Original|Odaily Planet Daily(@OdailyChina)

Author|Wenser(@wenser2010)

During the turbulent market period, the on-chain contract market has become increasingly vibrant, with Hyperliquid's trading volume and HYPE token market cap reaching historic highs: cumulative trading volume has surpassed $1.5 trillion, and the HYPE token price once exceeded $45.

Behind this impressive performance are not only the long and short contract operations of whales and retail investors but also the increased trading by investment institutions.

At the end of June, well-known investment institutions Galaxy and ManifoldTrading deposited a total of $30 million in USDC into HyperLiquid and began purchasing HYPE tokens; previously, the US-listed company Lion Group Holding Ltd. (stock code: LGHL) had allocated $2 million to purchase HYPE tokens.

Discussions about "institutional entry into HYPE" have intensified, with some even echoing the former slogan—"HYPE is the next SOL"—the last one to be highly anticipated was SUI, marking the first time HYPE has been elevated to such a level for discussion.

Odaily Planet Daily will provide a brief analysis of this speculation in this article, exploring the driving forces behind HYPE's rise and its future potential.

The Dynamics of HYPE's Rise: Platform, Institutions, and OTC Buying

Unlike the relatively stable price of SUI, the price of HYPE tokens has experienced a series of dramatic ups and downs.

In March of this year, due to issues with the platform's mechanism, Hyperliquid's HLP suffered a loss of millions of dollars due to targeted liquidation by large holders, leading to a trust crisis for the platform due to data rollbacks. (Note from Odaily Planet Daily: For details, refer to “Why did Hyperliquid's whales self-destructively close positions? Who bears the millions of dollars in losses?” and “To compensate for over $200 million in losses, Hyperliquid's 'pulling the plug' forced settlement sparked controversy” among other articles.) The price of HYPE was also affected, dropping from around $13 to about $10, leading many to believe that Hyperliquid would lose its contract market under the siege of CEXs like Binance, OKX, and Bybit.

However, as April arrived, following Trump's initiation of a tariff trade war and subsequent positive news, the overall market, along with the contract market, provided Hyperliquid with a new development opportunity, and HYPE began its journey of bottom recovery and even new highs—on May 23, the price of HYPE broke through $33, surpassing the previous high of $32.3 on December 22, 2024; until June 16, HYPE's price reached a historic high of $45.59.

HYPE Price Performance

Looking closely at the driving forces behind its rise, I believe they are mainly driven by the following factors:

Driving Force One: Platform Development and Buybacks

In addition to benefiting from the favorable development of the turbulent market, Hyperliquid's buyback mechanism and staking mechanism provide strong momentum for the steady rise in HYPE token prices.

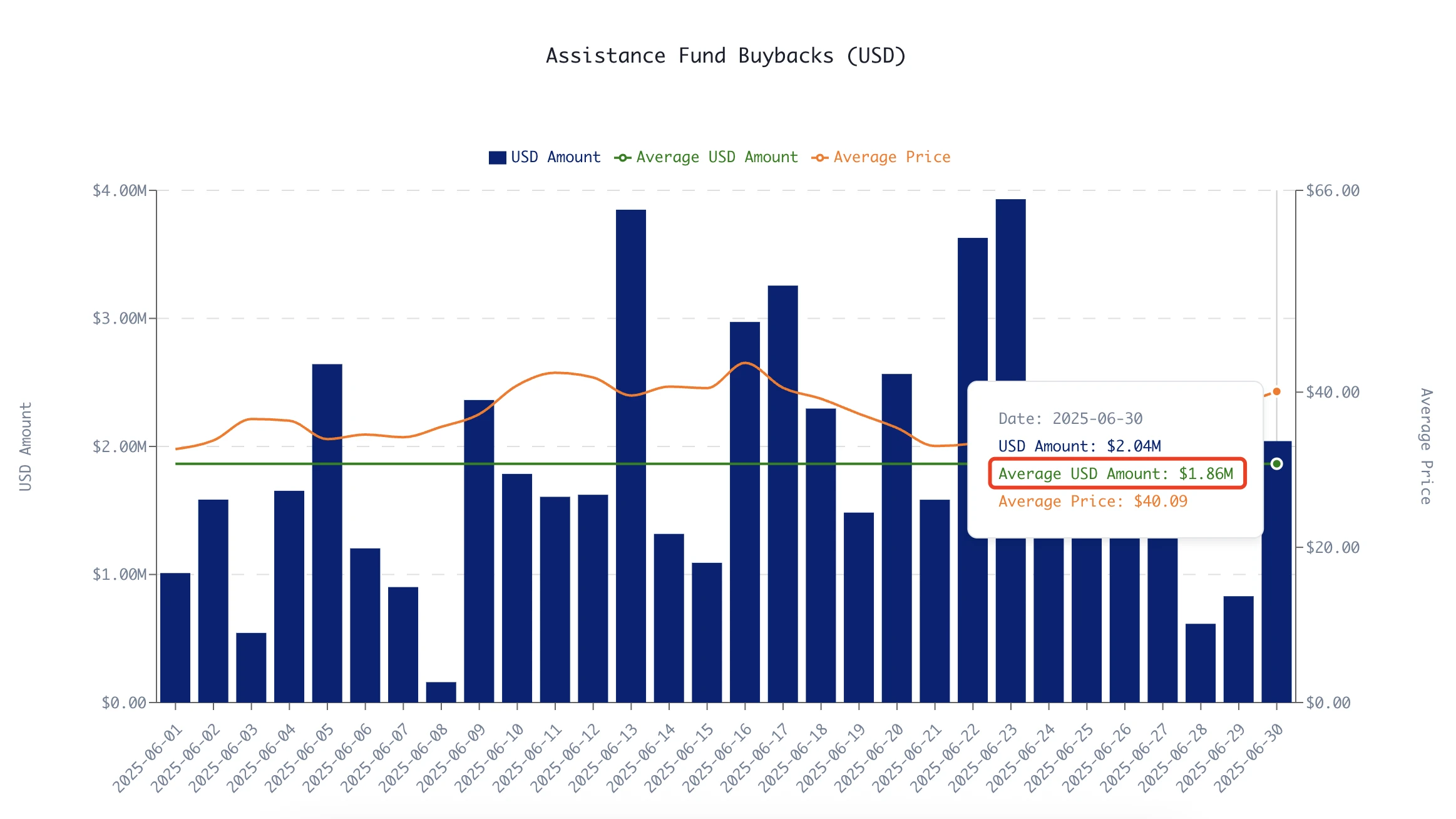

According to ASXN Data website data, based on on-chain data from the past 30 days as of June 30, 2025, the daily average buyback amount for Hyperliquid's HYPE token is $1.86 million. It can be said that this buyback fund is the largest driving force for the HYPE token, which has a total supply of 1 billion and a circulating supply of about 330 million.

HYPE Token Buyback Fund Scale

According to Hyperliquid community builders Charlie.hl and supermeow.hl, who previously applied the traditional stock market payment industry's "market cap / quarterly buyback amount" multiple indicator in “How does Hyperliquid, valued at $25.9 billion, occupy both infrastructure and application layers?”, they conservatively estimate that the price of HYPE could rise to $76.

Additionally, Hyperliquid's Builder Code program also provides functional support for developers to collect fees through the platform, offering convenience at the user level, which is expected to attract more on-chain developers and institutions to access the Hyperliquid portal, further promoting the development of the platform ecosystem.

Driving Force Two: Institutional-Level Layout

Similar to how early investors like Multicoin Capital invested in Solana and continuously bought SOL tokens, investment institutions are now also setting their sights on Hyperliquid, known as the "dominant player in the on-chain contract market."

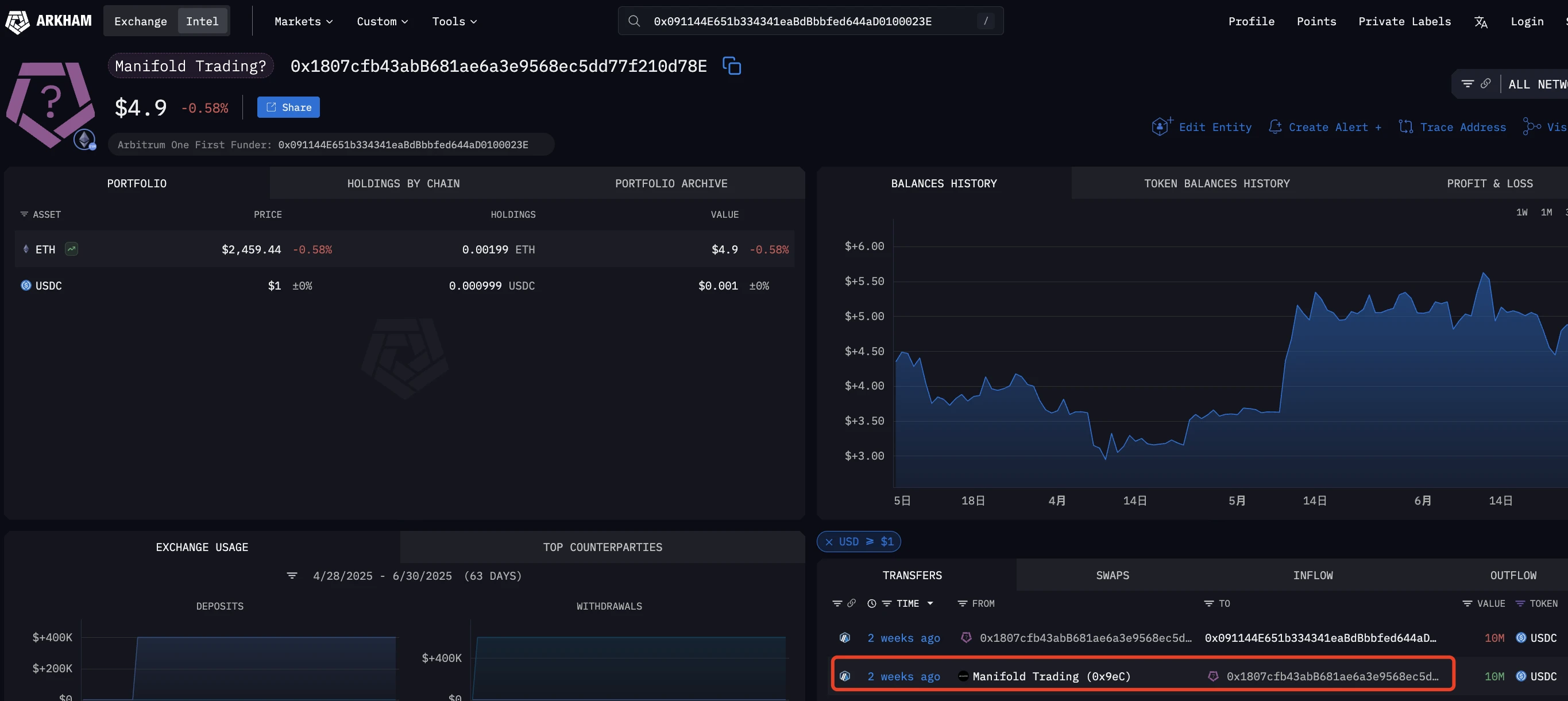

Previously, according to Onchain Lens monitoring, two investment institutions @galaxyhq and @ManifoldTrading deposited a total of $30 million in USDC into HyperLiquid and began purchasing HYPE tokens.

From the information I found on the Arkham platform, the address 0x091144E651b334341eaBdBbbfed644aD0100023E is indeed associated with ManifoldTrading, which previously received $10 million from the address 0x1807cfb43abB681ae6a3e9568ec5dd77f210d78E on June 16. The suspected galaxy address 0xcaC19662Ec88d23Fa1c81aC0e8570B0cf2FF26b3 is in a similar situation.

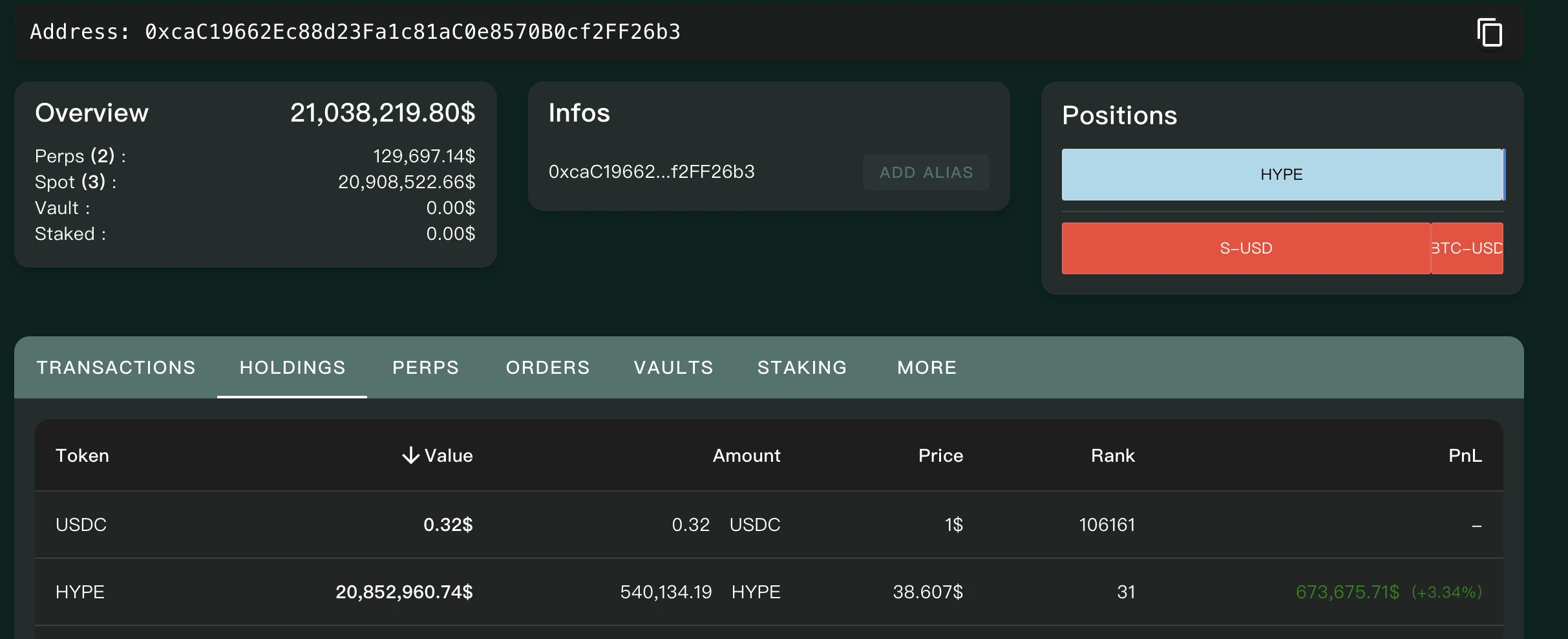

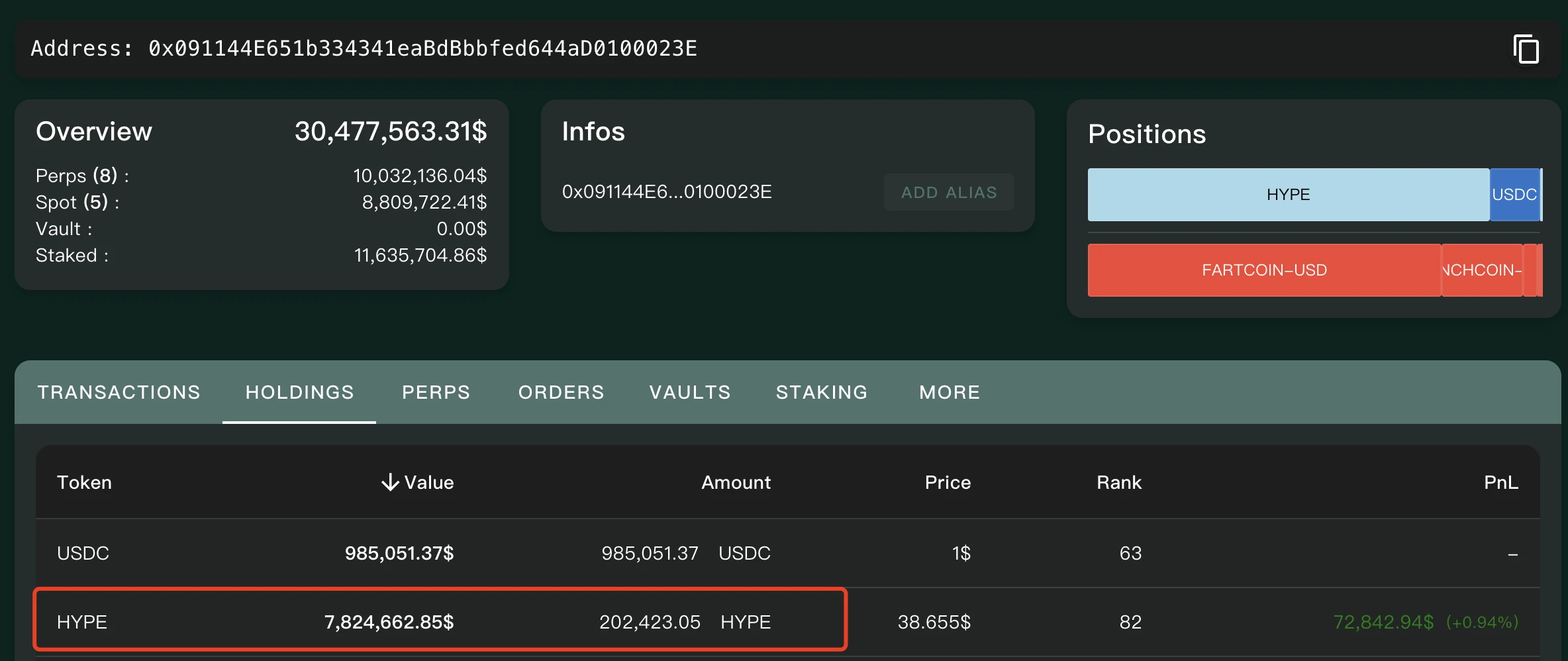

Currently, the galaxy-related address holds over 540,000 HYPE, valued at about $20.85 million, ranking 31st in holdings; the ManifoldTrading-related address holds about 202,000 HYPE, valued at about $7.82 million, ranking 82nd in holdings. Both addresses have opened multiple orders on Hyperliquid and still hold short positions in BTC, S, FARTCOIN, ENS, and other tokens, each with varying profits and losses.

It is evident that institutions are not only buying HYPE for layout but are also actively participating in the Hyperliquid platform to earn profits.

Galaxy Address Holding Information

ManifoldTrading Address Holding Information

Driving Force Three: OTC Buying by US-listed Companies

In addition to the above internal and external factors, similar to how Strategy hoarded BTC to boost both BTC prices and its own stock price, US-listed companies have applied the same strategy to HYPE.

On June 23, according to official announcements, Eyenovia, Inc. (NASDAQ stock code: EYEN) announced the completion of a $50 million private placement and acquired 1,040,584.5 HYPE tokens, thus becoming the first company listed on the US Nasdaq to hold HYPE tokens. Following the announcement, EYEN's stock price surged 77% in a single day and rose 181% over the past five days.

At the end of June, US-listed company LGHL (Lion Group Holding Ltd.) announced the completion of its first strategic purchase of Hyperliquid (HYPE) tokens for $2 million, with an average price of approximately $37.30 per token. This acquisition is also the first token purchase under the company's $600 million convertible bond financing.

Since then, HYPE has become one of the cryptocurrencies supported by OTC buying from US-listed companies, to some extent even achieving a market position comparable to established cryptocurrencies like BTC, ETH, and SOL.

How far is HYPE from SOL in terms of data dimensions?

On May 26, according to Coingecko data, the HYPE price was reported at $38.03, with a market cap of approximately $12.64 billion, surpassing SUI and ranking 13th in total cryptocurrency market cap (including USDT, stETH, WBTC, etc.).

On June 16, as the price reached an all-time high, HYPE's market cap briefly exceeded $15 billion, touching $15,017,966,172, setting a new historical record. As of the time of writing, the HYPE price is reported to be around $39, with a circulating market cap of about $13 billion and an FDV of approximately $39 billion.

In contrast, as of the time of writing, the SOL price is reported at $149, with a circulating supply of 534 million tokens and a total supply of 600 million tokens; its circulating market cap is approximately $80 billion, with an FDV of about $90 billion.

Although the ecological positioning of the two is not entirely consistent, in the current context where the meme coin craze has subsided and on-chain contracts have become a mainstream sector in the crypto market, there are signs of a "SOL consuming HYPE rising" phenomenon.

If we calculate based on the previously mentioned conservative estimate price of $76, HYPE's circulating market cap is expected to rise to around $25 billion; its FDV would then increase to about $76 billion, approximately 84% of SOL's current FDV.

Conclusion: HYPE's Next Explosive Point is Ecological Applications

In summary, considering the on-chain contract platform, HyperEVM ecosystem, Hyperliquid NFT, and other asset and ecological developments, Hyperliquid has immense future growth potential. If a "killer application" similar to Pump.fun for the Solana ecosystem emerges, HYPE could very well compete with SOL.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。