Original Author |Arthur Hayes

Compiled by | Odaily Planet Daily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

_Editor’s Note: Arthur Hayes, co-founder of the BitMEX exchange, has just published an article titled "Quid Pro Stablecoin," which points out: The U.S. Treasury is effectively implementing debt monetization by promoting the policy of "stablecoins issued by large banks" to address the massive financing challenges of the fiscal deficit, and this "stablecoin revolution" is not actually about financial freedom, but rather a transfer of financial control disguised as "innovation." Hayes' writing style is quite personal, and to ensure a consistent reading experience with the original text, Odaily Planet Daily will retain certain original expressions while making slight modifications to some vocabulary. _The following is the original text:

Stock investors are shouting: “Stablecoins, stablecoins, stablecoins; Circle, Circle, Circle.”

Why are they so bullish? Because U.S. Treasury Secretary Scott Bessent (referred to as BBC) believes: a thriving stablecoin ecosystem will drive private sector demand for U.S. Treasury bonds, as these bonds are the backing assets for stablecoins. This new demand could lower government borrowing costs and help control national debt.

Thus, this chart appears:

_This chart shows the market capitalization comparison between Circle and Coinbase. Don’t forget, Circle has to give 50% of its net interest income to its "parent" Coinbase. _So, why can Circle's market cap reach nearly 45% of Coinbase's? This raises questions…

And this chart makes me sad (after all, I hold Bitcoin instead of CRCL):

This chart shows the ratio of Circle's stock price to Bitcoin's price, indexed to 100 at the time of Circle's IPO. Since the IPO, Circle has outperformed Bitcoin by nearly 472%.

Cryptocurrency players should ask themselves: Why is BBC so bullish on stablecoins? Why does the "Genius Act" receive bipartisan support? Do American politicians suddenly care about "financial freedom"? Obviously not. Perhaps they acknowledge "financial freedom" on an abstract level, but hollow ideals cannot drive substantial action. There must be more realistic political motivations at play. Recall 2019, when Facebook attempted to integrate the stablecoin Libra into its social empire but faced a united front from politicians and the Federal Reserve, ultimately leading to the project's demise. To understand why BBC has started to "promote" stablecoins, we must return to the core issues he faces.

The Treasury's Urgent Dilemma

BBC (i.e., Treasury Secretary Scott Bessent) is facing the same problem as his predecessor Yellen: their bosses (the U.S. President and politicians in the House and Senate) are eager to spend recklessly but unwilling to raise taxes. The whims of the President and congressional politicians ultimately fall on the Treasury Secretary. They must borrow enough funds for the government at a reasonable cost. However, soon the market sends a signal: no one is willing to buy long-term bonds from debt-laden developed economies at high prices and low yields. This is the "doomsday bond market frenzy" scenario that BBC and Yellen have faced in recent years:

This chart shows the 30-year bond yields of the UK (white), Japan (gold), the US (green), Germany (magenta), and France (red).

_But worse, the "real value" of these bonds is being severely eroded: _Real Value = Bond Price / Gold Price

TLT US is an ETF tracking U.S. Treasury bonds with maturities of 20 years or more. Dividing it by the gold price and indexing to 100 shows that, over the past five years, the real value of long-term Treasury bonds has fallen by 71%.

If historical performance isn’t bad enough, Treasury Secretaries also face the following constraints:

① Financing approximately $2 trillion in annual federal deficits and $3.1 trillion in maturing debt by 2025.

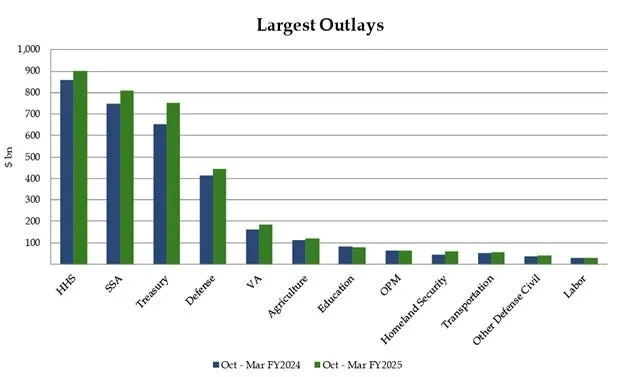

This table shows the major expenditures of the U.S. federal government and their year-on-year changes. Note that almost all expenditure items are growing at a rate higher than nominal GDP.

The first two charts show that the weighted average interest rate of existing Treasury bonds is still below any point on the current yield curve.

The financial system issues credit using nominally risk-free Treasury bonds as collateral. Therefore, interest must be paid. Otherwise, once nominal default occurs, the entire dirty fiat financial system will collapse.

As maturing debt is refinanced at higher interest rates, interest expenses will continue to rise, as the entire Treasury yield curve is above the weighted average interest rate of current debt.

Given the U.S. involvement in wars in Ukraine and the Middle East, the defense budget will not decrease.

As the baby boomer generation enters the peak of receiving "disease care" from big pharmaceutical companies, healthcare spending will continue to rise in the early 2030s, and the government will have to foot the bill.

② The Treasury must sell bonds while keeping the 10-year Treasury yield from exceeding 5%.

- Whenever the 10-year yield approaches 5%, the MOVE index (which measures bond market volatility) surges, and a financial crisis is imminent.

③ The method of bond issuance must stimulate the financial markets.

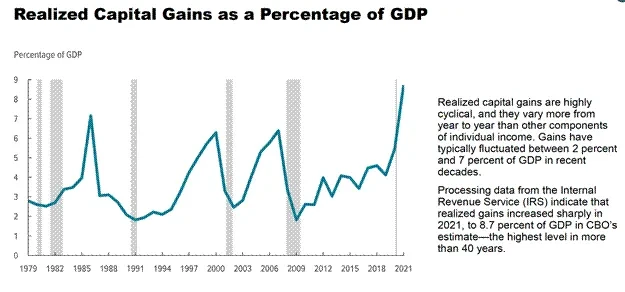

This chart from the U.S. Congressional Budget Office shows that since the 2008 financial crisis, as U.S. stocks soared, capital gains taxes have also surged.

The U.S. government needs to rely on tax revenue from annual stock market gains to offset the fiscal deficit.

Who does the government serve? Of course, the wealthy asset owners. In the past, only white male property owners had the right to vote. Although universal suffrage exists today, power is still dominated by the top 10% of families that control corporate wealth. During the 2008 global financial crisis, the Federal Reserve printed money to save banks and the financial system, but banks were still allowed to seize people's homes and businesses. The rich enjoy socialism while the poor face capitalism! No wonder mayoral candidate Mamdani is so popular in New York City—poor people also want a taste of socialist soup.

When the Federal Reserve was still implementing quantitative easing (QE), the Treasury Secretary's job was relatively easy. The Federal Reserve printed money and bought Treasury bonds, allowing the U.S. government to borrow at low costs and boost the stock market. But now, the Federal Reserve must at least appear to be combating inflation and cannot easily lower interest rates or restart QE. Thus, the Treasury must shoulder the burden alone.

By September 2022, the market began to marginally sell off Treasury bonds due to the belief that the largest peacetime federal deficit in U.S. history would persist, along with the Federal Reserve's hawkish stance. In just two months, the yield on 10-year Treasury bonds nearly doubled, and the stock market fell nearly 20% from its summer highs. At this point, Yellen donned her red-bottomed shoes and began to take action. In a paper from Hudson Bay Capital, this approach was referred to as the "Adaptive Treasury Issuance Strategy" (ATI). Yellen started issuing more short-term Treasury bills (T-bills) instead of coupon bonds. Over the next two years, as the balance of the Federal Reserve's reverse repurchase agreement (RRP) facility declined, approximately $2.5 trillion in liquidity was injected into the financial markets. If the goal was to achieve the three policy objectives I previously listed, Yellen's ATI policy was a perfect success.

But that was the past; what about now? It’s BBC's turn. How can he accomplish these three tasks in the current environment? With RRP nearly exhausted, where will he find trillions of dollars in idle funds that are both sitting on some balance sheet and willing to buy Treasury bonds at high prices and low yields?

The market environment in the third quarter of 2022 was quite challenging. The chart below shows the performance of the Nasdaq 100 index (green) compared to the yield on 10-year Treasury bonds (white): as yields soared, the stock market also experienced a significant pullback.

The effect of the ATI policy was that it effectively consumed the RRP (red) and drove up financial assets like the Nasdaq 100 (green) and Bitcoin (magenta). The yield on 10-year Treasury bonds (white) never broke above 5%.

Currently, there are still two pools of funds held by large TBTF (Too Big To Fail) banks that, given sufficient profit incentives, are willing to buy trillions of dollars in Treasury bonds. These two pools of funds are: checking/savings deposits and reserves held by the Federal Reserve. I am particularly focused on these eight TBTF banks because their existence and profitability depend on the government's guarantee of their liabilities, and regulatory policies are more favorable to them than to non-TBTF banks. Therefore, as long as there is a bit of profit margin, they are willing to follow government directives. If BBC asks them to buy these "bad debts," in return, he needs to provide them with risk-free returns.

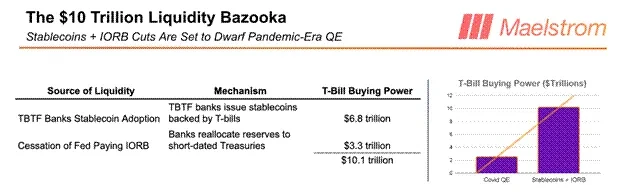

I believe that BBC is so excited about "stablecoins" precisely because once stablecoins are issued by TBTF banks, it can unleash up to $6.8 trillion in purchasing power for short-term Treasury bills. These previously idle deposits can be re-leveraged in this illusory fiat financial system, thereby boosting the market. In the next section, I will explain my model in detail, illustrating how the issuance of stablecoins guides the purchase of short-term Treasury bills and enhances the profitability of TBTF banks.

After discussing the flow of funds from "stablecoins → short-term Treasury bills," I will briefly explain how stopping interest payments on reserves by the Federal Reserve could release up to $3.3 trillion in Treasury bond purchasing power. This would be another policy that is technically not QE, but has the same positive impact on fixed-supply monetary assets like Bitcoin. Let’s understand BBC's new favorite—stablecoins.

The Liquidity Mechanism of Stablecoins

My predictions are based on the following key assumptions:

Assumption 1: Treasury bonds are fully or partially exempt from counting towards banks' Supplementary Leverage Ratio (SLR)

Once exempted, banks do not need to hold regulatory capital for the Treasury bonds they own. If fully exempt, banks can "infinitely leverage" their purchases of Treasury bonds.

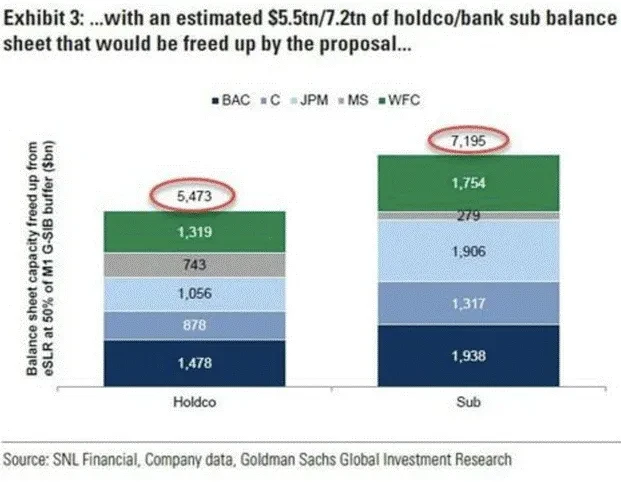

The Federal Reserve has voted to lower capital requirements for banks on Treasury bonds. This policy is expected to take effect in the next three to six months. According to the above chart, this new rule could free up $5.5 trillion of balance sheet space for banks to purchase Treasury bonds. Given that the market is forward-looking, this will push the Treasury bond market to start rising before the policy is implemented, thereby lowering yields (all else being equal).

Assumption 2: Banks are profit-driven and adept at controlling losses

Between 2020 and 2022, the Federal Reserve and the Treasury encouraged banks to buy large amounts of Treasury bonds. As a result, they indeed bought a bunch of high-yield bonds with long maturities. However, in April 2023, the Federal Reserve implemented the most aggressive interest rate hike cycle since the 1980s, leading to severe bond losses and the collapse of three banks within a week. Even TBTF banks were not spared. For example, Bank of America’s "held-to-maturity" bond portfolio has incurred losses exceeding its entire equity—if marked to market, this bank would face technical bankruptcy. To quell the crisis, the Federal Reserve and the Treasury effectively nationalized the entire U.S. banking system through the "Bank Term Funding Program" (BTFP). While non-TBTF banks can still fail, they will ultimately be cheaply acquired by large banks like Jamie Dimon's (CEO of JPMorgan). Therefore, bank chief investment officers are now reluctant to buy long-term Treasury bonds to avoid being caught off guard by sudden interest rate hikes from the Federal Reserve.

However, short-term Treasury bills are different. They have almost no interest rate risk, and the yields are close to the federal funds rate, making them a "zero-duration high-yield cash instrument."

Banks will only be willing to use customer deposits to buy short-term Treasury bills if both high net interest margin (NIM) and extremely low capital usage conditions are met.

What is JPMorgan Doing?

JPMorgan recently announced that it will issue a stablecoin called JPMD. JPMD will be deployed on the Ethereum Layer 2 network Base, which is under Coinbase. Therefore, JPMorgan will have two types of deposits.

The first type I call regular deposits. Regular deposits are still digital, but transferring them within the financial system requires outdated interbank systems to communicate with each other and involves a lot of manual oversight. Regular deposits move from Monday to Friday, 9 AM to 4:30 PM. Regular deposits have low yields; the Federal Deposit Insurance Corporation (FDIC) estimates that the average yield on regular checking accounts is only 0.07%, while one-year time deposits yield 1.62%.

The second type of deposit is the stablecoin, i.e., JPMD. JPMD is based on a public blockchain, in this case, Base. Customers can use JPMD 24/7, 365 days a year. JPMD is legally prohibited from paying interest, but I suspect JPMorgan will entice customers to convert regular deposits into JPMD by offering generous cashback incentives. It is still unclear whether staking rewards will be allowed.

Staking interest: Customers lock JPMD with JPMorgan and earn rewards during the lock-up period.

Customers are willing to convert regular deposits into JPMD precisely because JPMD has more functionality and offers cashback incentives. The entire TBTF banking system currently holds about $6.8 trillion in checking and savings deposits. With the overwhelming advantages of the stablecoin experience, these deposits will quickly migrate to JPMD or other stablecoins issued by TBTF banks.

Why is JPMorgan "asking for trouble" by encouraging customers to switch to JPMD?

First: Cost reduction and efficiency improvement.

If all regular deposits are converted to JPMD, JPMorgan can effectively eliminate its compliance and operations departments. Let me explain why Jamie Dimon is so excited after understanding how stablecoins actually work.

The compliance mechanism in banking is essentially a set of "if X happens, then execute Y" rule systems. These rules can be streamlined by a senior compliance officer and executed automatically by AI. Since JPMD operates on a public blockchain, all addresses are traceable, allowing AI to maintain real-time control over compliance processes. It can also generate reports for regulatory audits in seconds, with all data on-chain and full transparency. TBTF banks spend up to $20 billion annually on compliance and IT systems. If everything is converted to a stablecoin system, this cost will effectively drop to zero.

The second reason is that JPMD allows banks to purchase billions of dollars in short-term Treasury bills risk-free using custodial stablecoin assets (AUC).

As long as regulations permit, TBTF banks will use these deposits to buy Treasury bonds, killing two birds with one stone: they make money while assisting the Treasury in raising funds. Once the new SLR regulations are relaxed, banks will gain about $5.5 trillion in purchasing space for Treasury bonds.

Some readers might say, "Can't JPMorgan already buy short-term Treasury bills with regular deposits?" My response is: stablecoins are the future. They provide a better customer experience and help banks save $20 billion in costs. The cost savings alone are enough to drive banks to embrace stablecoins, while the additional net interest margin is just icing on the cake.

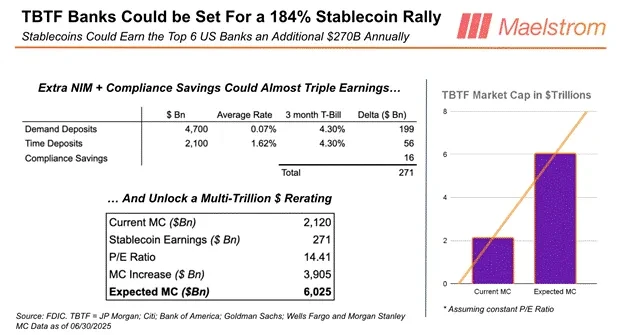

I know many investors are eager to invest their hard-earned money in Circle (CRCL) or other newly issued stablecoin projects. But don’t overlook the potential of TBTF banks. If we multiply the average price-to-earnings ratio (14.41 times) of TBTF banks by the cost savings and net interest margin benefits brought by stablecoins, their valuation could reach $39.1 trillion. Currently, the total market capitalization of the eight major TBTF banks is about $2.1 trillion. In other words, stablecoins are expected to increase the average stock price of TBTF banks by 184%. If you are looking for a "contrarian, large-position trading opportunity," it is: go long a basket of equally weighted TBTF bank stocks.

What about competition?

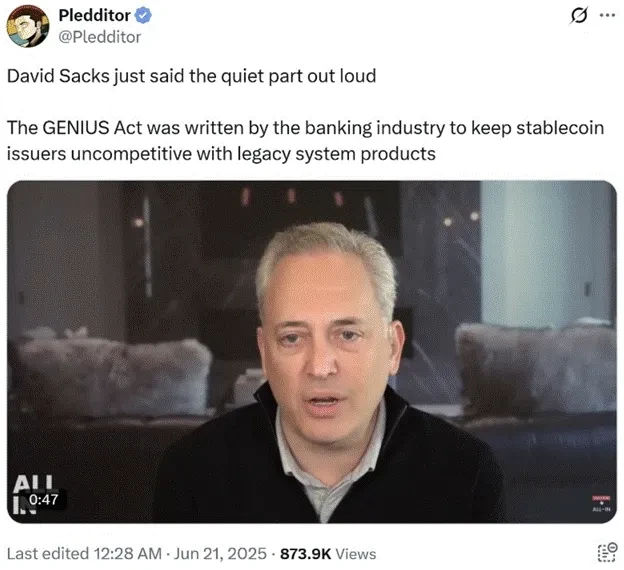

Don’t worry, the "Genius Act" ensures that non-bank issued stablecoins cannot participate in competition on a large scale. The act explicitly prohibits tech companies (like Meta) from independently issuing stablecoins; they must collaborate with banks or fintech companies. In theory, any institution can apply for a banking license or acquire an existing bank, but all new shareholders must be approved by regulatory agencies. Guess how long this approval process will take?

Another provision in the act also hands the stablecoin market over to banks: it prohibits paying interest to stablecoin holders. Since they cannot attract users with interest, fintech companies cannot siphon deposit flows from banks. Even companies like Circle, which have successfully launched stablecoins, will never be able to access the $6.8 trillion in regular deposits controlled by TBTF banks.

Moreover, fintech companies like Circle or small to medium-sized banks do not have the government’s credit guarantee for their debts, while TBTF banks do. If my mother ever needed to use stablecoins, she would definitely choose those issued by TBTF banks. People of her baby boomer generation would never trust any fintech company or small bank because they lack government backing.

Summary: Why Will TBTF Banks' Adoption of Stablecoins Completely Rewrite the Rules of the Game?

David Sacks, the former "crypto czar" appointed by President Trump, strongly agrees with this sentiment. I bet many political donors in the crypto industry feel quite upset about being excluded from the golden egg of the U.S. stablecoin market. Perhaps they should change their strategy and truly promote "financial freedom"—instead of just trying to pick up scraps from the table of TBTF bank CEOs.

In short, the stablecoin strategy of TBTF banks will: destroy the opportunities for fintech companies in the deposit competition; cut down on high and inefficient compliance costs; enhance net interest margin (NIM) without paying interest; and significantly boost bank stock prices.

In exchange, as long as BBC grants the tool of "stablecoins," TBTF banks will use their stablecoin assets to purchase up to $6.8 trillion in short-term Treasury bonds.

Next, I will discuss how BBC can release $3.3 trillion in idle reserves from the Federal Reserve's balance sheet.

Interest on Reserve Balances (IORB)

After the 2008 Global Financial Crisis (GFC), the Federal Reserve decided to ensure that banks would never fail due to insufficient reserves. It created reserves by purchasing Treasury bonds and MBS (mortgage-backed securities), which is what we call "quantitative easing" (QE). These reserves remain in the banks' Federal Reserve accounts and can theoretically be converted into actual money, but banks do not do this because the money printed by the Federal Reserve is enough to pay interest to the banks.

This interest (i.e., IORB) was originally intended to prevent inflation from surging, but as interest rates rise, IORB also increases, and the losses on the bonds held by the Federal Reserve also expand. Thus, the Federal Reserve finds itself in a state of negative cash flow and technical insolvency. However, this is entirely a result of policy choices and can be changed at any time.

Recently, U.S. Senator Ted Cruz suggested that the Federal Reserve should stop paying interest on reserve balances. Once this is done, banks will have to convert these reserves into Treasury bond purchases to make up for the loss of interest. I believe they are more likely to buy short-term Treasury bonds because these assets offer high yields, low volatility, and strong liquidity, akin to cash.

"Senator Cruz has been pushing his colleagues to end the IORB mechanism because he believes this reform will significantly help reduce the fiscal deficit." — Reuters

In simple terms, why does the Federal Reserve print money to pay interest but not allow banks to support the fiscal operations of this empire? There is no reason. Both Democrats and Republicans like fiscal deficits. If they stop paying IORB and release this $3.3 trillion in purchasing power, they can borrow more and spend more freely.

And the Federal Reserve is unwilling to foot the bill for Trump's "America First" agenda? Once the Republicans take control of Congress, they may push legislation to strip the Federal Reserve of its power to pay IORB. The next time bond yields soar, Congress will be ready to unleash this massive liquidity to fund their new spending spree.

Cautious Positioning Strategy Adjustment

While I remain optimistic about the future, I believe there may be a brief liquidity vacuum period after the passage of Trump's Big Beautiful Bill.

The current draft of this bill includes provisions to raise the debt ceiling. Although there is still a lot of content awaiting political maneuvering, it is certain that Trump will not sign any version that does not raise the debt limit. He needs the additional borrowing space to advance his governance goals. The problem is that when the Treasury resumes "net borrowing" operations, dollar liquidity will be compressed in the short term.

Since January 1, the Treasury has been maintaining government spending by depleting its checking account—the "Treasury General Account" (TGA). As of June 25, the balance of this account was $364 billion. According to the Treasury's latest refinancing announcement, if the debt ceiling is raised now, the TGA account will be replenished to $850 billion in the short term. This means dollar liquidity will shrink by $486 billion. The only variable that can buffer this negative impact is the change in the balance of reverse repurchase agreement (RRP) funds. The current RRP balance is $461 billion.

I do not see this as a decisive signal to short Bitcoin, but rather as a market phase that requires caution. I believe that from now until the Jackson Hole meeting in August, Bitcoin will exhibit a volatile or slightly retracing trend. If the TGA replenishment indeed causes liquidity tightness, Bitcoin may temporarily pull back to the $90,000–$95,000 range. However, if the market reacts mildly, Bitcoin is expected to consolidate in the $100,000 range, waiting to break through its historical high of $112,000.

I suspect that at that time, Powell will announce the termination of "quantitative tightening" (QT) at the meeting or release some seemingly mundane but highly impactful new banking regulations. By early September, with the debt ceiling raised and the TGA replenished, the Republicans will fully enter the "spending money to buy votes" phase to ensure that the 2026 midterm elections are not crushed by leftist candidates like Mamdani. At that point, the green candlestick will pierce through the bearish defense line, and the capital markets will once again welcome a surge of liquidity.

From now until the end of August, Maelstrom (our portfolio) will be overweight in staked USDe (Ethena USD). We have liquidated all liquid altcoin positions. Based on price trends, we may also moderately reduce our risk exposure to Bitcoin. Some altcoins purchased around April 9 have already yielded 2 to 4 times returns within three months. However, in the absence of clear liquidity catalysts, the altcoin sector is likely to be bloodied. After this round of correction, we can confidently "pick gold from the garbage," perhaps achieving five or ten times returns before the next low in fiat liquidity creation arrives in late 2025 or early 2026.

Tick the Boxes

TBTF banks issuing stablecoins can release up to $6.8 trillion in short-term Treasury bond purchasing power.

The Federal Reserve stopping the payment of interest on reserve balances (IORB) can further release $3.3 trillion in short-term Treasury bond purchasing power.

In total, $10.1 trillion is expected to flow into the short-term Treasury bond market through the "BBC policy combination." If my predictions come true, this $10.1 trillion liquidity injection will have a stimulating effect on risk assets comparable to the $2.5 trillion injected by Yellen back in the day.

This is another "liquidity arrow" in the hands of Treasury Secretary Scott, which can be drawn from his policy quiver to strike the market when necessary. And "when necessary" may be after the passage of Trump's Big Beautiful Bill and the raising of the debt ceiling. At that time, market concerns will resurface: "How will this massive amount of Treasury bonds be sold without blowing up the entire market?"

Are you still waiting for Powell to announce "infinite quantitative easing" (QE Infinity) and significantly lower interest rates before you are willing to sell bonds and buy cryptocurrencies? Wake up—at least until the U.S. clearly enters into a hot war with Russia, China, and Iran, or a systemically important financial institution explodes, that scene will not occur, and even a recession will not trigger it.

Many financial advisors are still advising clients to buy bonds, arguing that yields are about to decline. I agree that central banks around the world will eventually lower interest rates and print money to avoid a collapse in the government bond market. Moreover, even if central banks do not act, the Treasury will. This is precisely the core point I have made in this article: I believe that Bessent, by supporting stablecoin regulation, granting SLR (Supplementary Leverage Ratio) exemptions, and stopping the payment of interest on reserve balances (IORB), will be able to release up to $10.1 trillion in Treasury bond purchasing power. But the question is: what is the point of holding bonds long-term for a 5% or 10% return? You will miss the opportunity for Bitcoin to soar tenfold, breaking through $1 million, or for the Nasdaq 100 index to surge fivefold, breaking through 10,000 points (expected to be achieved in 2028).

The real stablecoin opportunity is not to bet on outdated fintech companies like Circle, but to see clearly: the U.S. government has handed a trillion-dollar liquidity nuclear warhead disguised as "innovation" to those TBTF banks.

This is not DeFi; this is not financial freedom. This is debt monetization dressed up as Ethereum.

And if you are still waiting for Powell to softly tell you "infinite QE" before you start increasing your exposure to risk assets, then I can only say: congratulations, you are the "liquidity exit" when others retreat.

Instead, go long Bitcoin, go long JPMorgan, and forget about Circle.

The stablecoin "Trojan Horse" has quietly infiltrated the castle. When it opens, what’s inside is not the dream of libertarians, but a liquidity bomb filled with trillions of dollars worth of Treasury bonds, aimed at propping up the stock market, financing the fiscal deficit, and allowing the baby boomer generation to continue living in peace and security.

Do not sit on the sidelines waiting for Powell's blessing. BBC is already "warmed up," and now he is ready to sprinkle his liquidity juice all over the globe.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。