The world is bustling, all for profit; the world is bustling, all for profit! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome everyone's attention and likes, and I refuse any market smoke screens!

Taking advantage of the stable market, let's talk about the future trends of the cryptocurrency world. It can be said that since last year's explosive growth, a large number of new users have entered the market, and the cryptocurrency world has leaped to become a well-known financial investment market. This has also given rise to a group of extreme ideologists, and most users' communication with Lao Cui tends to be somewhat radical. Many friends believe that Bitcoin doubling is a consensus issue, and that small coins should be based on a fivefold increase. The listing of stablecoins will further drive the bull market in the cryptocurrency world, especially compared to the volatility before 2020, which should impact the peak of the bull market even more. While everyone is generally optimistic, Lao Cui sees more crises. Before Bitcoin was listed, Lao Cui was not very optimistic about the development of the cryptocurrency world. At that time, the prevailing thought was that as long as one did not engage with the cryptocurrency world, it was seen as existing in the form of scams. Until the listing news was leaked, it gradually made Lao Cui re-evaluate the entire market.

Everyone can think about why the cryptocurrency world has survived to this day? And why, despite its notorious history, do relevant institutions still tolerate the cryptocurrency world? The answer is obvious: the existence of the cryptocurrency world definitely has an audience, and it is precisely because of its unique characteristics that it is widely used. Currently, the technology cannot decipher cryptocurrencies; since the technical aspect cannot solve it, it can only coexist in society, similar to a virus. Once the technology reaches a certain standard, the primary solution will be the cryptocurrency market. This can be seen from the breakthroughs in quantum computing in the U.S., which directly led to a significant drop in the cryptocurrency market. Only when the cryptocurrency industry guarantees the security of cryptocurrencies can the market stabilize. Therefore, the basic choice of major players in the cryptocurrency world to invest will revolve around Bitcoin, and at the same time, the choices of these major players further squeeze the market share of ordinary investors. Currently, users who can survive in the Bitcoin spot market are basically related to institutions, and personal investment has become quite challenging.

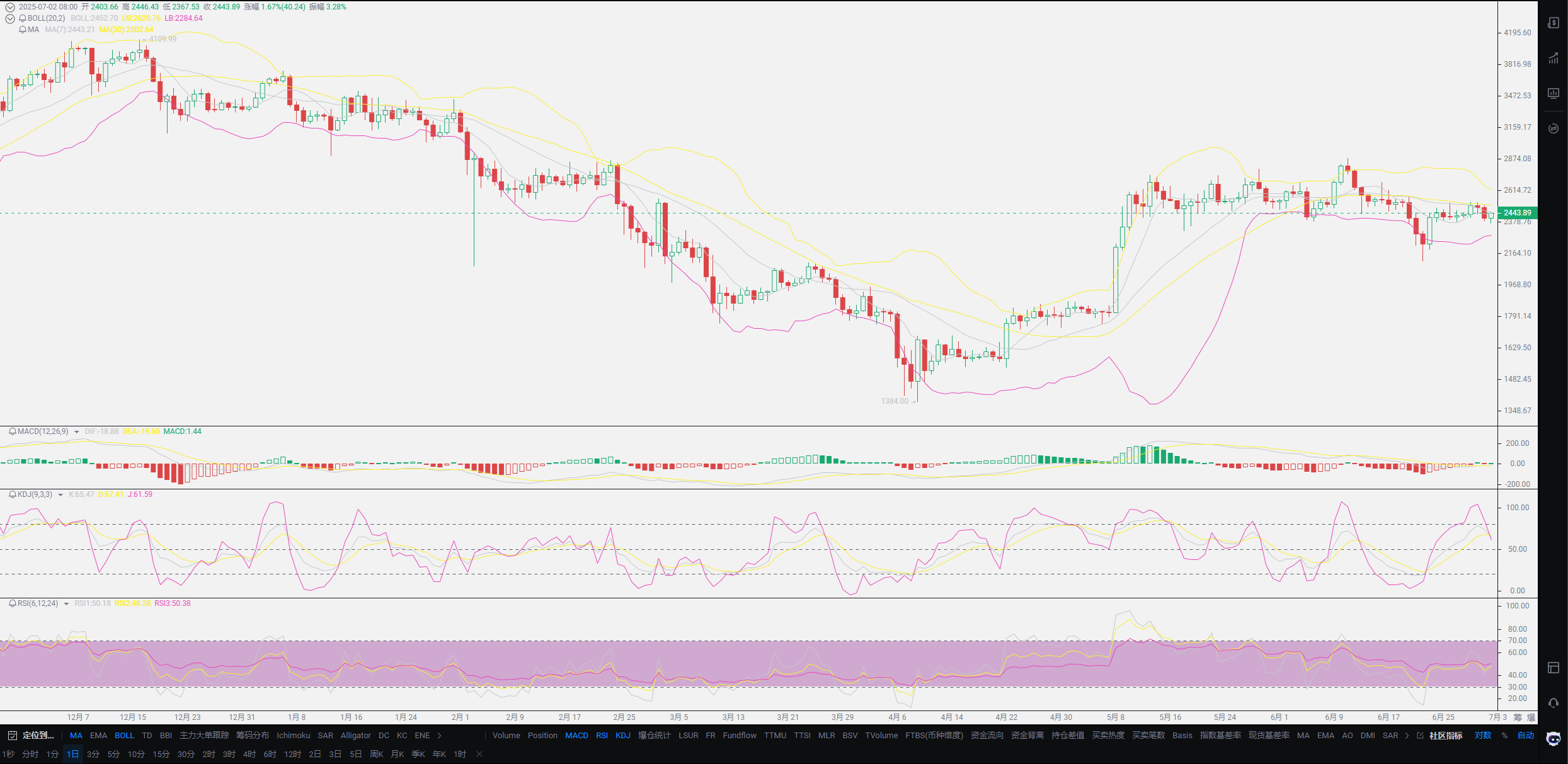

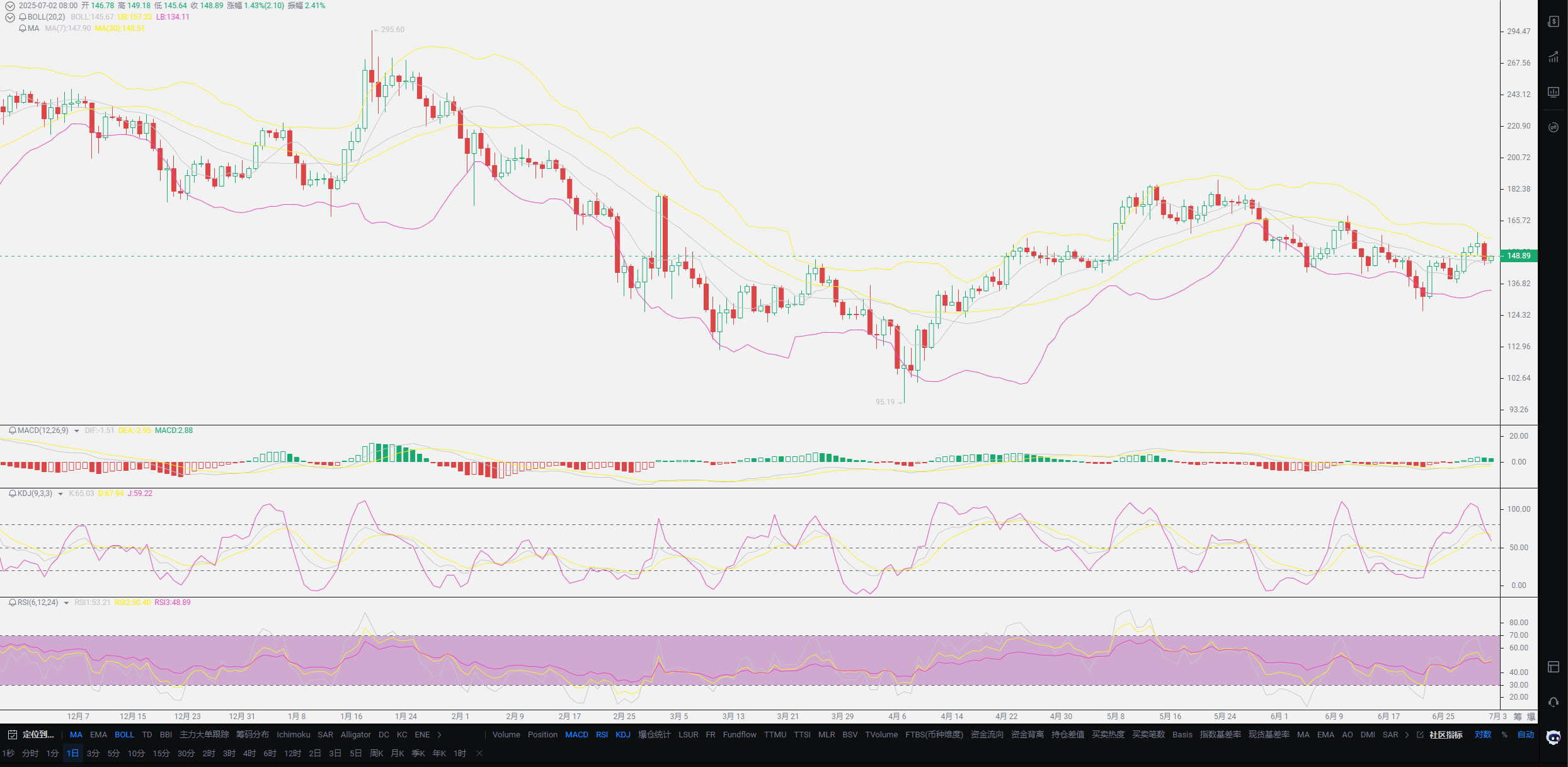

So, regarding this issue, Lao Cui's solution is primarily to focus on contracts based on Bitcoin. Many friends are puzzled: since the Bitcoin market is already saturated for ordinary investors, why not choose Ethereum or SOL? From an investment perspective, the POS mechanism of these two is indeed not suitable for large-scale investment. The POS mechanism will only enhance the characteristics of the coin, making the investment system stronger, which is not beneficial for ordinary investors. To put it bluntly, as long as the number of Ethereum investors increases, can V God hold the bottom line? Or for the Ethereum giants in the cryptocurrency world, can they maintain their holdings? From a human perspective, Lao Cui believes that as long as there are people's participation, there will definitely be human flaws. After all, the super issuance mechanism of POS is not entirely controlled by the program; the possibility of human intervention is much greater. Therefore, looking at this round of bull market, SOL's future may be broader, especially with the major boost of its listing, and with Trump's operations, it may have a much higher probability of doubling compared to Ethereum.

Currently, combining the entire U.S. strategy, Lao Cui has also made it clear about the interest rate cuts; thus, Lao Cui's focus has returned to the exchange rate level, observing the dollar index for a period, which has reached a new low. This is a very serious signal. Everyone can refer to the previous stablecoin legislation; for U.S. Treasury bonds, it basically announces that external actions need to be taken. The solution to debt may not be through internal purchases in the U.S. Everyone must refocus on the U.S. market; the weakening of the dollar may be a long-term signal, especially in Goldman Sachs' latest forecast, which assesses that the dollar index may fall to a range of 73-77 in the next 3-5 years, a decrease of about 30-40%. Those who may not understand finance might think that the depreciation of the dollar corresponds to the appreciation of CNY, which would be a good signal for us. The depreciation of the dollar will indeed push up some assets, such as U.S. stocks, gold, and Bitcoin.

This is major good news for the cryptocurrency world; such depreciation may last for 3-5 years, which means the cryptocurrency world may continue to grow. Combined with the interest rate cut strategy, this year and next year still belong to the interest rate cut cycle, which is extremely beneficial in the long term. However, from a national level, it is entirely a competitive relationship. One can compare the best years of export data when the CNY to USD exchange rate was maintained between 6.2-6.3 for a long time. Currently, the domestic policy is to cut interest rates and reserve requirements, which is essentially aimed at depreciating the CNY, while the U.S. strategy is to appreciate the CNY. Because after appreciation, for the U.S., the depreciation of the dollar may lead to more funds flowing into the domestic market, which complements their industrial transfer strategy. More funds flowing into the U.S. stock or Treasury bond market can help achieve their debt reduction goals. To put it simply, the depreciation of the dollar will bring in more funds to help reduce debt.

From the export perspective, earning more dollars is actually not very valuable. Because when it is consumed domestically, its value is in a depreciated state, and the dollar reserves from a national perspective are already decreasing. Regarding the stablecoin legislation, everyone buys U.S. Treasury bonds of the same value to exchange for stablecoins, which also ends up in a depreciated state. From a financial perspective, this is a targeted series of moves. If this strategy is executed, although Bitcoin maintains a growth state, its problems will also be very obvious; when everyone cashes out, they will find that its value is not equivalent. Currently, it seems that the decline in Bitcoin is not deep, but in reality, when cashing out, everyone will find that the price remains unchanged while the value decreases, which is entirely a losing deal. Lao Cui can directly provide the overall cyclical logic: when the dollar appreciates, it will lead to the decline of U.S. stocks, gold, and Bitcoin. At this time, the U.S. will buy assets at low prices, and when the dollar depreciates, the U.S. will cash out at high asset prices to achieve their debt reduction goals. Meanwhile, the speed of dollar depreciation must exceed the intrinsic value of the assets themselves, using this method for arbitrage.

When this strategy is applied to the cryptocurrency world, as long as the dollar continues to depreciate, everyone can hold a portion of their positions. In the current phase, for markets that are relatively stable and have the properties of safe-haven assets like commodities and gold, the investment priority may be higher than that of the Bitcoin market. If you have idle assets, you can try it out. This explanation does not include the A market; please do not misunderstand. Although the A market will also grow, it does not belong to the financial category. The depreciation of the dollar is essentially a lock on the market linked to the dollar, and it is highly likely that actions will be taken against U.S. Treasury bonds afterward. These two points are actually aimed at stablecoin issuers; the first strike is directed at this part of the assets. Now you understand why the issuance of stablecoins domestically is based on the Hong Kong dollar, while the U.S. issuance is based on the combination of the dollar and U.S. Treasury bonds. It seems that holding U.S. Treasury bonds for about 93 days can issue stablecoins, but in reality, there will be losses after maturity; this is the difference in mechanisms.

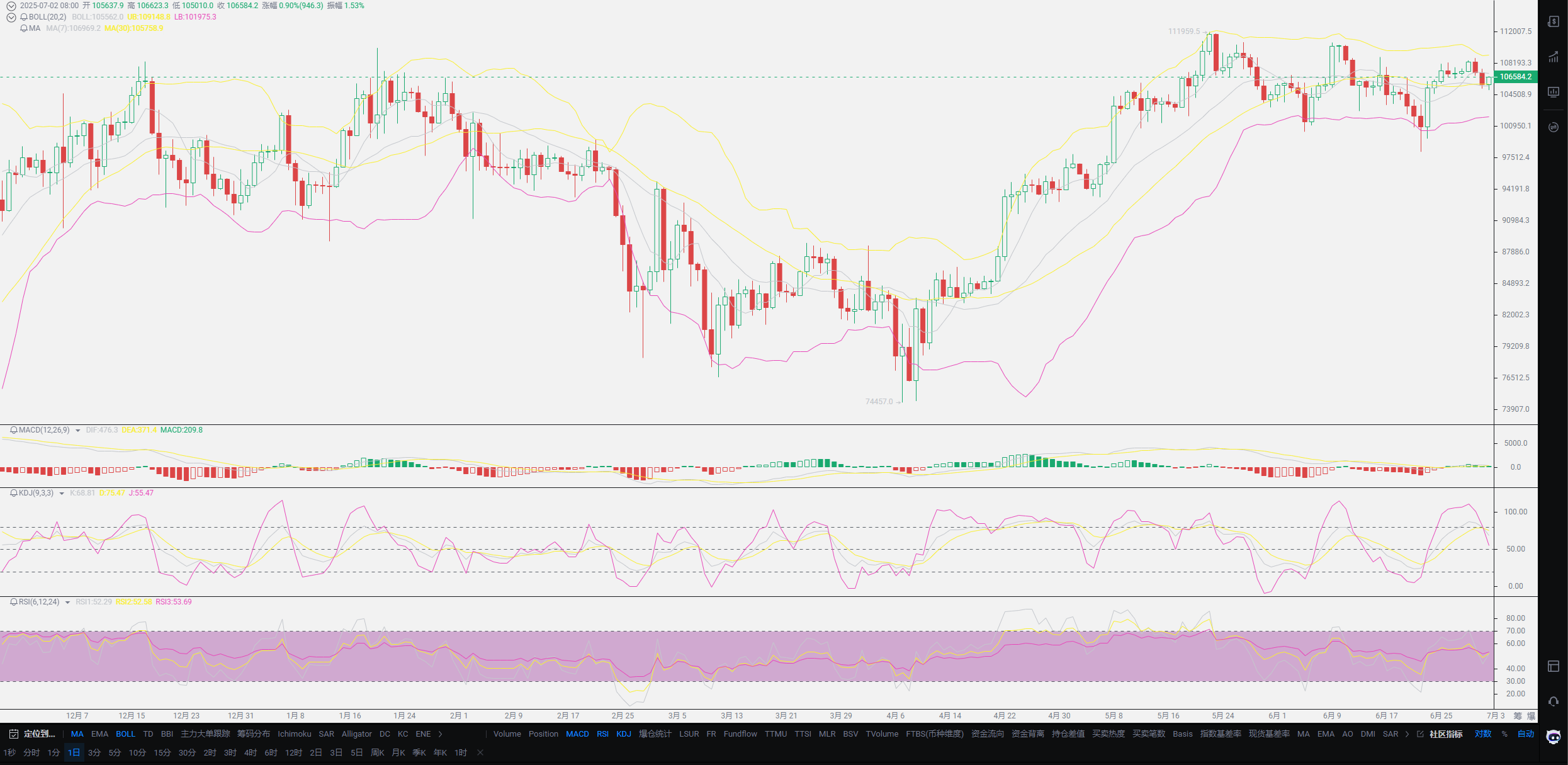

Lao Cui summarizes: Yesterday, Powell once again emphasized the stability of the market and the implementation of a no-interest rate cut strategy, which almost caused Bitcoin to break through the 105,000 mark. In the short term, it is still in a downward window, but everyone can clearly judge that even if Bitcoin maintains a stable state, the inflow and outflow of funds are not significant. Small coins are not experiencing a crazy surge either, especially Ethereum, which, compared to previous prices, is currently not showing strong rebound strength. Users investing in small coins need to be cautious. This year's interest rate cuts, combined with the depreciation of the dollar and the subsequent listing of small coins, will definitely make this year's Bitcoin bull market satisfying for everyone. The early depreciation of the dollar is certainly paving the way for future interest rate cuts, and the purpose is very clear: to bring funds back to the U.S. market. At the same time, the cryptocurrency world, due to the involvement of stablecoins, will also attract some funds. The current stablecoin market is already dominated by the U.S. Bitcoin may experience a wave of growth in the short term, but the short-selling strategy before the interest rate cuts remains unchanged, and new highs are unlikely to occur in the near future, so there is no need to be overly anxious. Lao Cui's thinking has not changed; as long as a short-term new high appears, the focus will still be on shorting. Currently, the spot positions in hand have not changed, so there is no need to elaborate. If you want to hold spot, you can layout with a 10% position; the current price is acceptable, and holding until the end of the year will definitely yield some returns. For those who still have questions, feel free to message Lao Cui directly!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation, strategizes for the big picture, and does not focus on individual pieces or territories, aiming for the ultimate victory. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。