Good evening, brothers!

As Buffett said, the characteristic of a bull market is that almost all reasons are used to justify the correctness of investments. Conversely, the characteristic of a bear market is that almost all reasons are used to justify the incorrectness of investments. In other words, in a bull market, no bad news is good news, while in a bear market, no good news is bad news. For example, in the A-share and Hong Kong stock markets from 2022 to 2023, there was a rapid decline almost instinctively without any significant positive stimulus. The price movements in the crypto space also underwent a bear market correction before this structural market.

The last two to three years have been characterized by a typical bear market atmosphere, with negative news everywhere. For instance, layoffs at major companies and hefty fines. In a normal market environment, routine personnel optimization and regulatory compliance requirements would hardly attract much attention. But now, not to mention normal news, even just a rumor or two can trigger a 5% or 10% crash, showing how panicked the market has become!

The more we reach this point, the more it tests true knowledge. We often say that we should face market fluctuations rationally. When the market is doing well or at least neutral, everyone feels that facing market fluctuations is a very easy thing. Now, it might be worth asking yourself again: when faced with emotionally driven short-term fluctuations, would a 10% drop in one day make you feel panicked? Would a 30% drop in a week make you feel anxious? If not, then congratulations, in the long run, it is highly probable that you will make money in the market.

……

As the release of non-farm payroll data approaches this Thursday, the market is closely watching the direction of the dollar, especially whether the non-farm data will trigger a strengthening of the euro and other non-US currencies.

According to news from the Wind Trading Desk, Citigroup's global foreign exchange strategy team released a research report on the 27th, stating that the asymmetry in non-farm data still exists, meaning that the dollar will decline more when the data is worse than expected than it will rise when the data is better than expected.

Citigroup economists predict that the unemployment rate will rise to 4.4%, with only 85,000 new jobs added. If this comes true, it could trigger widespread selling of the dollar, with the yen, Swiss franc, and euro likely to lead the gains.

BTC: On the 4-hour level, the price has broken below the lower Bollinger Band, indicating that the short-term market is oversold and there is a weak rebound demand.

On the daily level, the price has broken below the moving average support, but there are still multiple moving averages providing support below, indicating that the overall trend has not deteriorated.

In summary, the support level is 106300, and the resistance level is 106700.

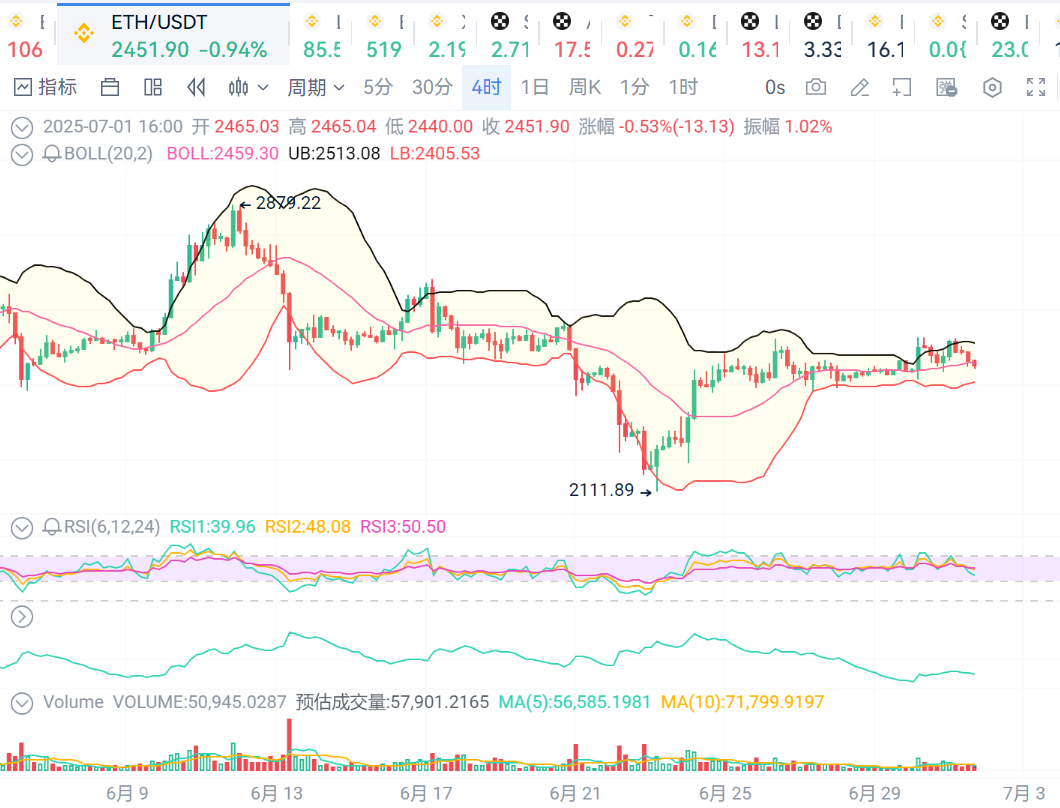

ETH: On the 4-hour level, the price has broken below the middle Bollinger Band, showing a weak price trend, with a support level at 2440 and a resistance level at 2460.

LTC: The price has broken below the middle Bollinger Band, indicating a weak short-term price trend, with a support level at 84 and a resistance level at 87.

BCH: The price continues to stay near the upper Bollinger Band, with the short-term market still close to the overbought range. Those with heavy positions can reduce their holdings to take partial profits, with a support level at 510 and a resistance level at 530.

That's all for now, good night!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。