In the past week, the market has completely shifted from being influenced by geopolitical conflicts to being influenced by monetary policy. The conflicts between Trump, Powell, and Musk reflect Trump's demand for short-term economic stimulus, which is also the main driving force behind the overall market rise. This demand is likely aimed at balancing the impacts of tariffs on one hand, and on the other hand, Trump needs to achieve results to escape his currently very low approval ratings.

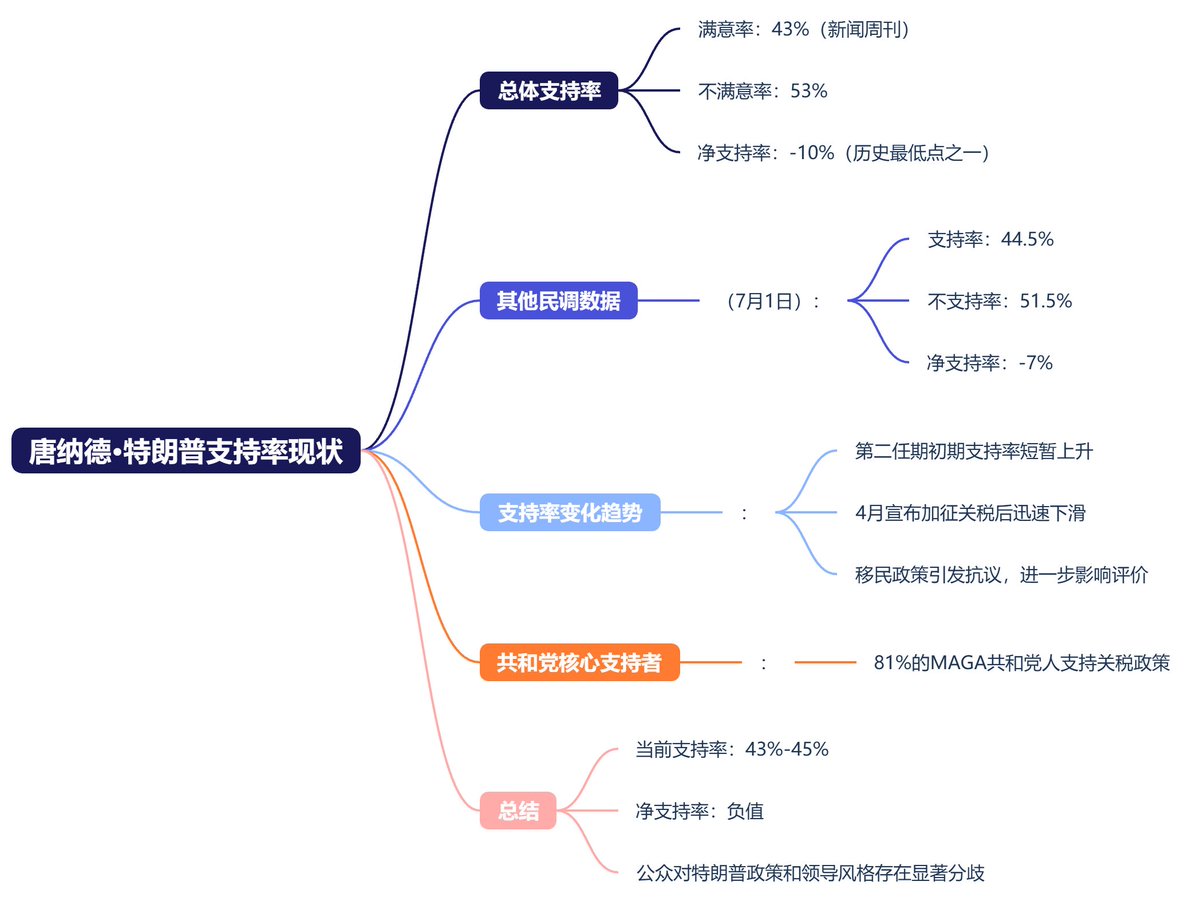

As of July 2025, Trump's approval rating remains between 43% and 45%, with a net approval rating of -7% to -10%, at a low point during his term. Since the launch of large-scale tariffs in April, his approval rating has continued to decline, and the hardline immigration policies have sparked widespread protests, further lowering public opinion. However, support remains solid among core Republican voters, with YouGov data showing that about 81% of MAGA supporters firmly back his tariff policies. Overall, Trump's approval ratings show a clear polarization; his solid base is strong, but he has lost significant support among moderate voters, and there is a huge divide in public opinion regarding his policies and governing style.

Therefore, this may also be a major reason why Trump has to continue maintaining a radical stance.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。