BTC Mega Bet: Metaplanet Issues Bonds, Hits 13,350 BTC

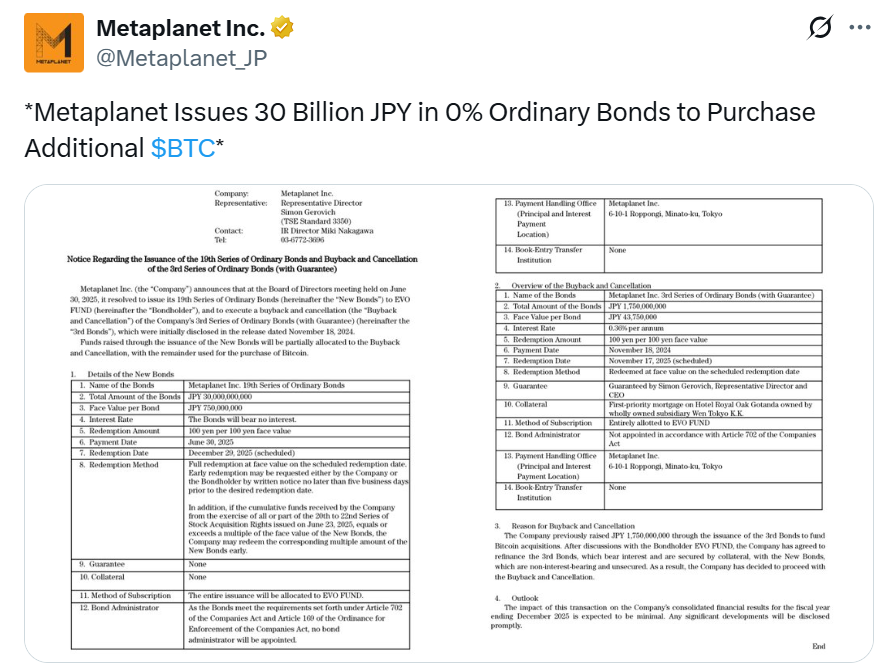

Metaplanet is showing every corp how it's done. They doubled down again — issuing ¥30B in zero-interest bonds just to stack more. That's conviction. This Japanese Companies bold move shows growing confidence in Bitcoin’s long-term value and potential. Zero-coupon, unsecured, and completely subscribed by EVO FUND, it has issued its 19th Series of Ordinary Bonds, valued at JPY 30 billion (about USD 208 million). The money raised will be used to repurchase JPY 1.75 billion in previous bonds, with the remaining funds going toward buying Bitcoin.

Source X

Issuing 30B JPY in 0% bonds to boost digital gold holdings shows bold financial vision. A smart step in treasury innovation . With this most recent bond trade, Metaplanet is increasing its bet on cryptocurrency and bolstering an aggressive accumulation model that is further advancing its "Japanese MicroStrategy" narrative. Social sentiment is extremely positive; traders and key opinion leaders adore the unrelenting stacking, and it's quickly emerging as the preferred equities proxy for exposure to Asian digital treasury.

Despite diluting noise, institutional and retail flows are reacting, and the stock is up 391% year-to-date. Their capital approach (equity-linked, zero-coupon) establishes a new standard for efficiency in the corporate treasury game by keeping costs low and putting the Bitcoin yield per share front and center.

Metaplanet now holds 13,350 BTC, worth $1.31B, up 391% YTD.

Simon Gerovich, the CEO of Metaplanet, disclosed that the company just acquired 1,005 bitcoins for about $107,601 per, for a total of about $108.1 million. The BTC yield on company for the year as of June 30, 2025, is 348.8%. With an average price of roughly $97,832 per bitcoin, the company presently owns 13,350 of them, representing an almost $1.31 billion total investment.

Source X

The increasing institutional interest in BTC as a treasury asset is highlighted by this action. Strong trust in Bitcoin's long-term prospects is shown by company's strategy, demonstrating the cryptocurrency's significance in the face of growing adoption trends. He also wrote “Just 3 months ago, we announced live at our shareholder meeting that we hit 3,350 BTC — and now we’ve added 10,000 more to reach 13,350 BTC”. on its X handle.

MSTR's Q2 Bitcoin gain of $14.2B, equivalent to $11.2B net income, is approximately $40.10 per share, a significant increase from $108,000, causing Wall Street to be bewildered by the substantial amount of money generated.

MicroStrategy of Asia? Metaplanet Sets Treasury Trend

A Web3 initiative Metaplanet,demonstrating the growing trust in its Web3 and blockchain technology. This investment demonstrates organisation's capacity for commercial impact and innovation in the rapidly developing Web3 space. Company’s drops $208M in 0% bonds to grab more Bitcoin—talk about bold moves! Are they building a digital gold vault, or just flexing their crypto muscles?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。