Strategy Bitcoin Gains Drive $14B Q2 Windfall and Shift

Strategy gains are putting the company in rarefied air. Once known as MSTR, the firm is now expected to report an astonishing $14 billion in the second quarter of the year 2025, in an unrealized profit. Thanks largely to his massive Bitcoin holdings and a key accounting rule change.

As prices surged, pivot from enterprise software to a crypto centric model redefined its price in the Financial world.

Source: Twitter

How Strategy Bitcoin Changed MSTR's Business Model

Under the leadership of Micheal Saylor, the company began acquiring in 2020 as a hedge against inflation. What began as an alternative treasury approach soon evolved into a full transformation– MSTR became its core identity shifted. Today, Strategy gains are no longer just a side note, they are the story right now.

Wall Street's New Crypto King: Saylor’s Next Move

While traditional analysts were skeptical, Saylor remained committed. Critics like Jim Chanos argued that MSTR's valuation model was flawed, recommending short positions in the stock.

Yet with a 3,000% increase in share price since the BTC pivot time– Saylor’s confidence seems more justified than ever.

“Saylor has every right to feel vindicated,” said Benchmark Capital’s Mark Palmer. ‘Despite constant criticism has significantly outperformed even the S&P 500.’

Corporate Strategy Bitcoin : A Playbook for Other CEOs?

The rise of Strategy Bitcoin gains may inspire other corporate leaders to reevaluate their Treasury Strategies.

Holding BTC as a long-term asset has turned Strategy Bitcoin from a midsized tech firm into a billion - dollar headline-maker. Could this model become the new crypto norm?

The Impact on Institutional Adoption of BTC

Strategy Bitcoin success has also impacted how institutional players view BTC.

If a publicly traded company can build wealth on BTC’s appreciation, it sets a precedent that could lead to broader Institutional adoption– not just by hedge funds or crypto firms, but by traditional corporations as well.

After this, there are many companies that are buying some of them as listed, companies like Metaplanets, Galaxy Digital, Block Inc. are now investing in digital assets.

Source: Coingecko

BTC as a Treasury Asset: Risk or Revolution?

Before Q1, 2025, MSTR was forced to treat like an intangible asset– recording only permanent markdowns when prices fell.

The new according brule now allows companies to reflect real-time market prices. This change helped flip a $4.2 billion Q1 loss into potential $14 billion Q2 profit Strategy Bitcoin gains, marking a revolutionary shift in how corporations account for crypto assets.

Regulatory and Market Risks Ahead

Despite the giants, it’s not all smooth sailing. MSTR faces several shareholders lawsuits alleging misleading statements related to the new accounting method.

The company has promised to “vigorously defend” itself’ but the legal clouds highlight the regulatory gray area many crypto-forward firms still operate in.

The Road to a BTC-Backed Wall Street Firm

With its software business taking a back seat, MSTR is essentially evolving into a BTC-backed financial entity.

The firm’s identity has changed– its value is now closely tied to crypto markets, making it a unique hybrid between a tech company and a financial powerhouse.

What’s Next for MSTR USD?

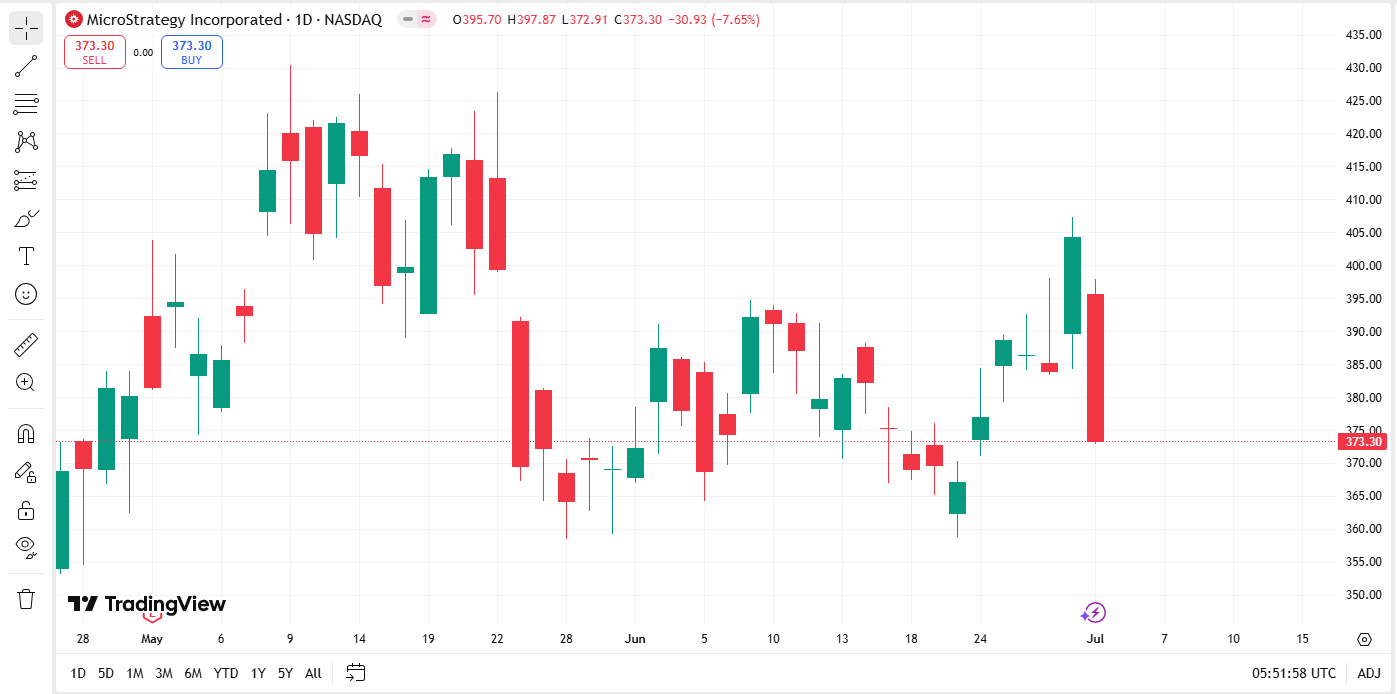

Recent price Action

Key Supports to watch– $360.

If the price drops below the $360 level, it could signal weakness and potentially open the door for a deeper correction-possibly bringing the stock down towards $300.

Upside Potential– Break above $400

On the flip side, if MSTR manages to break above the $400 resistance, it could trigger fresh buying momentum, and set the stage for a move toward new all-time highs.

Source: Trading View

A New Financial Era Driven by Crypto?

Strategy’s Bitcoin transformation and monumental Strategy Bitcoin grains represent more than just a company milestone– they point to a larger shift in global finance.

As more companies explore crypto as a strategic asset, journey could be remembered as the moment the corporate world crossed into a new financial era driven by digital assets in the Strategy Bitcoin.

Also read: Tomarket Daily Combo 02 July 2025: Boost Your Earning免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。