and distributing virtual asset-related products, including over-the-counter derivatives, structured notes, and tokenized securities.

However, in reality, since 2024, Guotai Junan International has been introducing structured products based on virtual asset spot ETFs in the Hong Kong market and has obtained permission from the Hong Kong Securities and Futures Commission to conduct virtual asset trading platform introduction agent business. Until February 2025, the Hong Kong Securities and Futures Commission released the "A-S-P-I-Re" regulatory roadmap, clearly stating that stablecoin management regulations would be implemented in August. Guotai Junan's actions coincided with the policy implementation rhythm and are seen as a practical landing of the Hong Kong government's "virtual asset international hub" strategy.

As of June 25, after the opening, Guotai Junan International's stock price surged, closing up 198.4%, driving the Hong Kong Chinese brokerage index up 11.75%. In the A-share market, several brokerage stocks, including Tianfeng Securities, hit the daily limit, and Dongfang Caifu rose over 10%, with the Wind brokerage index closing up 5.52%.

Why the Market Reaction is Intense — The Symbolic Significance of Licensing Effect

It is worth noting that MetaEraCN tweeted that although Guotai Junan International has become the first approved Chinese brokerage, it is not the only institution laying out virtual asset licenses. According to industry insiders directly involved in the virtual asset license application and system integration, several local Hong Kong brokerages, including Victory Securities and Ade Securities, have completed the upgrade application for the Type 1 license. After the news of Guotai Junan International's licensing was announced, the capital market reacted strongly, but Futu Holdings (FUTU.US) has been continuously laying out in the virtual asset field since 2022, and its Hong Kong subsidiary, Futu Securities (Hong Kong), has long been connected to compliant platforms and provides digital asset distribution, custody, and other services.

According to BTCdayu's analysis of this difference, Guotai Junan International is a holding subsidiary of Guotai Junan Securities, with the largest shareholder being Guotai Haitong, holding 74%, and the actual controller of Guotai Haitong is the Shanghai State-owned Assets Supervision and Administration Commission. Moreover, it has been reported that the Shanghai State-owned Assets Supervision and Administration Commission recently stated that it would invest 10 billion yuan in the next five years to support financial innovation and technological development. Against this backdrop, the market has attributed a "national-level strategic pilot" narrative to Guotai Junan International's virtual asset layout, believing it may enjoy first-mover advantages in policy, funding, and resource acquisition. In contrast, Futu, as an internet brokerage, is controlled by non-state capital, limiting its market association space and relatively small influence domestically. Furthermore, Guotai Junan International is the first Chinese-backed brokerage approved to provide full-chain virtual asset services (trading, consulting, distribution), which has symbolic significance as a "path pioneer" under the regulatory structure, thus creating a scarcity premium in the market. Although Futu obtained similar qualifications through its subsidiary as early as 2023, its identity as an internet platform and its positioning differ from traditional brokerages, and the market has high expectations for its Web3 transformation, with valuations fully reflecting this, lacking additional positive catalysts. In contrast, Guotai Junan International's stock price has been consolidating at a low level in 2024, and the market has not fully accounted for its progress in virtual assets. More importantly, Guotai Junan International (1788.HK) is a target of the Shanghai-Hong Kong Stock Connect, allowing A-share funds to invest in this stock through the northbound channel. Against the backdrop of the hot A-share brokerage, Web3, and stablecoin concepts, A-share funds tend to use the Hong Kong Stock Connect to allocate benefiting targets, further intensifying stock price fluctuations and capital chasing. In contrast, Futu Holdings is a U.S.-listed company (FUTU.US) and is not on the Hong Kong Stock Connect list, making it unable to receive A-share funds, even if its qualifications and business capabilities are not inferior, it is also difficult to form a narrative hype around "policy windfall."

Opportunities and Risks Faced by Chinese Brokerages and Exchanges

From Guotai Junan International's layout, its compliance path is to enter the virtual asset market as a traditional brokerage by upgrading its license and relying on local regulatory channels. However, according to EarningArtist, most brokerages currently do not have their own exchanges but mainly access trading services by establishing Omnibus Accounts on licensed platforms like HashKey. Several brokerages (such as Futu, Tiger Brokers, and ZhongAn Bank) adopt similar models and strictly limit the client base, for example, requiring clients to have Hong Kong or overseas identities and not accepting mainland residents for trading. Therefore, the seemingly hot regulatory breakthrough actually opens virtual asset services only to a small number of overseas investors. For most mainland residents, even with high attention, it is difficult to truly engage in this business. Even if they have the relevant identity, they still need to complete compliance tax information declarations and meet the compliance requirements for overseas capital channels, making the operational complexity far beyond what ordinary investors can easily accomplish. Mainland users are isolated outside the institutional threshold, while overseas users are already accustomed to using international platforms with richer liquidity and products, such as Coinbase and Binance. Under this dual limitation, how Guotai Junan International can convert this new business into sustainable revenue still lacks a clear path. As for the intense reaction in the capital market, it is more of a bet on future scenarios rather than a reflection of actual profitability. Through this cooperation, brokerages provide clients with compliant market entry channels, exchanges provide trading and clearing support for brokerages, and native exchanges like HashKey can also attract large brokerage traffic due to their licensed platform status, forming a complementarity. Thus, the market's bets will naturally extend to related service providers and virtual asset trading sectors — according to Nansen data, HashKey platform token HSK surged over 50% in the past 24 hours, and OSL (00863.HK) saw its stock price rise 18% to 14.6 HKD on June 25, reaching a one-year high.

Hidden Risks in Guotai Junan International's Compliance Path

In summary, the crypto business that has allowed Guotai Junan International to "break out" essentially relies on the underlying service framework provided by HashKey. Whether it is trading matching, asset custody, clearing processes, or on-chain asset management, it essentially operates within the "Omnibus Account" system built by HashKey. Guotai Junan International plays more of a front-end channel and brand credit role in this. In other words, this is a "brokerage + exchange" cooperation model: the brokerage provides client resources and licensed identity, while the exchange outputs technical capabilities and market depth. On the surface, this appears to be a reasonable division of labor with complementary advantages.

However, according to haocrypto101's supplement, there is a potential issue — once compliant exchanges expand their proprietary business in the future or encounter technical failures or compliance disputes, their highly bound cooperative structure with brokerages will make it difficult to cut and independently control risk exposure. The direct consequence of this business separation is a decrease in trust and a lack of product control capabilities. Moreover, HashKey's near-monopolistic position is due to the current regulations requiring brokerages holding Type 1 licenses to have their liquidity providers be virtual asset trading platforms (VATP) that have been issued Type 7 licenses when conducting virtual asset trading services. For a long time, there have only been two compliant platforms in the Hong Kong market, HashKey and OSL, available for integration. This has led to a high concentration of many brokerages and financial institutions choosing to access the services provided by these two platforms in actual business. The current regulatory design in Hong Kong, while ensuring compliance, has also somewhat suppressed market competition vitality. The limited number of compliant trading platforms available has resulted in overall insufficient liquidity, leading to certain price discrepancies compared to mainstream markets in Europe and the U.S. Consequently, many local Hong Kong investment institutions have chosen to go directly to trading platforms in the U.S. and other places to purchase cryptocurrencies for better prices and deeper liquidity.

At the same time, brokerages are dissatisfied with the limitations of the existing trading service ecosystem. They hope to obtain more competitive prices and service quality while ensuring compliance. Therefore, some institutions have chosen to apply for VATP licenses themselves and connect with global liquidity providers to enhance trading efficiency and customer experience, achieving business autonomy and differentiation.

Finally, the approval of Guotai Junan International for the Hong Kong virtual asset trading service license marks an important step for traditional brokerages to integrate with blockchain technology. This event indicates that under a strict regulatory framework, Hong Kong is striving to build a digital asset financial ecosystem that combines compliance and vitality. At the same time, this event also reflects that the market is no longer solely focused on Bitcoin or altcoins but is beginning to layout around "compliant virtual assets + financial infrastructure," such as stablecoins, tokenized bonds, and blockchain-based brokerages. Hong Kong is attempting to leverage its regulatory advantages to promote financial innovation and regain its former discourse power as a financial center. The implementation of the "Stablecoin Regulation" in May and the new licensing regulations in August are further reserving regulatory space for offshore stablecoins. The release of Guotai Junan allows licensed financial institutions and exchanges to become incubators for stablecoin distribution channels. The over 10 trillion yuan offshore RMB stock in Hong Kong can also provide liquidity support for stablecoins, offering numerous opportunities for brokerages to enter and join distribution channels. However, the current regulatory stance in mainland China remains very clear: cryptocurrencies like Bitcoin do not have legal tender status, and financial institutions and non-bank payment institutions are prohibited from providing account opening, fund transfer, and clearing services for virtual currency-related business activities. Therefore, for ordinary investors in mainland China to participate in the crypto asset services offered in Hong Kong, they must first legally possess a Hong Kong account, and the source of funds and identity background must meet the regulatory scrutiny standards for overseas compliant funds, because even if the service is provided through compliant licensed institutions in Hong Kong, both Guotai Junan International and Futu, Tiger Brokers, etc., explicitly prohibit investors with mainland Chinese identities from opening accounts to participate in digital asset trading. However, referencing the evolution of the Shanghai-Shenzhen-Hong Kong Stock Connect from institutions to individuals, qualified mainland investors (QDI, Hong Kong Stock Connect clients) may also participate in virtual asset investments through regulatory-approved methods in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。