The concept of Robinhood's tokenization of U.S. stocks is not a sudden idea.

Written by: Deep Tide TechFlow

As USD stablecoins gradually gain market attention, companies both inside and outside the crypto space have begun to view U.S. stocks as the next target.

At the end of May, U.S. cryptocurrency exchange Kraken announced it would offer tokenized popular U.S. stocks to non-U.S. customers; on June 18, Coinbase's Chief Legal Officer Paul Grewal revealed that the company is seeking SEC approval to launch a "tokenized stock" service.

Tokenization of U.S. stocks is gradually becoming a visible business.

Now, this business may welcome a new player --- the well-known American online brokerage, the "retail investor militia," and a key force in the movement against Wall Street --- Robinhood.

Previously, two insiders from Robinhood revealed to Bloomberg that they are developing a blockchain-based platform that allows European retail investors to trade U.S. stocks.

According to insiders, the technology selection for this platform may be Arbitrum or Solana, and the specific choice of partners is still in progress, with the protocol not yet finalized.

This news can be interpreted in at least two ways.

First, Robinhood is directly integrating Arbitrum L2 into this new platform that allows European users to trade U.S. stocks, serving as the foundational layer for its blockchain trading;

Second, a more likely scenario is that **Robinhood plans to utilize Arbitrum's Arbitrum Chains feature to develop its own dedicated L2 chain based on Arbitrum's tech stack (Rollup protocol, **EVM compatibility, etc.).

Regardless of the final outcome, market sentiment has already been stirred.

This also means that Robinhood, in pursuit of the U.S. stock tokenization business, may be creating its own dedicated L2, which would be more conducive to on-chain settlement and specialized operations for this business.

At the upcoming EthCC in Cannes, France, on the 30th, Robinhood will also announce an important declaration at 17:00 local time (23:00 Beijing time), leading to speculation that it is related to its L2 and U.S. stock tokenization business.

Meanwhile, A.J. Warner, Chief Strategy Officer of Offchain Labs, the company behind Arbitrum, will also attend the conference, providing more room for simultaneous official announcements.

Recently, the price of ARB, which had been somewhat sluggish, saw a 24-hour increase of over 20%, ranking high on the cryptocurrency gainers list.

More suggestively, Robinhood's European X account commented "Stay tuned" under a discussion thread about the conference agenda, which, combined with Bloomberg's report on providing U.S. stock trading in Europe, increases the likelihood of an official announcement regarding this feature.

Everything has a traceable path

The concept of Robinhood's tokenization of U.S. stocks is not a sudden idea.

In January of this year, CEO Vlad Tenev criticized the current U.S. regulations, stating that the U.S. has not provided a clear framework and rules for the registration of security tokens, hindering the promotion of tokenized products.

In a podcast in March, Tenev directly stated, "Right now, if you are overseas, investing in a U.S. company is very difficult."

This resonates with many investors who are keenly interested in U.S. stock trends but are not physically in the U.S.; they urgently need a smoother way to trade U.S. stocks.

At the same time, Tenev also mentioned that he was considering tokenizing securities and pointed out that this would be part of a broader push to integrate digital assets into the financial system.

Looking back, there are signs paving the way.

Currently, Robinhood's customers in the EU can only trade cryptocurrencies, and the company obtained a brokerage license in Lithuania last month, allowing it to offer investment services such as stock trading in the EU.

Additionally, Robinhood signed an agreement to acquire the cryptocurrency exchange Bitstamp last June, and after the transaction is completed, Robinhood will be able to use Bitstamp's MiFID multilateral trading facility (MiFID) license to provide crypto-related derivatives.

With the license obtained and regulatory compliance achieved, the next step is to consider which chain to choose for implementation.

Why might it be Arbitrum?

From a technical perspective, Arbitrum is a fully EVM-compatible L2 solution, which means Robinhood can seamlessly migrate its existing Ethereum smart contracts and development tools without significantly altering its tech stack.

EVM compatibility is crucial for large fintech companies like Robinhood to quickly go on-chain; if they can leverage Ethereum's extensive developer community and existing infrastructure, who would set it aside?

Furthermore, Arbitrum's Optimistic Rollup technology strikes a balance between transaction confirmation time and cost; in contrast, ZK Rollup incurs higher costs and relatively slower transaction confirmation times. As a platform that needs to handle large-scale user transactions, Robinhood is more likely to prioritize Arbitrum's mature technology and lower development threshold.

On the other hand, from a business perspective, this choice also avoids Coinbase.

Base is an L2 launched by Coinbase, using the OP tech stack, but since Robinhood competes directly with Coinbase in its main business, it is unlikely to run U.S. stock tokenization on Base.

Arbitrum offers the option of custom L2 chains (Arbitrum Chains), allowing Robinhood to differentiate itself from Base.

One piece of information you might overlook is that Robinhood and Arbitrum actually have collaborative experience.

As early as ETHDenver in 2024, Robinhood announced a partnership with Arbitrum to simplify the process for users to access Arbitrum through the Robinhood Wallet.

This indicates that there is already a foundation for technical integration and strategic alliance between the two parties, and Robinhood may choose to continue this collaboration, leveraging Arbitrum's existing technical support and brand effect to further expand its business.

Imitating Base, Distinguishing from Base

Although the news of Robinhood building its own L2 with Arbitrum has not been officially confirmed, it has already sparked widespread discussion in the crypto community.

The most pointed criticism is that this approach is a simple imitation of Base.

Base, launched by Coinbase, adopts an open strategy, inviting external developers to build DApps, thereby expanding the ecosystem and attracting users and assets. Part of Base's success can be attributed to this open ecosystem (for example, projects like Aerodrome and Uniswap migrating or building on it).

If Robinhood also builds an Arbitrum-based L2, open to external developers to expand the ecosystem and create more real asset on-chain use cases, despite the different tech stacks, this would be highly similar to Base's business strategy.

The perception of this "imitation" is largely due to the timing.

Don't forget that Coinbase launched Base at the end of 2023, while Robinhood is only now announcing its Arbitrum L2 plans. This time gap makes Robinhood's actions appear as a "follow-up" response to Base's success rather than an original strategy.

In traditional business, fintech companies often tend to replicate proven models, which is indeed a safer strategy; however, imitating Base means Robinhood will compete directly with Coinbase, which has already established a first-mover advantage through Base. For Robinhood to overtake, it will need to invest more resources and effort.

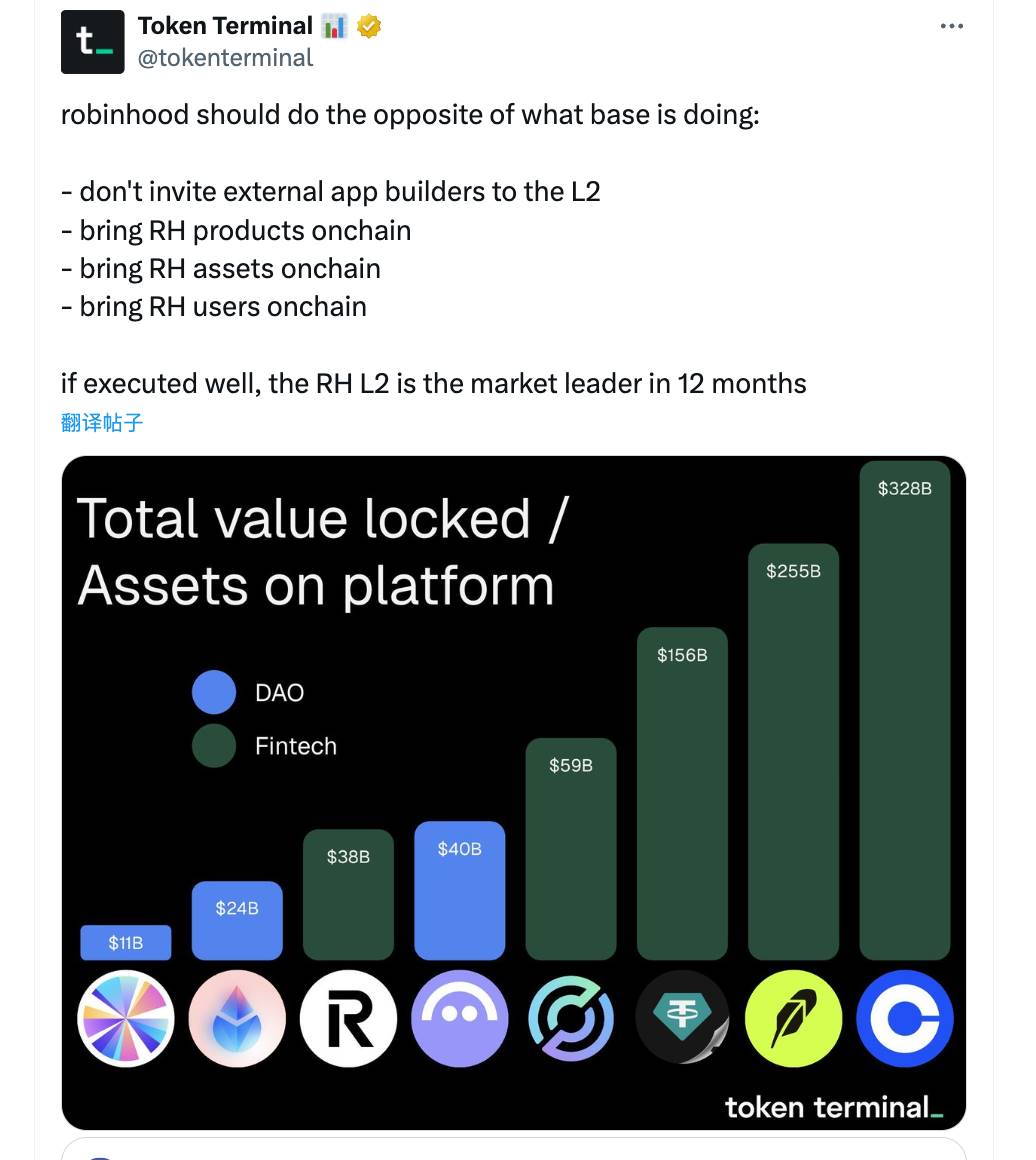

The well-known data platform Token Terminal has also pointed out a "clear path" for Robinhood, centered on **amplifying its advantages as an online brokerage and taking a "closed ecosystem" route opposite to **Base:

Do not invite external application developers to join its L2, but migrate all of Robinhood's existing financial products (such as trading or investment tools), assets, and users onto the chain, allowing users to operate directly on-chain rather than relying on traditional centralized systems.

This idea is more Crypto Native, combining Robinhood's existing customer base with pure on-chain operations, but a more aggressive approach also means greater resistance, and Robinhood may not necessarily follow this path.

If we step back from Robinhood to observe the entire Ethereum ecosystem, there are also voices suggesting that this could exacerbate the fragmentation of Ethereum L2s.

Ethereum L1 has already lost a significant amount of initiative in the current landscape of numerous L2s; performance is secondary; more importantly, it faces complete marginalization and pipeline-ization. Creating a dedicated L2 is easy, but reviving Ethereum's former glory is challenging.

Ultimately, how Robinhood will choose remains to be seen, and we may get answers after today's ETHcc.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。