# Recent Ecological Changes in Base

Since the end of May 2025, Base has entered a significant ecological "explosion period." The number of daily active addresses, TVL, and daily transaction volume have all been rapidly increasing. The main reason for the recent explosion in the Base ecosystem is the emergence of multiple popular narratives that have attracted considerable market attention. Additionally, from a macro perspective, the optimism surrounding the concept of stablecoins in the global stock market has spread due to Circle's IPO, especially in the context of a potentially improving regulatory environment, making Base a more favored choice for traditional institutions.

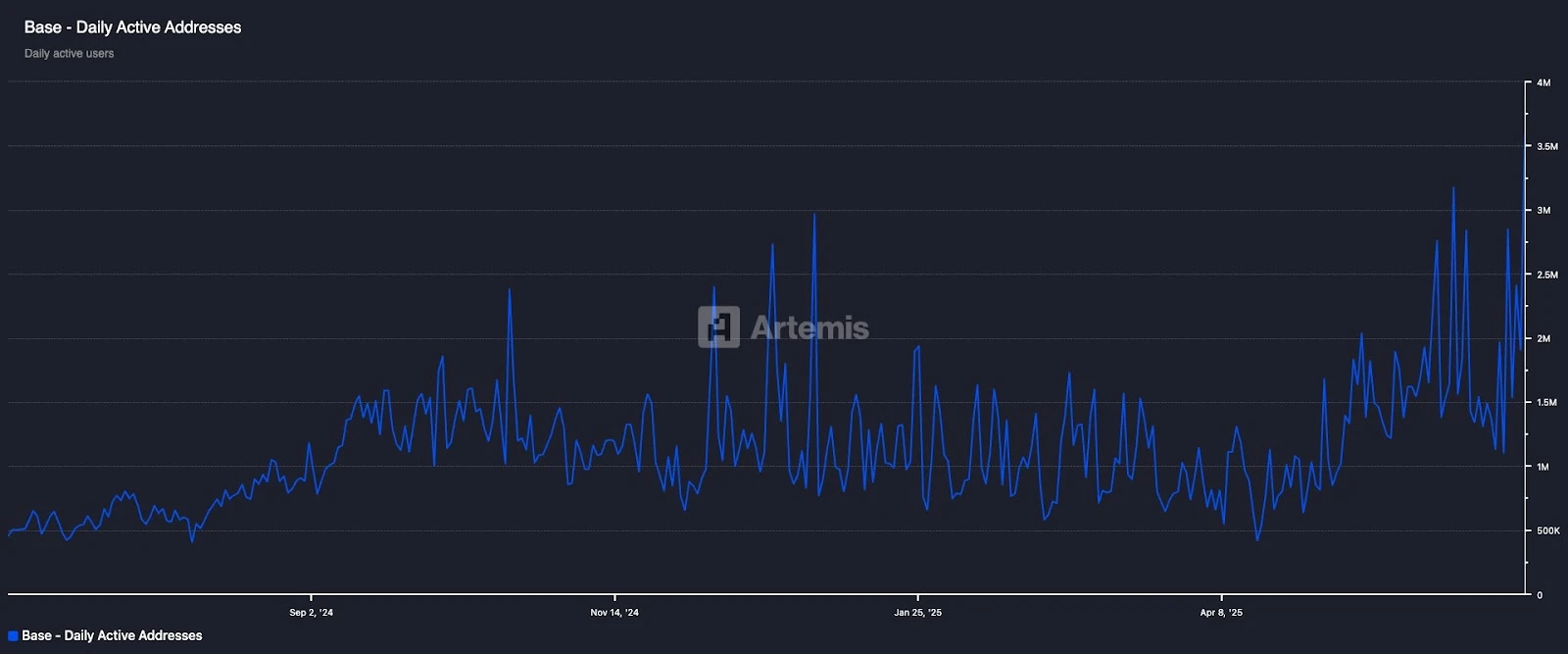

Active User Growth: The number of active addresses has seen exponential growth, recently reaching a historical high of 3.6M.

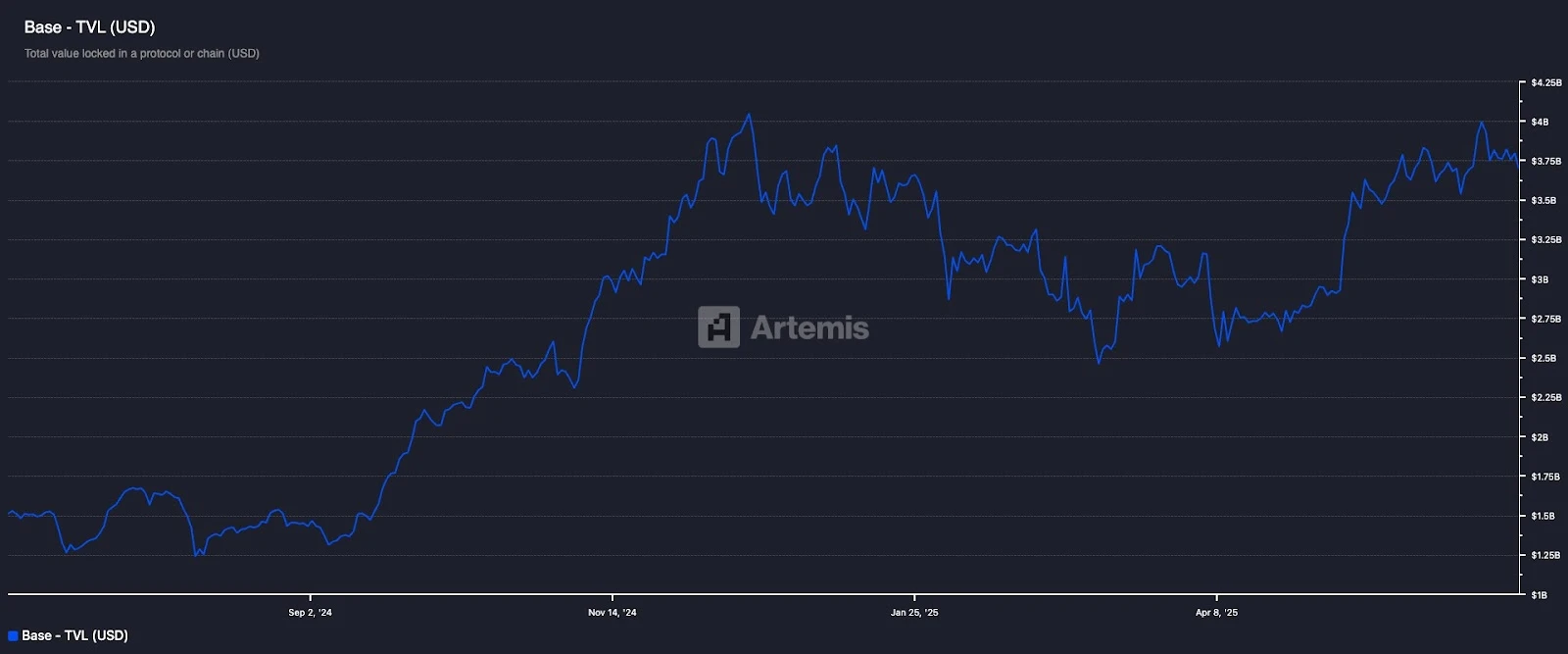

Rapid TVL Growth: The total value locked in Base rose from $2.8 billion in May to a peak of nearly $4 billion, returning to the highest point of the 2024 bull market.

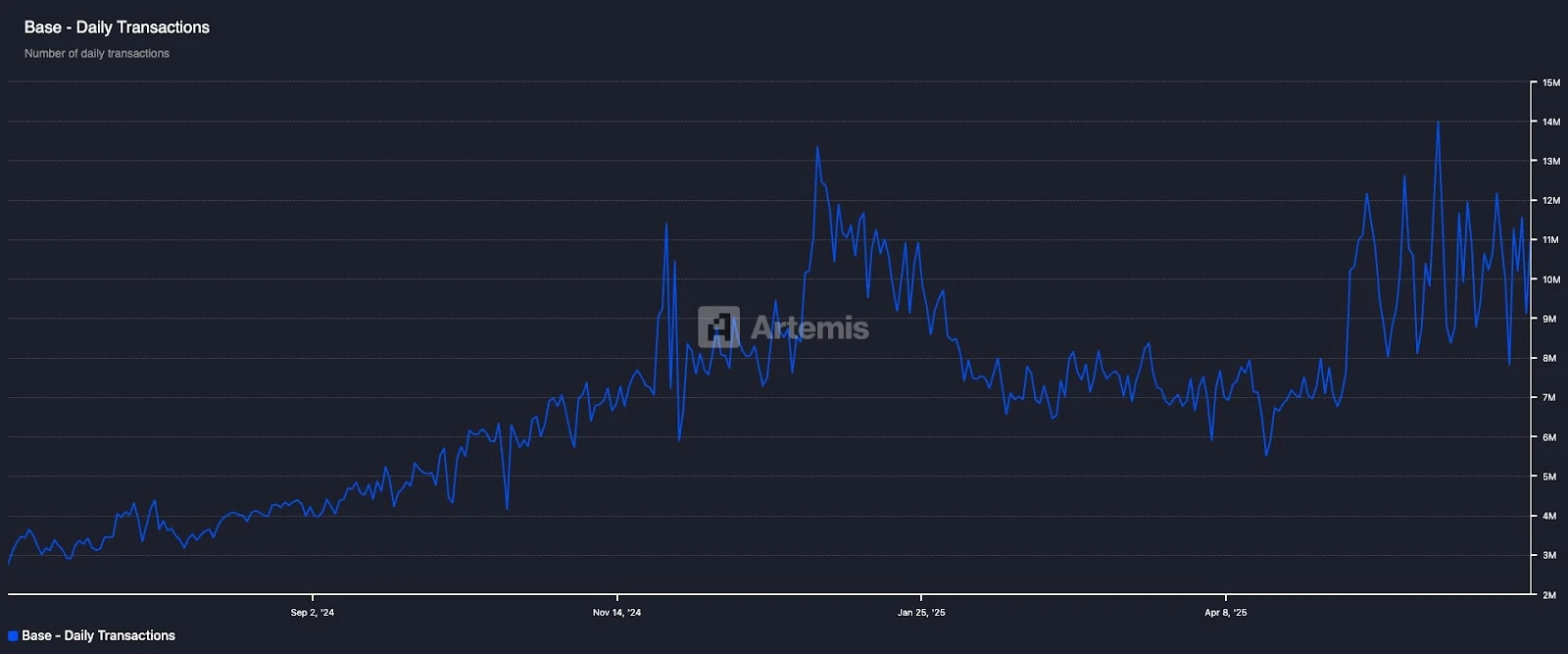

On-chain Transaction Activity: Since May, the average daily transaction count has approached 9 million, reaching the peak of the 2024 bull market.

# Recent Popular Projects in the Base Ecosystem

1. Virtual: Pumpfun + Bn Alpha New Project Mechanism Ignites Market Interest

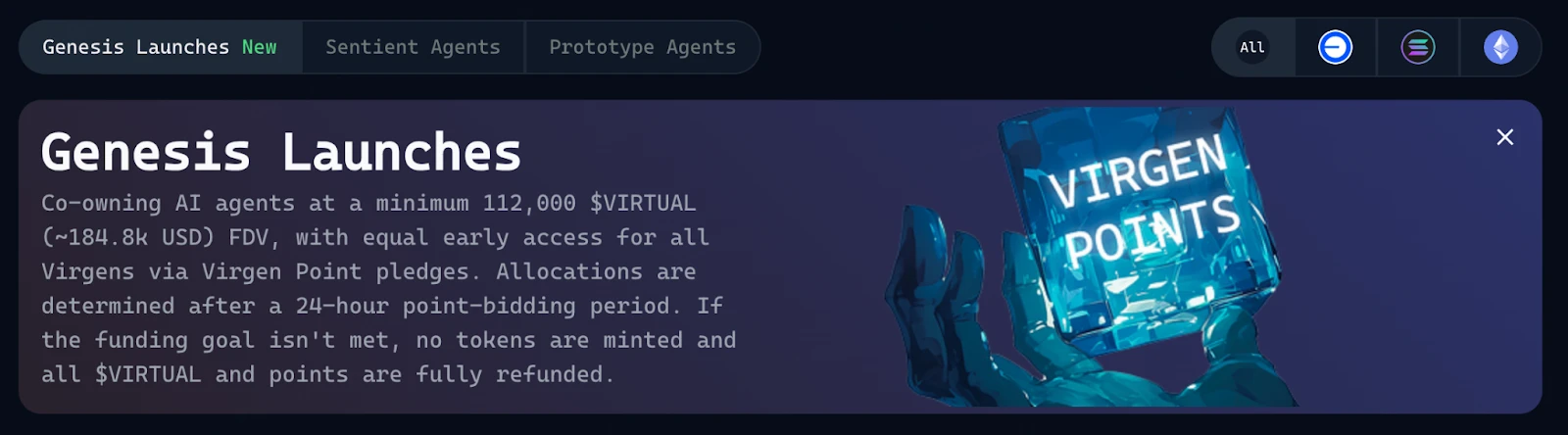

Among the various hot projects in the Base ecosystem, Virtual is undoubtedly one of the most market-attended projects recently. With its innovative new project mechanism, it has quickly attracted a large amount of capital and user participation, becoming the core representative of the current new project narrative in the Base ecosystem. The price of VIRTUAL has risen from $0.5 in mid-April to a peak of $2.5 in early June, an increase of 400%. The core advantages of Virtual's new project mechanism are:

Extremely Low Financing Price: Each new project raises funds with a market value of 42,425 virtual tokens (approximately $224,000), allowing users to participate in financing at a very low price, with significant potential profit space after the project launches.

Token Linear Unlocking: Unlike the MEME projects on PumpFun, Virtual's new projects do not unlock all at once after launch but have a transparent token economic model that unlocks in batches, similar to VC tokens. Additionally, to prevent project teams from dumping tokens, the raised funds are not directly handed over to the project team but are all injected into the initial liquidity pool.

Low New Project Risk: If a project fails to raise funds, users will receive a full refund, and since Virtual only launches a few new projects each day, the quality is generally higher than MEME, resulting in low risk for user participation.

Reduced Rug Probability for Project Teams: Virtual sets a 1% transaction fee, with 70% returned to the project team. This incentive model motivates project teams to enhance trading activity rather than cashing out in the short term, creating a positive ecological loop.

However, as the platform's popularity increased, early users frequently employed a strategy of selling immediately after the new project launch to gain short-term high returns, leading to significant selling pressure on new projects and undermining the overall stability of the ecosystem. In response, Virtual introduced a "Green Lock Mechanism" in mid-June, imposing a mandatory lock-up period for new project users during which they cannot sell their acquired tokens; violations will result in a suspension of points accumulation. Although this mechanism helps suppress early selling and extends project lifecycles, it also significantly alters the original speculative logic. Users' profit cycles are forced to lengthen, capital efficiency declines, and market enthusiasm experiences a temporary retreat. The price of Virtual entered a downward channel in mid-June, falling from its peak to $1.69, a decline of over 37%.

2. Kaito: Leader in the Attention Economy Track

Kaito is the leading project in the "Information Finance (InfoFi)" track. Since May, Kaito's price has risen from $0.79 to a peak of $2.41, an increase of nearly 205%. The highlight of Kaito's mechanism is its Yaps module, which tokenizes user attention on content published on X, incentivizing users to create high-quality content around popular projects (such as Berachain, Monad, Initia, etc.), thereby building a content-driven influence mechanism in Web3. This mechanism has greatly stimulated community participation, and combined with weekly airdrops and leaderboard rewards, it allows users to both "voice" their opinions and "monetize" them, effectively attracting a large number of content creators and opinion leaders to join, promoting the prosperity of social and narrative content on Base.

Additionally, Kaito has launched a Yapper Launchpad system based on points ranking and an AI-driven information network called Kaito Connect, achieving a collaborative loop among content contribution, points distribution, and project selection. Users can not only obtain airdrop qualifications and platform governance rights through Yaps but also participate in project ranking votes and quality content incentives, forming a unique "create while investing" logic. Kaito Connect provides an open InfoFi network that everyone can participate in, allowing ordinary users to receive due rewards for their information contributions. This content-value anchored model brings a new narrative to Base that differs from traditional DeFi, opening up new imaginative spaces in the integration of social and financial tracks.

# Future Development Trends of Coinbase and Base

In June 2025, the U.S. Senate passed the GENIUS Stablecoin Act, establishing a legislative framework for U.S. dollar stablecoins. The passage of this act marks the first time that regulators have legally affirmed the compliant status of digital assets. Against this regulatory backdrop, Coinbase, as a compliant exchange in the U.S., has begun its three major layouts. The first step is to connect Coinbase with on-chain assets through Base, making it a compliant on-chain trading entry. The second step is to collaborate with traditional financial institutions to issue compliant stablecoins based on Base, allowing traditional financial capital to go on-chain. The third step is to establish content within the Base ecosystem, including on-chain U.S. stocks, compliant payments, DeFi, AI Agents, etc., to attract traditional capital inflows.

Step One: Open Up the Channel for Compliant Assets to Enter the Chain—Bringing Coinbase Account Balances into the Base Chain

Coinbase is currently promoting deep integration between its centralized trading platform and the Base chain. It has recently launched the Coinbase Verified Pools feature, allowing KYC users to directly use their Coinbase account balances to interact with DApps on Base without the cumbersome wallet switching and on-chain transfer processes. Uniswap and Aerodrome have been announced as its DEX platforms for on-chain trading. Although this feature is still in its early stages, this direction is highly consistent with the current trend of several centralized trading platforms promoting the integration of on-chain and off-chain.

Step Two: Co-constructing a Compliant Stablecoin System with Traditional Financial Institutions: Promoting the On-chain Flow of Fiat Capital

Based on the opening of the on-chain entry, Coinbase further collaborates with Wall Street financial giants like JPMorgan Chase to pilot the issuance of "compliant stablecoins" and "deposit tokens" (such as JPMD) on the Base chain. These assets are directly custodied by regulated banks, possessing traditional financial attributes such as interest income, legal protection, and bank insurance, far exceeding the trust foundation of general crypto stablecoins. This move means that not only can U.S. dollars circulate on-chain, but the core asset structure within the traditional financial system will also undergo digital migration, thus evolving Base into the on-chain carrier layer for traditional finance.

Step Three: Building Diverse Ecological Scenarios—Activating the Demand for On-chain U.S. Dollars

To enhance the practical use scenarios of on-chain U.S. dollars, Coinbase is simultaneously promoting the diversification of the Base ecosystem, covering multiple dimensions:

On-chain U.S. Stock Trading: It is applying to the SEC for permission to bring U.S. stocks on-chain and plans to launch tokenized stock products, allowing users to trade U.S. stocks like Apple and Tesla on-chain, breaking the geographical limitations of traditional securities markets.

Ecological Interaction with Circle: The launch of the Circle Payments Network (CPN) provides a stronger clearing infrastructure for USDC. As one of the largest stablecoins in the Base ecosystem, it enables DeFi, RWA, or cross-border payment projects on Base to directly access global stablecoin payment channels, helping Base become an important part of compliant on-chain financial infrastructure.

Global Crypto Payments: Collaborating with Shopify and Stripe to embed stablecoins like USDC into e-commerce checkout processes, expanding the practical application of on-chain U.S. dollars in cross-border settlements.

Compliant DeFi and On-chain Credit: Guiding DeFi projects like Aerodrome, Uniswap, and Spark to operate compliantly through KYC modules, providing stable and auditable on-chain trading, lending, and other services for institutions and retail investors.

AI Agents and InfoFi New On-chain Play: Creating more innovative on-chain gameplay to attract traditional users.

Through these three major initiatives, Coinbase has not only built a "fast track" for compliant assets to enter the chain but also established a complete value loop for U.S. dollar stablecoins—from fiat capital going on-chain, to on-chain storage and circulation, and finally to the realization of practical use scenarios.

# High-Potential Projects in the Ecosystem

Aerodrome: With the integration of Base chain DEX into the main application through Coinbase, Aerodrome, as the leading project in the ecosystem, is expected to receive continuous and stable institutional liquidity support, further driving its trading volume, TVL, and platform revenue growth. Meanwhile, holders of the AERO token will benefit from higher revenue distribution and staking rewards due to the growth in platform revenue, stimulating more users to participate in staking and governance, thus forming a positive feedback mechanism.

Uniswap: Similarly to Aerodrome, as another DEX integrated with Coinbase, Uniswap will also gain more on-chain liquidity through this integration, enhancing its platform's potential revenue and thereby increasing the value of the UNI token.

Keeta: A high-performance RWA public chain, boasting tens of millions of TPS and sub-second transaction confirmations, has validated its performance authenticity through independent stress testing and has received support from several institutions, including former Google CEO Eric Schmidt. Although the token price has experienced significant adjustments, its token is expected to engage in deep cooperation with Base in the direction of RWA compliance in the future.

Creator Bid: Launched version 2.0 in collaboration with Kaito, introducing new mechanisms such as staking and new project launches to enhance user participation and expand creator economy gameplay. The new mechanism has driven the BID token to surpass a historical market value of $150 million in a short period, demonstrating the initial effects of the new mechanism on user engagement and community enthusiasm. Drawing on the early performance of similar projects (such as Virtual), Creator Bid still has sustained growth potential as it iterates on its features.

Upside: Upside is the first social-oriented prediction market platform on Base, allowing users to convert X/Twitter, articles, and video links into "content tokens" and vote and trade using USDC. The platform is currently in its second quarter testing phase, with approximately 20,000 followers in the X community. Although it has not yet issued tokens, Upside has attracted early user participation with its novel design combining social prediction and investment mechanisms, showing potential to become a new application on Base that integrates liquidity and content attributes.

Currently, Base is gradually evolving from a "transaction-active" L2 network into a "structurally complete" on-chain financial and content infrastructure. From the innovative mechanisms of Virtual and Kaito to the construction of the on-chain U.S. dollar value system promoted by Coinbase, although some hot projects face challenges of declining enthusiasm and user speculation in the short term, the narrative continuity and institutional linkage capabilities demonstrated by the Base ecosystem suggest that it may become a bridge for traditional capital to enter Web3 in the next phase. For investors, Base is no longer just a hot rotation track but an important sample for observing the transformation path of the crypto industry towards "compliance, financialization, and practicality."

# Risk Warning:

The information provided is for reference only and should not be considered as advice to buy, sell, or hold any financial assets. All information is provided in good faith. However, we make no express or implied representations or warranties regarding the accuracy, adequacy, effectiveness, reliability, availability, or completeness of such information.

All cryptocurrency investments (including returns) are inherently highly speculative and involve significant risk of loss. Past, hypothetical, or simulated performance does not necessarily represent future results. The value of digital currencies may rise or fall, and there may be significant risks associated with buying, selling, holding, or trading digital currencies. You should carefully consider whether trading or holding digital currencies is suitable for you based on your individual investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。