OpenAI’s recent warning about tokens bearing its name, which Robinhood is distributing to its users, exposes a fundamental misunderstanding of the fintech platform’s offering, according to Robinhood’s supporters. They argue that unlike traditional equity, which represents direct shares in the artificial intelligence (AI) firm, Robinhood’s OpenAI tokens track the value of OpenAI on private markets.

Amit, a social media user on X, clarified that OpenAI tokens, similar to the tokens of 200 other public companies Robinhood offers, “are [in fact] real equity” backed by the fintech firm’s stake in OpenAI acquired via a Special Purpose Vehicle (SPV). Amit’s explanation followed OpenAI’s insistence that it had no involvement with the tokens nor had endorsed the giveaway.

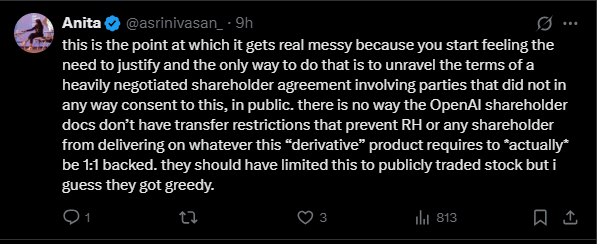

Robinhood co-founder and CEO, Vlad Tenev, also chimed in stating that while the tokens “aren’t technically” equity, they nonetheless “give retail investors exposure to these private assets.” However, in a post on X, OpenAI appeared to reject this notion, asserting that any transfer of its equity would require its approval, which Robinhood’s giveaway lacks.

“These ‘OpenAI tokens’ are not OpenAI equity. We did not partner with Robinhood, were not involved in this, and do not endorse it. Any transfer of OpenAI equity requires our approval—we did not approve any transfer. Please be careful,” the AI firm stated.

OpenAI’s warning immediately sparked a backlash, with billionaire Elon Musk branding the AI firm’s equity “fake.” Musk, an OpenAI co-founder turned nemesis, owns SpaceX, which is also subject to Robinhood’s equity tokenization. His response, by taking a potshot at OpenAI, prompted other users to question if SpaceX had an agreement with Robinhood about the giveaway of SpaceX tokens.

Meanwhile, one user offered an interesting take on how Robinhood’s tokenization of SpaceX equity might help monetize its unrealized gains.

“If they are also doing this to SpaceX, then they are also trying to unlock and monetize their unrealized gains in their private investment – by creating liquidity in a secondary market that is buying indirect exposure to SpaceX – via tokenization. They are unlocking a whole new revenue stream for themselves by utilizing locked up equity and they are using it from their private stake in SpaceX and riding on the back of SpaceX goodwill,” the user explained.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。