Original Author: 1912212.eth, Foresight News

No one expected that during the pessimistic moment in the crypto circle, where people lamented the lack of market innovation, the "stablecoin supercycle" mentioned by Paradigm founder Matt Huang would arrive. Since Circle, the first publicly traded stablecoin, went public on June 5, its stock price skyrocketed from $31 to over $298.99 in less than half a month, achieving nearly a tenfold increase. This exaggerated wealth effect once attracted insiders to rush into the coin stock gold rush.

The hot performance of Circle's stock in the U.S. market has once again drawn the crypto circle's attention to the stablecoin market.

Stablecoins were born in 2014 to address the issue of extreme price volatility in traditional cryptocurrencies. The USDT, launched by Tether, is one of the most representative stablecoins in the market, pegged to the U.S. dollar at a 1:1 ratio and supported by dollar asset reserves to maintain its value stability. The core idea of stablecoins is to use asset collateral to maintain the stability of their value, allowing them to possess the convenience and decentralization characteristics of digital currencies while avoiding the trading risks brought by price fluctuations. In recent years, the adoption and application of stablecoins have grown exponentially, playing a key role in areas such as cross-border payments, DeFi, and RWA, with the DeFi sector becoming the foundational asset for lending, staking, and yield farming.

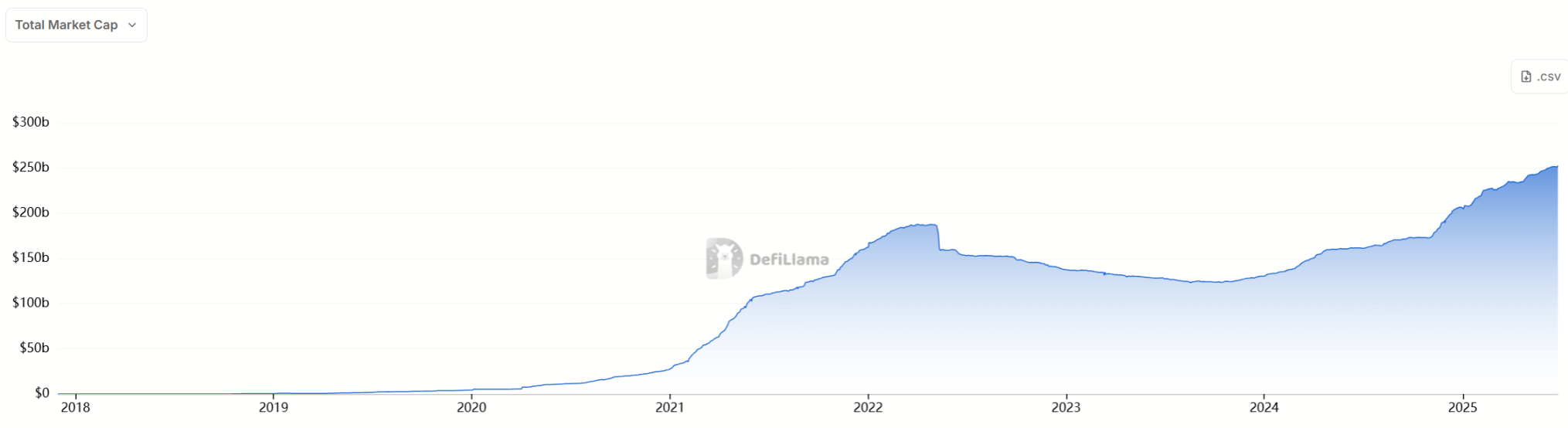

According to DefiLlama data, as of June 25, 2025, the global stablecoin market size has surpassed approximately $252.9 billion, with USDT accounting for over 62% of the market share, followed closely by USDC, which together holds over 85% of the market share. The on-chain transaction volume of stablecoins reached approximately $20.2 trillion, nearly 40% of the transaction volume of global payment giant Visa, demonstrating their important position in digital payments and cross-border settlements.

The stablecoin craze has even reached the giants of China and the U.S. This year, many global technology and financial giants have accelerated their layout in the stablecoin field, sparking a fierce competitive wave. In the U.S., PayPal announced that its dollar-pegged stablecoin PYUSD has been integrated into the Stellar network, focusing on cross-border remittances and financing for small and medium-sized enterprises; Walmart and Amazon are also actively exploring the issuance of their own dollar-backed stablecoins to reduce payment costs and create a closed-loop consumption ecosystem; Shopify has partnered with Coinbase and Stripe to support merchants in accepting USDC payments based on the Base chain, covering consumers in 34 countries.

The Asian market is equally lively, with Ant Group's Ant International and Ant Technology both applying for stablecoin licenses in Hong Kong, positioning Hong Kong as their global headquarters to promote the construction of compliant digital trading scenarios. JD Coin Chain Technology expects to obtain a license in the fourth quarter of 2025, planning to issue stablecoins pegged to the Hong Kong dollar and other currencies, focusing on cross-border payments, investment transactions, and retail payment scenarios.

The Trend of Stablecoins is Inevitable

Why have the giants of China and the U.S. chosen this moment to enter the stablecoin race? Is it a trend chase after a whim, or a strategic layout after careful consideration?

Fast, Low-Friction Characteristics: Natural Payment Tools

The traditional financial system faces many challenges in the digital economy era, especially in cross-border payments, fund clearing, and real-time settlement, where efficiency is low and cannot meet the rapidly developing needs of globalization and digitization. The traditional banking system relies on multiple intermediaries and cumbersome processes, resulting in cross-border transfers often taking several days and incurring high fees, severely restricting the liquidity and efficiency of funds. Additionally, traditional financial institutions need to redesign business processes and product services during their digital transformation, and many users suffer from restrictions or even freezing of their bank cards due to policy factors.

In contrast, stablecoins supported by blockchain technology, with their characteristics of being pegged to fiat currency and price stability, have become a more efficient and flexible "digital cash" in the digital age. Stablecoins can achieve fund transfers without intermediaries and with near-instantaneous settlement, significantly reducing transaction and time costs, and improving fund utilization.

Imagine that you need to transfer millions of dollars to a friend in the U.S. All they need to do is provide you with a string of code, and within minutes, your funds will be transferred to their account, with fees under $1. No limits, no freezes, no hefty fees, no requirement for financial proof, and no days of waiting—this characteristic has an absolute advantage in areas like cross-border payments.

In stark contrast, the arrogance of banks is everywhere. SIG partner Michael Yuan recently expressed his dissatisfaction with his experience at Singapore's DBS Bank, stating, "Just for receiving a $200 bank transfer, I was bombarded with inquiries. For a $1,000 bank transfer, I was asked to bring my passport to the bank headquarters, only to be interrogated at the front desk."

Many users in mainland China face various inquiries from banks when withdrawing funds, often being required to provide various proofs to open permissions, with such news frequently trending.

Stablecoins possess programmability, making it easy to deeply integrate with innovative applications like DeFi, supporting cross-border payments, supply chain finance, retail consumption, and other multi-scenario applications. Research shows that after stablecoins replace physical cash, they can not only maintain the credit intermediation function of the financial system but may also promote an increase in credit supply and drive the digital upgrade of the financial system. Therefore, stablecoins are gradually becoming an important bridge connecting traditional finance and emerging digital finance in the digital economy era.

The Battle for Digital Hegemony: Onshore vs. Offshore

The entry of giants from China, the U.S., and globally into the stablecoin field is driven by a profound motivation: the competition for digital hegemony. U.S. Treasury Secretary Janet Yellen stated in a Senate hearing in June 2025 that stablecoins, especially those pegged to the U.S. dollar, will become an important tool to consolidate the dollar's position in the global financial system. Against this backdrop, some analysts predict that the market value of stablecoins could reach $2 trillion or even higher in the future.

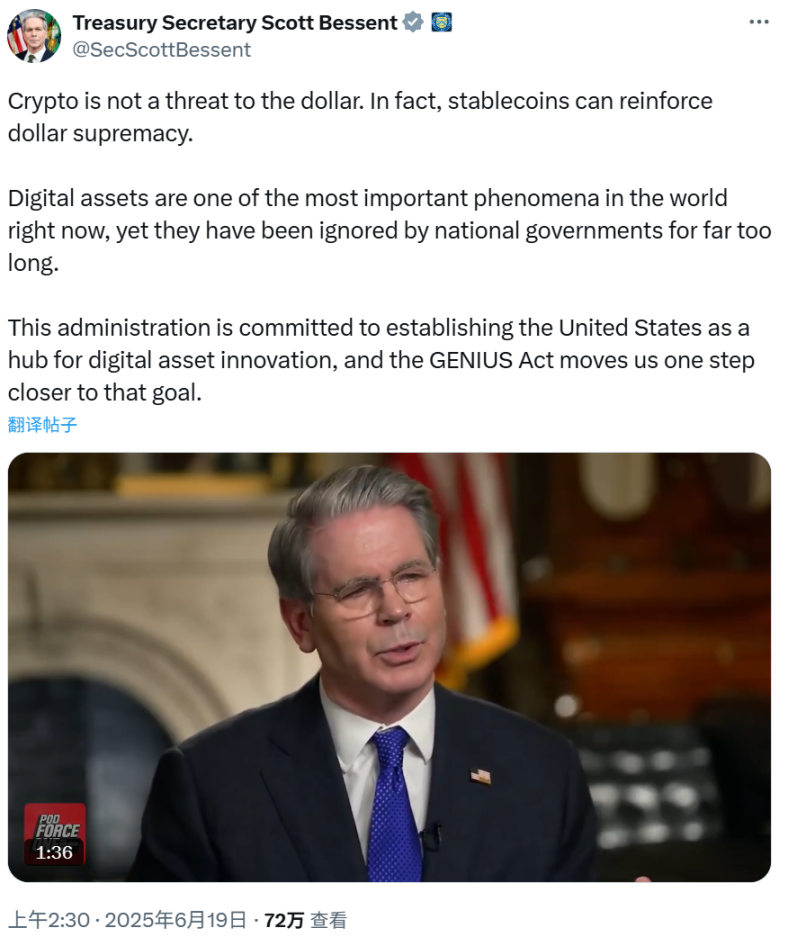

On June 19, Yellen even tweeted again, stating, "Cryptocurrencies do not pose a threat to the dollar. In fact, stablecoins can reinforce the dollar's hegemonic position. Digital assets are one of the most important phenomena in today's world, but have long been overlooked by governments. This administration is committed to making the U.S. a center for digital asset innovation, and the GENIUS Act brings us one step closer to that goal."

The U.S. government aims to strengthen the dollar's status as an international reserve currency by promoting the GENIUS Act to establish a federal regulatory framework for stablecoins, preventing other countries or digital currencies from challenging dollar hegemony. Meanwhile, retail giants like Walmart and Amazon are also actively laying out stablecoins, attempting to bypass traditional payment networks like Visa and Mastercard, saving billions in fees, and achieving instant settlements to gain greater influence and market share in the global payment system.

While U.S. giants are intensively laying out stablecoins, mainland China and Hong Kong are also accelerating research on stablecoins and opening doors for development.

At the 2025 Lujiazui Forum, People's Bank of China Governor Pan Gongsheng announced the establishment of an international operation center for the digital yuan, launching a pilot program for offshore trade finance services in the Shanghai Lingang New Area. He also stated that new technologies such as blockchain and distributed ledgers are driving the vigorous development of central bank digital currency stablecoins, reshaping the traditional payment system from the ground up and significantly shortening the chain of cross-border payments.

This layout is not only a reflection of technological innovation but also a strategic game surrounding the dominance of digital currency and the formulation of global financial rules, reflecting the deep motivations of Chinese and U.S. giants to seize the initiative in the stablecoin field and maintain or challenge the existing monetary system.

Wang Yongli, former vice president of the Bank of China, pointed out that the U.S. is legislating to protect and support the mining and trading of crypto assets, even making it a national strategic reserve, supporting the legal operation of dollar stablecoins, and actively seizing the high ground in the field of crypto assets and stablecoins, enhancing the demand for U.S. Treasury bonds and the international influence of the dollar, which has significant and far-reaching strategic implications. China needs to fully recognize and actively respond to this. Li Yang, a member of the Chinese Academy of Social Sciences and chairman of the National Finance and Development Laboratory, stated that on one hand, since any form of stablecoin cannot avoid the issue of monetary sovereignty, firmly promoting the internationalization of the renminbi remains the core task of cultivating a strong currency (renminbi). On the other hand, it must be recognized that the trend of the integration and development of stablecoins, cryptocurrencies, and the traditional financial system will be difficult to reverse. Stablecoins and cryptocurrencies will achieve complementary development with central bank digital currencies, comprehensively improving payment efficiency and reducing payment costs, thereby reconstructing the global payment system.

As a "testing ground" for mainland China, Hong Kong's "Stablecoin Ordinance" has officially become law and will take effect on August 1 of this year. Its main purpose is to regulate activities involving stablecoins and establish a licensing system for regulated stablecoin activities in Hong Kong. Financial Secretary Paul Chan stated, "After the ordinance takes effect, the licensing system will provide appropriate regulations for related stablecoin activities, marking a milestone in promoting the sustainable development of Hong Kong's stablecoin and digital asset ecosystem."

Overall, the U.S. strategy embraces privately issued dollar stablecoins (such as USDC and PYUSD) and incorporates them into regulation, aiming to leverage market forces and innovation to consolidate the dollar's hegemonic position in the global digital economy. China's strategy, on the other hand, focuses on the mainland, with the core being the central bank-led digital yuan (CBDC). Allowing Ant Group and JD to apply for licenses in Hong Kong is more about using Hong Kong as a "testing ground" and "firewall" to explore offshore models for the internationalization of the renminbi and digital finance, serving international trade scenarios such as the "Belt and Road Initiative," essentially representing "offshore exploration."

Regulatory Path Becoming Clearer

Since Trump took office, the U.S. has been expected to be friendly to the crypto market. Various government officials have been appointed to key positions as crypto-friendly individuals. There have been continuous actions regarding stablecoins. On June 17, 2025, the U.S. Senate passed the "Guidance and Establishment of the U.S. Stablecoin National Innovation Act" (GENIUS Act) with a vote of 68 to 30, marking the first approval of major cryptocurrency legislation in the U.S. This act establishes a federal regulatory framework for dollar-pegged stablecoins, requiring issuers to hold 1:1 reserve assets, comply with anti-money laundering regulations, and disclose reserve details monthly, aiming to enhance market transparency and consumer protection while stimulating demand for U.S. short-term Treasury bonds and consolidating the dollar's global position. On June 24, Senator Hagerty stated in an interview with well-known KOL Scott Melker that Trump is ready to sign the GENIUS Act, which may soon be sent to his desk.

David Sacks, the White House cryptocurrency and AI director, known as the "crypto czar," stated in an interview with FOX that the passage of the GENIUS Act is a significant victory for the crypto community. Some members of the crypto community analyze that this act may push the stablecoin market to reach $2 trillion by 2028.

Hong Kong passed the "Stablecoin Ordinance" on May 21, 2025, establishing the world's first comprehensive regulatory framework for fiat-pegged stablecoins, requiring issuers to be licensed and maintain high liquidity reserve assets through the "value anchoring regulation" principle, attracting companies like Ant Group and JD to lay out their plans. The improved regulatory frameworks in both regions reduce policy risks and significantly promote financial innovation and compliant development.

Competition Among Chinese and American Corporate Giants

In June of this year, Liu Qiangdong, Chairman of the Board of JD Group, stated that JD hopes to apply for stablecoin licenses in all major currency countries globally, aiming to reduce cross-border payment costs by 90% and improve efficiency to within 10 seconds through the stablecoin licenses. JD expects to obtain the license in the first quarter of this year and simultaneously launch the JD stablecoin.

In the same month, Bian Zhuoqun, Vice President of Ant Group and President of Ant Technology's blockchain business, revealed that Ant Technology has initiated the application for a stablecoin license in Hong Kong and has already engaged in multiple rounds of communication with regulators. Ant Technology has designated Hong Kong as its global headquarters this year and has completed preliminary trials in the regulatory sandbox in Hong Kong. JD, which has been active recently, had already planned to issue a stablecoin pegged to the Hong Kong dollar at a 1:1 ratio last year. In May 2025, Liu Peng, CEO of JD Coin Chain Technology, announced the progress of the JD stablecoin, stating, "The first phase of the JD stablecoin is tentatively set to issue stablecoins pegged to the Hong Kong dollar and the U.S. dollar, with testing scenarios mainly including cross-border payments, investment transactions, and retail payments." Liu Peng further stated, "JD's self-operated e-commerce in Hong Kong and Macau will soon support stablecoin shopping."

In terms of business scenario expansion, the JD stablecoin focuses on two major scenarios: cross-border payments and supply chain finance. In cross-border payments, JD has partnered with Visa to launch a linked card, reducing settlement costs from 6% with SWIFT to 0.1%, and compressing the time from 3 days to 10 seconds, with a target of capturing 10%-15% of the global cross-border payment market by 2028. Additionally, JD is exploring an offshore renminbi stablecoin (JD-CNH) to connect with "Belt and Road" trade settlements, replacing the SWIFT system.

Chinese internet companies are embarking on an exploratory path, but American financial giants like Visa have had ambitions since 2020, although they withdrew from the Facebook-led Libra (now Diem) project early on due to regulatory uncertainties.

With the gradual implementation of regulatory frameworks like the U.S. GENIUS Act, Visa has adjusted its strategy to collaborate with regulated stablecoin issuers. In 2025, Visa officially joined the Global Dollar Network (USDG) stablecoin alliance initiated by blockchain company Paxos, becoming the first traditional financial institution to participate in the alliance. This means that Visa, under a compliance framework, indirectly gains legitimacy for stablecoin issuance and settlement through its membership in the alliance. Furthermore, Visa has partnered with the African cryptocurrency exchange Yellow Card to promote stablecoin payments in the Central and Eastern Europe, Middle East, and Africa (CEMEA) regions.

Visa's technological layout focuses on the seamless integration of stablecoins with existing payment systems. In 2023, Visa became the first global payment network to support USDC stablecoin settlements, integrating stablecoins into its core clearing system. Its technical architecture connects through the Visa Token Service and on-chain smart contracts, allowing stablecoin payments to be embedded in automated settlement, revenue sharing, and other business processes. For example, Visa's cross-border payment API now supports real-time settlement of stablecoins, reducing the traditional cross-border payment arrival time from several days to seconds, with costs lowered to below 0.1%.

PayPal, a predecessor of Ant Group, has also been laying the groundwork for stablecoins. Since its launch on the Ethereum mainnet in August 2023, PayPal USD (PYUSD) has rapidly evolved from a peer-to-peer experiment into a multi-chain, enterprise-level payment tool. This stablecoin was developed in collaboration with Paxos Trust Company and is 100% backed by U.S. dollar deposits, short-term U.S. Treasury bonds, and similar cash equivalents; Paxos regularly issues reserve audit reports to ensure transparency and regulatory compliance. From the beginning, PayPal has enabled seamless deposits and withdrawals between PayPal and Venmo balances and Ethereum-based wallets, truly integrating traditional payment channels with decentralized finance channels, providing near-real-time settlement and global coverage.

In May 2024, PayPal announced that PYUSD would be launched on the Solana blockchain, aiming to leverage Solana's sub-second finality and extremely low transaction fees for faster and cheaper transfers. Major wallet and deposit channel providers like Crypto.com, Phantom, and Paxos were the first to integrate, helping users access PYUSD on the Solana chain.

This move not only broadens the application of the stablecoin in retail payments and cross-border remittances but also attracts developers to integrate PYUSD into acquiring systems, DeFi protocols, and Web3 applications. As of June 2025, the issuance of PYUSD on the Solana network exceeded $300 million. In the future, PayPal plans to expand PYUSD support to more Layer 2 networks and public chains while continuously optimizing smart contract functions to meet the diverse needs of merchants.

Interestingly, Wall Street giants are also not falling behind. In 2019, JPMorgan launched JPMCoin for institutional clients, used for internal cross-border payments and settlements, with an average daily transaction volume of about $1 billion, showcasing its high-frequency application value in institutional-level scenarios. However, JPMCoin is limited to JPMorgan's internal network and has not circulated on public chains.

In mid-June 2025, JPMorgan announced the launch of the "JPMD" deposit token based on the Coinbase Layer 2 network, Base. Unlike traditional stablecoins, JPMD represents actual bank deposits and plans to be included in federal deposit insurance, aiming to provide institutional clients with compliant, auditable digital deposit certificates while adhering to strict KYC/AML processes to support near-real-time 24/7 settlement and liquidity management.

It is evident that these giants, which have formed monopolistic scales in the internet and financial sectors, are all stepping into the new track of stablecoins.

Summary

In the future, the mission of stablecoins is to accelerate the transformation of cross-border payments, breaking the monopoly of traditional banks and SWIFT, achieving real-time settlement 24/7 with costs approaching zero, and becoming a core tool for remittances in developing countries and international trade settlements. Stablecoins will not only be a subset of cryptocurrencies but may also become a key force in reconstructing the global monetary order and financial infrastructure.

However, the risks faced by many companies entering the stablecoin space cannot be ignored. Liu Honglin, a lawyer at Shanghai Mankun Law Firm, told Foresight News that the issuance of stablecoins is a matter of governance structure, risk control boundaries, and regulatory dialogue.

First, the initial structural planning must be clear. In Hong Kong, the operational path must be designed from the beginning to comply with the "Stablecoin Ordinance," including license applications, reserve trust structures, information disclosure systems, and compliance reviews of directors. The "issue first, comply later" approach is not allowed, as the Monetary Authority explicitly prohibits unlicensed issuance of tokens.

Second, compliance budgets should be adequately reserved. Stablecoins are not light asset projects; reserve custody, audit report preparation, IT system security testing, daily operations, and legal compliance personnel allocation are all long-term expenses. It is recommended to establish a special compliance budget pool and set up third-party risk control mechanisms, such as regular external reviews.

Third, a neutral corporate governance system must be established. Avoid structural defects where the parent company has absolute control over the issuer, directors lack independence, and significant matters lack internal review processes. The Monetary Authority has clear precedents for rejecting "opaque beneficial ownership" and "unisolated governance."

For ordinary users, to avoid the lessons learned from the collapse of UST, users need to pay attention not only to the project mechanism design but also to whether the "redemption promises are credible." Although regulatory measures are continuously being introduced in places like Hong Kong and the U.S., retail investors still need to be vigilant when choosing stablecoin asset allocations to avoid losses. "The core of stablecoins is not whether the technical means are innovative; payment design can prevent systemic risks, but it does not equate to risk elimination," Liu Honglin admitted.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。