Revealing the market anomalies generated under Binance Alpha's incentive mechanism, particularly the essence of Bedrock $BR's $3 billion trading volume.

Author: Ltrd

Translation: Tim, PANews

"Show me the incentive, and I will show you the outcome," is a famous quote by Charlie Munger. Incentives are equally visible in the market, as exchanges can favor specific market participants by establishing particular fee structures, thereby indirectly influencing spreads and liquidity. They can also provide corresponding value loans based on liquidity scale to incentivize market makers to provide more liquidity. The possibilities are endless, but the key lies in understanding what incentive mechanisms are needed to attract attention and achieve goals.

After the massive airdrop of Hiperliquid, traders were eager not to miss out on opportunities, which was particularly evident in the upgrade of Binance Alpha 2.0. This platform serves as a pre-listing segment of Binance, specifically incubating emerging tokens with potential that have not yet met the main site listing standards. The launch of version 2.0 groundbreaking introduced a bidding trading model, providing an unprecedented liquidity entry for early projects.

Today, we are not here to discuss the auction features or other characteristics of Binance Alpha. I want to tell a small story: about incentive mechanisms, FOMO psychology, and how potential future gains can give rise to various anomalies in the market.

Binance Alpha points, which are the core element of this article, can be earned by users through trading activities on the Binance Alpha platform. Users can earn points by creating trading volume or holding tokens, but trading volume points seem to play a decisive role. These points can be used to participate in Alpha series activities (such as airdrops or TGEs). Historical data shows that tokens associated with Binance Launchpad often perform exceptionally well, making the projects quite attractive. Given that the potential scale of returns is still unclear, many traders are rushing to collect points in anticipation of substantial rewards.

Now, let's get to the point. The mechanism is simple: users need to generate trading volume to earn points. As a result, we see that most tokens related to Binance Alpha have experienced a surge in trading volume. At the same time, the market is exhibiting an unusual volatility pattern that is extremely rare under normal conditions.

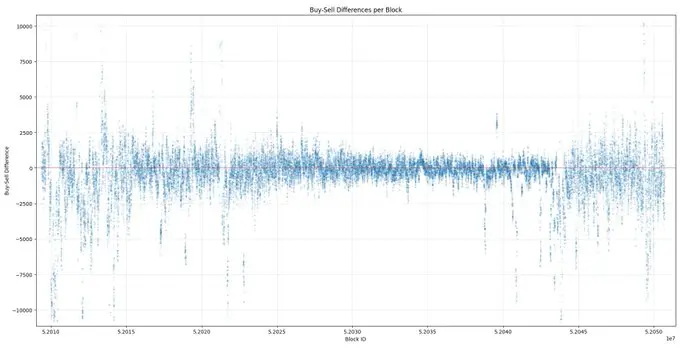

Taking Bedrock ($BR) as an example, it is currently the hottest token on PancakeSwap, with a trading volume exceeding $3 billion in the past 24 hours. Its chart shows that both buyers and sellers are actively trading, resulting in massive transactions (as shown in the 10-minute rolling trading volume below).

This indicates that despite the total trading volume reaching approximately $3 billion, the net difference in the value of USDT traded on both sides is close to zero. This phenomenon suggests that there are market participants executing hedging strategies, whose trading activities generate almost no net position risk.

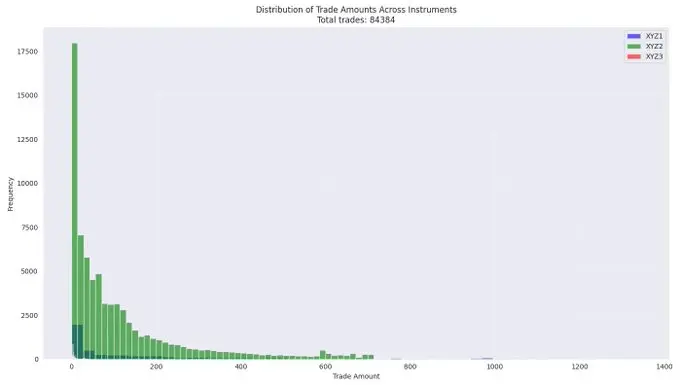

When trying to interpret the truth behind the data, especially in the absence of additional background information (on-chain data usually provides more clues, while centralized exchanges only disclose information visible to all users), you must dig into every detail: transaction amounts, transaction frequency, outliers, market impact distribution, order sizes, etc. When you cannot grasp the complete information held solely by the exchange, you need to focus on every detail. Let's focus on order size analysis.

The histogram does not conform to a normal distribution at all. In most cases, we see trading volume exhibiting an exponential distribution, but this is not the case here. Most trades are concentrated in the 12k-14k range, which is considered high by conventional standards. Such concentration should raise alarms and warrant in-depth analysis. It is advisable to refer to trading volume data of other assets on the BASE chain as a comparative benchmark.

Diving deep into on-chain data can particularly reveal the issues at hand. Clearly, some anomalies are occurring. It is highly likely that people are trying to quickly earn points to participate in future Binance airdrop activities. Let's see if this hypothesis holds.

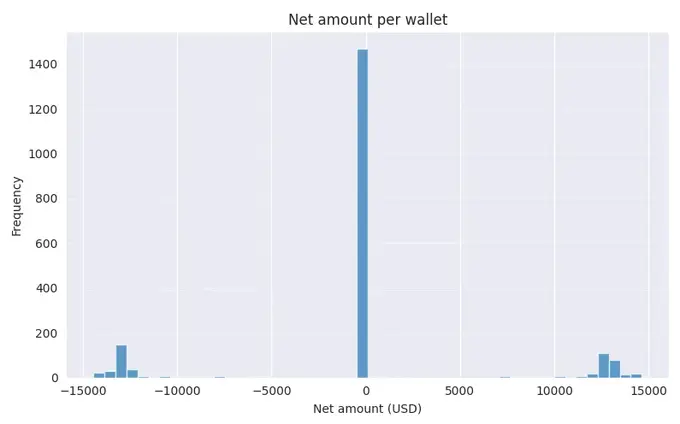

How is this strategy executed? It's simple: engage in two-way trading, minimize losses, and accumulate points as much as possible. This is actually a clever idea. If this strategy holds, then we should see that the number of tokens traded on both the buy and sell sides for most wallets is almost the same. Now, let's extract a small sample of on-chain data for analysis.

As we can see, the net circulation of most wallets indeed approaches zero. Now let's quantify how many currency units fall into this near-zero range.

To be honest, this result is even more astonishing than I expected. Over 95% of wallets participating in the trading of this token have net positions close to zero (which means the quantities they bought and sold during this period are basically balanced). It is clear that the purpose of such operations is to generate points while avoiding risk exposure.

I also want to know what these wallets' target for points is. They are likely following some strategy, studying Binance Alpha's documentation, and identifying opportunities to hit specific point thresholds. Let's analyze the data.

According to my dataset, all wallets, except for five outliers, generated between 14 to 20 Alpha points, no more, no less. This may be because there is no rule stating "more points = larger airdrop rewards"; traders only need to reach a specific threshold.

I am also curious: what is the cost of generating one Alpha point? Since they often engage in two-way trading within the same or adjacent trading blocks, it is likely to incur some losses, but how much?

The average cost of Alpha points is about 5 to 10 cents, which is not high, but we are still uncertain about the final returns.

What I want to illustrate is that people will always try to "crack" the system; they want to exchange the lowest investment for the highest return. Whether you are building an exchange, a DeFi protocol, or a management team, designing a reasonable incentive structure is your responsibility. I hope this example clearly reveals this core point.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。