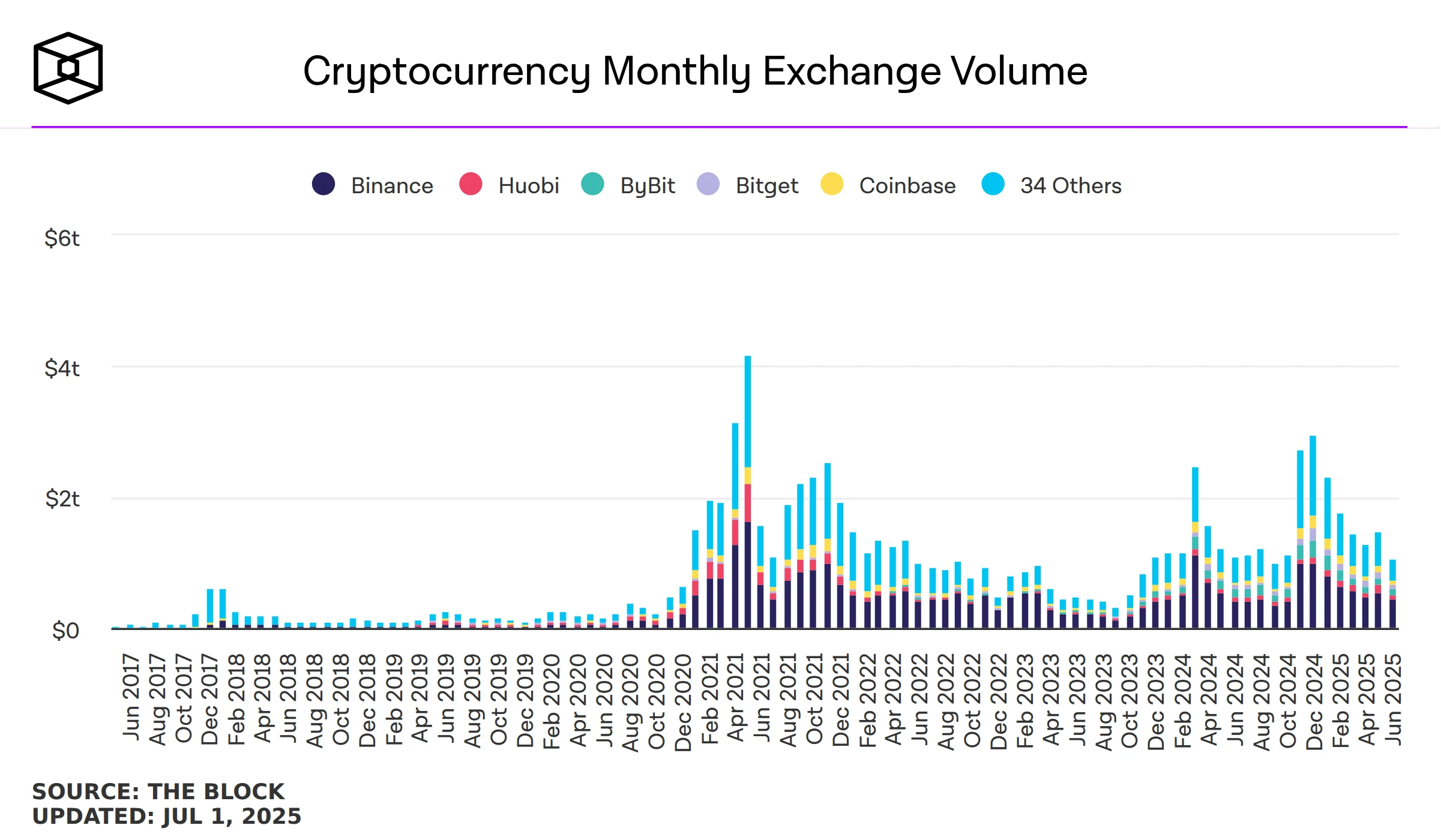

According to the latest data from The Block, in June 2025, the spot trading volume of centralized exchanges (CEX) fell to $1.07 trillion, a decrease of about 27% from $1.47 trillion in May, marking the lowest level in nine months. This significant drop in trading volume not only reflects the short-term volatility of the cryptocurrency market but also reveals structural changes within the market. Presto Research analyst Min Jung pointed out that while Bitcoin prices remain stable and close to historical highs, the altcoin market, including Ethereum (ETH), has performed poorly, with prices down nearly 40% from their peaks.

This divergence indicates that market momentum is primarily driven by institutional investors in Bitcoin trading, while retail participation in altcoins is notably lacking. This article will delve into the background of the trading volume decline, focusing on the internal dynamics of the market and looking ahead to future market trends.

CEX Spot Trading Volume Plummets in June

In June 2025, CEX spot trading volume plummeted from $1.47 trillion in May to $1.07 trillion, marking the lowest record since September 2024. As a major trading venue in the cryptocurrency market, changes in CEX trading volume often directly reflect market sentiment and participation. This significant decline in trading volume indicates that market activity is waning, potentially influenced by changes in investor behavior, market structure adjustments, and asset class differentiation. In particular, the performance disparity between Bitcoin and altcoins provides important clues for understanding the internal dynamics of the market.

Internal Market Dynamics: Divergence Between Bitcoin and Altcoins

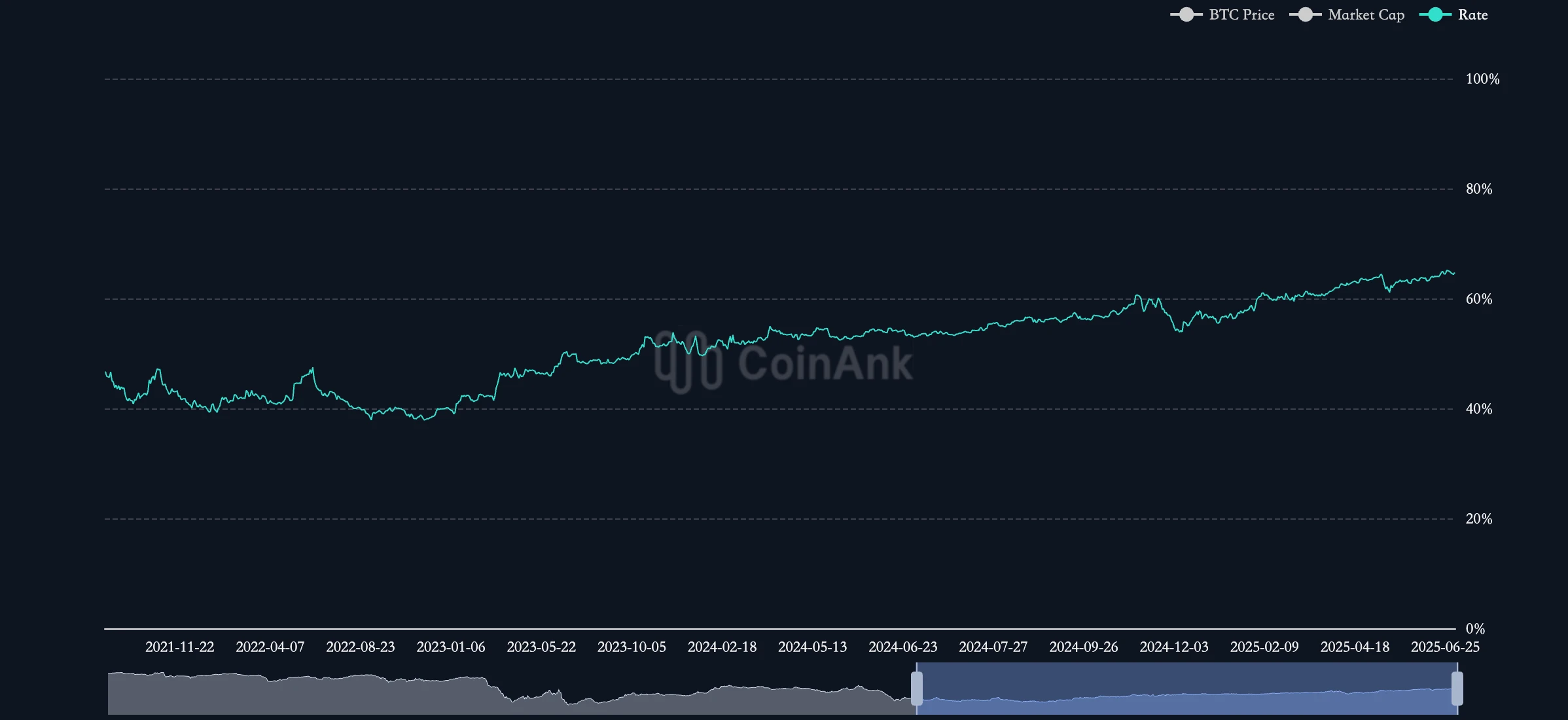

The internal structure of the cryptocurrency market underwent significant changes in June 2025, with a clear polarization in the performance between Bitcoin and altcoins. As the dominant asset in the market, Bitcoin's price remained relatively stable, with fluctuations close to its historical highs. This stability is attributed to Bitcoin's market positioning as "digital gold," with its low volatility and broad institutional acceptance making it a safe-haven choice for investors. On-chain data shows that Bitcoin's trading volume dominates CEX, maintaining a market share of around 55%.

Institutional investors have continued to increase their holdings of Bitcoin through spot ETFs and corporate balance sheet allocations, further solidifying its market position. For example, companies like MicroStrategy continue to increase their Bitcoin holdings through bond financing, while net inflows into spot ETFs provide solid support for Bitcoin prices. This institution-driven capital inflow not only maintains Bitcoin's price stability but also reinforces its dominant position in CEX trading volume.

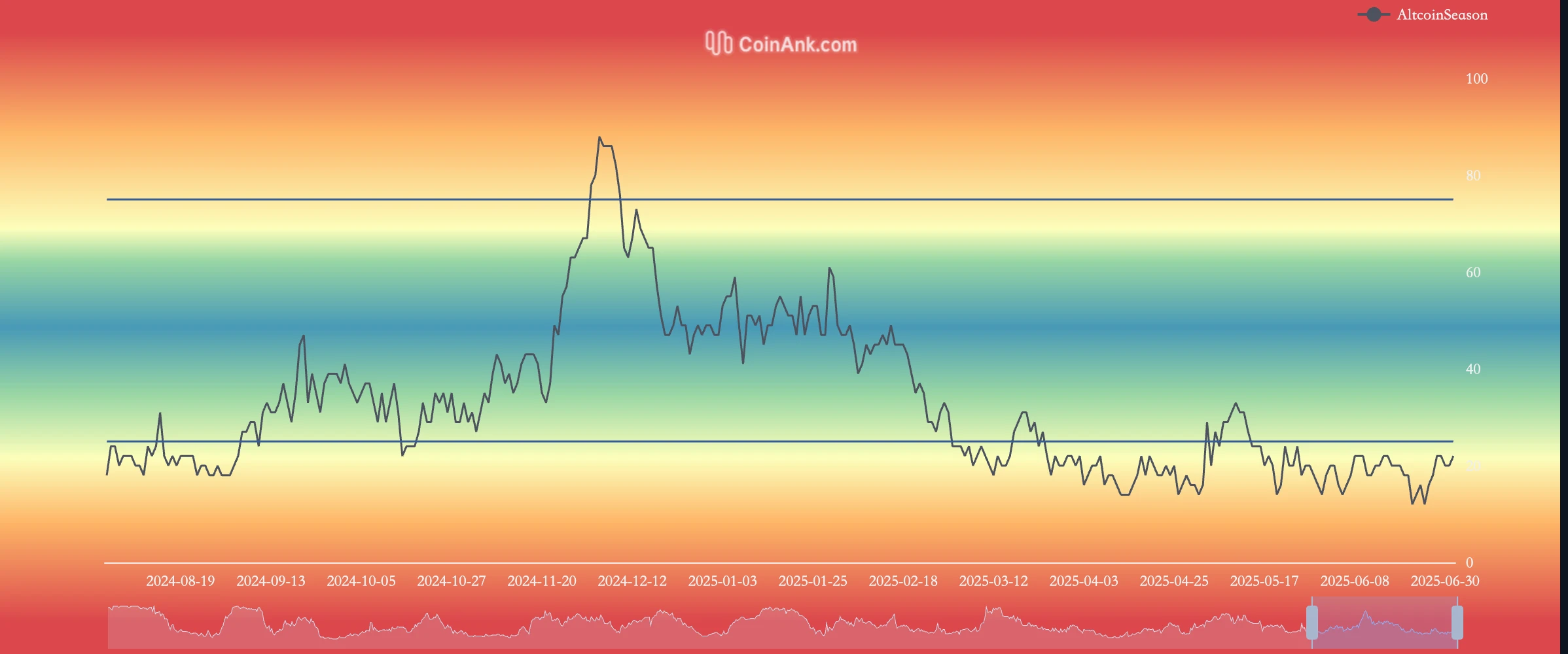

In contrast, the altcoin market has fallen into a slump. Ethereum (ETH), as the second-largest cryptocurrency, has seen its price drop nearly 40% from historical highs, and other major altcoins like Solana (SOL), Cardano (ADA), and Polkadot (DOT) have also failed to escape the downturn. On-chain activity further corroborates this trend: the transaction volume and active addresses on the Ethereum network significantly declined in June, indicating low user participation and trading demand. This slump is partly due to the high volatility and speculative nature of altcoins.

Unlike Bitcoin, the price movements of altcoins often depend on the rotation of market hotspots and the catalysts of technological innovation. For instance, the DeFi boom and NFT craze in 2021 drove the prices of Ethereum and related tokens to soar, but the market in June 2025 lacks similar new narratives. Although Layer 2 solutions (such as Optimism and Arbitrum) have made progress in reducing transaction costs and improving efficiency, these technological advancements have yet to translate into widespread market enthusiasm, leading to a continued shrinkage in altcoin trading volume.

The low participation of retail investors is another key factor in the altcoin market's slump. Retail investors typically favor altcoins, seeking high-risk, high-reward opportunities. However, data from June 2025 shows a significant decline in altcoin trading activity, reflecting a wait-and-see sentiment among retail investors. Many retail investors suffered losses during the market crash of 2021-2022, and the current price slump, coupled with a lack of clear investment themes, may further undermine their confidence. Additionally, the complexity of the altcoin market may pose barriers to entry. For example, the complicated operational processes of DeFi protocols and the speculative risks of the NFT market may deter ordinary investors. In contrast, Bitcoin's simplicity and widespread recognition make it more accessible to newcomers, further exacerbating the slump in the altcoin market.

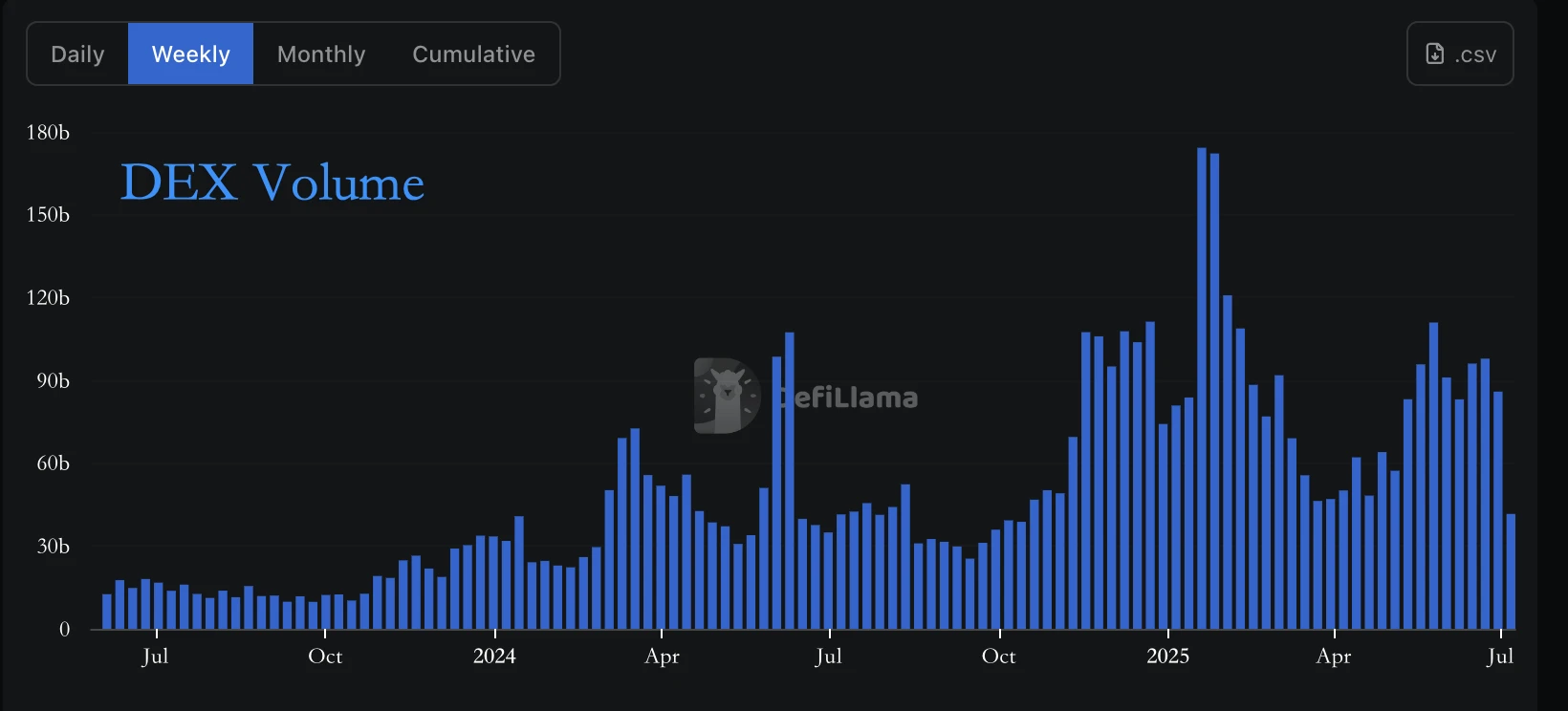

Another noteworthy phenomenon in the market is the shift in trading patterns. In the past, CEX trading volume was often dominated by short-term speculation and leveraged trading driven by retail investors, but data from June 2025 indicates a decrease in the proportion of leveraged trading, with spot trading's dominance becoming more pronounced. This may be related to the trading strategies of institutional investors, who tend to prefer long-term holding over high-frequency trading. Additionally, the trading volume on decentralized exchanges (DEX) also did not see significant growth in June, indicating that overall market liquidity is contracting. This liquidity contraction may further suppress trading activity in the altcoin market, as price discovery and market depth for altcoins heavily rely on an active trading ecosystem.

Divergence Between Institutions and Retail

Min Jung's comments from Presto Research provide an important perspective for understanding market dynamics. She noted, "Although Bitcoin remains stable and is close to historical highs, the altcoin market is struggling, with most altcoins, including ETH, down nearly 40% from their peaks. This indicates that the market is primarily driven by institutional investors purchasing Bitcoin, while retail participation, which typically favors altcoins, remains relatively low." This analysis accurately captures the core characteristics of the current market: the divergence between institutions and retail in terms of investment preferences and market participation.

The continued positioning of institutional investors in the Bitcoin market is a key factor driving market stability. The ongoing inflow into Bitcoin spot ETFs, increased corporate adoption, and the improvement of institutional custody solutions all provide solid financial support for Bitcoin. This institution-driven market logic makes Bitcoin a "stability anchor" in the market, while altcoins perform poorly due to a lack of similar support. Conversely, the low participation of retail investors leaves the altcoin market lacking the necessary momentum. The wait-and-see sentiment among retail investors may stem from multiple factors, including previous investment losses, the absence of market hotspots, and unfamiliarity with complex investment tools. This divergence not only reflects the different motivations of market participants but also suggests that the cryptocurrency market may be entering a more mature phase, with institutional investors' long-term strategies gradually replacing retail investors' short-term speculation.

Implications for Future Markets

The decline in CEX spot trading volume in June and the internal divergence in the market provide several insights into future market trends. First, Bitcoin's dominant position may continue to solidify in the short term. The ongoing entry of institutional investors and Bitcoin's safe-haven attributes make it more attractive in uncertain market conditions. However, this may further compress the market space for altcoins unless the latter can find new growth points. For example, further upgrades to Ethereum (such as the implementation of sharding technology) or the emergence of new application scenarios (such as Web3 or the metaverse) could inject new vitality into the altcoin market.

Second, a rebound in retail participation will be key to the recovery of the altcoin market. Lowering investment thresholds, simplifying user experiences, and providing broader educational resources may help attract retail investors back into the market. Additionally, new market narratives or technological breakthroughs could reignite retail enthusiasm. For instance, past DeFi and NFT booms have driven rapid price increases in altcoins, and similar new hotspots could reshape the market landscape in the future.

Finally, the restoration of market liquidity will be crucial for future development. Whether in CEX or DEX, growth in trading volume requires broader participation and a healthier ecosystem. The current contraction in market liquidity may be a short-term phenomenon, but if it persists, it could have long-term implications for price discovery and market depth. Investors need to closely monitor on-chain data, trading volume trends, and changes in the behavior of institutions and retail investors to grasp market direction.

The sharp decline in CEX spot trading volume in June 2025 reflects profound changes within the cryptocurrency market. The stability of Bitcoin stands in stark contrast to the slump in altcoins, and the divergence between institutional and retail investors further exacerbates this trend. Institution-driven Bitcoin trading provides support for the market, but the low participation of retail investors has left the altcoin market in distress. In the future, market development will depend on technological innovation, a rebound in retail participation, and the restoration of overall liquidity. For investors, understanding these dynamics and adjusting strategies based on market signals will be key to seizing opportunities.

Disclaimer: This article is for market analysis only and does not constitute investment advice. The cryptocurrency market is highly volatile and risky; CoinRank advises investors to make decisions cautiously based on thorough research.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。