What are the similarities and differences between the two major stablecoin-specific chains supported by USDT, Stable and Plasma?

Written by: Alex Liu, Foresight News

As stablecoins increasingly dominate crypto payments and cross-border settlements, the infrastructure specifically designed for them is gradually emerging. Stable and Plasma are the two major stablecoin-specific chains supported by USDT, and they not only have different paths but also different underlying philosophies: are they serving individual users or building a central hub for enterprise settlements? This article will outline the design philosophy and development path of Stable, and conduct an in-depth comparison with Plasma, analyzing the practical significance and future possibilities of stablecoin-specific chains.

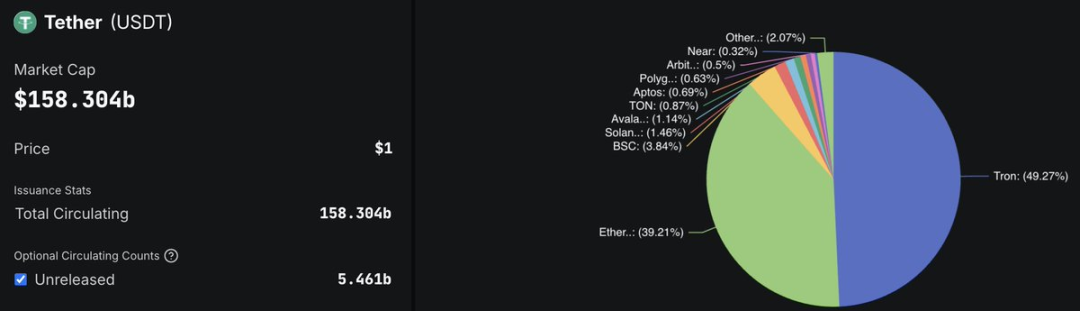

Stablecoins are moving from the financial fringe to the mainstream. Data shows that the global circulation of USDT has surpassed $150 billion, with over 350 million users, and in some Latin American countries, supermarkets have directly priced goods in USDT. This leap is forcing infrastructure to redefine itself. Stable was born in this context.

Stable: A Dedicated Payment Chain Centered on USDT

Stable is a Layer 1 blockchain specifically designed for stablecoin payment scenarios, supported by Bitfinex and USDT0, with Tether CEO Paolo Ardoino as an advisor. Unlike general-purpose public chains like Ethereum or Tron, Stable has a clear positioning, aiming to solve the core pain points in the current use of stablecoins: unstable fee structures, inefficient confirmation speeds, and complex interaction experiences, advocating for a "Stablechain" to change the technical carrying method of stablecoins.

In its core design, Stable uses USDT as the native Gas on-chain, allowing users to initiate transactions without holding platform tokens, and P2P (peer-to-peer) USDT transfers are completely Gas-free. This design simplifies the user experience, making it suitable for frequent small payments and cross-border remittances.

Additionally, Stable supports high throughput and second-level confirmation times, with its StableBFT (based on Cosmos's CometBFT) consensus mechanism and the upcoming DAG architecture ensuring performance scalability; enterprise users can apply for dedicated block space, making transaction rates and fees predictable. This "institution-oriented" design language runs throughout its entire development blueprint.

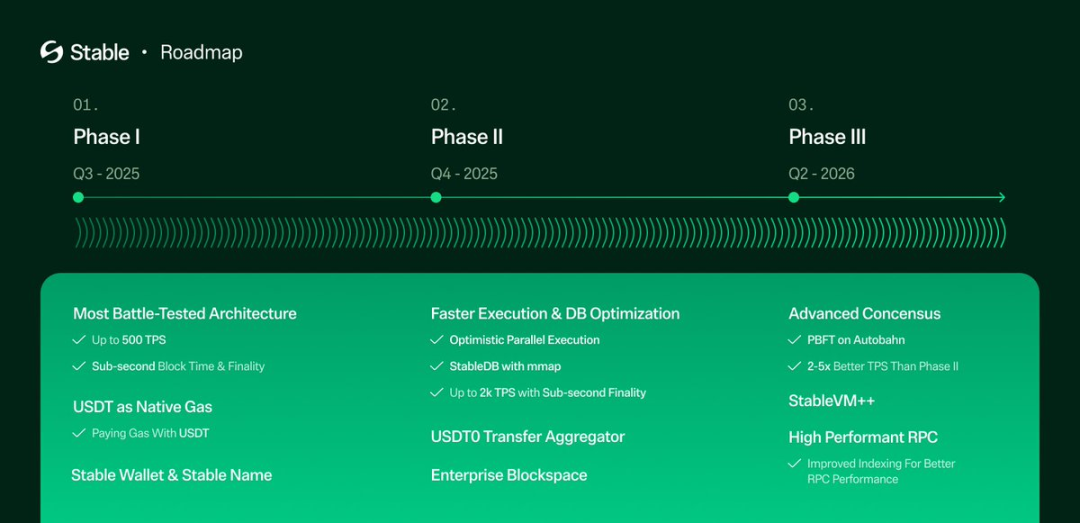

The technical roadmap of Stable is divided into three phases: the first phase uses USDT as the native GAS token to achieve sub-second block confirmation; the second phase introduces Optimistic Parallel Execution to enhance throughput, breaking TPS (transactions per second) beyond 5,000; the third phase upgrades to a DAG-based consensus mechanism.

To serve the developer ecosystem, Stable is fully compatible with EVM, equipped with dedicated SDKs and APIs. On the wallet side, Stable Wallet supports social login, user-friendly addresses, bank card integration, and other features, clearly aligning with Web2 users.

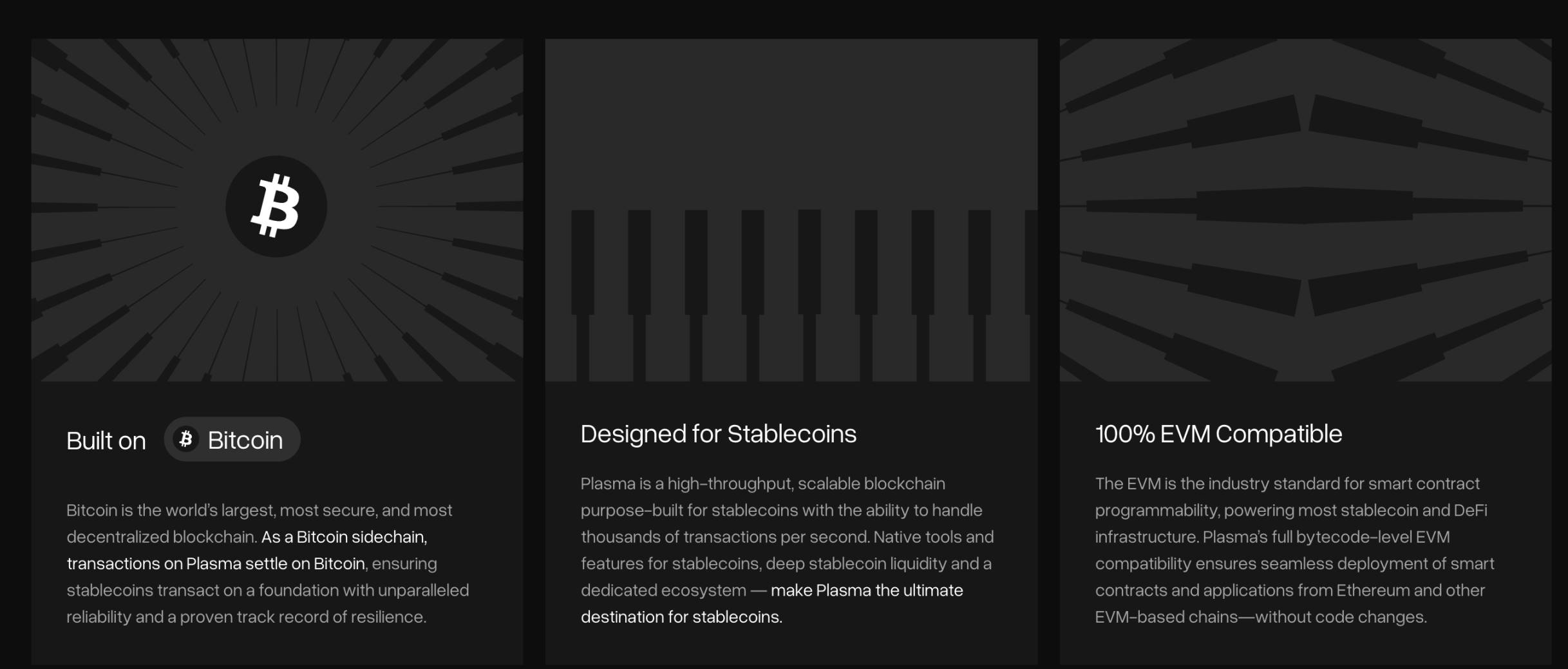

Plasma: An Alternative Path Anchored to Bitcoin

In contrast to Stable's "independent autonomy," Plasma is a Bitcoin sidechain. It establishes its operating mechanism by leveraging the anchoring security of BTC, yet possesses independent consensus and settlement processes. Plasma utilizes Bitcoin block timestamps for synchronization to achieve resistance against reorganization attacks, writing checkpoints to the Bitcoin mainnet every 10 minutes. Architecturally, it is somewhat similar to Liquid but focuses more on stablecoin scenarios.

The biggest selling point of Plasma is "free transfers": users do not need to pay any Gas fees when transferring USDT. However, other on-chain operations are charged as usual—this is a "free traffic, paid expansion" strategy model.

Plasma is currently scheduled to launch its mainnet in the third quarter of this year. In terms of financing, Plasma completed a $24 million funding round in February 2025, led by Framework Ventures, with PayPal co-founder Peter Thiel participating as a personal investor in the seed round. The team behind Plasma was founded by Paul Faecks, who previously co-founded the institutional digital asset operating platform Alloy.

Like Stable, Plasma is also fully EVM compatible, allowing developers to directly deploy applications on Ethereum. Additionally, users can pay transaction fees on Plasma using USDT or BTC, further strengthening its financial linkage with BTC. As a product jointly promoted by Bitfinex and Tether, Plasma and Stable differ in technical implementation but share a narrative centered around USDT in their strategic paths.

Commonality: The Logic of Stablecoin-Specific Infrastructure

Despite their different paths, Stable and Plasma share many commonalities. Both are built around USDT0, which is the native cross-chain USDT realized through LayerZero technology, aimed at reducing the fragmentation of stablecoins and enabling multi-chain atomic swaps. Currently, USDT0 has covered networks such as Arbitrum and HyperEVM, providing stronger liquidity unity at the protocol level.

In terms of privacy protection, both have planned related features. Plasma proposes Shielded Transactions, while Stable plans to support Confidential Transfers, both enhancing privacy protection capabilities under compliance.

However, the real difference lies in the understanding of "institutional scenarios." Stable has launched "Enterprise Blockspace" and "USDT Transaction Aggregator" features, reserving bandwidth for high-frequency enterprise users and aggregating multiple transfers for processing, achieving lower costs and higher performance. Stable is not satisfied with serving retail users but aims to become the technological backbone of multinational enterprise settlement networks.

Reality and Vision: Are These Chains Really "Necessary"?

It is natural to raise the question—do we really need dedicated chains for stablecoins? Currently, over 49% of USDT is on the Tron network, where stablecoins dominate, but Tether itself has not deeply participated in the operation or governance of the chain.

The emergence of Stable and Plasma aims to "draw away" the liquidity of stablecoins that are stuck in old networks—not through token incentives, but through "free," "faster," and "more stable" actual experiences to achieve "gentle siphoning." If a complete ecosystem can be built through Gas-free transfers, enterprise-level services, and native cross-chain functionalities, Stable and Plasma may become roles similar to SWIFT in the future—providing stablecoins while dominating the operational network.

Current Progress and Future Observations

Currently, Plasma has obtained over $1 billion in user deposits through token sales (pre-mining), rising to become one of the top ten public chains for stablecoin liquidity, and has achieved several global partnerships: such as promoting USDT transfers in Africa with YellowCard and connecting local fiat channels in Turkey with BiLira.

Stable, on the other hand, is still in the early stages of construction, showing its "infrastructure ambition": whether it is the attempt at DAG architecture or services aimed at enterprises and developers, it reflects its intention to build a "chain-based financial network tailored for stablecoins."

Conclusion: The Future of Stablecoin Chains is Taking Shape

The emergence of Stable and Plasma, in a sense, signifies that crypto infrastructure has entered the "function-specific chain" stage. They do not completely replace existing public chains but represent a vertical segmentation reconstruction. Stablecoins, as the most practically valuable asset type in the crypto world, should have their own sovereign networks—this is precisely the gap that Stable and Plasma are attempting to fill.

In the coming years, whether these two chains can build a truly active and sustainably developing ecosystem will become an important reference for measuring the necessity of "stablecoin chains." For USDT itself, this architectural innovation may also signify a profound transformation from "passive use" to "dominant operation."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。