Original Title: "MicroStrategy Buys $530 Million More BTC, Holdings Approach 600,000; Michael Saylor: You Will Only Wish You Had Bought More"

Original Author: Editor Jr., BlockTempo

According to an 8-K filing submitted to the SEC by MicroStrategy on June 30, the company purchased an additional 4,980 bitcoins between June 23 and 29, at a total cost of $531.9 million, with an average purchase price of approximately $106,801. This transaction increased the company's total bitcoin holdings to 597,325 BTC, accounting for about 2.8% of the circulating supply of bitcoin, with an average cost basis of $70,982.

Bitcoin Enthusiast Continues to Accumulate, Reiterates Long-Term Position

Bitcoin enthusiast Michael Saylor has once again pressed the "buy" button. According to MicroStrategy's 8-K filing submitted to the SEC on June 30, the company purchased an additional 4,980 bitcoins between June 23 and 29, at a total cost of $531.9 million, with an average purchase price of approximately $106,801.

This transaction increased the company's total bitcoin holdings to 597,325 BTC, accounting for about 2.8% of the circulating supply of bitcoin, with an average cost basis of $70,982. This accumulation continues MicroStrategy's strategy of "only increasing," and Saylor emphasized his long-term position again on the X platform last weekend: "In 21 years, you will wish you had bought more bitcoin."

Funding Sources: Three ATM Pipelines

According to the filing, MicroStrategy utilized three "At-the-Market" (ATM) programs to raise cash, including:

· MSTR Common Stock: Sold 1,354,500 shares, raising $519.5 million, with a remaining capacity of $18.11 billion.

· STRK 8% Perpetual Preferred Stock: Sold 276,071 shares, raising $28.9 million, with a remaining capacity of $20.52 billion.

· STRF 10% Perpetual Preferred Stock: Sold 284,225 shares, raising $29.7 million, with a remaining capacity of $1.94 billion.

The three programs collectively raised $578.1 million. In addition to purchasing bitcoin, MicroStrategy also paid dividends on STRK and STRF that were due on June 30.

Remaining $40.6 Billion Available for Further Investment, Potential Pressure to Watch

Currently, the three pipelines have approximately $40.6 billion available, providing ammunition for MicroStrategy to continue executing its "issue stock—buy bitcoin—boost stock price" flywheel model. However, the annual interest rates on the preferred stocks are 8% and 10%, respectively, and cash flow pressure will increase as the issuance expands; common stock shareholders will also face stock dilution issues.

MicroStrategy Added to Russell Top 200 Value Index

Additionally, according to Bitcoin News, MicroStrategy's stock has been included in the Russell Top 200 Value Index. The Russell Top 200 Value Index is maintained by FTSE Russell and is part of the Russell Index series. It selects stocks with "value" characteristics from the 200 largest U.S. publicly traded companies in the Russell 3,000 Index, measuring the performance of large-cap value stocks in the U.S. through market capitalization weighting, and is typically used as a benchmark for large-cap value investments.

Stock Price and Bitcoin Market Performance

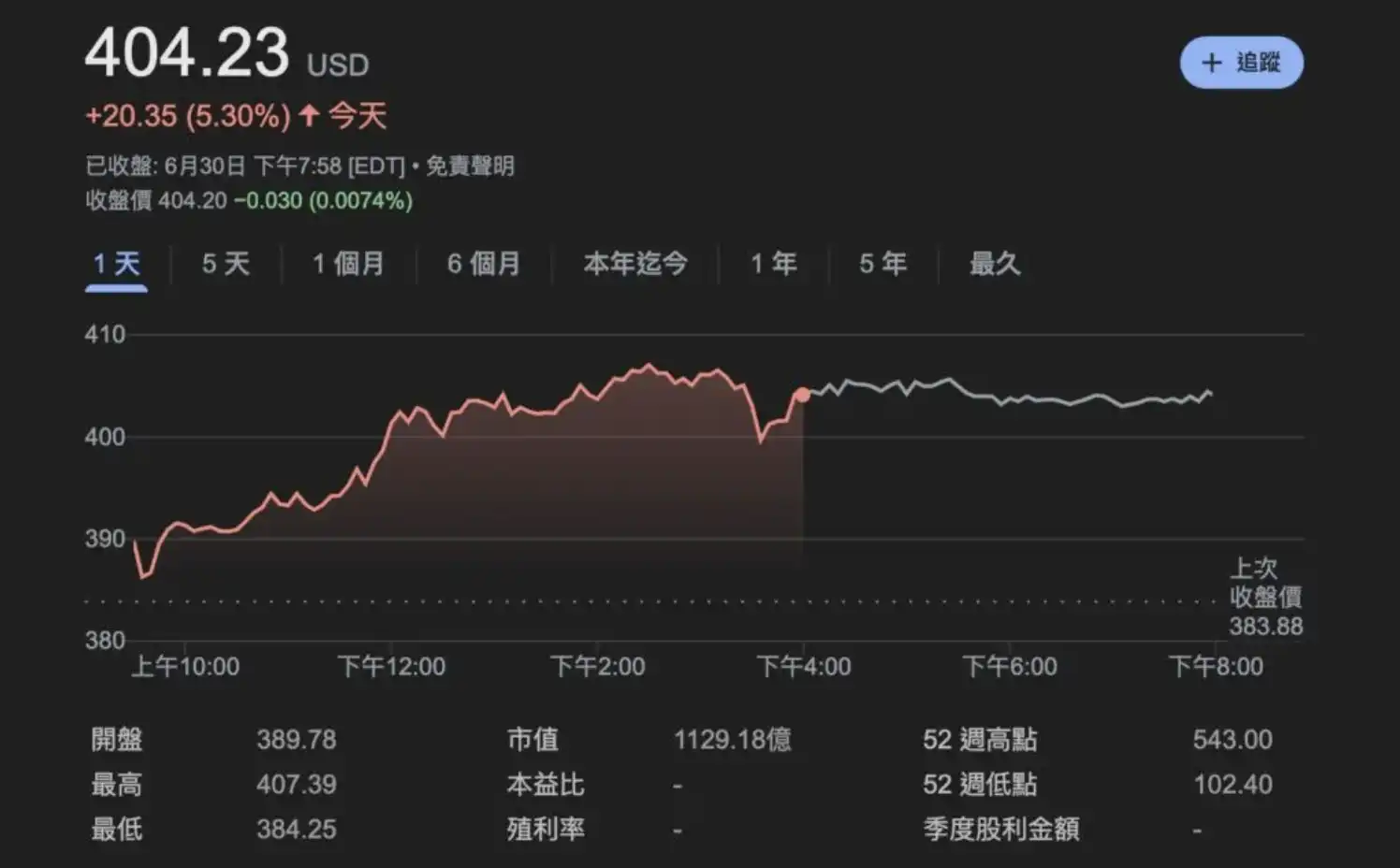

According to Google Finance data, MicroStrategy's stock price has increased by 34% year-to-date. After the U.S. stock market opened on the evening of June 30, MSTR closed at $404.23, up 5.3%, with a market capitalization of approximately $112.9 billion.

In the bitcoin market, BTC has been fluctuating around the $107,000 level for over a week, with no clear direction yet.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。