Rising tokens are always similar, while the tokens that plummet each have their own misfortunes.

Written by: Bright, Foresight News

In the cryptocurrency world, the specter of zeroing out is common, but it is rare for large-cap tokens to drop over 80% within an hour. The dramatic scenes of short-term halving or even dropping to the ankles are particularly "striking" in this volatile market.

As 2025 is more than half over, Bitcoin has experienced a V-shaped trend from 100,000 to 70,000 to 110,000, and during this period, how many of the "mudslides" formed by the large bearish candles in the crypto space have you managed to avoid?

The Stain That Cannot Be Washed Away: Libra

Meme tokens are the main theme of the crypto world in 2024-2025. From community memes to the FOMO craze of AI agents, meme tokens with on-chain market caps exceeding 100 million dollars have frequently appeared, and the Pionex players are happily battling in various narrative games.

Looking back, two presidents have historically influenced this feast of meme liquidity.

The first is U.S. President Trump, whose Trump token, launched in January, surged to nearly 80 billion dollars in market cap within two days. Many in the Chinese-speaking community became legends in the first battle, with the single token A8 being the most undisputed "big opportunity" of 2025 so far. It can be said that Trump's issuance of a token propelled the meme track to its peak. For a time, the market was shaken, and it was widely believed that Trump's token issuance would become a model for political leaders and celebrity artists in various countries to follow.

As expected, the second candidate for the "Most Influential Award in the Crypto Space 2025," Argentine President Milei, made his appearance. On February 14, Milei publicly supported LIBRA, a token initially promoted on X as a tool to support small businesses and Argentine startup projects. Following Trump's token issuance, LIBRA surged to a market cap of 4.24 billion dollars within half an hour. However, as more insider addresses disclosed massive profit information and Milei denied any association with the token, LIBRA's price briefly crashed to 0.2 dollars, becoming the first major "mudslide" in the crypto space this year.

If Trump represents the highlight of the meme track, then Libra marks the critical turning point from prosperity to decline for memes. According to data from DefiLlama, after the LIBRA incident, Solana's liquidity plummeted from 12.1 billion dollars to 8.29 billion dollars, and the price of Sol also dropped over 20%.

On-chain data statistics show that a total of 75,000 users were affected by the LIBRA flash crash, with total losses amounting to approximately 286 million dollars, with the number of losers exceeding 86% of the total number of traders, making it the largest on-chain fraud incident of 2025. This scandal, which drained on-chain liquidity at the time and destroyed the trust in "celebrity tokens," exposed the ugly faces of various "RUG PULL" players related to KIP Protocol, Kelsier Ventures, Meteora, Jupiter, and others.

Hayden Davis, the CEO of Kelsier Ventures, is one of the instigators of this incident. It is rumored that he claimed he could "control" Argentine President Milei through benefits funneled to Milei's sister. In fact, Hayden Davis is a habitual offender involved in multiple meme token "RUG PULL" schemes, implicated in insider trading of various meme tokens such as MELANIA, ENRON, and BOB, reaping over 200 million dollars. Later, Hayden Davis casually referred to LIBRA as "just a meme," revealing his view of memes merely as harvesting tools, showing no consideration for any substantive obligations or consequences of the harvest.

The crypto world spins rapidly, and the loss threshold for retail investors is extremely high. However, what Hayden Davis said can be seen as the thoughts of all meme conspirators. "But (everything I do) is not illegal in the meme market. This is what happens in every trade. This is the rule here; people know it, agree to it, and make money off it. If you want to blame this, you have to blame everything else."

"This is not a capital market; this is a casino."

The Ruthless "Delisted Token": ACT

However, even established community memes are at risk of flash crashes under the intricate systems built by exchanges, market makers, and large holders.

On April 1, 2025, at 6:30 PM, low market cap tokens like ACT collectively halved in value within half an hour, marking a shocking April Fool's Day. Among them, ACT, which had once surged to a market cap of 1 billion dollars during the AI Agent craze in 2024, plummeted from 0.1899 dollars to 0.0836 dollars in just 36 minutes, a drop of over 55%, leaving people astonished.

Rewinding the timeline to April 1 at 3:30 PM, Binance announced adjustments to the leverage and margin tiers for several USDT perpetual contracts, including ACTUSDT, PNUTUSDT, and NEOUSDT, with the adjustment time set for 6:30 PM.

The announcement targeted the position limits and leverage margin ratios for the above token contracts, which clearly became the trigger for the evening's panic sell-off. Taking ACT as an example, the position limit before the adjustment was up to 4.5 million dollars, which was reduced to a maximum of 3.5 million dollars after the adjustment.

After the crash, most users pointed fingers at Binance, believing that the exchange's reduction of position limits triggered forced liquidations, further inciting panic selling. Additionally, the community questioned whether Wintermute, which was suspected of being an ACT market maker, had sold a large number of meme tokens at the same time, leading to the crash.

After 8 PM, Binance released a preliminary investigation report regarding the incident, stating that the drop in ACT was primarily due to three VIP users and one non-VIP user selling approximately 1.05 million dollars worth of spot tokens in a short period, causing the price to drop.

Wintermute founder Evgeny Gaevoy also stated that the company did not participate in the leading operations of the ACT and other meme token crashes, only engaging in arbitrage on the AMM liquidity pool after the price volatility, asserting that the crash was not led by Wintermute.

For a time, only four unknown Binance users bore the brunt. However, CoinGlass data showed that at 6:30 PM, the open interest of Binance's ACT contracts plummeted by 75%, which is hard to explain as the "masterpiece" of four large holders.

At this point, ACT essentially declared chronic death. Perhaps there were no evildoers like Libra in this flash crash, but retail investors still became victims of a "coincidental" mistake made by the rule-makers of the game.

The VC Token Zeroing Incident: OM

To paraphrase Tolstoy's famous saying, "Rising tokens are always similar, while the tokens that plummet each have their own misfortunes."

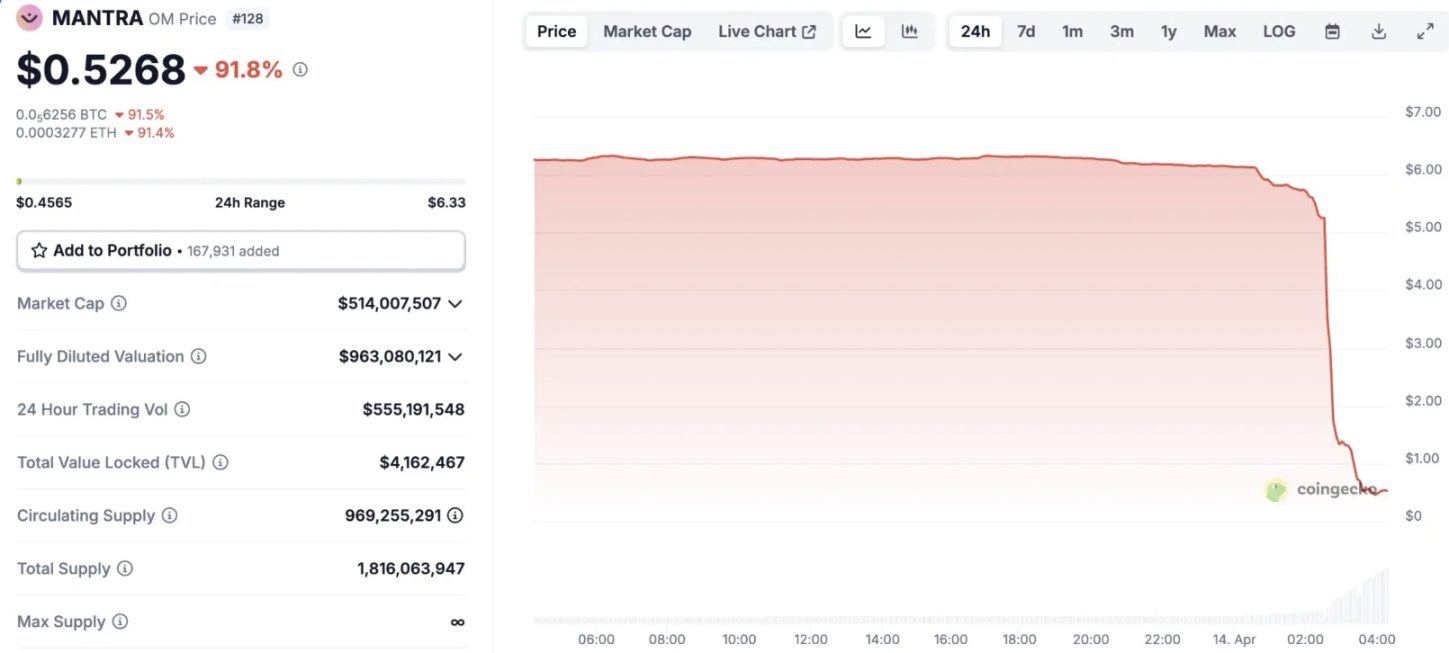

On April 14, 2025, MANTRA (OM) evaporated 5.5 billion dollars in market cap in just 15 minutes in the middle of the night, plummeting over 90%, directly dropping from within the top 25 cryptocurrencies to outside the top 90, undoubtedly marking it as one of the "top tragedies" in the crypto space.

However, before the crash, OM had been on a seemingly irreversible "demon coin" path. From October 2023 to February 2025, OM violently surged from 0.017 dollars to 9.17 dollars, an increase of nearly 540 times, which is uncommon for a VC token. The market and community attributed OM's myth of only rising and not falling to the strong backing behind it.

OM almost met all the expectations of a VC token—luxurious financing background, application scenarios (tokenization cooperation with a Middle Eastern real estate group), and listings on major exchanges like Binance, and moreover, it only rose without falling.

There must be a reason for the abnormality; the entire OM project is, in fact, very opaque. Multiple sources revealed that the MANTRA team held 792 million OM in a single address, accounting for 90% of the total supply, meaning the actual market circulation might be less than 1%. Some commented, "The team was even too lazy to distribute this supply across multiple wallets."

Analyst Mosi once wrote an analysis on how OM, a project with only 4 million dollars in TVL, could have a FDV exceeding 10 billion dollars. In reality, the only way to achieve this is to control the vast majority of the actual circulating supply.

The MANTRA team has been engaging in PUA tactics with the OM airdrop in the community, initially claiming to distribute 50 million OM tokens within a month and promising to unlock 20% upon listing. However, in practice, they repeatedly delayed and changed the rules, indefinitely extending the fulfillment period, thereby achieving passive locking of community tokens. In fact, if the full airdrop had been distributed, the actual circulating supply of OM would have significantly increased, and on-chain data indicated that the price would have dropped sharply.

In stark contrast to the constant teasing of the community, the addresses of large OM holders frequently withdrew tokens and transferred them to exchanges.

On March 25, the address of MANTRA's investment institution Laser Digital deposited 1.7 million OM into Binance, worth 11.49 million dollars. Additionally, according to Genç Trader's monitoring, the wallet address 0x9a…1a28 transferred approximately 20 million dollars worth of OM to OKX a day before the crash. From on-chain interaction records, this address had just withdrawn about 40 million dollars worth of OM from Binance in early March, being one of the whales that previously drove up the token price.

Additionally, on the day of the crash, on-chain detective ZachXBT stated that the OM crash event might be related to Denko (founder of Reef Finance) and Fukogoryushu. It is reported that these two contacted multiple people in the days leading up to the 90% drop in OM token price, attempting to secure large loans using their held OM tokens as collateral. The rumors of large OTC trades added a conspiratorial flavor to what seemed to be a premeditated harvesting.

In response to the crash, the MANTRA team released a statement claiming that the drop was due to irrational liquidations and was unrelated to the project itself, asserting that the team was not responsible. Subsequently, Mantra co-founder JP Mullin expressed on a podcast, "I feel bad, the community feels bad, but we didn't do anything wrong." He hinted in a public statement that the OM crash was targeted by a certain exchange and promised "full transparency of all information" and a "buyback and burn plan."

However, to this day, the MANTRA team has continued to "change their tune," shirking responsibility and shifting the blame while allowing their unimplemented plans to decline alongside the token price.

The New Scythe Spawned by Binance Alpha: ZKJ, KOGE

When discussing the cryptocurrency space in 2025, the innovations of Binance Alpha are undoubtedly a topic that cannot be overlooked. However, the flash crashes of ZKJ and KOGE within Binance Alpha have early on doused the enthusiasm for trading volume among the masses.

On June 15 at 8:30 PM, the native token of Polyhedra Network, ZKJ, plummeted over 85% within two hours, crashing from 2 dollars to 0.29 dollars, evaporating nearly 500 million dollars in market cap. Meanwhile, the governance token KOGE of 48 Club DAO dropped from 61 dollars to 8.46 dollars within half an hour.

Coinglass data shows that during the period from 8 PM to 10 PM that evening, the total liquidation amount across the network reached 102 million dollars, with ZKJ contributing 94.336 million dollars in liquidations, and long positions liquidating up to 93.6878 million dollars, completely harvesting the contract liquidity.

The points mechanism of Binance Alpha essentially creates a "liquidity illusion"—to obtain airdrops from Binance Alpha, users need to frantically trade pairs to earn points. However, many Alpha tokens are still highly volatile new coins or memes, and recklessly trading does not align with the risk preferences of Alpha players. Therefore, tokens with better liquidity and relatively stable prices in the Binance Alpha ecosystem have topped the "first trading list."

ZKJ and KOGE, caught in the eye of the storm, were precisely the two tokens with the largest trading volume on the BSC chain within Binance Alpha just before the incident. The low slippage strategy for trading the ZKJ-KOGE pair was widely shared in the community and on social platforms. Before the incident, the daily trading volume of this trading pair had consistently exceeded 200 million dollars.

However, the calm before the storm would not last long. The "liquidity illusion" led to LPs (liquidity providers) generally setting extremely narrow price ranges for ZKJ and KOGE. Once the illusion was pierced, massive sell-offs caused prices to break through this narrow range, and there was not enough capital in the market to absorb the sell orders, leading to an endless death spiral.

According to on-chain analyst Ai Yi, the flash crashes of ZKJ and KOGE exhibited characteristics of a meticulously planned harvesting operation. Three main addresses targeted the massive trading volume and liquidity formed by the trading of the two tokens under the Binance Alpha backdrop, employing a dual strategy of "large liquidity withdrawals + continuous selling," causing both tokens to crash in succession:

The address starting with 0x1A2 withdrew approximately 3.76 million dollars in KOGE and 532,000 dollars in ZKJ liquidity twice between 8:28 PM and 8:33 PM, subsequently exchanging 45,470 KOGE for ZKJ, valued at 3.796 million dollars, and selling off 1.573 million ZKJ in batches.

The second key address withdrew about 2.07 million dollars in KOGE and 1.38 million dollars in ZKJ liquidity while selling 1 million ZKJ.

The third address conducted a liquidation operation after receiving 772,000 ZKJ transferred from the second address, further exacerbating the downward trend of ZKJ.

Thus, Binance Alpha cannot guarantee the safety and credibility of projects. The short-term stability and high returns are merely a poison that forms a habitual mindset, making it easier for you to remain attached when the final net is cast.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。