Original|Odaily Planet Daily (@OdailyChina)

Last night, the L1 public chain Stable, supported by USDT, was officially launched, which means that the USDT ecosystem now has its own dedicated public chain. On the other hand, the issuance of USDT in the TRON ecosystem surpassed 80.6 billion on the 22nd of last month, accounting for 51.6% of the total global USDT supply, setting a new historical high.

Undoubtedly, as the stablecoin sector welcomes an epic positive development, even Tether, with an annual net profit exceeding $13 billion, cannot remain indifferent and will not hand over the benefits of the USDT settlement layer to ecosystems like TRON. With USDT as the native Gas and free peer-to-peer USDT transfers, can Stable replace TRON's dominant position in the USDT issuance network? What is the future development direction of Stable? Odaily Planet Daily will provide a brief analysis of these questions in this article.

Detailed Explanation of Stable: The First L1 Public Chain Supported by USDT

In the introduction document officially released by Stable, the vision of this public chain is nothing short of grand: Remittances as simple as sending a text message to a friend, businesses can settle payments instantly without hidden fees, and developers can build financial tools without restrictions.

When mentioning its positioning, the official document explains: “Stable is a dedicated L1 stablecoin public chain optimized for payments using USDT, aimed at solving the current inefficiencies in infrastructure—unpredictable fees, slow settlement times, and overly complex user experiences. Essentially, Stable aims to unleash the true potential of stablecoins, allowing everyone to transact faster, cheaper, and more reliably.”

As for the specific role of Stable, the official document first briefly explains from the "user-side demand."

Industry Pain Points: High Gas Fees, Long Settlement Cycles, High Usage Barriers

Currently, the obstacles facing stablecoins like USDT and USDC, aside from regulatory compliance pressures, include the following challenges for both C-end individual users and B-end enterprise users:

From the perspective of usage barriers, users need to first understand basic information about blockchain networks, mnemonic phrases and private keys for crypto wallets, password management for daily use, and security awareness;

From the perspective of transaction costs, the Gas fees for on-chain transfers and payments are a hard expense, and for small, high-frequency operations in daily life, it can be likened to "small knives cutting flesh," accumulating costs that are not low;

From the perspective of settlement cycles, some enterprise-level stablecoin payments and transfer chains are lengthy and complex, requiring extended settlement periods to ensure the safety of internal and external fund management, which to some extent affects business development among enterprises.

The 7 Basic Functions of Stable: Gas Costs, Throughput, Security, and Scalability Including Wallets

According to the official document, as the L1 public chain with the original "StableChain" concept, Stable's main functions cover the following seven points:

USDT as Native Gas: Users pay transaction fees directly with USDT, eliminating the complexity of holding additional, volatile tokens. Peer-to-peer USDT transfers require no gas, making remittances and daily transactions easy and convenient.

Ultra-Low Fees and Instant Settlement: Transactions can be confirmed within seconds, always maintaining a minimum fee far below 0.1 cents, suitable for small payments and large-scale settlements.

High Throughput: Stable can process thousands of transactions per second, with fast and reliable performance during peak times.

Enterprise-Level Security and Scalability: Institutions will benefit from guaranteed block space allocation, scalable batch processing, and robust security measures, ensuring platform resilience and credibility.

Cross-Chain Interoperability: Using USDT0 and LayerZero technology to seamlessly bridge USDT to other blockchain ecosystems.

Developer-Friendly Environment: With complete EVM compatibility, dedicated SDKs, and powerful APIs, developers can easily build dedicated decentralized applications (dApps) for stablecoin use cases.

Wallet for Global Payments: Stable Wallet provides an intuitive interface with features like social account login, debit/credit card integration, and readable wallet aliases.

It is worth mentioning that according to information released by Stable, this "USDT native L1 public chain" is not only for institutional and enterprise users but is designed to serve everyone (in their own words: Stable for Everyone).

Target Users of Stable: Individuals, Enterprises, Developers

Individuals: Can use Stable Wallet to remit money for free globally, pay for goods and services using USDT-linked debit or credit cards, or conduct instant cross-border transactions;

Enterprises: Simplify operational processes, facilitate high-throughput, cost-predictable transactions, while bypassing expensive third-party processors and significantly reducing transaction fees;

Developers: Conveniently build stablecoin-based dApps on the Stable chain, such as payment platforms, lending protocols, or DeFi solutions.

Stable's Future "Three-Step Strategy": Starting with USDT, Not Just USDT

Beyond the existing plans, Stable's ambition is not limited to just building "stablecoin payment infrastructure," but aims to establish a "Stable ecosystem network," thus planning for "three major development stages" in the future:

Stable's Three-Step Strategy

Phase 1: USDT Base Layer (Q3 2025)

The main tasks of this phase are:

Use USDT as the native gas token.

Achieve sub-second block times and finality. (Tentative goal of up to 500 TPS)

Launch Stable Wallet and Stable Name to enhance user experience.

In the initial phase, Stable's focus is on usability and convenience, thus planning from aspects like wallet entry, address domain names, gas payments, and confirmation times, with the main goal of attracting as many loyal USDT users from other ecosystems as possible.

Phase 2: USDT Experience Layer (Q4 2025)

The main tasks of this phase are:

Adopt OP parallel execution to improve transaction throughput. (Tentative goal of up to 2000 TPS)

Introduce USDT transfer aggregators and dedicated block space for enterprises to ensure efficient and consistent transaction processing.

In the mid-term phase, Stable will tilt more technology towards enterprise-level usage to ensure improvements and guarantees in transaction scale, performance, and outcomes. At that time, Stable's dedicated block space may generate a trading market worth hundreds of millions or even billions of dollars, similar to the current energy rental market of TRON.

Phase 3: USDT Full-Stack Optimization Layer (Q2 2026)

The main tasks of this phase are:

Upgrade to a DAG-based consensus to improve speed and resilience. (Tentative goal of 2-5 times that of Phase 2, i.e., 4000-10000 TPS)

Expand developer tools and resources to promote dApp development.

In the final phase, Stable is expected to build the StableVM++ ecosystem, with RPC node performance also set to see further development, and the ecosystem network will generate more developer applications beyond just stablecoin payments, transfers, and settlements.

Stable VS TRON: A Battle Between "Beloved Child" and "Partner"

Currently, with the official launch of Stable, the biggest impact will be on the "network with the largest USDT issuance"—TRON.

Although TRON occupies an absolute initiative in the stablecoin sector due to its market position as the largest issuer of USDT, the emergence of Stable as a similar L1 public chain means that TRON's previous "stablecoin business model" may face significant challenges. Specifically, this includes the following aspects:

Challenge 1: Sharp Decline in USDT Issuance

After Stable goes live, it is expected that Tether will intentionally or unintentionally control the issuance of USDT on TRON and other blockchain networks, shifting the main issuance to the Stable ecosystem.

After all, the USDT in the Stable ecosystem has cross-chain interoperability supported by USDT0 and LayerZero, allowing it to circulate flexibly and freely to other blockchain networks without affecting the usage scenarios of USDT.

Challenge 2: The Battle Between USDT and USD1

Previously, under the mediation of Sun Yuchen, TRON became the third-largest ecosystem for the stablecoin USD1 launched by the Trump family's crypto project WLFI, which to some extent reflects the "distribution channel battle" between the old stablecoin USDT and the new generation stablecoin USD1—

The former is one of TRON's basic foundations and main sources of income; the latter is backed by Trump and a number of American asset management institutions.

The emergence of Stable will further intensify the market share competition between USDT and USD1, and TRON, as the "ecosystem intermediary," may soon face a "team selection moment."

Challenge 3: Protocol Revenue May Be Affected

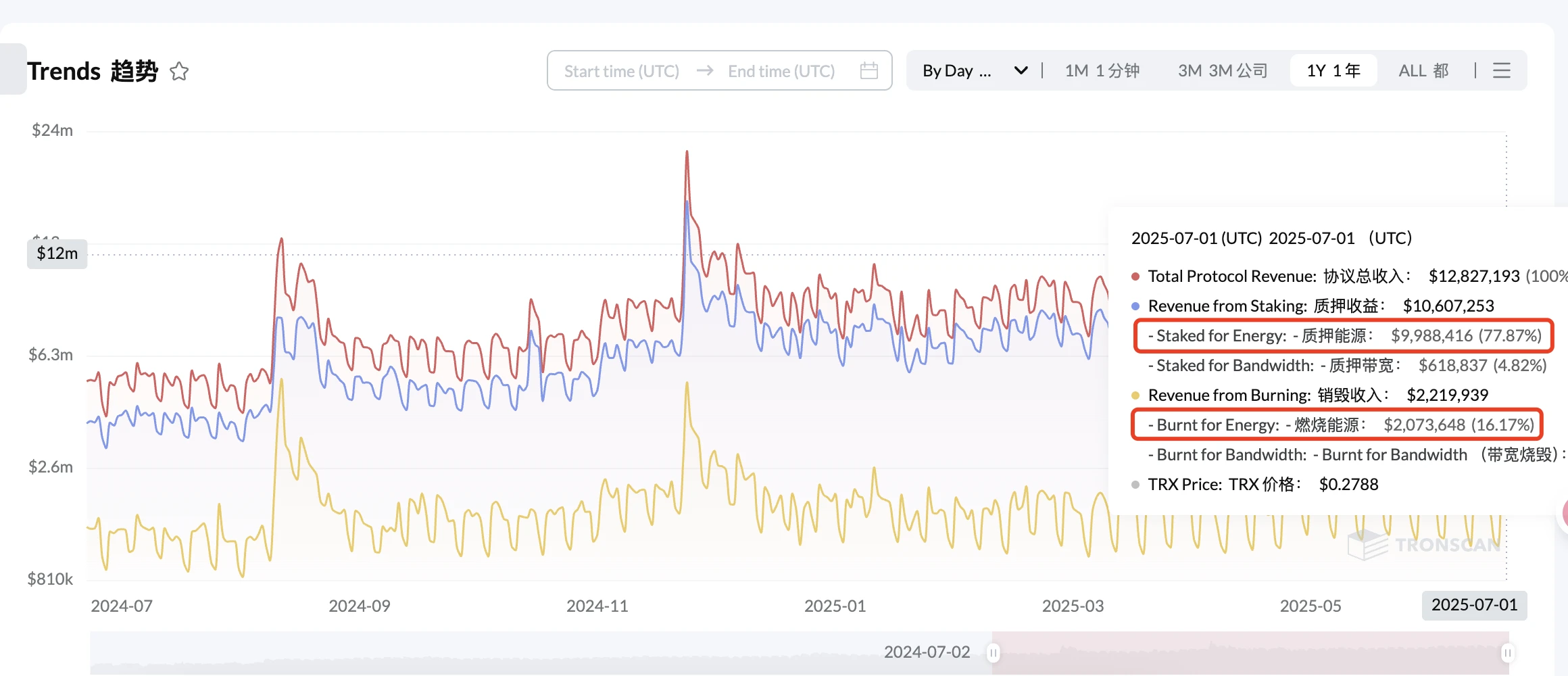

According to Tronscan official data, in the past year, the TRON protocol revenue reached as high as $3.15 billion; in the past 30 days, the total protocol revenue was $343 million; on just July 1st alone, the total protocol revenue reached $12.83 million. Among this, the revenue related to energy staking and burning associated with transactions of stablecoins like USDT accounts for about 94%, indicating that USDT contributes almost equally to the TRON protocol revenue, with a staggering 99.02% share in its ecosystem.

Whether the future cooperative relationship between the two can continue will largely depend on the development trend of Stable.

From a business perspective, there is undoubtedly a significant overlap in the commercial ecological niches of Stable and TRON, and a battle between the two is inevitable. For more data on TRON, please refer to “Left Hand Plasma, Right Hand Stable, Tether is Building Its Own ‘TRON’”.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。