Author: Luke, Mars Finance

Choices at the Crossroads

The market is holding its breath, almost viewing the Federal Reserve's interest rate cut as the starting gun for a new round of asset frenzy. However, a warning from JPMorgan is like a boulder thrown into a calm lake: what if this is the "wrong type of easing"?

The answer to this question is crucial. It determines whether we are about to witness a joyous "soft landing" comedy or a tragic "stagflation" scenario where economic growth stagnates alongside high inflation. For cryptocurrencies intertwined with macroeconomic fate, this is not just a directional choice but a test of survival.

This article will delve into these two possibilities, attempting to outline how the future might unfold if the "wrong type of easing" scenario comes true. We will see that this script will not only reshape the landscape of traditional assets but may also trigger a profound "great divergence" within the crypto world, putting DeFi's infrastructure through an unprecedented stress test.

Script One: The Dual Nature of Rate Cuts

How the script unfolds first depends on how we interpret history. Rate cuts are not a panacea; their effects entirely depend on the economic environment in which they are released.

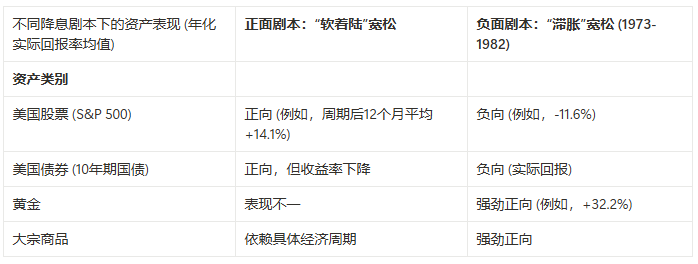

Positive Script: Soft Landing and Comprehensive Prosperity In this script, economic growth is robust, inflation is under control, and the Federal Reserve cuts rates to stoke the economy further. Historical data is a staunch supporter of this script. Research from Northern Trust indicates that since 1980, in the 12 months following the initiation of such "correct rate cut" cycles, the average return of U.S. stocks has been 14.1%. The logic is simple: lower capital costs lead to heightened consumer and investment enthusiasm. For high-risk assets like cryptocurrencies, this means catching a tailwind and enjoying a liquidity feast.

Negative Script: Stagflation and Asset Catastrophe But what if the script takes a different turn? Economic growth falters while inflation stubbornly persists, forcing the Federal Reserve to cut rates to avoid a deeper recession. This is the "wrong type of easing," synonymous with "stagflation." The U.S. in the 1970s is a prelude to this script, where the oil crisis and loose monetary policy co-directed a disaster of economic stagnation and rampant inflation. According to the World Gold Council, during that era, the annualized real return of U.S. stocks was a dismal -11.6%. In this scenario, where almost all traditional assets suffer, only gold stood out, recording an annualized return of up to 32.2%.

Goldman Sachs recently raised the probability of a U.S. economic recession and predicted that the Federal Reserve might cut rates in 2025 due to economic slowdown. This warns us that the enactment of the negative script is not mere alarmism.

Script Two: The Fate of the Dollar and the Rise of Bitcoin

In the macro drama, the dollar is undoubtedly the protagonist, and its fate will directly influence the direction of the script, especially for the crypto world.

A repeatedly validated rule is that the Federal Reserve's easing usually accompanies a weakening dollar. This is the most direct boon for Bitcoin. When the dollar depreciates, the price of Bitcoin, priced in dollars, naturally rises.

However, the significance of the "wrong type of easing" script goes far beyond this. It will become the ultimate test of the theories of two macro prophets in the crypto world—Michael Saylor and Arthur Hayes. Saylor views Bitcoin as a "digital property" to combat the continuous devaluation of fiat currency, a Noah's Ark escaping the doomed traditional financial system. Hayes believes that the U.S.'s massive debt leaves it no choice but to "print money" to cover fiscal deficits. A "wrong rate cut" is a key step toward making this prophecy a reality, at which point capital will flood into hard assets like Bitcoin seeking refuge.

However, this script also harbors a significant risk. As a weakening dollar enhances Bitcoin's narrative of kingship, the cornerstone of the crypto world—stablecoins—faces erosion. The stablecoin market, valued at over $160 billion, is almost entirely composed of dollar-denominated assets. This presents a huge paradox: the macro forces driving Bitcoin's rise may be hollowing out the actual value and credibility of the financial instruments used to trade Bitcoin. If global investors lose confidence in dollar assets, stablecoins will face a severe trust crisis.

Script Three: The Collision of Yields and the Evolution of DeFi

Interest rates are the baton of capital flow. When the "wrong type of easing" script unfolds, there will be an unprecedented collision of yields between traditional finance and decentralized finance (DeFi).

U.S. Treasury yields serve as the global "risk-free" benchmark. When they can provide stable returns of 4%-5%, similar yields in higher-risk DeFi protocols appear paltry in comparison. This opportunity cost pressure directly limits the inflow of fresh capital into DeFi.

To break the deadlock, the market has birthed "tokenized U.S. Treasuries," attempting to bring the stable returns of traditional finance onto the blockchain. But this could be a "Trojan horse." These safe Treasury assets are increasingly being used as collateral for high-risk derivative trading. Once a "wrong rate cut" occurs, Treasury yields will fall, and the value and attractiveness of tokenized Treasuries will decline, potentially triggering capital outflows and a chain of liquidations, precisely transmitting the macro risks of traditional finance to the heart of DeFi.

At the same time, economic stagnation will weaken the demand for speculative borrowing, which is a primary source of high yields for many DeFi protocols. Faced with internal and external challenges, DeFi protocols will be forced to evolve rapidly, shifting from a closed speculative market to a system that can integrate more real-world assets (RWA) and provide sustainable real yields.

Script Four: Signals and Noise—The Great Divergence in the Crypto Market

When the macro "noise" drowns everything out, we need to listen more closely to the "signals" from the blockchain. Data from institutions like a16z shows that regardless of market fluctuations, core metrics for developers and users continue to grow steadily. Construction has never ceased. Veteran investors like Pantera Capital also believe that as regulatory headwinds turn into tailwinds, the market is entering the "second phase" of a bull market.

However, the "wrong type of easing" script may become a sharp knife, splitting the crypto market in two and forcing investors to make a choice: are you investing in macro hedging tools or tech growth stocks?

In this script, Bitcoin's "digital gold" attribute will be magnified infinitely, becoming the preferred choice for capital hedging against inflation and fiat currency devaluation. Meanwhile, many altcoins will find themselves in precarious positions. Their valuation logic is similar to that of growth tech stocks, but in a stagflation environment, growth stocks often perform the worst. Therefore, capital may massively withdraw from altcoins and flood into Bitcoin, causing a significant divergence within the market. Only those protocols with strong fundamentals and real income will survive in this wave of "flight to quality."

Conclusion

The crypto market is being pulled by two enormous forces: on one side is the macro gravity of "stagflation-style easing," and on the other is the endogenous momentum driven by technology and applications.

The future script will not be a single-threaded narrative. A "wrong rate cut" may simultaneously elevate Bitcoin while burying most altcoins. This complex environment is forcing the crypto industry to mature at an unprecedented pace, and the true value of protocols will be tested in a harsh economic climate.

For everyone involved, understanding the logic of different scripts and grasping the complex tension between macro and micro will be key to navigating future cycles. This is no longer just a bet on technology; it is a grand gamble about which script you choose to believe at a critical juncture in global economic history.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。