If BTC/ETH ETFs are the "funding entry" from off-chain to on-chain, then RWA is the "asset bridge" from on-chain finance to the mainstream world.

Written by: @Laaaaacieee, Bitget Wallet Researcher

1. Why is it important to pay attention to RWA now?

RWA is becoming one of the fastest-growing sectors in on-chain finance. With traditional financial institutions embracing blockchain technology and changes in the interest rate environment, an increasing number of real-world assets, such as U.S. Treasury bonds, gold, stocks, and accounts receivable, are being mapped onto the blockchain to achieve more efficient trading, custody, and yield distribution.

If BTC/ETH ETFs are the "funding entry" from off-chain to on-chain, then RWA is the "asset bridge" from on-chain finance to the mainstream world. Leading projects like Ondo Finance and Matrixdock have established partnerships with financial institutions such as Circle and BlackRock. At the same time, the trend of RWA products moving on-chain is accelerating from DeFi to wallet, exchange, and other end application scenarios.

2. Overview of the RWA Industry and Development Trends

2.1 Definition and Core Logic of RWA

RWA refers to the process of converting valuable assets from the real world into tokenized assets that can circulate and interact on the blockchain through on-chain issuance, mapping, staking, and splitting. Its core logic lies in achieving more efficient, transparent, and composable asset utilization through smart contracts and open financial protocols.

Assets typically include:

Bonds (e.g., U.S. Treasury bonds, private debt)

Commodities (e.g., gold, carbon credits)

Income (e.g., accounts receivable, prepaid orders)

Real estate (ownership shares held as NFTs)

Equity & securities (mapping traditional company stocks or fund shares onto the blockchain, usually involving the issuance of security tokens)

The advantages of bringing assets on-chain include increased liquidity, more real-time and convenient clearing and settlement (including cross-border), better transparency, reduced intermediary steps, and lower costs of asset issuance. Additionally, once RWA is on-chain, it can participate in various DeFi activities, making RWAfi a significant advantage.

Moreover, some RWA products have indeed realized the vision of allowing users to purchase assets that are unavailable off-chain (due to qualification issues) but can be bought on-chain:

For example, Goldfinch's Private Debt FoF product, which is based on private debt products from Mega Funds like Ares: these TradFi private debt products have high investment thresholds in traditional finance, but on the platform, investments can start from just $100.

For example, products like USDY, which are based on U.S. Treasury bonds: these solve the problem for residents of many countries who have no compliant way to purchase U.S. Treasury bonds.

2.2 Market Size and Growth Potential

2.2.1 Market Size & Growth Rate

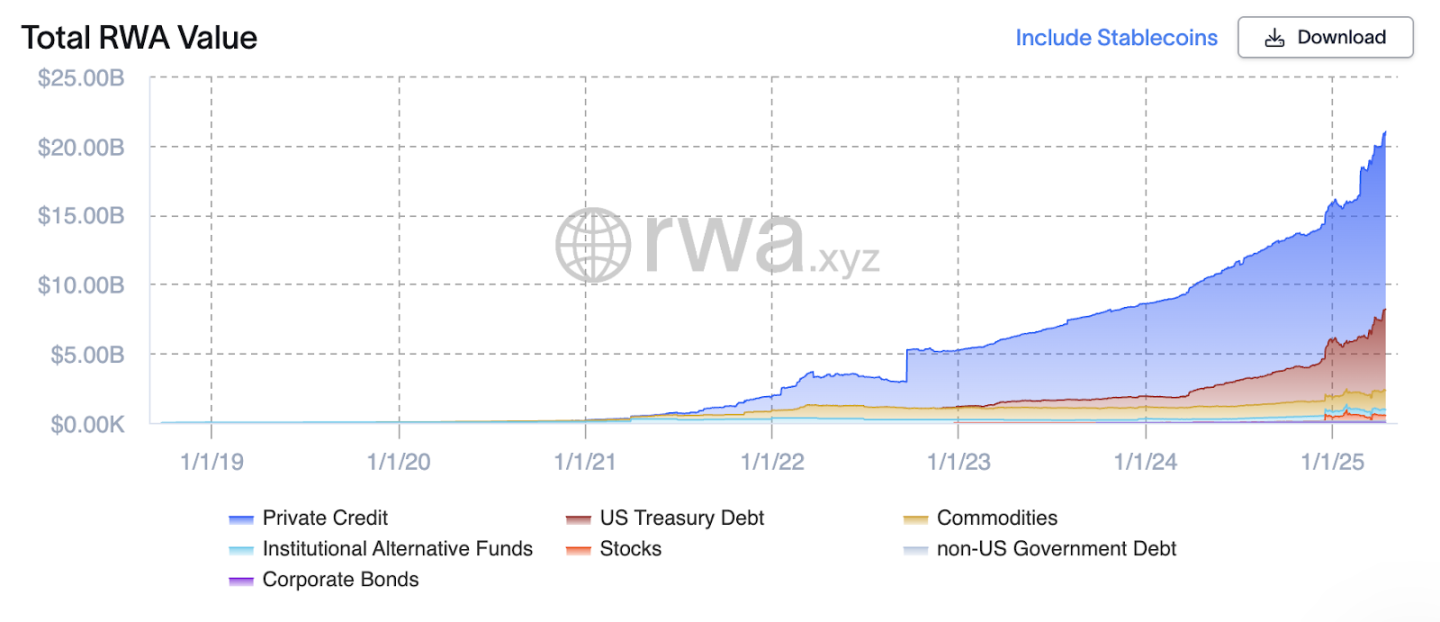

As of mid-April 2025, the total size of global on-chain non-stablecoin RWA is approximately $21 billion, with a year-on-year growth of nearly 115%, and a compound annual growth rate (CAGR) of about 120% over the past three years. The growth in scale is primarily driven by debt-type RWA represented by U.S. Treasury Debt and Private Credit, with 3-Year CAGR of 3590% and 135%, respectively.

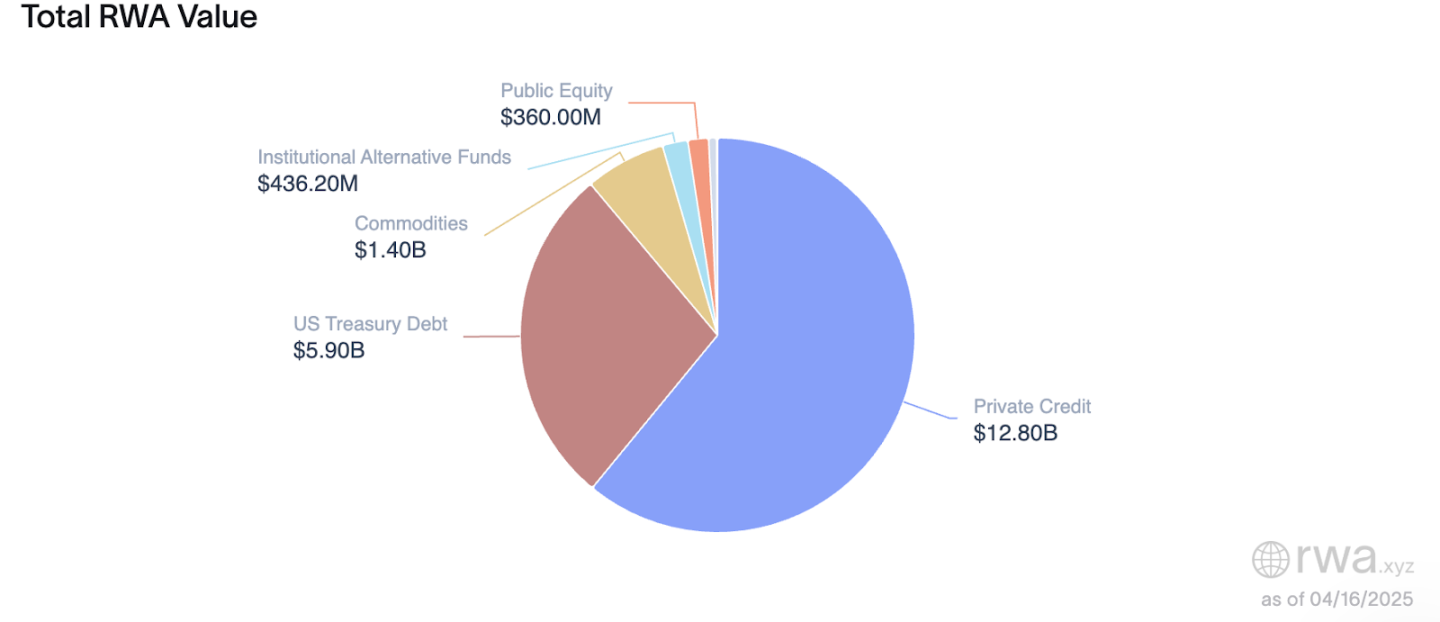

Among global on-chain non-stablecoin RWA, the top three categories are Private Credit, U.S. Treasury Debt, and Commodities, with on-chain sizes of $12.8 billion, $5.9 billion, and $1.4 billion, respectively, accounting for approximately 61%, 28%, and 7%.

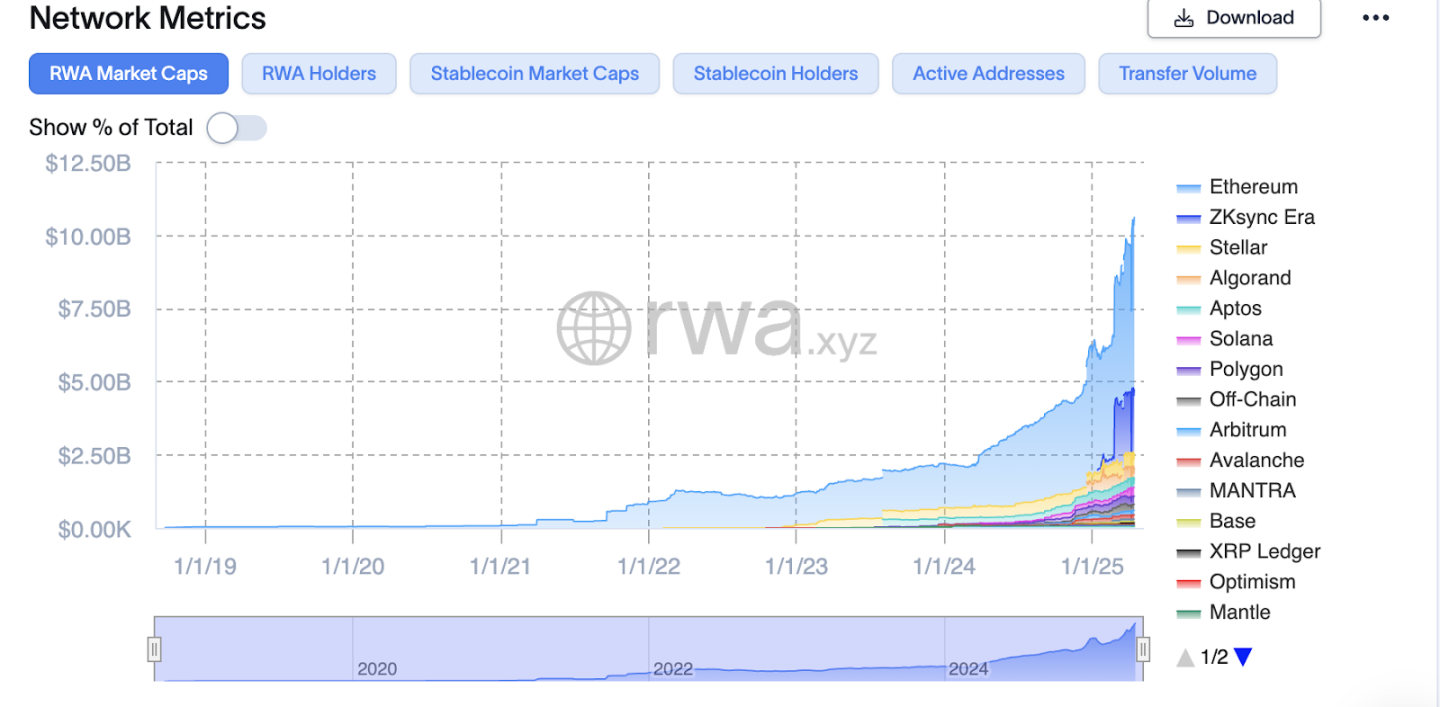

From the on-chain distribution perspective, Ethereum remains the primary issuance platform for RWA, holding about 58.6% of the market share, with an asset management scale of $5.87 billion; followed by ZKsync Era, which accounts for 17.4%, with a scale of $1.74 billion.

2.2.2 Future Growth Space

According to a research report titled "Reimagining Asset Management" jointly released by Boston Consulting Group (BCG) and digital securities platform ADDX in July 2022, the total size of global tokenized assets is expected to reach $16 trillion by 2030 (indicating a 760x growth potential from the current size), with RWA becoming an important component of on-chain assets.

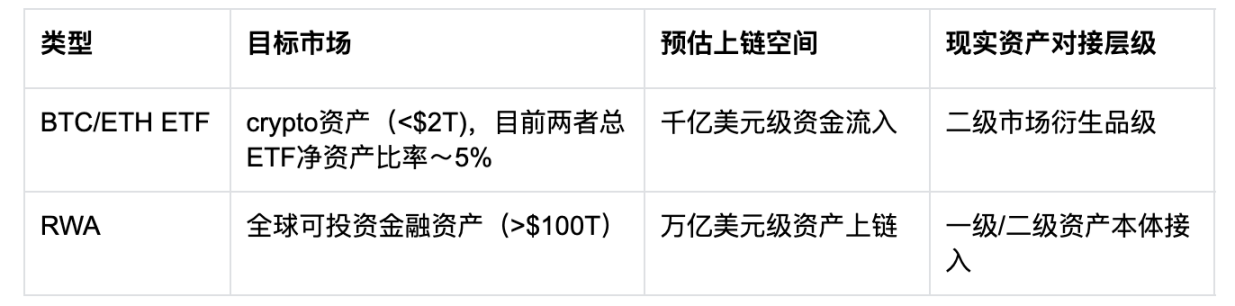

I believe a significant comparative dimension is BTC/ETH ETFs. As of the closing data on April 15, 2025, the total assets under management for Bitcoin ETFs were $97.23 billion, and for Ethereum ETFs, $8.29 billion, totaling 5x the asset size of non-stablecoin RWA.

BTC/ETH ETFs are the "funding entry," while RWA is the "asset exit."

ETFs: package on-chain assets into traditional financial products → guide traditional funds onto the chain; representative significance: compliant investment channels + public-level recognition; limitations: investment targets are still limited to BTC/ETH, leaning towards speculation / hedging needs.

RWA: map off-chain assets onto the chain → build a new financial market on-chain; representative significance: allow on-chain DeFi and wallets to carry real value from off-chain; advantages: a wider variety of asset types (bonds, gold, real estate, credit…), stronger yield support.

RWA has the potential to truly bridge TradFi and on-chain DeFi through "structural integration."

ETFs are more of an "asset packaging and repackaging," essentially still a manifestation of the TradFi market.

RWA disassembles the underlying assets of TradFi into smart contracts + part of the on-chain account system, deeply embedding into DeFi protocols (such as collateral lending, yield aggregation, stablecoin anchoring, etc.).

RWA brings a structural revolution in asset supply — more "difficult," but also more "significant," with long-term implications and ecological embedding depth far exceeding that of ETFs.

ETF vs RWA Scale Potential

ETFs represent opportunities for CEX, asset management, and exchanges.

RWA is the core battlefield for DeFi, wallets, and on-chain protocols.

Wallets can manage assets, display portfolios, serve as entry points for wealth management, and provide KYC visibility.

For example, wallets integrating products like Ondo, sUSDS, USDY, etc., provide on-chain guaranteed wealth management functions, serving as a complement to CEX products.

Meanwhile, ETFs are primarily managed by BlackRock, Charles Schwab, and Blackstone, and will not have a revolutionary impact on wallet products.

2.3 Driving Factors in the Sector

2.3.1 Macroeconomic Interest Rate Environment Driving "Real Returns" On-Chain

Since 2022, the world has entered a high-interest-rate cycle, particularly represented by the U.S., where the federal benchmark interest rate has remained above 5%, significantly increasing the attractiveness of traditional financial assets (such as U.S. Treasury bonds and money market funds).

At the same time, the traditional DeFi ecosystem faces challenges of declining on-chain risk-free interest rates and a competitive yield model during market fluctuations, leading to a rapid rise in user demand for "stable, high-yield" asset allocations.

RWA products precisely fill this demand gap: mapping real-interest-bearing assets like U.S. Treasury bonds, bonds, and income certificates onto the chain, providing on-chain users with investment options that offer "low volatility + real interest."

2.3.2 Traditional Financial Institutions Actively Entering the Market, Bringing Asset and Credibility Endorsements

Starting in 2023, top global financial institutions, including BlackRock, Franklin Templeton, WisdomTree, JPMorgan, and Citibank, have begun launching RWA-related businesses.

These institutions are attempting to issue traditional financial assets natively on-chain (rather than merely bridging or mapping) through methods such as issuing on-chain fund shares, tokenizing U.S. Treasury products, and establishing tokenized asset funds.

This move not only expands asset offerings but also signifies the integration of traditional financial sovereign credit with blockchain settlement efficiency, greatly enhancing market confidence in RWA.

Representative cases include:

Franklin Templeton issued the on-chain U.S. money market fund share BENJI Token, traded on the Polygon and Stellar networks.

BlackRock invested in the tokenization platform Securitize and plans to issue a tokenized fund on Ethereum.

Citi announced a pilot for on-chain settlement of certain custodial bonds.

2.3.3 Gradual Relaxation of Global Regulations, Unlocking Legalization Channels

Unlike the "wild growth" of the ICO era, RWA involves "heavily regulated assets" such as securities, bonds, and funds, and must be advanced through compliant pathways.

Currently, several countries and regions have established clear regulatory frameworks to set legal foundations for asset on-chain, token issuance, and holder rights:

p.s. Reg A+ is a lightly regulated issuance mechanism under U.S. securities law that allows project parties to issue stocks or tokens to the general public, rather than just accredited investors, without going through a traditional IPO, with a maximum fundraising limit of $75 million per year. Currently, Exodus Movement, INX, and tZERO have all utilized Reg A+ to issue assets.

Notable cases:

Swiss Sygnum Bank has issued tokenized bonds for its industry, allowing investors to purchase corporate financing products on-chain;

Hong Kong supports the China Construction Bank in issuing HKD 200 million tokenized green bonds on-chain, marking Asia's first government-supported Tokenized Bond project.

2.4 Main Participant Classification

Participants in the RWA ecosystem can be primarily divided into four categories: asset issuers, infrastructure providers, application layer platforms, and data service providers.

Asset Issuers (Token Issuers)

Responsible for mapping real-world assets (such as U.S. Treasury bonds, gold, real estate, etc.) into tradable tokens on-chain, undertaking key tasks such as asset compliance structure design, yield distribution, and custody regulation.

Infrastructure Providers (RWA Infra & Issuance Chains)

Provide asset custody, identity verification, regulatory compliance support, and asset issuance platforms, mostly Layer 1 or permissioned chains.

Application Layer Platforms (Access Products & User Protocols)

Provide user interfaces, asset portfolios, wealth management tools, etc., often integrated with DeFi modules, connecting retail investors with on-chain RWA.

Data and Index Service Providers (Oracles & Indices)

Provide on-chain data foundations such as prices, volatility, and indices for real-world assets, serving as a bridge between off-chain information and on-chain protocols.

2.5 Development Limiting Factors

Many companies are experiencing rapid business changes, and their business models are still in the experimental phase: this is reflected in the fact that press releases from six months ago have become distorted, and the business content presented on current websites has changed significantly (e.g., projects like Credix, which previously operated as a credit platform, now have no related introduction on their official website and have transformed into PayFi products).

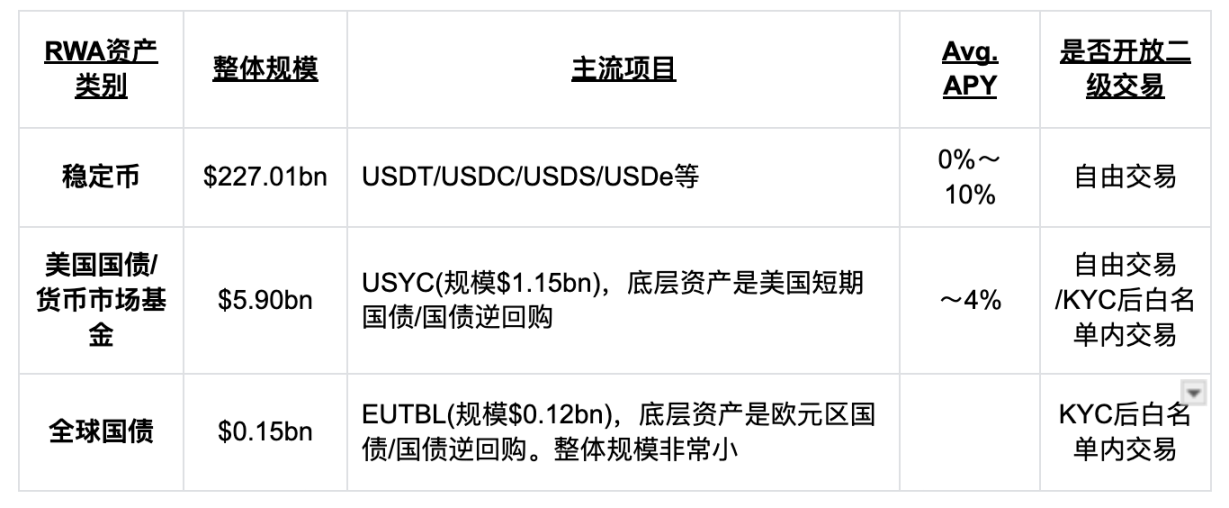

In terms of liquidity, most current RWA products only support transactions within a whitelist, with only a small number of products supporting free market circulation:

Most RWA products (such as Private Credit LP certificates, Treasury products, etc.) only support free transfers within the whitelist. Currently, only the following can achieve completely free secondary market trading:

Products based on commodities (such as gold, etc.)

U.S. Treasury products like $USDY issued by Ondo Finance, which are built through a compliance framework.

Compliance risks and the alignment of on-chain and off-chain assets remain unresolved: RWA essentially connects the on-chain contract system with off-chain asset custody and contractual rights relationships, and this cross-domain mapping inherently carries compliance risks and inconsistencies in asset alignment. Most current projects adopt a "hybrid architecture" using "SPV (Special Purpose Vehicle)" or collaborating with regulated custodians to complete asset issuance, where the centralized end requires users to complete KYC and subscription reviews, while the on-chain end (such as bTokens) is assumed to have free circulation properties as standard ERC-20 tokens. However, due to the lack of unified regulatory paths across different jurisdictions, inconsistent KYC policies, and difficulties in verifying on-chain identities, the following core challenges remain:

Widespread regulatory vacuum or gray area operations: Many projects have not obtained clear securities issuance licenses but instead use structural design to "evade definitions" (regulatory arbitrage). However, once regulatory policies tighten, they will face the risk of being phased out.

Difficulty in verifying the authenticity of asset custody: Whether on-chain tokens truly correspond to off-chain assets, users mostly rely on custodians to provide proof or third-party audit reports, but these proofs lack standardization and enforceability.

Lack of transparency in clearing and recovery processes: When underlying assets encounter issues (such as defaults, early redemptions, or SPV bankruptcies), how on-chain holders can assert their rights and participate in clearing remains unanswered, and on-chain smart contracts cannot handle off-chain legal matters autonomously.

Difficulty for regulators to define the compliance identity of DeFi products: Especially when integrating RWA into DeFi (such as using them as collateral for loans or combining with AMM liquidity pools), current laws do not clearly define their attributes, leading to potential risks of "illegal securities issuance" or "cross-border transaction violations" for project parties and users.

Representative cases:

Maple Finance faced situations where LPs could not redeem due to defaults by some borrowing institutions. Although the project had on-chain funding logic, it ultimately required off-chain arbitration to resolve.

Backed Finance explicitly positions its products as "for compliant whitelist users only," which limits their liquidity but is also a way to mitigate compliance risks.

RealT holders must undergo KYC verification through a U.S. entity to assert property and income rights. If issues arise with the KYC mechanism, on-chain rights will become fragile.

3. RWA Key Player Ecosystem Map

3.2.1 U.S. Treasuries Category

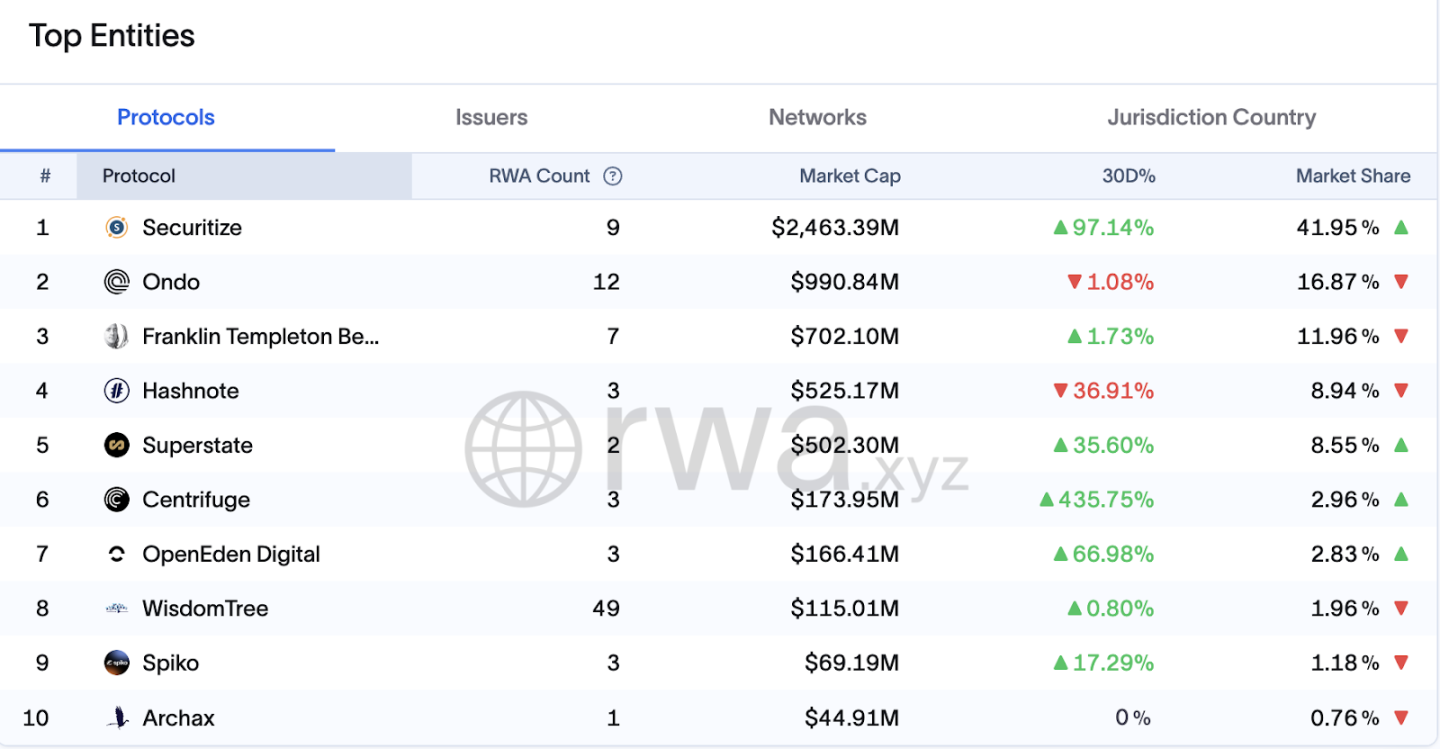

Currently, the top 5 project parties hold an 88% market share, with Securitize and Franklin Templeton representing "traditional financial compliance-type issuers," while Ondo and Superstate represent "Web3 native compliant yield product platforms."

Securitize

https://x.com/Securitize

Founded: 2017

Headquarters: San Francisco, USA

Founders: Carlos Domingo (former head of digital business at Telefónica), Jamie Finn

Funding: Raised approximately $100 million, with investors including BlackRock, Morgan Stanley, Blockchain Capital, Circle Ventures, etc.

Core Resources:

SEC-registered broker-dealer and transfer agent

Operates Securitize Markets, providing a compliant digital asset securities trading platform

Collaborates with BlackRock to serve as the transfer agent for its first publicly tokenized fund on a blockchain.

Representative Products:

Provides equity tokenization services for companies like Exodus and Oddity

Supports tokenization of various assets including private equity, bonds, and real estate.

Ondo Finance

https://x.com/OndoFinance

Founded: 2021

Headquarters: New York, USA

Founders: Nathan Allman (former Goldman Sachs employee), Pinku Surana

Funding: Secured multiple rounds of funding, with investors including Founders Fund, Pantera Capital, etc.

Core Resources:

Established strategic partnerships with BlackRock, Mastercard, Aptos, etc.

Launched Flux Finance, supporting decentralized lending for assets including USDC and OUSG.

Representative Products:

USDY: A stable yield token backed by short-term U.S. Treasury bonds and bank deposits.

OUSG: A token pegged to short-term U.S. government bonds.

Franklin Templeton (Traditional Financial Asset Management Giant)

https://x.com/FTI_Global

Founded: 1947

Headquarters: California, USA

Core Resources:

Global asset management scale exceeding $1.6 trillion

Launched BENJI tokens on multiple blockchains including Stellar, Ethereum, Polygon, Arbitrum, Base, etc.

Representative Products:

- BENJI: A token representing the Franklin OnChain U.S. Government Money Fund (FOBXX), with each token corresponding to a fund share.

Hashnote

https://x.com/Hashnote_Labs

Founded: 2023

Headquarters: Chicago, USA

Founder: Leo Mizuhara

Funding: Incubated with a $5 million investment from Cumberland Labs.

Core Resources:

Acquired by Circle in 2025, integrated as part of its digital asset capital market products.

Launched USYC, becoming one of the largest tokenized money market funds globally.

Representative Products:

- USYC: A tokenized money market fund supported by short-term U.S. Treasury bonds (Primary and Secondary trading limited to whitelisted investors passing a KYC/AML onboarding process).

Superstate

https://x.com/superstatefunds

Founded: 2023

Headquarters: San Francisco, USA

Founders: Robert Leshner (founder of Compound), Dean Swennumson, Reid Cuming, Jim Hiltner

Funding: Raised a total of $18.1 million, with investors including CoinFund, Distributed Global, Breyer Capital, Galaxy Digital, etc.

Core Resources:

Launched USTB (Short-Term U.S. Government Securities Fund) and USCC (Crypto Arbitrage Fund)

Fund assets are held by regulated third parties to ensure compliance and security.

Representative Products:

USTB: Provides an on-chain investment channel for short-term U.S. Treasury bonds.

USCC: Combines crypto arbitrage and government securities yield strategies.

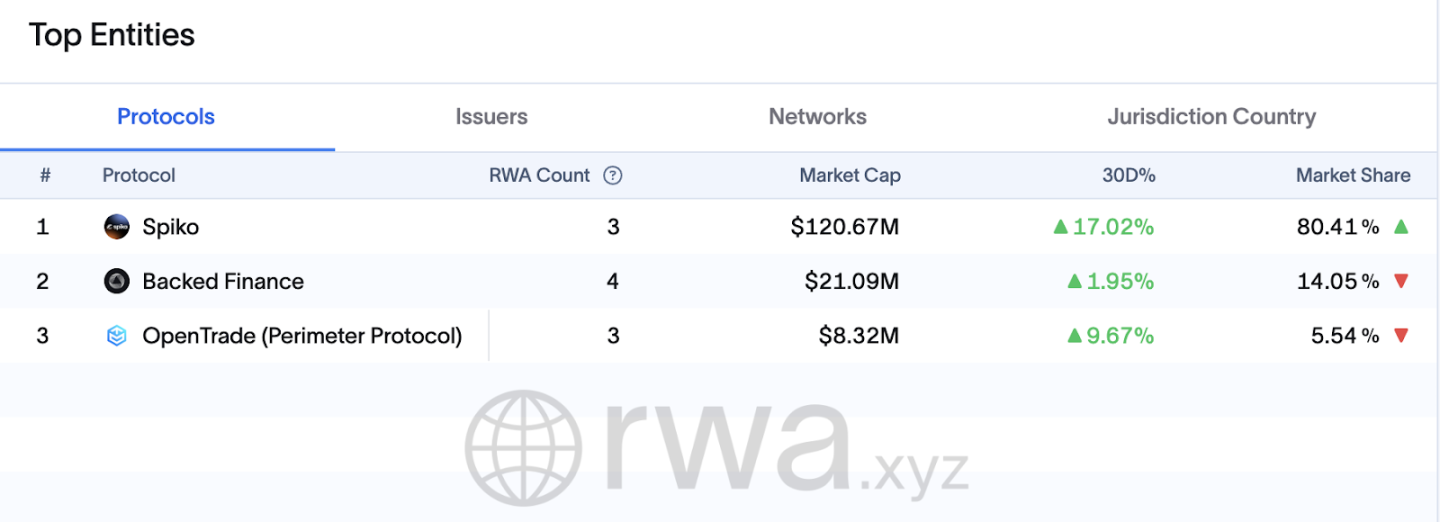

3.2.2 Global Bonds Category

Spiko

https://x.com/Spiko_finance

Founded: 2023

Headquarters: Paris, France

Founders: Paul-Adrien Hyppolite and Antoine Michon, both with financial and regulatory backgrounds, having held senior positions in the French government and private sector.

Funding: Specific funding information has not been publicly disclosed.

Core Resources:

Collaborates with the French Financial Markets Authority (AMF) to ensure product compliance.

Assets are held by subsidiaries of Crédit Agricole and Santander, ensuring asset security.

Representative Products:

€MMF: Invests in short-term government bonds from Eurozone countries, with an average maturity of less than 60 days and a maximum asset maturity of no more than 6 months.

$MMF: Invests in U.S. Treasury bonds, structured similarly to €MMF.

On-chain deployment: Launched on multiple blockchain networks including Polygon, Arbitrum, Starknet, and Etherlink.

OpenTrade

https://x.com/opentrade_io

Founded: 2023

Headquarters: San Francisco, USA

Funding:

Completed seed round funding in April 2024, raising $3.2 million, with investors including a16z crypto CSX, CMCC Global, Draper Dragon, Plassa Capital, and Ryze Labs.

Completed seed round extension funding in November 2024, raising $4 million, with investors including AlbionVC, a16z crypto CSX, and CMCC Global.

Core Resources:

Collaborates with WOO X, Littio, Nest, etc., to provide RWA yield products.

Assets are held by regulated third parties to ensure asset security.

Representative Products:

- RWA Yield Vault: Provides stable yield products backed by real-world assets.

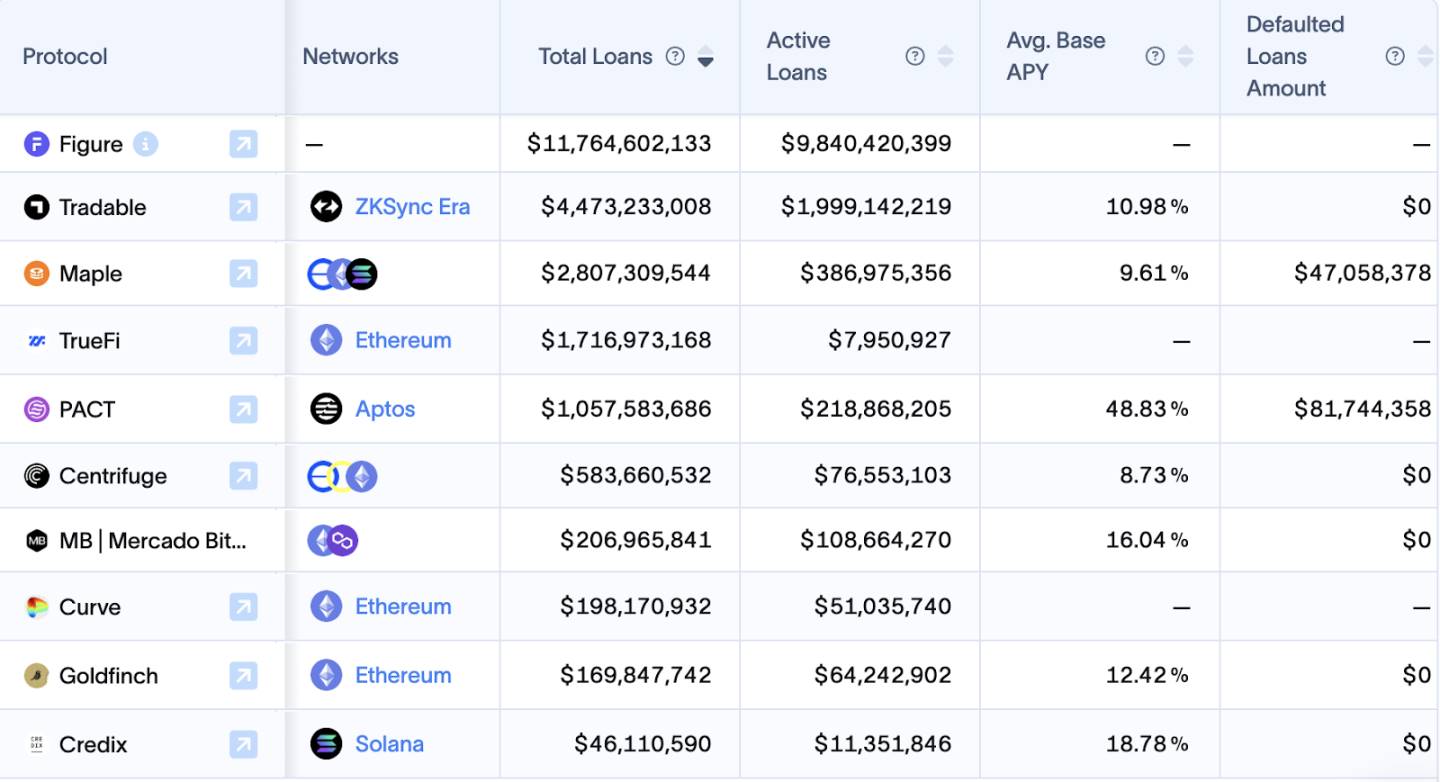

3.2.3 Private Credit Category

Centrifuge

https://x.com/centrifuge

Founded: 2017

Headquarters: Berlin, Germany

Team Background: Founded by Lucas Vogelsang and others, with team members having extensive experience in fintech and blockchain.

Funding: Completed multiple rounds of funding, raising over $15 million, with investors including Galaxy Digital, IOSG, BlueYard Capital, etc.

Core Resources:

Collaborates with DeFi protocols like MakerDAO and Aave to promote the development of on-chain lending markets for RWA.

Launched Centrifuge Credit Group, responsible for asset risk assessment and auditing.

Representative Products:

Tinlake: An open RWA investment platform that allows users to tokenize real-world assets for financing (KYC required).

Centrifuge Chain: A permissionless chain for the tokenization of RWA assets, only KYB.

On-chain deployment: Launched on multiple blockchain networks including Ethereum and Polkadot.

Figure

https://x.com/Figure

Founded: 2018

Headquarters: San Francisco, USA

Team Background: Founded by former SoFi CEO Mike Cagney, with team members having extensive financial and technical backgrounds.

Funding: Completed multiple rounds of funding, raising over $200 million, with investors including DST Global, RPM Ventures, DCG, etc.

Core Resources:

Developed the Provenance blockchain, focusing on blockchain applications in financial services.

Collaborates with multiple financial institutions to promote asset digitization and on-chain trading.

Representative Products:

Figure Markets: Provides a zero-fee trading platform for crypto assets (KYC required).

Figure Lending: Offers home equity-based loan services.

Tradable

https://x.com/tradable_xyz

Founded: 2022

Headquarters: Singapore

Team Background: Composed of fintech and blockchain experts dedicated to promoting asset digitization and on-chain trading.

Funding: Specific funding information has not been publicly disclosed.

Core Resources:

Provides asset tokenization services, supporting various asset types.

Collaborates with multiple financial institutions to promote asset digitization and on-chain trading.

Representative Products:

- Tradable Platform: An asset tokenization and trading platform that supports the tokenization and trading of various asset types.

Maple Finance

https://x.com/maplefinanec

Founded: 2021

Headquarters: Sydney, Australia

Team Background: Founded by Sidney Powell and Joe Flanagan, with team members having extensive financial and technical backgrounds.

Funding: Completed multiple rounds of funding, raising over $30 million, with investors including BlockTower, Maven 11, Framework Ventures, etc.

Core Resources:

Provides an institutional-grade decentralized credit market, supporting unsecured loans.

Launched the Syrup protocol, combining Maple's lending infrastructure with the openness of DeFi.

Representative Products:

Maple Direct: Provides direct loan channels for institutions.

Syrup: Offers high-quality asset-backed loans for DeFi users.

TrueFi

https://x.com/TrueFiDAO

Founded: 2020

Headquarters: San Francisco, USA

Team Background: Launched by the TrustToken team, with members having extensive financial and technical backgrounds.

Funding: Completed multiple rounds of funding, raising over $30 million, with investors including a16z, BlockTower, Alameda Research, etc.

Core Resources:

Provides an unsecured decentralized credit market, supporting loans for various asset types.

Launched a credit scoring system to assess borrower credit risk.

Representative Products:

TrueFi Lending: Offers unsecured loan services (KYC required).

TrueFi Credit: Provides credit scoring and risk assessment services.

Mercado Bitcoin

https://x.com/MercadoBitcoin

Founded: 2013

Headquarters: São Paulo, Brazil

Team Background: Mercado Bitcoin is one of the largest cryptocurrency exchanges in Latin America, dedicated to promoting financial innovation and the development of digital assets.

Funding: Completed $200 million funding in 2021, led by SoftBank.

Core Resources:

Collaborates with Polygon Labs, planning to issue $200 million worth of RWA tokens by 2025.

Partners with Plume Network to tokenize Brazilian assets, including asset-backed securities, consumer credit, corporate debt, and receivables.

Representative Products:

MB Tokens: Launched over 340 tokenized products, with a total tokenized asset value of $180 million.

RWA Tokens: Includes tokens related to energy, oil, and real estate, providing stable yield distributions.

Goldfinch

https://x.com/goldfinch_fi

Founded: 2020

Headquarters: San Francisco, USA

Team Background: Founded by former Coinbase engineers Blake West and Michael Sall, dedicated to building an on-chain credit market without crypto collateral.

Funding: Completed $25 million Series A funding in 2021, led by a16z, with participation from Coinbase Ventures, Variant, BlockTower, etc.

Core Resources:

Collaborates with top private credit funds like Ares, Apollo, Golub, providing institutional-grade private credit products.

Launched Goldfinch Prime, allowing users to invest in multiple private credit funds for stable returns.

Representative Products:

Goldfinch Prime: Provides stable yield products backed by real-world assets, targeting an annualized return of 10-12%.

Callable Loans: Allows investors to withdraw their investments before the loan matures.

Credix

https://x.com/Credix_finance

Founded: 2021

Headquarters: Brussels, Belgium

Team Background: Founded by Thomas Bohner and others, with team members having extensive experience in fintech and blockchain.

Funding: Completed $11.5 million Series A funding in 2022, led by Motive Partners and ParaFi Capital, with participation from Valor Capital, Circle Ventures, Voltage Capital, and others.

Core Resources:

Focuses on on-chain credit markets in emerging markets, particularly in Latin America.

Collaborates with multiple fintech platforms to provide unsecured loan services.

Representative Products:

- Credix Platform: A decentralized capital market ecosystem that allows asset originators to tokenize assets and raise funds.

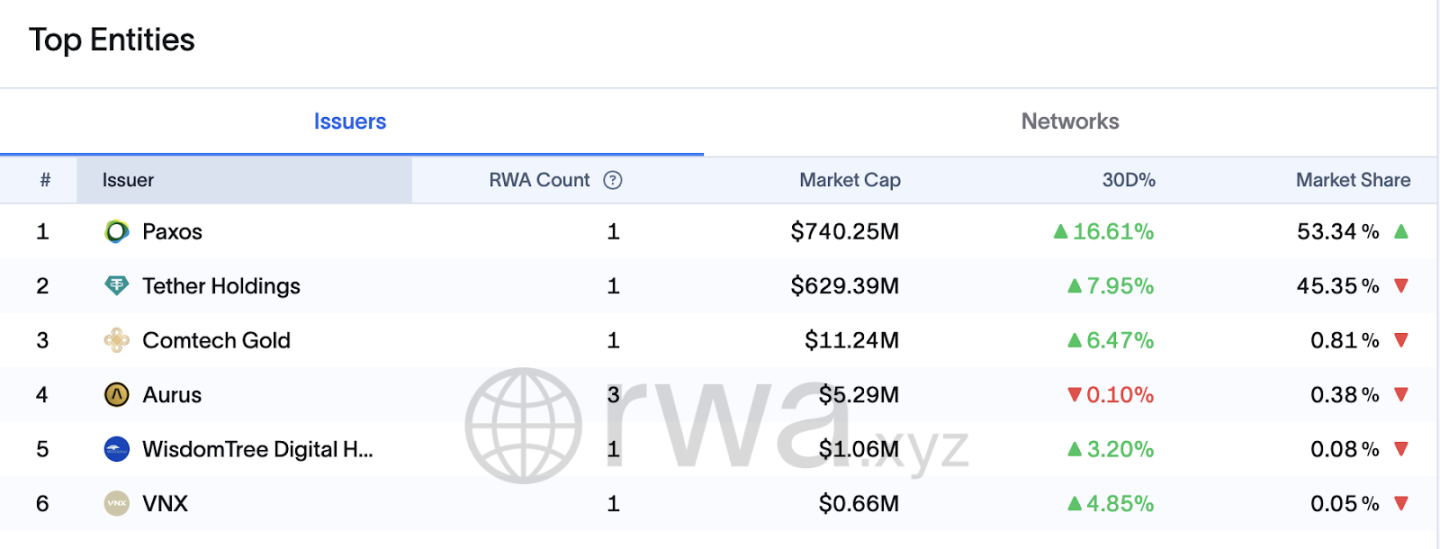

3.2.4 Commodities Category

RWA Gold Track Comparison

Paxos Trust Company

https://x.com/Paxos

Founded: 2012 (formerly itBit)

Headquarters: New York, USA

Team Background: Founded by Charles Cascarilla and Rich Teo, with team members having extensive financial and technical backgrounds. Paxos is the first blockchain company to receive a "limited purpose trust company" license from the New York State Department of Financial Services (NYDFS), dedicated to building regulated blockchain infrastructure.

Funding:

Raised over $540 million, with a valuation of $2.4 billion.

Investors include PayPal Ventures, Bank of America, Founders Fund, Oak HC/FT, Mithril Capital, and others.

Core Resources and Partnerships:

Provides crypto trading and stablecoin issuance services (e.g., PYUSD) for PayPal.

Collaborates with Stripe to provide stablecoin payment infrastructure for its "Pay with Crypto" product.

Works with financial institutions like Credit Suisse, Société Générale, and Revolut to promote asset digitization and on-chain trading.

Representative Products:

USDP (Pax Dollar): A regulated USD stablecoin, backed 1:1 by USD.

PAXG (Pax Gold): A regulated gold-backed token, with each token representing one ounce of physical gold.

PYUSD (PayPal USD): A USD stablecoin issued in partnership with PayPal.

USDL (Lift Dollar): A yield-bearing stablecoin issued by a UAE subsidiary, providing daily yield distributions to holders.

itBit Exchange: A regulated digital asset trading platform supporting various cryptocurrency trades.

3.2.5 Stocks Category

Synthetix

https://x.com/synthetix_io

Founded: 2018 (formerly Havven)

Headquarters: Australia

Team Background: Founded by Kain Warwick, with team members having extensive financial and technical backgrounds.

Funding: Completed multiple rounds of funding, with investors including Framework Ventures, Paradigm, and others.

Core Resources:

Originally positioned as an over-collateralized synthetic asset protocol, now transformed into a crypto-native derivatives platform, with a TVL of $71.97M.

Pioneered a debt pool model supporting multi-asset synthesis (stocks / commodities / forex). Maintains system stability through high collateralization rates (400-600%).

Representative Products:

Synths: Synthetic assets that track the prices of real assets.

Synthetix Exchange: A decentralized trading platform supporting the trading of Synths.

Backed Finance

https://x.com/BackedFi

Founded: 2021

Headquarters: Zug, Switzerland

Team Background: Co-founded by Dr. Adam Levi, Roberto Klein, and Yehonatan Goldman, with team members having extensive backgrounds in finance and blockchain technology.

Funding: As of April 2024, Backed Finance has completed a total of $17.9 million in funding, with investors including Gnosis, Coinbase Ventures, Semantic Ventures, Stratos Technologies, Blockchain Founders Fund, Stake Capital, 1kx, Nonce Classic, and others.

Core Resources and Partnerships:

Issues tokens based on the Swiss DLT Act, covering European retail investors through the EU MiFID II passport, with tokens representing real stocks held by an SPV (e.g., bCSPX corresponding to the S&P 500 ETF).

Collaborates with Chainlink to integrate a Proof of Reserve (PoR) mechanism, ensuring each bToken is backed 1:1 by assets.

Partners with INX to provide trading of bNVDA (NVIDIA stock) for qualified non-U.S. users on its platform.

Works with eNor Securities to promote its tokenized securities in the Latin American market.

Representative Products:

bCSPX: A tokenized product tracking the S&P 500 index.

bTSLA: A tokenized product tracking Tesla stock.

bNVDA: A tokenized product tracking NVIDIA stock.

bIB01: A tokenized product tracking the iShares 0-1 Year U.S. Treasury ETF.

bHIGH: A tokenized product tracking high-yield corporate bonds.

Product Features:

All bTokens are ERC-20 tokens, with transferability and composability, supporting multi-chain deployment.

Each bToken is backed 1:1 by real assets held by regulated third-party custodians.

Complies with the Swiss DLT Act framework, ensuring the legality and security of the products.

Utilizes Gnosis Chain to reduce gas costs.

Dinari

https://x.com/DinariGlobal

Founded: 2022

Headquarters: California, USA

Funding: Total funding of $17.5 million, with investors including Alchemy Ventures, 500 Global, Version One, and others.

Core Resources and Partnerships:

Registered as a transfer agent with the U.S. Securities and Exchange Commission (SEC), compliant in issuing dShares (tokenized stocks), backed by physical securities 1:1.

dShares are now deployed on Arbitrum and Ethereum mainnet, supporting multi-chain circulation.

Ensures compliance of security tokens through integration with compliant platforms like Securitize and INX.

Representative Products:

dAAPL: A tokenized product tracking Apple Inc. stock.

dTSLA: A tokenized product tracking Tesla stock.

dGOOGL: A tokenized product tracking Alphabet Inc. stock.

Product Features:

All dShares are ERC-20 standard tokens, supporting on-chain transferability (limited to whitelisted addresses), backed by real securities held by compliant custodians.

Complies with U.S. securities laws, requiring KYC/AML verification, primarily targeting accredited investors.

Swarm X

https://x.com/SwarmMarkets

Founded: 2020

Headquarters: Berlin, Germany

Team Background: Co-founded by Philipp Pieper (co-founder of Swarm Fund), Timo Lehes, and others, with team members having deep backgrounds in blockchain, financial markets, and regulatory compliance.

Funding: Seed round funding of approximately $5.5 million, with investors including Fenbushi Capital, Blockwall Capital, NEO Global Capital, and others.

Core Resources and Partnerships:

Regulated by the Federal Financial Supervisory Authority (BaFin) in Germany, holding a financial services license (FSP), enabling regulated digital asset trading services.

Launched Open dOTC (a permissionless RWA trading platform), supporting on-chain permissionless trading of RWA.

Representative Products:

Tokenized US Treasuries: Tokenized U.S. Treasury bonds.

Tokenized AAPL: Tokenized Apple Inc. stock.

Tokenized EUR Bonds: Tokenized Euro bonds.

Product Features:

All assets are ERC-20 standard tokens, backed 1:1 by physical assets, regulated by BaFin.

Supports permissionless OTC trading, lowering entry barriers and promoting liquidity.

3.3 Key Chains / Yield Aggregators and Other Infrastructure

Plume Network

https://x.com/plumenetwork

Positioning: Plume is the first modular Layer 1 blockchain designed specifically for real-world assets (RWA), dedicated to efficiently and securely bringing traditional assets on-chain.

Technical Features:

EVM compatible, supporting smart contract development.

Built-in compliance and asset tokenization mechanisms to simplify the on-chain process for RWA.

Supports cross-chain connectivity, deployed across 16 blockchain networks.

Ecosystem Development:

Over 180 protocols and 18 million unique addresses.

Launched Plume Passport (RWAfi wallet) and pUSD (ecosystem stablecoin).

Received investments from institutions such as Haun Ventures, Galaxy, and Superscrypt.

Converge

Ethena and Securitize are launching a new public chain, Converge, planned for Q2 launch. Converge is a settlement network for traditional finance and digital dollar transactions driven by Ethena Labs and Securitize. Its vision is to provide the first settlement layer designed for the integration of TradFi and DeFi, centered around USDe and USDtb, secured by ENA. This blockchain is considered to have two core application scenarios:

Settlement for permissionless spot and leveraged DeFi speculation;

Storage and settlement of stablecoins and tokenized assets.

Securitize will deploy its core future tokenized asset issuance layer on Converge. This will go beyond tokenized government bond products and funds, covering securities forms across all asset classes. Ethena will launch its core products USDe, USDtb, and iUSDe, with native issuance.

Applications will be built on Converge specifically to enable traditional finance to interact on-chain with iUSDe, USDe, and Securitize-supported assets.

Currently, five protocols have committed to building and distributing institutional-grade DeFi products on Converge:

Horizon by Aave Labs: A market designed specifically for Securitize tokenized assets (including Ethena's institutional-grade iUSDe), bridging traditional finance and DeFi;

Pendle Institutional: Provides interest rate speculation infrastructure for scalable institutional opportunities (like iUSDe);

Morpho Labs: Modular money markets for Ethena and Securitize assets;

Maple Finance and Syrup: Building verifiable on-chain institutional yield and credit products based on USDe and real-world assets (RWA);

EtherealDEX: Designing high-performance derivatives and spot trading for Ethena liquidity, using USDe as collateral.

Stellar

https://x.com/StellarOrg

Founded: 2014

Headquarters: San Francisco, USA

Team Background: Co-founded by Jed McCaleb and Joyce Kim, with Jed McCaleb also being a co-founder of Ripple and Mt. Gox.

Funding: Supported by the Stellar Development Foundation (SDF) with technology, resources, and funding to promote the development and application of the network.

Core Resources:

Utilizes the Federated Byzantine Agreement (FBA) consensus mechanism for fast, low-cost transactions.

Supports the issuance and trading of various assets, including fiat and crypto assets.

Collaborates with institutions like IBM and MoneyGram to promote global payment solutions.

Representative Products:

Stellar Network: Mainnet supporting the issuance, management, and trading of assets.

Lumens (XLM): Native token used for paying transaction fees and account activation.

Soroban: Smart contract platform supporting developers in building decentralized applications.

Algorand

https://x.com/Algorand

Founded: 2017

Headquarters: Boston, USA

Team Background: Founded by Turing Award winner and MIT professor Silvio Micali, with team members having deep backgrounds in cryptography and blockchain technology.

Funding: Supported by the Algorand Foundation to promote the development and application of the ecosystem.

Core Resources:

Utilizes a Pure Proof of Stake (Pure PoS) consensus mechanism for fast transaction confirmations.

Supports the creation and management of smart contracts and various assets.

Provides various development tools and SDKs, supporting multi-language development.

Representative Products:

Algorand Network: Mainnet supporting efficient, low-cost transactions.

Algorand Standard Assets (ASA): A Layer 1 feature allowing users to represent any asset on the Algorand blockchain, enjoying the same security and usability as the native Algo.

PolyTrade

https://x.com/Polytrade_fin

Founded: 2021

Headquarters: Dubai, UAE

Team Background: Founded by fintech expert Piyush Gupta, with team members from leading traditional finance and Web3 institutions such as SocGen, J.P. Morgan, HSBC, Polygon, PayU, possessing rich experience in asset management and on-chain finance.

Funding: Completed $3.8 million seed round funding in 2023, with investors including Alpha Wave, Matrix Partners, Polygon Ventures, Singularity Ventures, GTM Ventures, and CoinSwitch Ventures.

Core Resources:

Built an asset-agnostic RWA aggregation platform, integrating multiple issuers and nine asset classes (such as credit, real estate, government bonds, invoices, etc.).

Introduced the ERC-6960 standard to support the bundling/splitting of RWA assets.

Supported over 70 issuers and 7,000+ RWA assets, with a clear asset discovery → investment → secondary circulation process.

Representative Products:

Polytrade Marketplace: RWA aggregation platform providing asset discovery, trading, and bundling functions.

Polytrade Scan: On-chain asset browser enhancing asset traceability and transparency.

3.4 Notable Data & Research Promotion Channels

Data Websites:

RWA.XYZ: https://app.rwa.xyz/

DefiLlama RWA Module: https://defillama.com/protocols/rwa

Tokeny RWA Ecosystem Map: https://tokeny.com/real-world-asset-rwa-tokenization-ecosystem-map/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。