Trump FED Rate Cut Demands Revive Debate Over Policy Autonomy

Trump Rate Cut calls have resurfaced, with the President publicly urging the Federal reserve to make deep interest rate cuts. On Monday, Donald Trump sent a handwritten letter to Chair Jerome Powell, criticizing the current rate level and suggesting they be slashed to around 1%.

The note, which he posted on social media, claimed the US was “losing hundreds of billions” due to tight monetary policy. Trump accused the falling to act in time and called central banking. “One of the easiest jobs”-- reigniting debate over political influence on monetary policy.

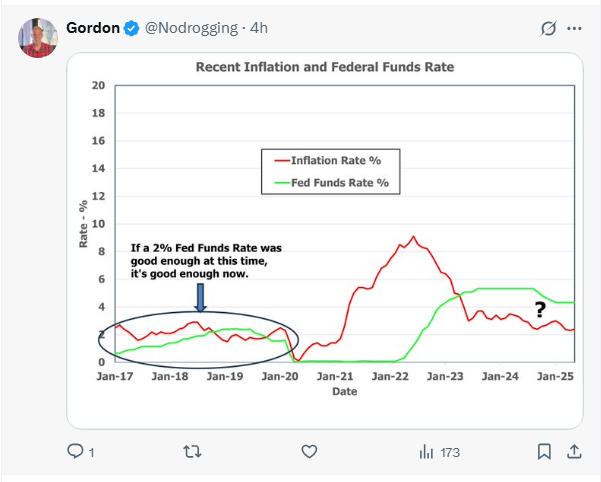

Economic Reality: Is 1% the Right Call

Trump’s push for a 1% interest rate raises eyebrows, especially considering that such low rates in the past were typically tied to economic slowdowns or even recessions.

Many analysts have pointed out that Trump’s benchmark short-term rate with the broader market interest are driven by investors sentiment, inflation expectations, and economic confidence– all factors that the only partially controls.

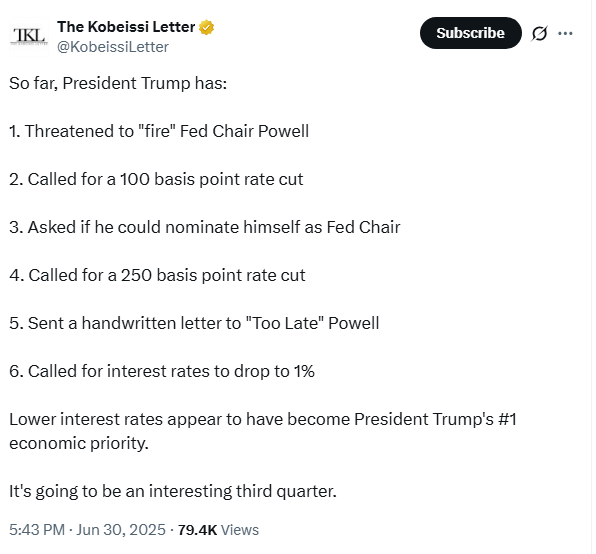

Trump Fed Obsession: From letters To Self-Nomination

President Donald Trump has made it abundantly clear that slashing interest is his top economic agenda heading into Q3.

His campaign to push the Federal reserve into action has become increasingly vocal- and, at times, unconventional.

-

Threatened to fire Chair Jerome Powell

-

Demanded a 100 basis points cuts

-

Jokingly (or not) asked if he could nominate himself as Chair

-

Pushed for a massive 250 basis point rate cut

-

Sent Powell a handwritten note

-

Called for interest rates to be cutdown to 1%

Source: Twitter

Fed Stays Cautious Amid Tariff Uncertainty

Trump FED Rate Cut despite the political pressure, the Federal reserve has shown little interest in cutting rates for now. With inflation still running above the 2% target and unemployment remaining low, officials are wary of acting prematurely– especially given the risk that Trump’s own trade policy and tariffs could add fresh inflationary pressure.

On Monday, several Fed Officials reiterated their concerns about current inflation levels and expressed hesitation to lower the policy, which currently sits in the 4.25% to 4.5% range.

Source: Twitter

Transition Talks: Powell’s Future Is Question

Meanwhile , behind the scenes, Treasury Secretary Scott Bessent has begun planning for Powell’s expected departure in May 2026.

Though cannot dismiss Powell over policy disagreements, he has openly called for his resignation.

In contrast, Bessent hinted at a more structured and conventional transition, avoiding attempts to manipulate policy through premature appointments.

“There's a seat opening up in January,” Bessent said in a Bloomberg TV interview. He suggested that the person nominated for that seat could potentially step into the chair role when Powell exits.

Fed Governor Adiana Kugler’s term ends in January, making that seat the likely target for nomination, with a decision potentially coming by October or November.

Source: Twitter

Potential Successors: Waller and Warsh is the Running

Amongst the candidates reportedly under consideration are current Fed Governor Crhiistopher Waller, who already participates in policy meetings, and former Fed Governor Kewin Warsh, who would need to be reappointed and confirmed before influencing policy.

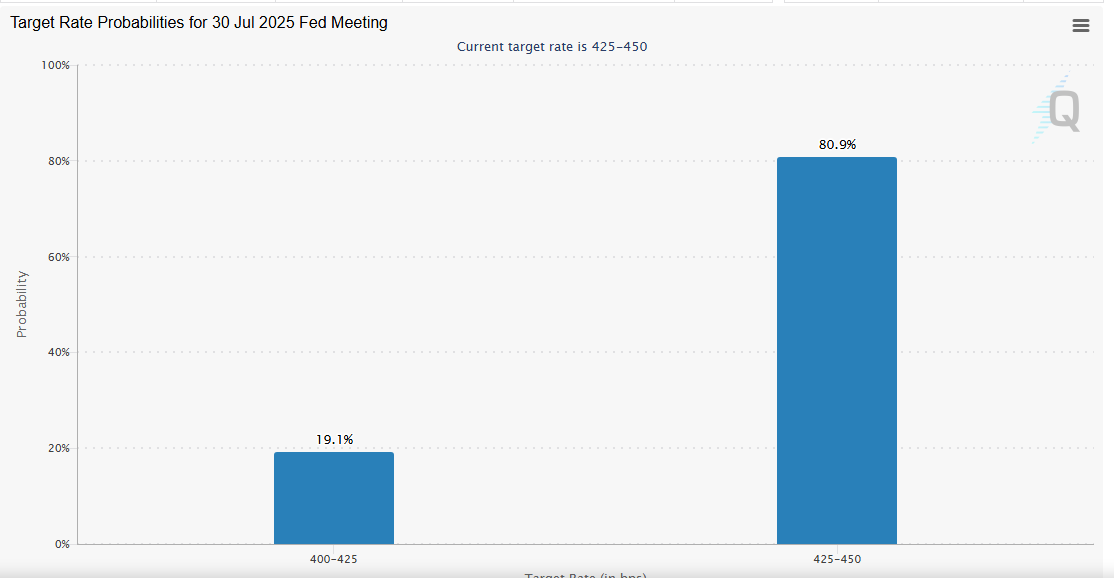

Trump Demands Cuts, But Fed Holds Firm- For Now

Despite intense pressure from Donald Trump, the Federal Reserve seems unlikely to cut interest in the upcoming July 30th meeting.

According to the FED Tool Watch , there’s currently an 80.9% probability that they will keep steady at 4.25% to 4.50%, and only a 19.1% chance of a rate cut.

Trump has been publicly pushing for sharp reductions– even suggesting a drop to 1%-- arguing that high borrowing costs are hurting the US economy. However, Powell appears to oppose the budget, especially with inflation still running above target and the job market remaining.

Source: Fed Tool Watch

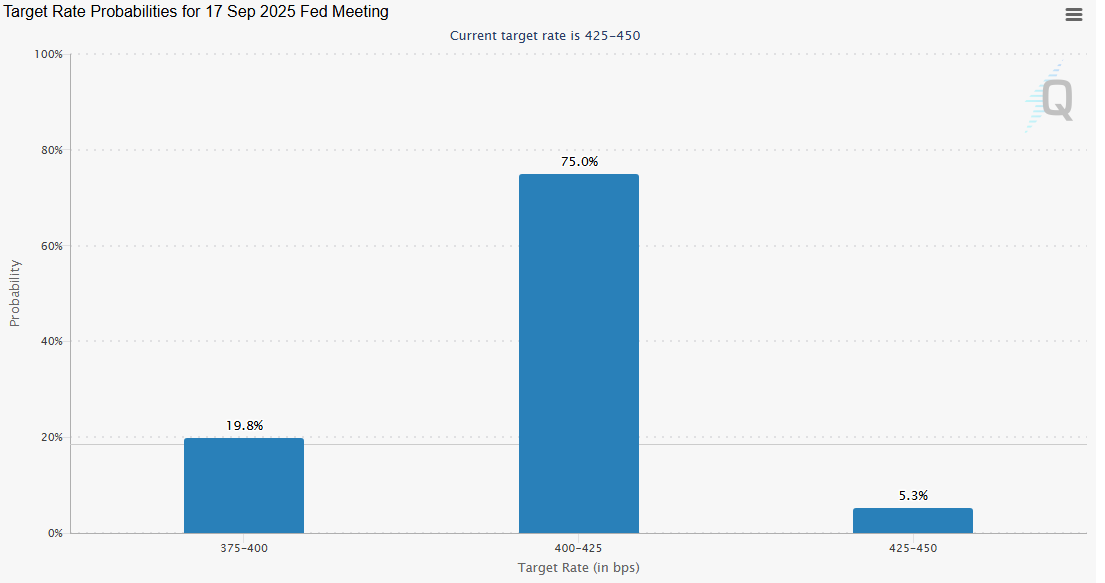

Eyes On September: Rate Cuts Likely?

Market expectations shift dramatically when looking ahead to september. According to the analyst of Fed Tool Watch, now there is a chance of 94.8% yes vin the rate cuts at the Fed's September meeting– signalling that a po;licy shift might happen later, once more economic data is in.

What Would a Rate Cut Mean for the US Economy?

If the Fed does cut rates in September, it could make borrowing cheaper for businesses and consumers– boating, spending, investment and stock market sentiments.

It could also weaken the US dollar’ supporting exports. However, there’s a tradeoff, cutting rattes too soon might fuel inflation again, especially if the economy remains resilient.

For now, Powell seems committed to a ‘wait and watch” approach, resisting political pressure and relying on hard data to guide monetary policy– even as Trump continues to make low rates a central part of his economic agenda.

All Eyes on Summer Data

While Trump’s loud calls for rate cuts might complicate the confirmation process– especially given the Fed’s mandate for political independence– the coming months could shift the narrative. If inflation slows and growth weakens, the central bank may have grounds to cut rates regardless of political pressures.

Market watchers are already pricing in a rate cut as soon as September. Even Goldman Sachs, which had to forecast a later move, revised its expectations on Monday, now predicting the Fed will make its first cut in the September meeting.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。