Stablecoins have formed a clear divide.

Written by: Zuo Ye

Top-tier alpha players are adept at both politics and business, such as Justin Sun, or Gabriel Abed, the current Chairman of Binance.com, who intriguingly was previously the Barbados Ambassador to the UAE.

You might wonder how a Barbados ambassador studying in North America became the chairman of Binance. This highlights the importance of considering one's own efforts while keeping pace with historical developments.

Image caption: Stable investor Gabriel Abed, image source: @zuoyeweb3

Before today, USDT was equivalent to half of TRC-20 USDT. Justin Sun relied on providing circulation channels for USDT to support a business empire centered around $TRX, but the emergence of Stablechain has caused cracks in that empire.

Stablechain is a Layer 1 payment-specific platform issued by Stable, using USDT as its Gas Token, directly supported by USDT. Therefore, bringing in Gabriel Abed and launching a blockchain can be seen as Tether exploring outward, targeting the institutional market.

This is directly related to the current competitive market landscape. Aside from USD1, which is purely a Trump concept coin, competitors like USDC/USDe are focusing on the institutional settlement market. Not to mention, USDG supported by Paxos and Kraken is also eyeing this lucrative segment, and even BUSD plans to undergo a transformation.

Stablecoins are moving towards enterprises

Focusing on the C-end user market for stablecoins is akin to engaging in black and gray markets.

In terms of C-end users, Justin Sun has provided the most successful business strategy to date, not by making Tron the issuance network for USDT, but by identifying specific groups in the real world that have a strong demand for stablecoins. The binding relationship between TRX and USDT has also made Tron the blockchain with real users, second only to Ethereum.

However, under the wave of institutional adoption with Stablechain, CPN, and Converge, it remains to be seen if Justin can come up with new ideas. Focusing solely on the Trump family is insufficient, as he has at most four years, while business is a lifelong endeavor.

Currently, the U card and interest-bearing battlefield are heating up, and YBSBarker is continuously following up. The B-end enterprises are far from ordinary users, but there lies the opportunity for the next Circle or Stripe. (Recently, the number of friends consulting me about stablecoins has grown exponentially, with countless projects claiming to be the next Stripe, indicating the fierce competition in the market.)

In the B-end market, pure compliance can bring significant incremental growth and is more suitable for entrepreneurs looking to land. As stablecoins begin to evolve similarly, let’s all get involved!

Image caption: Comparison of USDC/USDT/USDe, image source: @zuoyeweb3

USDT --> USDT0 (LayerZero) --> Stablechain

USDe --> USDtb --> Converge

USDC --> CCTP (Wormhole) --> CPN (Circle Payment Network)

The current market structure is stablecoins --> on-chain cross-chain --> off-chain institutions, with business development methods divided into three main lines: compliance, cross-chain, and institutional.

USDT expands the on-chain market through USDT0. Beyond direct deployment, it creates OFT format tokens via LayerZero, issued with a 1:1 reserve of USDT, primarily aimed at providing compatibility similar to Circle's CCTP, although USDT did not create it but chose to use USDT0.

It can be considered that using USDT0 is equivalent to using USDT, opening up possibilities for institutional adoption and compatibility with more public chains and products. For example, Kraken-supported L2 Ink has also deployed USDT0, and Stablechain will use USDT/USDT0 to expand more institutional-level transfer and settlement services.

Outside of its own ecosystem, USDe issues the compliant stablecoin USDtb, supported by BlackRock BUIDL, to meet institutional compliance requirements. USDe focuses on developing its on-chain ecosystem, such as collaborating with TON to enter the third world.

Converge, which is comparable to Stablechain, also emphasizes institutional adoption and transfer and settlement services, with a similar business model but slightly different focuses on compliance, cross-chain standards, and institutional adoption.

USDC prefers self-development; although it has a partnership with Wormhole, the cross-chain standard CCTP is primarily managed by itself, while CPN serves as a global settlement network for USDC, similar to Visa/SWIFT.

In summary, USDT prefers to support ecosystems, USDe often uses collaborative methods, while Circle likes to operate independently.

Decoding Stablechain, business development remains challenging

With the end of technological innovation, the ability to operate commercially becomes prominent.

From a technical perspective, Stablechain, as an L1, lacks significant innovation, such as using a variant of CometBFT called StableBFT as its consensus protocol, with plans to upgrade to a DAG model, which is somewhat surprising.

Overall, Stablechain has also announced that it will adopt a dPoS mechanism to ensure efficient operation, aiming for minimal centralization, and may even adopt a "single-machine mode" similar to Hyperliquid's early days. Although it is not a perpetual contract, large-scale USDT transfers require high network robustness.

Additionally, the upcoming StableEVM will upgrade to StableVM++, introducing more parallel capabilities, based on the Block-STM modification proposed by Aptos. If you don't remember, think back: parallelism is not limited to EVM; the high-performance L1 (Sui) is in a battle with Ethereum L2?

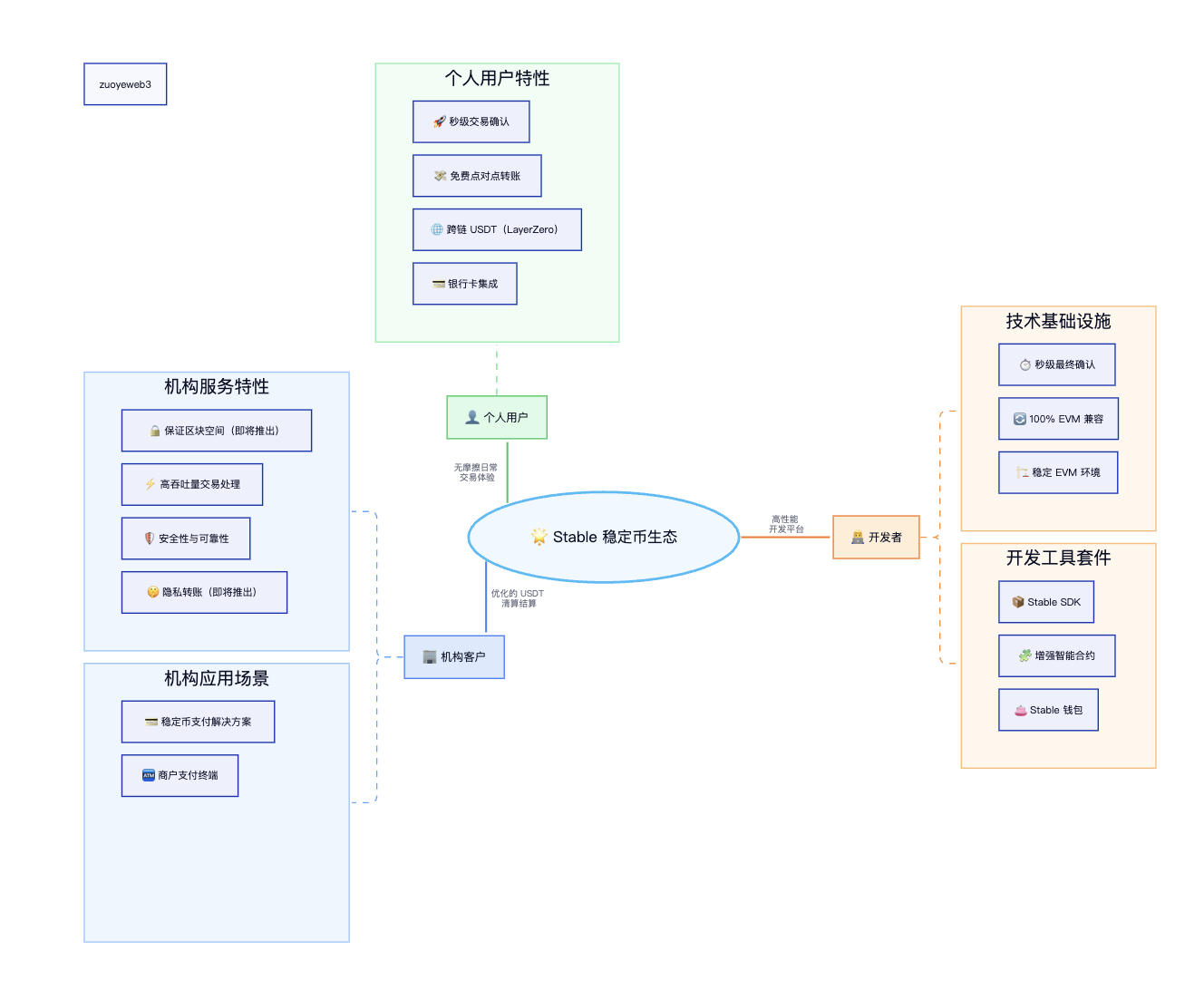

Broadly speaking, Stablechain is mainly divided into personal users, business users, and developers. Compared to the user education already completed by USDT, most enterprise clients and developers are still in a stage of confusion.

Image caption: Features of Stablechain, image source: @zuoyeweb3

Targeting enterprise users is the focus of Stablechain. From the documentation, I have categorized three main features, with more detailed content and applications for individuals and developers available in the image above.

Guaranteed Blockspace: Enterprises can enjoy customized block space for transactions, ensuring reliable and correct execution, akin to reserving a fast lane during a holiday.

Only trading USDT: Ensures safety and speed, even allowing real-time tracking to meet high compliance requirements such as anti-money laundering.

Privacy transfers: Settlements between enterprises are not public, ensuring that transaction details remain undisclosed, especially from business competitors, thus protecting commercial privacy.

In addition, general features include gas-free transfers, sub-second confirmations, and USDT0 cross-chain bridges, which are mostly unremarkable. Essentially, the significance of Stablechain lies not here, but in commercially countering Circle.

Let’s discuss potential commercialization opportunities. At this stage, everyone is uncertain about the correct entry point for B-end commercialization. Note that this does not conflict with the earlier mention of starting commercialization.

You must keep up with what your competitors are doing. Just as Sui developed the storage product Walrus, Aptos is rushing to create a Shelby. While everyone knows that enterprises need settlement and internal transfers, how should this be done?

For instance, the Yiwu settlement network used TRC-20 USDT before being cracked down, which is the default industry standard and a real commercial need. But can Stablechain meet this demand?

Currently, it seems unable to, as Stablechain does not belong to a compliant settlement system and can only resort to alternatives, such as collaborating with licensed PSP enterprises, which would significantly reduce target customers' brand recognition of Stablechain.

In Stablechain's planning, future commercial operations will be divided into consumer payment solutions, merchant acquiring tools, and Stable Wallet, along with built-in compliance tools. However, these are too broad and have yet to form a specific operational strategy, leaving it to be observed in the future.

Conclusion

Stablecoins have formed a clear divide.

One side consists of traditional financial practitioners or the general public's perception: stablecoins are meant to be used like dollars or Alipay, which is also the goal that USDTs strive to achieve.

The other side is the DeFi route, still serving as a representation of financial products, essentially YBS (yield-bearing stablecoins), which core represents financial certificates and dividend shares. USDe also aims to transition into the development path of USDT after YBS.

Currently, Stablechain seems to have little to do with Justin Sun, and I hope he can pull through this time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。