The report identifies three key themes: improved U.S. macroeconomic prospects reducing recession fears, increasing adoption by corporate treasuries as a significant demand source, and a shifting U.S. regulatory landscape supporting stablecoins and market structure. While acknowledging risks like potential yield curve steepening or forced selling from specialized corporate vehicles, Coinbase views these as manageable near-term concerns.

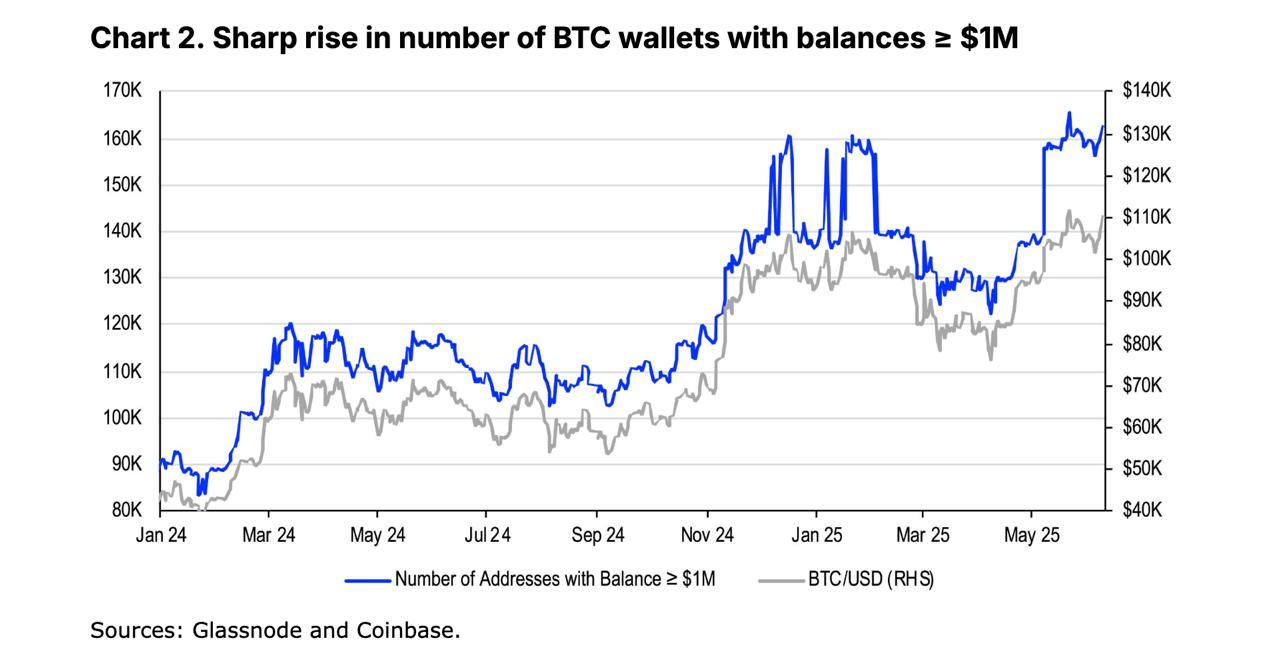

A notable trend is the sharp rise in corporate entities focused primarily on accumulating bitcoin and other cryptocurrencies. This corporate adoption is reflected in on-chain data showing a significant increase in the number of bitcoin (BTC) wallets holding balances exceeding $1 million. Data cited from Glassnode indicates these high-value wallets rose substantially from levels seen in early 2024 through May 2025.

This corporate accumulation, often funded through equity or debt issuance, introduces potential systemic risks related to forced selling or discretionary selling pressure. However, Coinbase analysts note that major debt maturities for these vehicles generally extend to late 2029 or beyond, mitigating immediate forced selling concerns.

On regulation, Coinbase highlights strong momentum for stablecoin legislation potentially reaching President Trump’s desk before the August congressional recess, alongside progress on a broader crypto market structure bill clarifying roles for the CFTC and SEC. The SEC also faces decisions on numerous pending exchange-traded fund (ETF) applications throughout 2025.

Despite risks, Coinbase expects bitcoin’s upward trend to continue, while altcoin performance may depend more on specific factors like upcoming regulatory decisions on single-asset ETFs. The overall outlook remains positive based on the confluence of economic, adoption, and regulatory factors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。