Written by: Yangz, Techub News

In August 2020, before its name change, MicroStrategy made a shocking decision that stunned Wall Street—shifting its corporate cash reserves to Bitcoin, making an initial investment of $250 million to purchase 21,454 Bitcoins, and subsequently continued to increase its holdings, embarking on its own "gamble." This action, which was seen as radical at the time, now appears to have toppled the first domino, gradually evolving into a global "cryptocurrency reserve revolution" over the next few years.

Initially, this movement was limited to a few tech pioneer companies. Just two months after MicroStrategy, the payment platform Square, founded by Jack Dorsey, announced a $50 million investment in Bitcoin; the following year, Tesla's purchase of $1.5 billion in Bitcoin shocked the market, while the Hong Kong-listed company Meitu became the first "early adopter" in Asia. Although these early explorations were sporadic, they laid the groundwork for the current widespread trend.

If the period from 2020 to 2023 was an exploratory phase for corporate cryptocurrency reserves, then 2024 is undoubtedly a critical turning point for this movement. With Trump being re-elected as President of the United States and promoting the "U.S. Strategic Bitcoin Reserve Plan," cryptocurrency reserves have suddenly escalated from experimental initiatives by tech companies to another option for asset allocation among publicly listed companies. Now, under the leadership of MicroStrategy, global publicly listed companies represented by Metaplanet are pushing this movement to a climax. This corporate-level cryptocurrency experiment is rewriting the rules of traditional asset allocation, and behind this wave, a key question urgently needs to be answered: Is this a forward-looking asset allocation innovation, or a brewing financial crisis?

Who is "All in" on Cryptocurrency

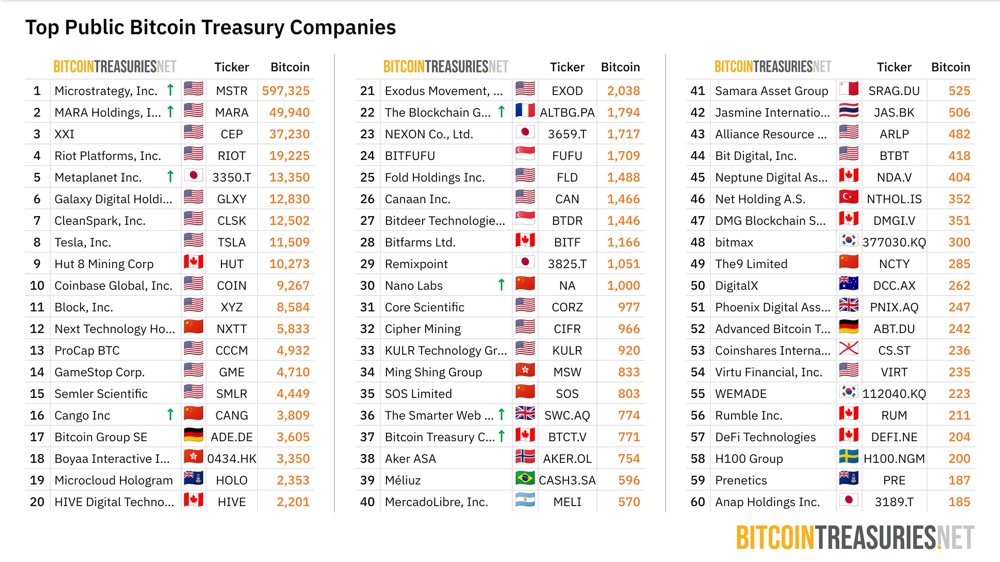

According to data from BitcoinTreasuries.net, as of the time of writing, a total of 141 publicly listed companies hold or have previously included Bitcoin in their asset reserves (Meitu sold all its cryptocurrency holdings last December), with a total of 848,902 Bitcoins held. Among them, the largest holder, Strategy, holds 597,325 Bitcoins, accounting for a staggering 70.36%.

The top 60 publicly listed companies holding Bitcoin

Looking at the top 60 publicly listed companies holding Bitcoin, the current Bitcoin reserve landscape shows a clear structural differentiation.

From a geographical perspective, North American companies dominate, with U.S. companies, led by tech giants like MicroStrategy, forming an overwhelming advantage; MicroStrategy alone holds more than the total of other regions combined. In the Asian market, Metaplanet, known as the "Japanese MicroStrategy," is rapidly rising and has now entered the global top five, while the layouts of Hong Kong-listed companies like Boyaa Interactive are also noteworthy. Additionally, European companies show a diversified participation trend, ranging from Norway's energy giants to Germany's digital asset firms, although individual sizes are small, they cover a wide range of fields.

From an industry distribution perspective, aside from early adopters like MicroStrategy, Tesla, and Block, companies focused on cryptocurrency business, such as Bitcoin mining firms, constitute the main force in reserves, with their holding strategies deeply tied to mining operations, exhibiting distinct operational attributes. Other companies are scattered across various industries such as healthcare, energy, gaming, and video, with their participation being more exploratory and their holdings relatively small.

It is noteworthy that the holding scale presents a typical "pyramid" structure: the apex is controlled by a very small number of super-large holders, the middle is concentrated with professional institutions focused on cryptocurrency business, and the base consists of a large number of traditional companies making exploratory allocations. This extremely uneven distribution pattern not only means that market fluctuations will have differentiated impacts on different types of companies but may also lay the groundwork for potential systemic risks.

In addition to Bitcoin, this cryptocurrency reserve competition has gradually expanded from the initial single asset of Bitcoin to mainstream tokens such as Ethereum, SOL, XRP, BNB, and TRX, even including HYPE, TAO, and DOGE. This shift reflects that companies are building differentiated digital asset reserve systems based on their business characteristics and market demands.

According to incomplete statistics, in the field of Ethereum reserves, the Nasdaq-listed company BioNexus (BGLC) was the first to adopt Ethereum as a primary reserve asset, pioneering corporate-level ETH reserves. Bitcoin mining companies like Bit Digital (BTBT) and BitMine (BMNR) have also begun to bet on Ethereum. Notably, sports betting operator SharpLink Gaming (SBET), under the guidance of its chairman and Ethereum co-founder Joseph Lubin, has developed a financial strategy centered on ETH, further enriching the diversity of the Ethereum reserve camp.

SOL has also attracted the attention of many publicly listed companies. E-commerce platform Upexi (UPXI) and educational technology company Classover Holdings (KIDZ) have both included SOL in their corporate reserve assets, with Classover Holdings' $500 million SOL reserve plan being particularly noteworthy. Additionally, companies like Sol Strategies (HODL.CN), DeFi Development (DFDV), and MemeStrategy (2440.HK) are also actively reserving SOL.

Nasdaq-listed energy company VivoPower International (VVPR) and technology service company Trident Digital Tech (TDTH) have chosen to reserve XRP, while companies like 微巴国际 (WEBU) and Wellgistics Health have also joined the XRP reserve ranks.

Other cryptocurrencies have also gained recognition from publicly listed companies:

BNB: Selected as a reserve asset by Nano Labs (NA) and Build & Build Corporation

TRX: Became the main reserve choice for SRM Entertainment (SRM)

DOGE: A key allocation target for Dogecoin Cash

HYPE: Favored by biotech company Eyenovia (HYPD)

TAO: Adopted by biopharmaceutical company Synaptogenix

It is noteworthy that some publicly listed companies have adopted a combination reserve strategy. Lion Group (LGHL) holds Bitcoin, Ethereum, and SOL simultaneously, while Everything Blockchain (EBZT) and Amber International (AMBI) have also established multi-currency reserve systems.

Cryptocurrency

Public Companies (Stock Codes)

Ethereum (ETH)

SharpLink Gaming (SBET)

BioNexus Gene Lab (BGLC)

Bit Digital (BTBT)

BitMine Immersion Tech (BMNR)

Solana (SOL)

Upexi (UPXI)

Sol Strategies (HODL.CN/CYFRF)

DeFi Development (DFDV)

MemeStrategy (2440.HK)

Classover Holdings (KIDZ)

XRP

VivoPower International (VVPR)

微巴国际 (WEBU)

Trident Digital Tech (TDTH)

Wellgistics Health (WGRX)

BNB

Nano Labs (NA)

Build & Build Corporation

TRX

SRM Entertainment (SRM)

DOGE

Dogecoin Cash (DOGP)

HYPE

Eyenovia (HYPD)

TAO

Synaptogenix (SNPX)

Multi-Currency

Lion Group (LGHL)

Everything Blockchain (EBZT)

Amber International (AMBI)

Drivers Behind Public Companies' Cryptocurrency Reserves

The decision for publicly listed companies to allocate cryptocurrency assets is influenced by multiple dimensions. From asset characteristics to market demonstration effects, and changes in the policy environment, these factors all impact the current landscape of corporate cryptocurrency reserves.

Advantages of Cryptocurrency Asset Allocation and Market Choices

In terms of asset characteristics, compared to traditional corporate reserve assets (including cash equivalents, short-term bonds, precious metals, etc.), cryptocurrencies offer new choices for corporate asset allocation due to their low correlation with traditional financial markets, around-the-clock liquidity, and anti-inflation properties. Among all publicly listed companies' cryptocurrency reserves, Bitcoin, with its leading asset status, naturally becomes the preferred choice for corporate cryptocurrency reserves due to its excellent liquidity and anti-inflation characteristics as "digital gold." Those companies that choose to allocate other altcoins, although their choices may not be directly related to their main business, often have special considerations behind them. For example:

Sports betting operator SharpLink Gaming's choice to make Ethereum its core reserve asset is closely related to its chairman Joseph Lubin's background as a co-founder of Ethereum;

SRM Entertainment's allocation of TRX stems from its deep ties to the Tron ecosystem—last month's $100 million TRX token PIPE transaction not only gave Sun Yuchen's father Weike Sun control of the company but also propelled the company to rename itself Tron Inc., with Tron executives fully taking over key committees.

Currently, over 90% of publicly listed companies' cryptocurrency reserves are concentrated in the top five cryptocurrencies by market capitalization, showing a clear "leader effect." This concentrated allocation reflects not only the importance that publicly listed companies place on the liquidity and market recognition of mainstream cryptocurrencies but also includes differentiated choices by individual companies under special strategic considerations.

The Demonstration Effect of MicroStrategy and Its Industry Impact

MicroStrategy, as a pioneer in corporate cryptocurrency allocation, has profoundly influenced the asset allocation strategies of publicly listed companies worldwide. Data shows that since its initial announcement to purchase Bitcoin in August 2020, its stock performance has become the most intuitive success case for cryptocurrency corporate allocation. After adjusting for the 1:10 stock split on June 1, 2021, the company's stock price soared from $12.7 (the closing price on August 10, 2020) to a peak of $131.5 on February 9, 2021, achieving an astonishing increase of 935% in just six months. This performance not only far exceeded the gains of the S&P 500 index during the same period but also created a wealth myth for tech stocks in the cryptocurrency field.

Moreover, from September 2020 to February 2021, MSTR's stock performance significantly outpaced Bitcoin. During this period, Bitcoin's price surged from around $10,000 to approximately $58,000, a rise of 480%; meanwhile, MSTR's stock price increased from about $15 to $130, a rise of 765%. This "crypto leverage" effect directly influenced the decisions of other publicly listed companies. Shortly after MicroStrategy's massive investment in Bitcoin, Tesla announced in February 2021 that it had purchased $1.5 billion in Bitcoin. As of the time of writing, MSTR's market capitalization has reached $112.374 billion, nearly 80 times its pre-transformation value (around $1.4 billion), becoming a benchmark for Bitcoin concept stocks.

In terms of financial strategy, MicroStrategy's innovations are equally groundbreaking. The company has constructed a unique model of "low-cost financing + continuous accumulation" through issuing ultra-low interest convertible bonds, allowing it to continuously expand its Bitcoin reserves at an extremely low cost, successfully reshaping the paradigm of corporate asset allocation. Of course, this model also comes with significant risks. For instance, during the severe fluctuations in the cryptocurrency market in 2022, MicroStrategy's stock price experienced a single-day drop of over 27%, highlighting the vulnerability of this strategy. We will elaborate on this later.

Policy Promotion: U.S. Strategic Bitcoin Reserve and Regulatory Optimization

On March 7 of this year, the U.S. cryptocurrency policy environment underwent a milestone transformation. President Trump officially signed an executive order to launch the "Bitcoin Strategic Reserve" and "U.S. Digital Asset Reserve" plans, providing unprecedented policy backing for publicly listed companies to allocate cryptocurrency.

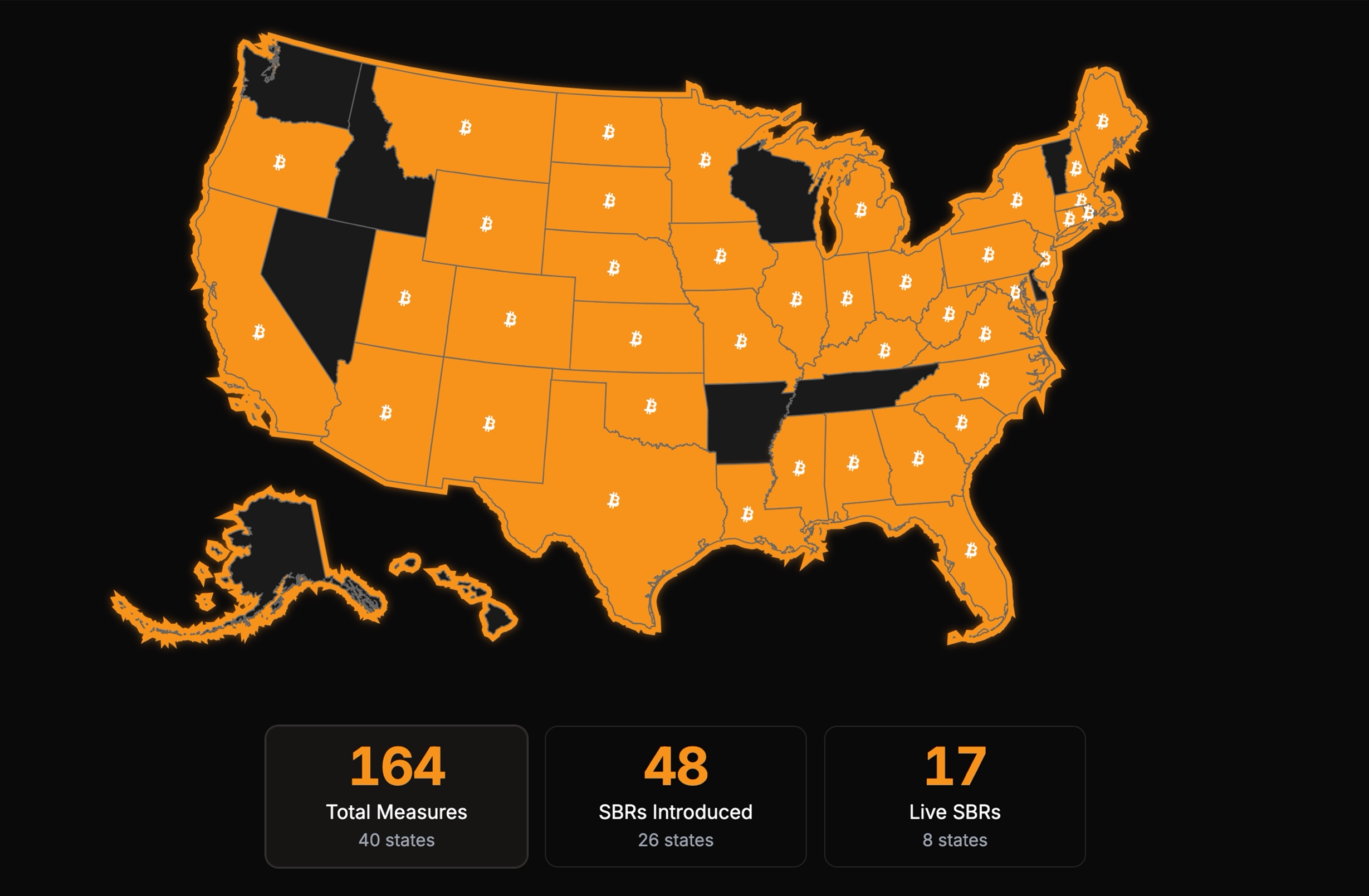

Additionally, at the state level, various states are actively promoting related legislation. According to data disclosed by Bitcoin Laws, as of the time of writing, 40 states across the U.S. have proposed 164 digital asset-related legislative measures, of which 48 involve "State Bitcoin Reserves." Among these, 17 reserve bills are currently being advanced or have completed the legislative process. States that have passed Bitcoin reserve bills include Texas (SB21), New Hampshire (HB302), and Arizona (HB2749).

This policy synergy at both the federal and state levels is producing significant effects. The fundamental shift in the policy environment is reshaping publicly listed companies' perceptions of cryptocurrency—from previously viewed as high-risk speculative assets to gradually transforming into strategic reserve assets with policy backing. As more state-level legislation progresses, the cryptocurrency reserves of publicly listed companies are evolving from isolated cases to more widespread market practices.

Beyond the U.S., the global cryptocurrency policy environment is also continuously optimizing. Countries in Asia, such as Japan and South Korea, are gradually improving their regulatory frameworks, while Europe is establishing unified standards through the MiCA legislation. Although these measures have not directly driven national reserves, they provide clearer policy guidance for companies allocating cryptocurrency assets.

In-depth analysis reveals that these three driving forces do not simply add up but form a significant synergistic effect: the scarcity and decentralization of Bitcoin lay the foundation for value storage, MicroStrategy's successful practice validates the feasibility of the business model, and the strategic layout and regulatory improvements at the U.S. policy level provide institutional guarantees. This positive feedback loop is profoundly reshaping the logic of corporate asset management.

However, it is essential to be cautious, as this rapid proliferation also brings new risks, especially when companies overly rely on leveraged operations, as market fluctuations may trigger a chain reaction.

Dangerous Financial Alchemy

Despite an increasing number of publicly listed companies following MicroStrategy's lead in incorporating cryptocurrency into their balance sheets, this trend hides unsettling financial alchemy.

Take MicroStrategy itself, for example; it has reshaped itself into a complex, highly leveraged "Bitcoin acquisition machine," continuously increasing its Bitcoin holdings through issuing bonds, convertible bonds, and other leveraged instruments. This strategy can showcase astonishing power during a bull market: the appreciation of Bitcoin boosts the value of collateral, thereby gaining more financing capacity and forming a self-reinforcing wealth cycle. However, once the market turns, this financial perpetual motion machine may evolve into a death spiral. A decline in Bitcoin prices will trigger collateral devaluation, leading to a depletion of financing channels, while high debt costs continuously erode cash flow. More dangerously, as more companies emulate this model, the interconnected risks of cryptocurrency holdings across the corporate sector may potentially trigger a systemic crisis in the future.

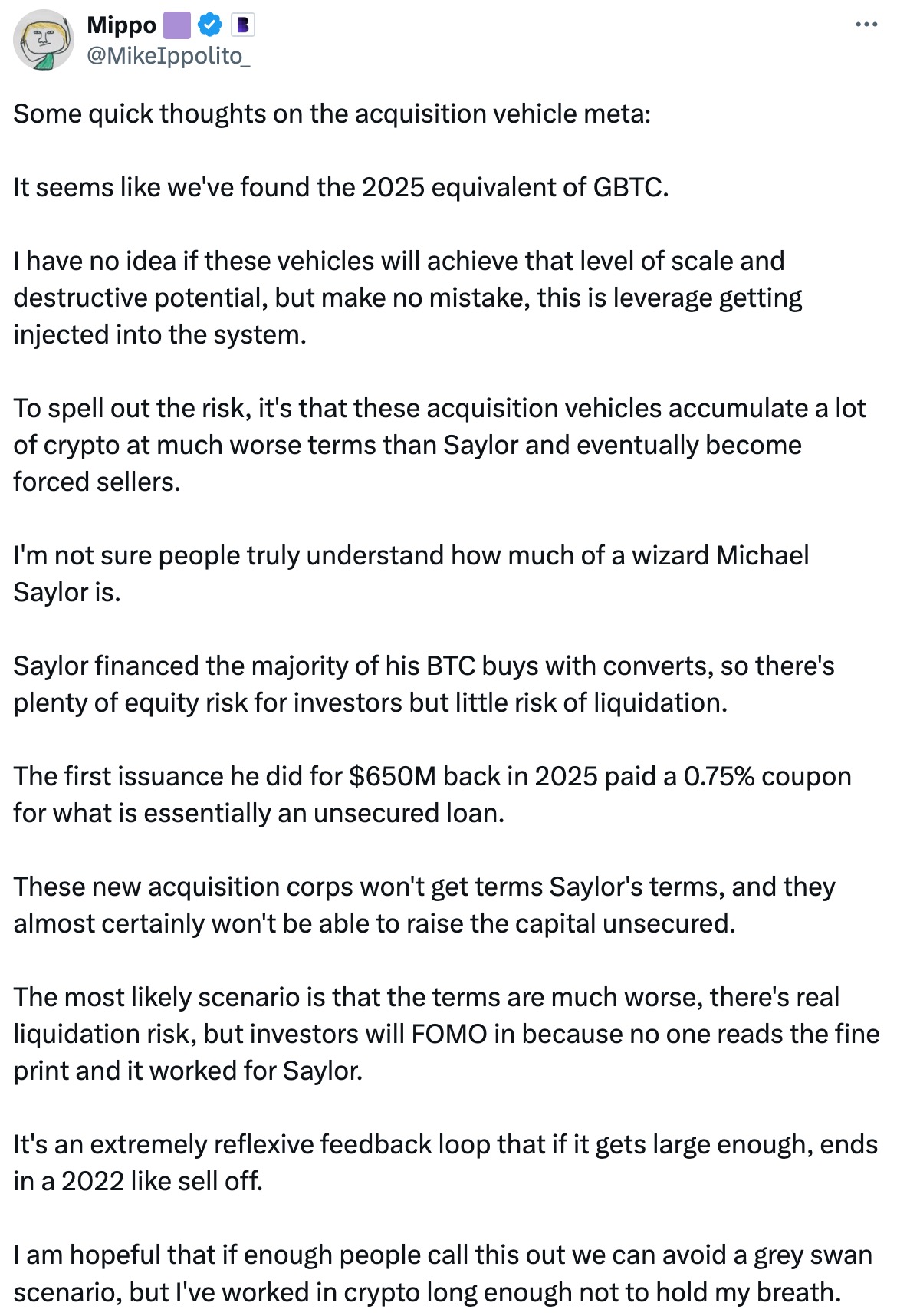

Many market analysts are currently highly vigilant about the risks associated with publicly listed companies' massive allocation of cryptocurrency assets. Standard Chartered Bank's head of digital asset research, Geoffrey Kendrick, calculated that if Bitcoin's price falls below $90,000, half of the companies' Bitcoin reserves will face unrealized losses; Blockworks co-founder Mike Ippolito likened these types of asset management companies to "GBTC of 2025," warning of the systemic risks they may bring. He pointed out that unlike MicroStrategy founder Michael Saylor, who could issue unsecured convertible bonds at an ultra-low interest rate of 0.75%, these latecomers find it challenging to obtain equally favorable financing conditions and instead face real liquidation risks. Similarly, Castle Island Ventures partner Nic Carter compared this to the previously premium-traded GBTC, warning that when market sentiment reverses, it may replay the chain reaction event triggered by GBTC's discount in 2022.

Indeed, from the actual market performance, not all publicly listed companies can achieve sustained stock price increases through Bitcoin reserves like MicroStrategy. The effectiveness of cryptocurrency reserve strategies varies significantly: there are cases like Metaplanet that have seen significant stock price increases through cryptocurrency reserves, while others like SharpLink Gaming and Upexi experienced initial rises followed by substantial pullbacks.

Matthew Sigel, head of digital asset research at VanEck, recently issued a warning, pointing out that excessive reliance on Bitcoin reserves may lead to "capital erosion" risks—when a company increases its Bitcoin holdings by issuing new shares or taking on debt, if the stock price falls back to near net asset value, subsequent financing will dilute shareholder equity, accelerating the shrinkage of corporate value. The U.S. medical technology company Semler Scientific is a typical case; despite the rise in Bitcoin prices, its stock price plummeted by 45%, and its market capitalization even fell below the value of its Bitcoin holdings, severely impairing its subsequent financing capacity.

These cases reveal a harsh reality: when the main business loses growth momentum, cryptocurrency reserves are more like a shot in the arm rather than a cure; excessive concentrated allocation may trigger systemic risks such as liquidity crises and capital structure deterioration.

Furthermore, in addition to the difficulty of simply replicating MicroStrategy's model, there is another trend worth noting. Many publicly listed companies, in pursuit of higher returns, are opting for less liquid and more volatile small and medium-sized digital assets as reserve targets. Compared to Bitcoin, these assets often suffer from insufficient market depth, and when companies face financial pressure and need to liquidate urgently, the lack of hedging tools and emergency mechanisms can easily trigger systemic risks.

Moreover, the uncertainty of the policy environment may also cast a shadow over this trend. Currently, Bitcoin reserve bills at the state level in the U.S. are frequently stalled, with several legislative proposals being rejected, and Senator Cynthia Lummis's proposed "Strategic Bitcoin Reserve Act," aimed at authorizing the U.S. government to gradually purchase 1 million Bitcoins over the next five years, has not made substantial progress.

Conclusion

The phenomenon of publicly listed companies massively allocating cryptocurrency reserves marks the transition of digital assets from the margins to the mainstream, but this is by no means a guaranteed financial revolution. While MicroStrategy's success story is indeed alluring, the cases of those trapped in capital erosion and liquidity crises are equally thought-provoking.

For publicly listed companies considering following suit, it may be wise to remember: cryptocurrency reserves can be a tool for asset allocation but should not become a financial magic trick to cover up the weakness of the main business; they can be a pawn in strategic layout but must not devolve into a blind speculative bet. At this crossroads of innovation and risk, the prudent may find new value anchors, while the reckless may become footnotes to the next financial storm.

Historical experience shows that those who can withstand the test of cycles are always the enterprises that maintain restraint amid fervor and adhere to risk control bottom lines amid innovation. The experiment of cryptocurrency reserves has just begun, and its ultimate judges will be the ruthless tests of time and market laws.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。