Editor's Note: On June 30, Robinhood co-founder Vlad Tenev posted on X that the company would make a significant announcement related to its crypto business at 11 PM Beijing time tonight. This move aligns perfectly with Robinhood's current pace of comprehensive expansion in the crypto and fintech sectors.

As fintech gradually evolves towards "platformization" and "intelligence," Robinhood stands at the intersection of traditional brokerage and the new order of crypto, sketching out potential forms of future personal financial services with a series of product line reorganizations.

Robinhood is moving away from a single trading tool positioning and shifting towards a user lifecycle-centered "operating system" layout. From private equity tokenization, integrating CFTC-compliant prediction markets, launching Cortex and Strategies that cover AI strategy advisory and options strategy construction, to introducing "cash delivery" style Robinhood Banking and a unified multi-chain wallet architecture, its financial landscape expansion pace far exceeds traditional expectations for a fintech company.

In this deep interview with Bankless, Tenev systematically elaborated on Robinhood's overall vision for expanding into crypto, AI, private banking services, and private equity. He emphasized that Robinhood is not the "opposite of centralization," but is becoming a bridge connecting TradFi and DeFi: providing more efficient and fair financial access methods outside of a banking license; at the same time, he responded to the controversy of "whether it is Bankless," pointing out that Robinhood plays a channel service role rather than a sovereign issuer in the crypto business.

Currently, Robinhood is no longer just an entry ticket for retail investors in U.S. stocks but is attempting to become a shared entry point for crypto-native users, AI wealth management users, and global asset investors.

This interview was published on March 31, and the following is a translation of the conversation:

Bankless: Welcome to Bankless, a program dedicated to exploring the forefront of internet finance. Today, my guest is Vlad Tenev, CEO of Robinhood. With the continuous growth of platform users and asset management scale, Robinhood is accelerating its position as a leading player in the cryptocurrency space. In fact, they entered the crypto market early: not only did they offer cryptocurrency trading features in the Robinhood App, but they also launched the Robinhood Wallet—a true non-custodial crypto wallet.

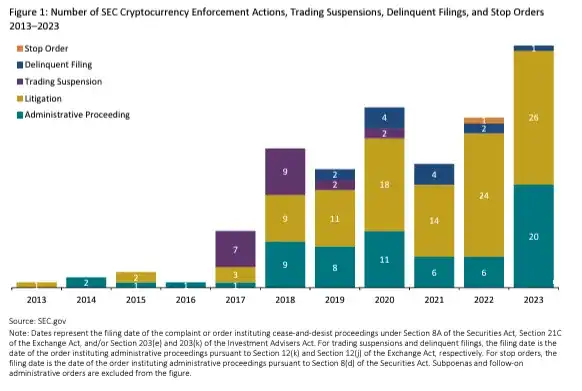

However, due to the previous U.S. Securities and Exchange Commission (SEC)'s tough stance on regulating the crypto space, Robinhood's further expansion in the crypto field was once put on hold. Now that phase has passed, and I want to understand—after finally getting the SEC's approval, how will Robinhood advance its crypto product layout? Coincidentally, during the week I spoke with Vlad, Robinhood announced a series of major product lines: including Robinhood Banking strategy and Cortex. I also wanted to take this opportunity to have an in-depth conversation with Vlad about these new businesses.

For me, the most interesting part of the entire interview, and my favorite part, was the discussion about "the increasing barriers for private companies to go public in traditional financial markets" and "how this trend intersects with the tokenization movement." Some of the most promising companies today, like SpaceX, OpenAI, and Anthropic, are still private companies. Although their equity circulates in various ways in the private market, there is no real public market.

Vlad believes that tokenization can play a significant role here—it can not only bring liquidity to these private companies but also provide investment opportunities for investors looking to access cutting-edge technology companies. This innovation is a perfect match, and if we were to talk about the most suitable platform to support this tokenization market, Robinhood is undoubtedly the most promising candidate.

Overall, I thoroughly enjoyed my interview with Vlad. Although Robinhood is not yet a fully "de-banked" platform, they are continuously challenging the traditional financial system and forcing the old order to change—this is a good thing for the entire industry. So, let's officially start today's program. But before that, I want to thank the sponsors who make this show possible, allowing this so-called DeFi "Wild West" program to continue. That's why you should check out FRAC's Finance—a cutting-edge protocol that is completely reshaping the stablecoin system.

Welcome to Bankless Nation. Today, we have Vlad Tenev, CEO of Robinhood. This is Vlad's third appearance on the show. Every time he comes, there are always some major updates about Robinhood. At the same time, every time Vlad appears, Robinhood further delves into the crypto space. This time is no exception. Vlad, it's great to have you back; welcome back to Bankless.

Vlad Tenev: Thank you for having me; I'm always happy to be here.

Bankless: You recently released a series of major product updates: Robinhood Strategies, Robinhood Banking, and Robinhood Cortex. The timing of our episode is just right, although it's actually a coincidence. We will talk about these products shortly, but I want to start with some more crypto-native topics, especially the new changes in the regulatory environment for crypto in the U.S.

Under the leadership of this new government, the U.S. crypto industry has welcomed many new opportunities, especially for institutional investors who were previously hesitant due to regulatory uncertainty. Now that this new government is in place, what specific "doors" have been opened? What can Robinhood do now that it couldn't do before? Which door do you plan to walk through first?

Change in SEC Regulatory Attitude

Vlad Tenev: I think the most direct change is that the U.S. has stopped the practice of "enforcement instead of regulation." Simply put, we no longer have to face a full-on crackdown on every aspect of our business. This shift has brought about significant improvements. For example, the SEC announced that it would stop investigating Robinhood's crypto business, as well as the crypto businesses of several other companies in the industry. At that moment, we felt an immediate sense of relief—we could finally move forward as a company and as an industry without constantly fighting against that endless suppression.

The previous administration had a very clear stance on crypto: they did not believe that crypto should exist at all, let alone allow it to deeply integrate with the traditional financial system. So, this policy shift is a huge boon. Additionally, there are two important legislative directions that are also advancing. Of course, I must emphasize that stopping "enforcement-style regulation" itself is already a very important turning point.

Another noteworthy development is the clear regulatory stance on meme coins. You may have seen that the SEC released a memo regarding meme coins, clearly stating that these tokens are not securities. This is actually not very controversial. From a legal analysis perspective, meme coins do not meet the definition of securities, which is relatively clear. However, in the past, each project had to conduct this analysis individually to determine whether it was a security.

Robinhood has always been one of the more compliant companies; we conduct strict reviews and compliance analyses for each cryptocurrency, including whether it constitutes a security. This is both costly and cumbersome. So now that there is clear guidance and exemptions from the authorities, it is very valuable and greatly reduces the operational burden on us and the entire industry.

Similarly, there is now a clearer definition regarding whether staking constitutes a security. This is a very positive development. Think about it: the essence of staking is that users contribute their computational resources to support the operation of the blockchain. The existence of staking service providers is to reduce the complexity of this process.

Overall, this means that users can achieve higher returns, which means more crypto assets flowing into their wallets. The previous lack of clear regulation in this area was actually harming American consumers because they could not earn the returns they deserved on platforms with more robust regulations.

So, having clear guidance now is a good thing. Currently, there are two important legislative directions being advanced in the U.S.: one is stablecoins, and the other is market structure. The stablecoin legislation is expected to pass first, which is certainly good news for the entire industry. But what we are really excited about is the legislation on "market structure."

We believe this legislation is key, as it will provide a clear roadmap for how we can integrate crypto technology into traditional financial assets in the real world. For example, securitized assets, yield-generating stablecoins, and even prediction markets, etc. We will be able to clearly define:

Which assets belong to crypto asset securities (Crypto Asset Security),

Which belong to crypto asset commodities (Crypto Asset Commodity),

What compliance steps we need to take as a platform to launch crypto asset securities,

And what conditions issuers need to meet to issue such assets to the American public.

I think these questions are key, and legislation can help us answer them one by one, which is the real prerequisite for unleashing the potential of crypto technology. We are very excited about this.

You just mentioned that some companies are exploring using stablecoins to build banking services, meaning that users' stablecoins can be staked or put into some pool to earn returns. I believe that the real implementation of such innovative products requires the cooperation of "crypto market structure legislation," which will bring more competitors into the banking industry.

Currently, the stablecoin legislation does not fully cover these "yield-generating stablecoins," so it cannot provide a solid legal foundation for such models. We do need more regulatory clarity to make these products more compliant and safer for the public. But we remain optimistic and are actively participating in the relevant legislative work in Washington. From the current situation, the direction is positive, and we are confident about it.

Bankless: From what you said, I feel that there are already many product lines that could theoretically be launched, but we are still in a stage of exploration or conception. To truly enter the implementation and construction phase, Congress needs to pass the relevant bills quickly. Is my understanding correct?

Vlad Tenev: Absolutely correct. For example, a stablecoin that directly pays interest to holders is essentially very similar to a money market fund. In fact, many stablecoins themselves hold government bonds, so from this perspective, they are not much different from money market funds. The regulatory treatment of stablecoins has always been somewhat different, but we believe this is precisely where regulatory clarity is needed.

Private Equity Tokenization

Bankless: Let's talk about the field of "asset tokenization." I think this is a particularly hot topic, especially in traditional finance. Because it essentially serves as a bridge between traditional finance and the crypto world: can we put more assets on-chain to truly leverage the advantages of public, permissionless blockchains? What role does Robinhood play in this trend of tokenization? I guess you are optimistic about it. Will you be an issuer or a platform? Will Robinhood issue tokenized products itself, or is it more inclined to become a trading market for these products? Where do you position yourself in this tokenization technology stack?

Vlad Tenev: For us, the definition of "asset tokenization" is creating a mapping of a non-native crypto asset on-chain so that it can be freely traded. We actually already have some examples of this, such as stablecoins. Stablecoins are essentially tokenized government bond assets. Another interesting example is the tokenized gold product launched by Paxos. We have also collaborated with Paxos and other companies to launch USDG, the Dollar Global Network project, aimed at creating a stablecoin that can pay attractive yields to holders globally.

The next step, naturally, is tokenized securities, which is a direction we are very much looking forward to. Because it would allow global users to own shares in U.S. companies just like they do with stablecoins. Just as stablecoin legislation is seen as a tool to promote the global dominance of the dollar, tokenized securities could also become key for U.S. companies to maintain their dominance in the global market.

Vlad Tenev: Currently, it is very difficult for overseas investors to invest in U.S. companies. Just as stablecoins have made it easy to access dollars, tokenized securities can allow global users to easily invest in U.S. stock companies. This is beneficial for businesses and for investors outside the U.S., as they can access quality assets as a means of diversifying their wealth against their own depreciating currencies. This is also a boon for U.S. entrepreneurs and capital markets. If we can more easily finance companies through the global crypto market, we will see more interesting and promising companies emerge. In fact, we published an op-ed in The Washington Post a few months ago calling for the promotion of private securities tokenization.

Think about it: how difficult it is to invest in private companies like OpenAI or SpaceX right now. And crypto technology is actually a solution. If we can tokenize the shares of private companies, it would be beneficial for both the companies and the investors. What I find absurd is that we now have very clear regulatory definitions for meme coins, allowing people to freely invest in these fundamentally baseless projects, but we can't invest in high-quality private companies like OpenAI or SpaceX.

Bankless: If I piece this information together, there is already a "market" for SpaceX equity, but it currently remains in the private market. Many people have bought shares of SpaceX through various means. Are you saying that we can actually tokenize these shares, using crypto to make this market more standardized and structured, turning it into a truly regulated and deep market?

In this process, Robinhood could become a platform providing a trading market. Are you suggesting that this is one of your roadmaps? And how far are we from Robinhood launching tokenized products for companies like SpaceX?

Vlad Tenev: Yes, Robinhood is at the intersection of traditional finance and crypto finance. We have all the crypto technology, and we also possess a complete traditional financial infrastructure, as we have multiple licensed brokerage entities. This is where we can contribute to the ecosystem.

In the future, I think it might resemble the issuance mechanism of ETFs. An ETF essentially holds a basket of securities and then issues ETF shares to the public. This can actually be seen as a precursor to tokenized securities. In the operation of an ETF, investors can exchange a basket of underlying assets for ETF shares and can also redeem ETF shares for those assets. This "creation/redemption" mechanism is essentially a counterpart model to the tokenization logic in traditional finance. And crypto technology can make this process more efficient and decentralized.

Bankless: We see that while the number of IPOs has not plummeted dramatically, the overall trend is indeed declining. The reason is simple: the cost of IPOs is simply too high, making it increasingly difficult for many companies to meet the threshold. Will this also drive the development of this new path of "private market tokenization"? Or is this path too complex and difficult to implement from the perspective of compliance and traditional financial regulations in various countries? What do you think?

Vlad Tenev: I believe this trend will push "securities tokenization" to become an alternative path to IPOs. This situation will happen sooner or later—even if the U.S. does not implement it in the short term, other countries will start to try. The essence of crypto is global. If you can issue tokens for a company's shares through blockchain in a compliant jurisdiction, then you can immediately reach a market that is increasingly liquid, with participants spread across the globe and a user base of hundreds of millions. For this reason, I believe the U.S. will ultimately have to accept this trend.

This tokenization has two key uses:

First, in the startup phase, this is akin to a traditional IPO, which is primary market financing. The "main capital" at this stage is very important. As a founder who once started during the seed round, I know that fundraising takes up a lot of energy and resources, which is very tight for small companies. If we can quickly access a global pool of funds to complete financing, this is a very attractive option. This will also give rise to more new companies and projects, providing investors with early (albeit riskier) but potentially higher-return opportunities.

Second, for later-stage private companies, like OpenAI or SpaceX, whose founders have already raised substantial funds and may even be planning an IPO. In this case, tokenization may not be very attractive to the founders, but it is very valuable for employees. Many large companies have thousands or even tens of thousands of employees, but without a clear expectation of IPO or exit liquidity, there is no predictable channel for liquidity. At this point, they may want to liquidate or cash out a portion of their shares to achieve asset diversification. This creates a strong real-world incentive for tokenization.

There are indeed some "employee equity secondary markets," such as EquityZen and Forge, which actively contact employees to help them transfer shares. But the biggest problem with these platforms is that liquidity is fragmented. The platforms have to match buyers and sellers themselves, which makes the process inefficient. The advantage of crypto lies in interoperability. As long as you put the assets on-chain and turn them into freely tradable tokens, you can immediately tap into global liquidity. This is where tokenization as a technological solution is most powerful.

Bankless: Indeed, there are many trends pushing in this direction. Companies like SpaceX and OpenAI are private and clearly have no interest in going public. Many AI private companies are like this—they do not have publicly traded equity and are not as large as Meta or Google, where stock purchases face dilution issues, making it difficult for investors to truly bet on the AI track.

Vlad Tenev: For ordinary investors, the options to bet on AI are very limited. You might only be able to buy NVIDIA (but its market cap has exceeded a trillion), Alphabet (also a trillion-dollar company), and Tesla. Of course, they are all too large and have already reflected most of the AI premium. But you cannot invest in truly core AI startups like OpenAI, Anthropic, or Perplexity.

Bankless: Yes, just look at the current trends in the public market—it is clear that new investment opportunities are increasingly not appearing in the public market but are concentrated in the private market. Part of the reason for this, as I mentioned earlier, is that the compliance costs of IPOs are rising, and the thresholds are becoming harder to cross. Meanwhile, crypto is providing a potential solution. I see many favorable winds pushing this trend toward its conclusion: private market equity tokenization may ultimately become a form of "quasi-public market."

Alright, I also want to talk about prediction markets because I remember Robinhood has recently ventured into this area. Didn't you once have a slogan that said "Everything can be marketized"? Or am I mistaken? Is this your formal strategic direction, or is it just an impression from the outside? Can you help clarify this for me?

Robinhood's Entry into Prediction Markets

Vlad Tenev: Actually, Robinhood has not officially used the slogan "Everything can be marketized."

Bankless: So that was indeed my imagination.

Vlad Tenev: However, our parent company is called Robinhood Markets, and you may have heard our mission slogan: to enable everyone to participate in financial democratization. This means we believe in the power of markets; if a market exists, we think it should be facilitated to operate, allowing traders to participate. Especially in markets that were originally only open to institutions, if retail investors are interested, we believe they should also be able to participate in a fair environment. This is actually one of our goals in "building markets," and this certainly applies to prediction markets as well.

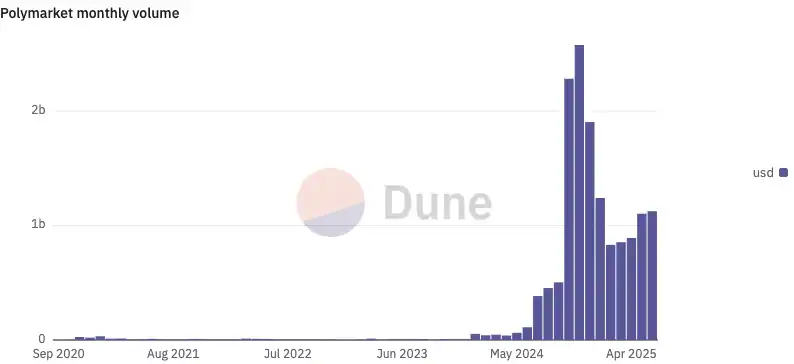

Personally, I believe prediction markets have an additional social value: they are not just trading venues; they can also provide more accurate event predictions. We have already seen this in presidential elections—while mainstream media was still watching, prediction markets had already given directional judgments hours or even days in advance. I believe we will see this trend in more areas in the future. So I think prediction markets are a kind of "truth machine"; they are an evolution of traditional news—sometimes even allowing us to "see the news" before events happen, which is very interesting.

Bankless: I also hosted a presidential election party like many others. The mainstream media was on TV, but most of my friends were from the crypto space, so in addition to the mainstream media, we specifically opened a Polymarket page on the screen. As a result, everyone kept switching between the mainstream media and Polymarket to check the data—Polymarket felt more "real-time" and closer to the truth.

Recently, Robinhood has made a new move in the prediction market space. Let me read a press release to introduce this topic: Robinhood has recently launched a prediction market section within its app, allowing users to trade on the outcomes of major global events. At launch, the contracts available for users to trade include "the upper limit of the Federal Reserve's federal funds rate in May" and contracts related to "the men's and women's NCAA basketball championships." It seems like two completely different types of markets. So, the first question I already know the answer to—what was the original intention behind launching the prediction market? But more importantly, this product is powered by Kalshi. Can you explain Kalshi's role in this collaboration?

Vlad Tenev: Sure, Kalshi is a DCM (Designated Contract Market), and its role is similar to that of an exchange in the stock market. For example, in the stock market, we have NASDAQ and the New York Stock Exchange. Robinhood, as a broker, connects with these exchanges or market makers to facilitate trades between buyers and sellers, with the trading matching occurring at the exchange. In the stock domain, Robinhood acts as a broker, introducing brokers and clearing brokers, sending orders to exchanges or market makers. In the futures market, which is regulated by the CFTC (Commodity Futures Trading Commission), the DCM plays the role of the exchange. Robinhood's role in this prediction market is as an FCM (Futures Commission Merchant), where we handle customer interactions, provide interfaces and order channels, and route orders to the DCM for matching.

You can think of Kalshi as NASDAQ, while we are the traditional broker. For contracts related to the presidential election, we connect with another DCM called ForecastEx, which is a subsidiary of Interactive Brokers. We can actually connect with multiple DCMs to provide users with different contract trading access. However, all the prediction market contracts we offer must be officially listed by a DCM before we can launch them.

Bankless: So, Robinhood itself cannot launch its own prediction market and can only connect through third-party DCMs, right?

Vlad Tenev: That's correct. The reason Polymarket, which you mentioned earlier, cannot operate compliantly in the U.S. is primarily that it is not a DCM. They operate their prediction market in a completely decentralized manner based on crypto technology. But this is one of the issues that the market structure legislation we mentioned earlier aims to address: who should regulate prediction markets like Polymarket within the U.S. regulatory framework? Should they be managed under the CFTC's commodity contracts, or should there be a new regulatory framework specifically for "crypto versions" of prediction markets? Currently, these questions do not have clear answers, and only after legislative progress can such markets operate legally in the U.S.

Bankless: I think our audience would certainly hope to use Polymarket legally in the U.S. as well. So, the last question about prediction markets: Robinhood has launched prediction markets for "federal funds rate" and "college basketball games." What new prediction trading products can we expect next? Can you share Robinhood's next steps?

Vlad Tenev: With the latest batch of prediction market contracts going live, we have upgraded from being able to launch only one contract at a time to being able to launch hundreds simultaneously. This involves complexities related to clearing, settlement, and dependencies between contract structures, especially for series contracts like the men's and women's NCAA basketball tournaments, which have greatly tested our systems. Next, we will soon have the capability to launch tens of thousands of contracts at once, which will completely unlock the diversity and potential of prediction markets.

We are excited about many areas, especially the development of artificial intelligence. There are some interesting prediction markets around AI technology advancements that can indeed provide insights, and our users are very interested in this. But more importantly, I believe prediction markets should become a "new type of newspaper." For example, it should include "front-page news" (what everyone is currently most concerned about), as well as sections like "sports," "business," and "entertainment." Prediction markets can serve as a miniature model of this information—a news form driven by real trading intentions.

Bankless: Yes, "prediction markets as truth machines" is why many crypto users are so fascinated by them. A typical example was the conflict between Israel and Iran; when missiles began crossing borders, the prediction markets on Polymarket provided very cutting-edge, real information. These events not only involve sensitive geopolitical issues but are also high-risk, high-impact events. We are entering an increasingly turbulent global situation, and ordinary people naturally want to better understand the probabilities of these possibilities occurring. How do you see Robinhood potentially integrating prediction markets related to global macro and geopolitical issues in the future?

Vlad Tenev: I believe this is valuable for society as a whole. Currently, the CFTC has certain guidelines for "event contracts" (i.e., prediction markets), such as clearly stating: "Prediction markets that do not serve the public interest should not be listed for trading." However, the concept of "contrary to public interest" is quite vague and broad. I think we should try to clarify this limitation because I believe that the vast majority of prediction markets are fundamentally in the public interest.

Three Product Lines

Robinhood Banking Product Line

Bankless: Back to the topic of Robinhood. You recently held a large launch event, similar to a Robinhood summit, where you introduced three new product lines: Robinhood Strategies, Robinhood Banking, and Robinhood Cortex. Let's discuss them one by one, starting with the one I'm most interested in: Robinhood Banking. What is the motivation behind this product? How did you initially come up with the idea?

Vlad Tenev: The core idea of this Gold event is that we want to provide all users with the same resources and services as high-net-worth individuals. High-net-worth clients typically have private banking advisors, investment consultants, and research teams that help them find opportunities globally (whether in public or private markets). Technology now allows us to offer this "family office-level service" to ordinary users at a very low cost. This is precisely the direction we want to achieve—putting a high-net-worth family's financial team in every user's pocket for just $5 a month, allowing Gold members to enjoy this service. What we want to do is not just provide financial services but to create a "financial product like the iPhone"—a high-end product that everyone can afford and be proud to own.

So, the three products we launched at the Gold event actually follow a complete mainline logic: Strategies is your digital investment advisor; Cortex is your intelligent research assistant; and Robinhood Banking is your private banker. This is also the first time Robinhood has launched AI products. In the future, you will see more cutting-edge reasoning models and intelligent models gradually integrated into the product experience, achieving deep interconnection between products and truly providing an intelligent financial service experience.

Robinhood Cortex Product Line

Bankless: When I read the announcement about Robinhood Cortex, I initially thought you were launching an AI agent. After reading more carefully, I understood it better. Why don't you give an example of how users actually use Cortex? I guess you have integrated it into Robinhood's mobile app, so is it like a ChatGPT specifically for the financial field? Can you elaborate on what kind of product it is?

Vlad Tenev: Currently, within the Robinhood App, Cortex has two main functional scenarios: the first is answering "what is happening with a particular stock right now." We often send push notifications to users, for example, when a stock rises or falls more than 5%. Many users will then click in to see what is happening with that stock. Cortex will explain the reasons driving the current price fluctuations on the stock's detail page, providing as clear an explanation as possible.

The second is related to options trading. Options can be very complex for most people, especially when it involves multi-leg strategy combinations that require a lot of professional judgment. Cortex, using the Trade Builder feature, can automatically construct suitable options strategy combinations based on your predictions for a stock's future movements, making the entire experience quite magical. We demonstrated this at the Gold event: users select a stock, input their predictions, and the system generates options strategies that can be traded directly or enters our new feature—the parallel options chain view, which allows for efficient operation of multiple options trades on one screen.

Bankless: It sounds like this process involves expressing trading intentions in natural language, and the AI processes that input and provides several suggested options combinations. Is it essentially "translating" human language into strategy execution suggestions? Is that the logic?

Vlad Tenev: Yes, but we don't just match based on your language input. We also integrate various external data, such as real-time market data, technical indicators, news, etc., to help you better form your predictions. In other words, we not only provide strategies based on your existing predictions but also assist you in making more accurate predictions.

Bankless: Can you talk about the underlying structure of this LLM (large language model)? I guess you are not just using a ChatGPT shell, right? Does it have any special data or training methods that make it a truly Robinhood-centric financial AI?

Vlad Tenev: That's correct. Most general-purpose LLMs do not have real-time financial data; their data is often lagging. Therefore, they cannot tell you the "current" price of a stock, nor can they accurately explain the reasons for price fluctuations. More seriously, they are prone to hallucinations in the financial domain due to a lack of accurate data support. The AI layer we developed addresses the hallucination problem and the real-time data issue, which are two major shortcomings of traditional LLMs.

Bankless: Yes, if an AI in the financial domain experiences hallucinations, the consequences could be catastrophic.

Vlad Tenev: Indeed. But the advantage of finance is that we have a "data truth source." Unlike writing a history paper where it's hard to say if there are hallucinations, financial data has clear standards, and we can set "guardrails" to accurately identify and correct "hallucinations."

Bankless: And this might be the core competitive advantage of Robinhood as a financial AI assistant: you not only have real-time market data but also user behavior data and all the contextual data from various financial scenarios.

Vlad Tenev: Yes, that's a significant advantage. Another point is that we can complete trading operations within the app. If we can make Cortex "context-aware" of the user's behavioral scenarios, it will become even more valuable. We don't want to just place a chat box in the app; that kind of thing is hard to use, produces lengthy outputs, and is prone to hallucinations. That would be a very naive approach, and we deliberately avoid going down that path.

Robinhood Strategies Product Line

Bankless: Let's talk about Strategies (the strategy platform) again: are you considering expanding this product to include crypto assets in the future? Because everyone involved in crypto gets asked by those around them, "How should I buy coins?" "How should I allocate?"—but no one really knows how to answer. If Strategies could provide intelligent allocation suggestions for crypto assets, wouldn't that be particularly valuable? How do you plan to expand into this area?

Vlad Tenev: Technically, there are no issues at all. We have a long list of features, perhaps dozens or even hundreds under consideration. Right now, we are primarily looking at what users want the most. We chose to start with individual stocks because most digital investment advisor platforms only support ETFs, while our core supports both individual stocks and ETFs in investment portfolios. At the same time, we designed a beautiful interface, such as a pie chart showing your asset allocation ratios, and it can help you automatically rebalance, creating an "almost hands-off investment experience." As for crypto assets, we actually considered adding them during the launch phase, and we will definitely integrate them gradually in the future. We are already live, and users can experience it directly; the feedback has been very positive, with many people starting to migrate their investment portfolios over.

Additionally, our Strategies have a significant differentiating advantage: we have completely disrupted the traditional fee structure of advisory platforms. Traditional advisors typically charge based on the percentage of assets under management (AUM). Traditional advisors charge about 1%, and the cheapest robo-advisors charge at least 0.25%. This creates a problem: the more you invest, the fees increase linearly, but the service does not improve correspondingly. For example, managing a million dollars with a robo-advisor is not ten times more complex than managing a hundred thousand dollars. But you have to pay ten times the fees. This has made high-net-worth users increasingly dissatisfied. Our designed strategy product has a fee cap: it charges a maximum of $250. Regardless of your asset size, the fees will no longer continue to grow. This way, the more assets a person has, the more cost-effective it is to use Robinhood Strategies, and they will be more satisfied.

Bankless: The fee cap for your Strategies is $250, so it is not charged based on AUM. Does this mean Robinhood is more inclined to treat this product as a "user count-driven" business? How does Robinhood benefit from the large-scale growth of Strategies?

Vlad Tenev: Yes, this fee model is actually a significant incentive—it will attract users with substantial external assets to transfer their funds to the Robinhood platform. Robinhood can benefit in several ways: asset management fees and Robinhood Gold subscription fees.

Moreover, we have observed that once users become Gold members and transfer a significant amount of funds, say $1,000, they will start to truly feel the value of the platform, and they are more likely to use more of our services, such as credit cards and self-trading. This is the goal we want to achieve—to "migrate" the user's entire financial relationship to Robinhood, allowing them to conveniently manage all their funds. As the total amount of funds on the platform increases, our revenue will also grow accordingly.

Cash Delivery Service

Bankless: Got it. I also want to ask about your new product—the cash delivery service. My reaction when I saw this feature was: is this the "Uber Eats" of cash? Why are you doing this? How does it work?

Vlad Tenev: Yes, we are indeed entering the "logistics business," which is quite interesting to me personally. First of all, this is a high-end private banking service. Robinhood does not have physical branches, so we asked ourselves: how can we provide customers with a full digital banking experience without a branch? Although cash payments are declining, they still account for 16% of all payments in the U.S., and many people still need cash. But if you are using a purely digital bank, you can only withdraw cash at places like 7-11 or CVS. Clearly, "withdrawing cash at a convenience store" is completely contrary to the "private banking experience."

We asked, can we turn this around—make the bank "come to your door"? Current logistics platforms are already very mature, delivering in 15 minutes; you can even have an iPhone delivered directly to your door. So, what we want to do is apply this model to cash services.

Of course, we won't build a complete logistics system ourselves but will collaborate with professional partners, and we will announce this partnership soon. Although it's complex, we believe it will bring tremendous value. I used to be a customer of First Republic, and they offered a "cash delivery" service (though it involved armored vehicles for large cash amounts). We are thinking about how to standardize this "service exclusive to the wealthy" so that more people can afford it.

Bankless: I guess the minimum withdrawal amount you set won't be something like $100, right?

Vlad Tenev: We set a minimum delivery amount of $200 during the demonstration. However, we are still in the exploratory phase, and the specific minimum amount, user behavior, average withdrawal amount, and other data will depend on user feedback after launch. But we expect the average amount to fall within the range of several hundred dollars.

Robinhood's Next Stop: Product Matrix and Ecological Layout

Bankless: Back to the crypto topic. There aren't many crypto assets currently available on Robinhood; do you have plans to expand to more coins?

Vlad Tenev: Yes, since the regulatory environment has improved, we have actually launched quite a few assets, such as Trump Coin, which we launched on inauguration day and was very popular. Now, thousands of new coins are being created every week. We also realize that we need to rethink our strategy for launching assets. You should see Robinhood Wallet (our on-chain wallet product)—currently somewhat disconnected from the main app—will be more integrated with the main app in the future.

You will see: the main app gaining more on-chain functionalities; smoother withdrawals and deposits for the wallet; and a gradual integration between custody and DeFi products. As the industry matures, our strategy will shift from "carefully selecting assets to launch" to "efficient optimization based on backend demand," allowing customers to choose independently. However, we must also establish a filtering mechanism to avoid fostering speculative bubbles and prevent users from accessing high-risk junk coins in an information-asymmetrical situation.

Bankless: So you currently have Robinhood Wallet, the main Robinhood App, and the Robinhood credit card, which is part of Robinhood Banking, right?

Vlad Tenev: Yes, the Robinhood credit card has now been integrated into Robinhood Banking.

Bankless: Is the division of labor among these three applications mainly due to compliance/regulatory considerations? Is there any thought of integrating them into a "super financial app"?

Vlad Tenev: We initially did want to create an "integrated app," but the issue is that the design of the homepage becomes too important. Active traders and users who use credit card/banking functions have completely different expectations for the homepage. Moreover, most users indeed treat the "trading interface" and "banking interface" as separate.

So, whether to integrate, I am open to it. We can try to create a super app, but I am not fixated on "having to merge." More importantly: unified KYC; seamless fund flow between accounts. Beyond that, let the best interface win. Our main app may add more features, and we do not rule out allowing different teams to create independent apps, even splitting and merging like Uber and Uber Eats.

Bankless: Finally, I want to chat more freely. You know our show is called Bankless, advocating for "de-banking," emphasizing self-custody and self-management of assets. And Robinhood has many features that actually sound very "bank-like," such as your plans to launch banking products. Crypto indeed challenges traditional finance, like Wells Fargo, which only offers a 0.25% savings rate and lacks innovation. But Robinhood does provide a better choice, and you are not "completely Bankless." So I want to ask:

Vlad Tenev: "How Bankless am I, really?" Right?

Bankless: Yes, how Bankless are you? Where is Robinhood headed in the future?

Vlad Tenev: Actually, we are literally Bankless right now; we do not have a banking license. Sometimes people ask me: do you want to apply for a banking license? Because we are often compared to traditional financial companies that have banking licenses. Having a license has some benefits, such as direct access to systems like FedWire and Zelle; being able to issue loans, conduct clearing, and other businesses.

But currently, our strategy is to cooperate with banks as a neutral platform. For example, in our credit card business, our partner bank is Coastal Community Bank, and other banks are also involved in our cash management program. In fact, many DeFi projects essentially need bank interfaces—because whenever you want to convert fiat currency into on-chain assets, the bank is a part of that link.

I believe that more "crypto banks" will emerge in the future—those that have certain licenses, are regulated, but are not burdened like traditional banks. These banks can manage key aspects like fund pools and reserves, avoiding past collapse events, such as Terra Luna, Anchor, Celsius, and other projects that "look like banks but have no real rules." I have always been pro-market; I believe in free competition and fair regulation. These two worlds—traditional banking and crypto technology—will ultimately merge rather than be divided.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。