Author: David Duong CFA & Colin Basco, Coinbase

Compiled and Organized by: BitpushNews

Main Points

Geopolitical risks are easing, with the Israel-Iran ceasefire stabilizing the market. Concerns over tariff issues are diminishing, and downward pressure on inflation is more likely to support a Federal Reserve rate cut.

The success and high valuation of Polymarket highlight the market's focus on consumer-centric applications, particularly prediction markets, which are expected to accelerate in development.

Market Overview

Are Geopolitical Risks Easing?

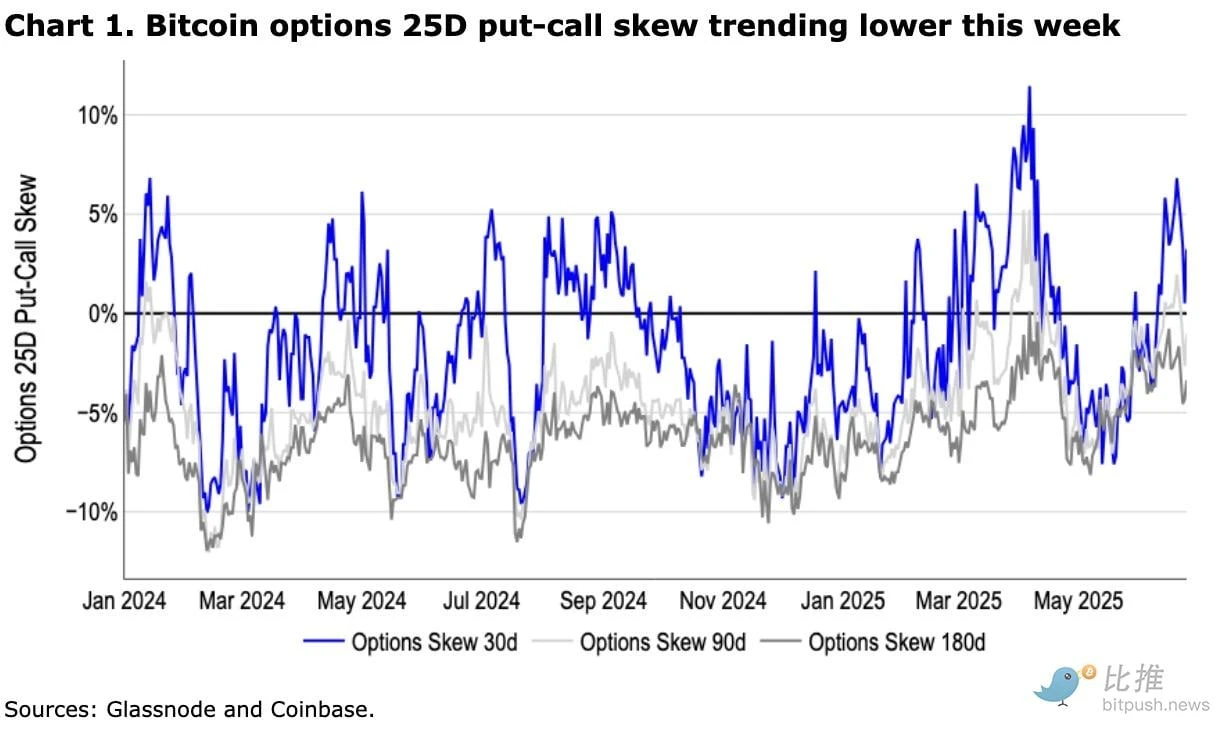

Since the ceasefire agreement between Israel and Iran on June 23, market sentiment has stabilized, with the COIN50 index rebounding alongside U.S. stocks. In fact, the 25 delta put-call skew for Bitcoin's 30-day options has begun to decline after surging last week, while the skew for 90-day and 180-day contracts remains in negative territory.

This indicates a relief in demand for short-term Bitcoin put options for downside protection. We believe that longer-term options show investors' desire for Bitcoin exposure without wanting to pay the upfront costs of the spot market, reflecting a slight bias towards out-of-the-money call options. The implied volatility for one-week and one-month contracts has significantly decreased, reducing the attractiveness of selling volatility at this time.

Nevertheless, there remains persistent uncertainty about whether tensions could flare up again. Looking ahead, we believe the most likely potential scenarios include:

Maintaining the status quo, characterized by a fragile and tense balance, with Iran continuing to leverage its nuclear program and regional proxies to project influence, essentially buying time without crossing clear red lines.

A second, more severe scenario involves limited military escalation, given Israel's residual concerns over Iran's nuclear capabilities.

Closing the Strait of Hormuz (which accounts for one-fifth of global oil consumption) would be a major red line indicating an escalation of conflict. However, we believe this scenario is unlikely, as the ceasefire not only reduces this threat but such an action would severely damage Iran's own economy. Therefore, we think that currently buying on dips during geopolitical events may still be a viable market strategy, consistent with our latest monthly outlook.

What About Tariff Issues?

As the July 9 deadline for suspending reciprocal tariffs (August 12 for China) approaches, there has been no significant progress on trade agreements—despite reaching a rare earth transportation agreement with China and submitting a proposal to the EU. However, both traditional and crypto markets have largely ignored the potential economic risks arising from this, partly because it has not been reflected in economic data.

Federal Reserve Chairman Powell testified this week before the House Financial Services Committee and the Senate Banking Committee that inflation could still be affected by tariffs later this summer. (Notably, President Trump subsequently announced that he might appoint Powell's successor as early as September or October this year.)

But keep in mind that commodities only account for about 20-25% of the core CPI basket, and it remains unclear whether businesses will fully pass on tariff costs to consumers. Additionally, service prices have been declining since mid-2024 and are more sensitive to long-term developments like artificial intelligence. In fact, we believe the impact of tariffs is more likely to be deflationary due to their net effect on overall demand. In our view, this will continue to drive the Fed to cut rates in the second half of this year. All of this may explain some complacency in the market regarding tariffs, and we believe this sentiment may persist until the upcoming deadline. Ultimately, we do not see trade barriers posing a significant risk to our constructive outlook for Q3 2025.

Regulatory Updates

The "Guidance and Establishment of a National Stablecoin Innovation Act" (GENIUS Act) has passed the U.S. Senate with a vote of 68 to 30 and is currently under consideration in the House of Representatives. House Majority Whip Tom Emmer (R-IN) is attempting to merge this bill with the "CLARITY Act" (House Market Structure Bill), but the complexity of the latter's content may lead to delays. Notably, President Trump has called for the House to pass the GENIUS Act "without delay or additions." Additionally, Senate Banking Committee Chairman Senator Tim Scott (R-SC) has indicated that a crypto market structure bill is expected to be completed by September 30.

Furthermore, on June 23, Senator Adam Schiff (D-CA) introduced the "Limiting Official Income and Non-Disclosure Act" (COIN Act), which aims to restrict senior executive branch officials and their immediate family members from issuing, sponsoring, or endorsing digital assets.

At the same time, the Federal Reserve announced this week that it will no longer consider reputational risk as part of its bank supervision and examination program. This seems to be a continuation of the current administration's deregulation under the "Operation Chokepoint 2.0" policy. Given the subjectivity of "reputational risk," previous guidelines had led to the systematic exclusion of the crypto industry from banks.

Polymarket: A New Unicorn in the Crypto Space?

This week, the decentralized prediction market platform Polymarket is seeking a valuation of approximately $1 billion, led by Founders Fund, making it the latest unicorn in the crypto space.

Just a day later, its regulated competitor Kalshi announced it had completed a $185 million funding round at a $2 billion valuation.

These transactions collectively indicate that venture capital's focus this week is on distribution moats (consumer-facing applications) rather than liquidity moats (token chains and DEXs), with real-time event markets leading the way.

Driving the valuation is its strong usage metrics. Despite regulatory barriers preventing U.S. users from trading, Polymarket's total trading volume has exceeded $14 billion, with approximately $1 billion occurring just in May. The platform averages 20,000 to 30,000 traders daily, surpassing many mid-cap DEXs, demonstrating its ability to attract a non-crypto-native audience.

With a new content partnership established with X (formerly Twitter), positioning the prediction market as viral social content rather than purely a financial tool, its development momentum is expected to accelerate further.

Stablecoins—Especially USDC—Are Its Invisible Beneficiaries.

Polymarket's trades are settled in USDC on Polygon, and the flow of these stablecoins is reflected in on-chain metrics. For example, in November 2024, when headline news events drive market attention, monthly trading volume surged to $2.5 billion, triggering a spike in USDC transfers and cross-chain bridge activity. Unlike lending protocols that lock up large amounts of total value locked (TVL), the rapid turnover of funds in prediction markets and high-frequency settlement activities drive significant on-chain payment behavior.

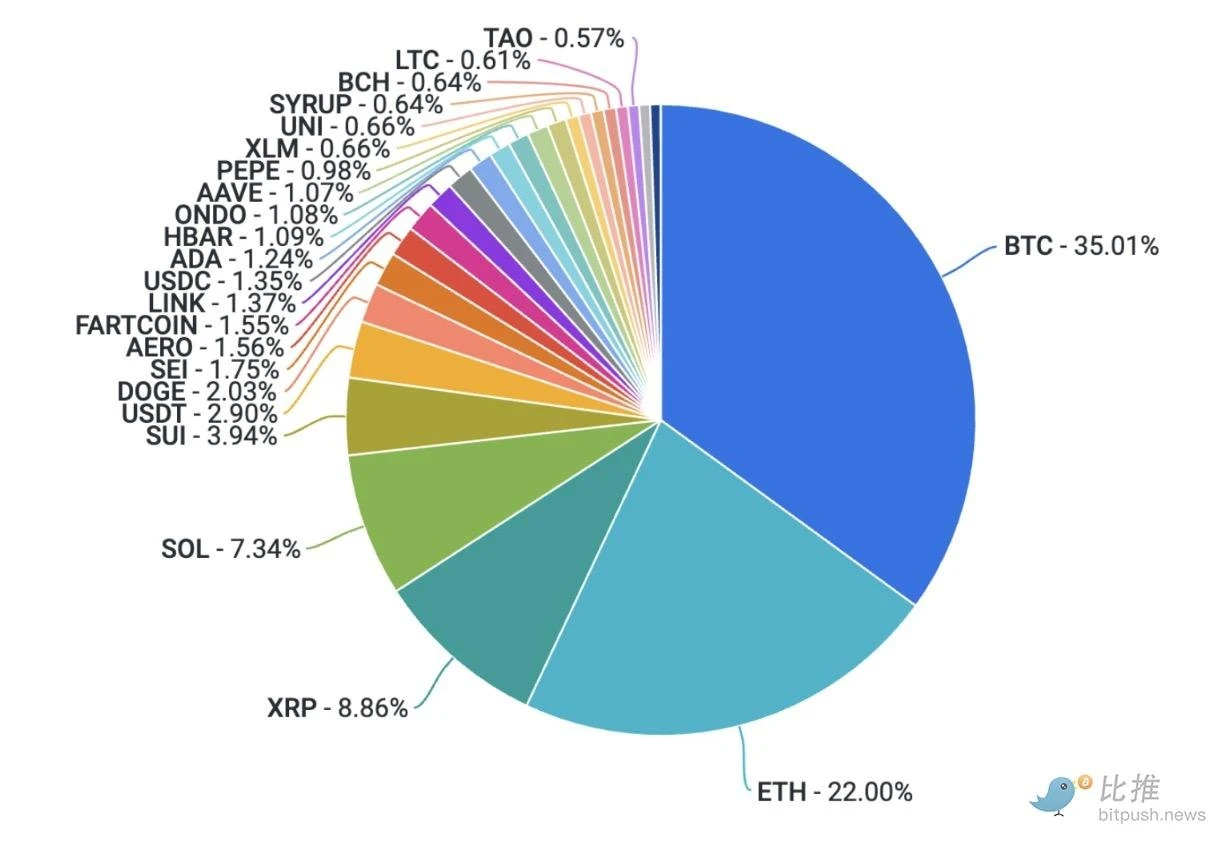

Coinbase Exchange and CES Insights

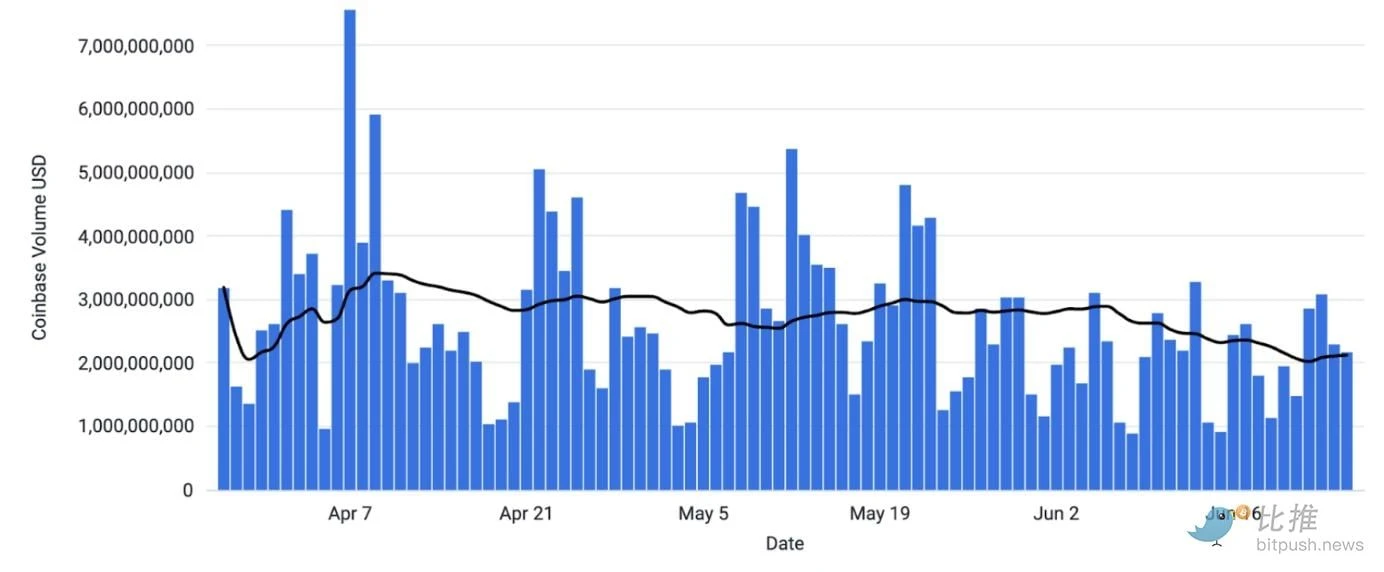

This week, Bitcoin in the crypto market held firm above the $100,000 mark, while the broader market remained in a consolidation phase.

In the housing market, U.S. housing mortgage regulators issued an order requiring Fannie Mae and Freddie Mac to consider cryptocurrency holdings as assets when assessing housing loan risks. We also see continued inflows into spot BTC and ETH ETFs, with BlackRock (Invesco) submitting an application for a spot SOL ETF, marking the ninth application to date.

All of this, combined with the ongoing tensions in the Middle East and comments from Federal Reserve Chairman Powell, has led traders to maintain a constructive attitude. The perpetual contract funding rates are in the low single digits, and positions appear relatively neutral, which may leave room for further upside.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。