Table of Contents

Table of Contents…………………………………………………………………………………………. 1

1. Background: The Demand for Stablecoins Continues to Grow……………………………………………………….. 1

2. Traditional Enterprises' Layout for Stablecoins……………………………………………………………………… 3

2.1 Mastercard…………………………………………………………………………. 3

2.1.1 Mastercard Promotes On-Chain Settlement Closure……………………………………………. 3

2.1.2 Other Layouts of Mastercard Regarding Stablecoins………………………………………….. 9

2.2 Fiserv Plans to Launch FIUSD…………………………………………………………. 12

2.3 JD.com Actively Layouts in the Stablecoin Sector…………………………………………………….. 13

2.4 Ant Group Plans to Issue Stablecoins in Multiple Locations………………………………………… 13

2.5 Eight Major National Banks in South Korea Form a Korean Won Stablecoin Alliance……………… 14

2.6 Meta Explores Integrating Stablecoins into Social Platforms……………………………………………. 15

3. The Significance and Value of Stablecoins for Traditional Enterprises……………………………………. 15

4. Summary and Reflections…………………………………………………………………………… 16

References………………………………………………………………………………………… 17

1. Background: The Demand for Stablecoins Continues to Grow

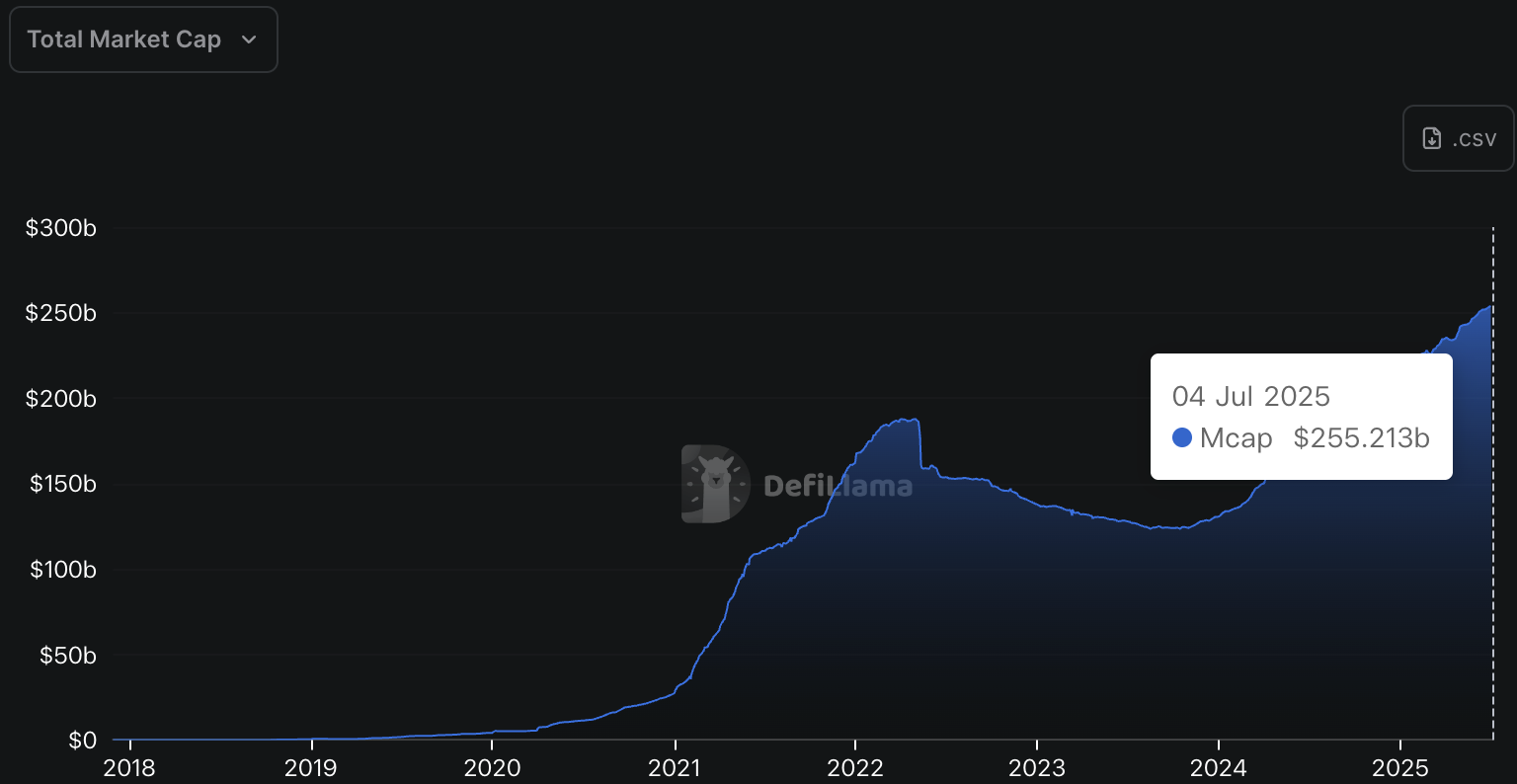

In the past, stablecoins were primarily seen as important tools in the crypto world, mainly used for on-chain transactions and asset hedging. Today, the role of stablecoins is undergoing a profound transformation. The total market capitalization of stablecoins has surged from $650 million at the end of 2018 to over $250 billion in 2025, achieving an explosive growth of 384 times in just six years. Stablecoins represented by USDT and USDC have long had daily trading volumes comparable to or even exceeding Bitcoin and Ethereum. Stablecoins are now not only the dollar of the crypto world but are also becoming a key bridge connecting Web2 and Web3.

Figure 1. Stablecoins total market cap. Source: https://defillama.com/stablecoins

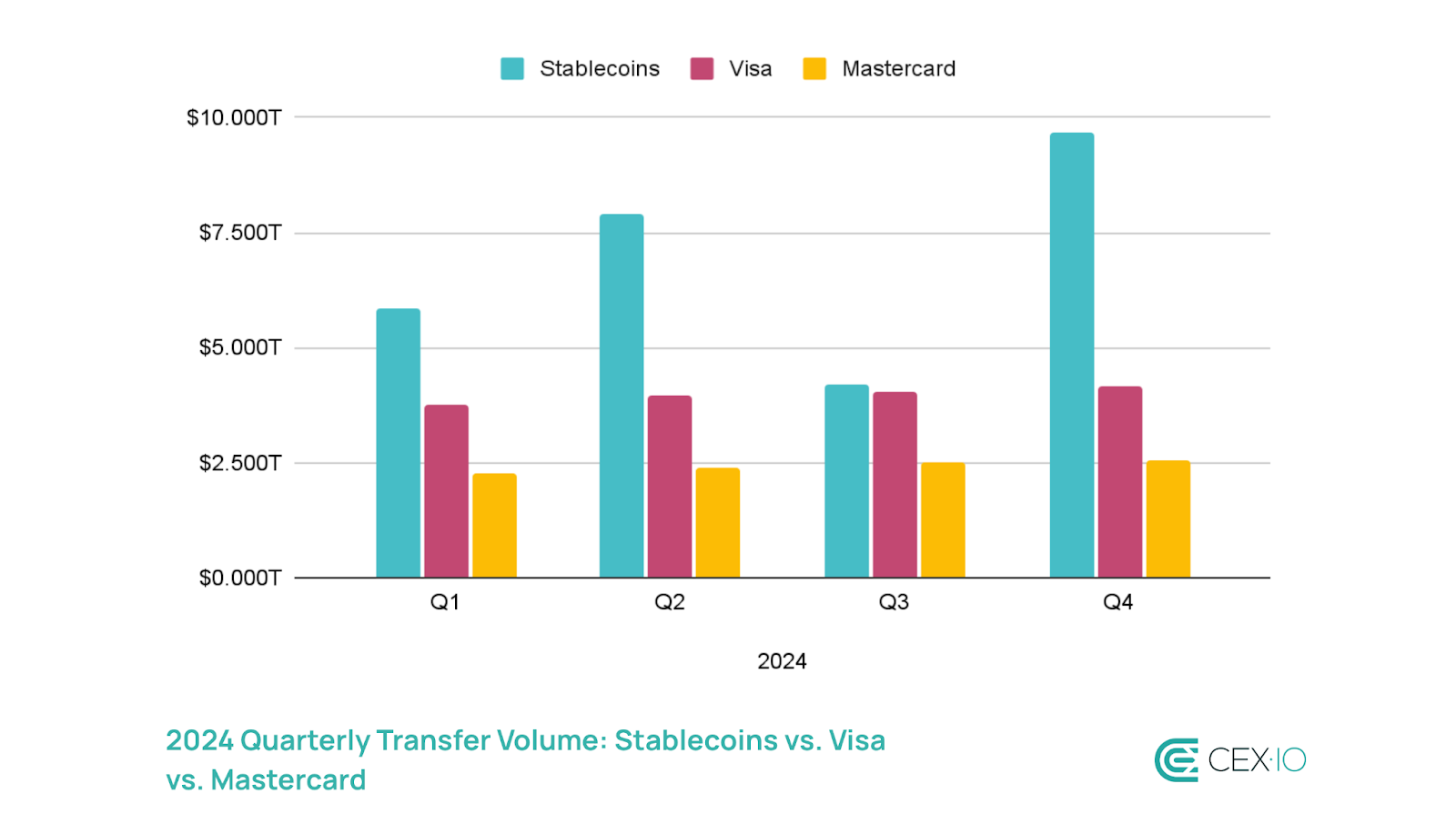

The rapid rise of stablecoins is not coincidental. Against the backdrop of high costs and slow processing times for global cross-border payments, traditional Web2 enterprises and institutions are urgently seeking more efficient and compliant new payment solutions. According to data from CEX.IO, the total trading volume of stablecoins is expected to exceed $27 trillion in 2024, surpassing the combined annual transaction volume of Visa and Mastercard for the first time. Whether in cross-border e-commerce, international logistics, or global financial services, there is a practical demand for stablecoins.

Figure 2. 2024 Quarterly Transfer Volume: Stablecoins vs. Visa vs. Mastercard. Source: https://blog.cex.io/ecosystem/stablecoin-landscape-34864

At the same time, policy levels are also sending positive signals, such as the U.S. Senate passing the GENIUS Act, the EU passing the MiCA policy, and places like Singapore and Hong Kong accelerating the promotion of clear regulatory frameworks, all of which provide a good backdrop for traditional enterprises to legally issue stablecoins. It is evident that stablecoins are moving from the gray area of the crypto world to the sunny side of the global payment system.

Against this backdrop, traditional Web2 giants are entering the stablecoin sector one after another. Recently, institutions including Mastercard, JD.com, Ant International, and several leading banks in South Korea have announced their own stablecoin issuance plans or related collaborations, making stablecoins a coveted territory for various enterprises.

2. Traditional Enterprises' Layout for Stablecoins

2.1 Mastercard

2.1.1 Mastercard Promotes On-Chain Settlement Closure

Collaborating with Chainlink to Support Direct Purchase of Cryptocurrencies from On-Chain Using Mastercard

On June 24, 2025, Mastercard announced a partnership with blockchain infrastructure giant Chainlink, along with institutions such as Shift4, Zerohash, Uniswap, Swapper Finance, and XSwap, to streamline the process from card payment to on-chain asset delivery. The 3.5 billion Mastercard credit cards worldwide can now directly purchase crypto tokens on DEXs (like Uniswap). This means that even without registering an account on a centralized exchange, ordinary users can directly swipe their cards to buy coins, seamlessly entering the Web3 world.

The entire payment process is fully on-chain, real-time, and compliant. When users initiate a transaction through the Swapper Finance frontend, the traditional payment gateway service provider Shift4 first submits the Mastercard payment request, completing the fiat deduction (such as USD, EUR, etc.). Subsequently, the cryptocurrency and stablecoin infrastructure provider Zerohash converts the fiat into the intermediate crypto asset USDC. At this point, Chainlink verifies the transaction instructions and sends them to Swapper's smart contract, which then calls a DEX like Uniswap to complete the final token exchange and send the desired crypto assets to the users' wallets. The entire process is automated, secure, and traceable, and can be completed within minutes.

Currently, Swapper Finance has officially launched, and users can purchase through its official website (https://swapper.finance/). Mastercard has also stated that it will continue to explore more on-chain payment scenarios with Chainlink in the future, allowing on-chain assets to be used as conveniently as traditional currencies.

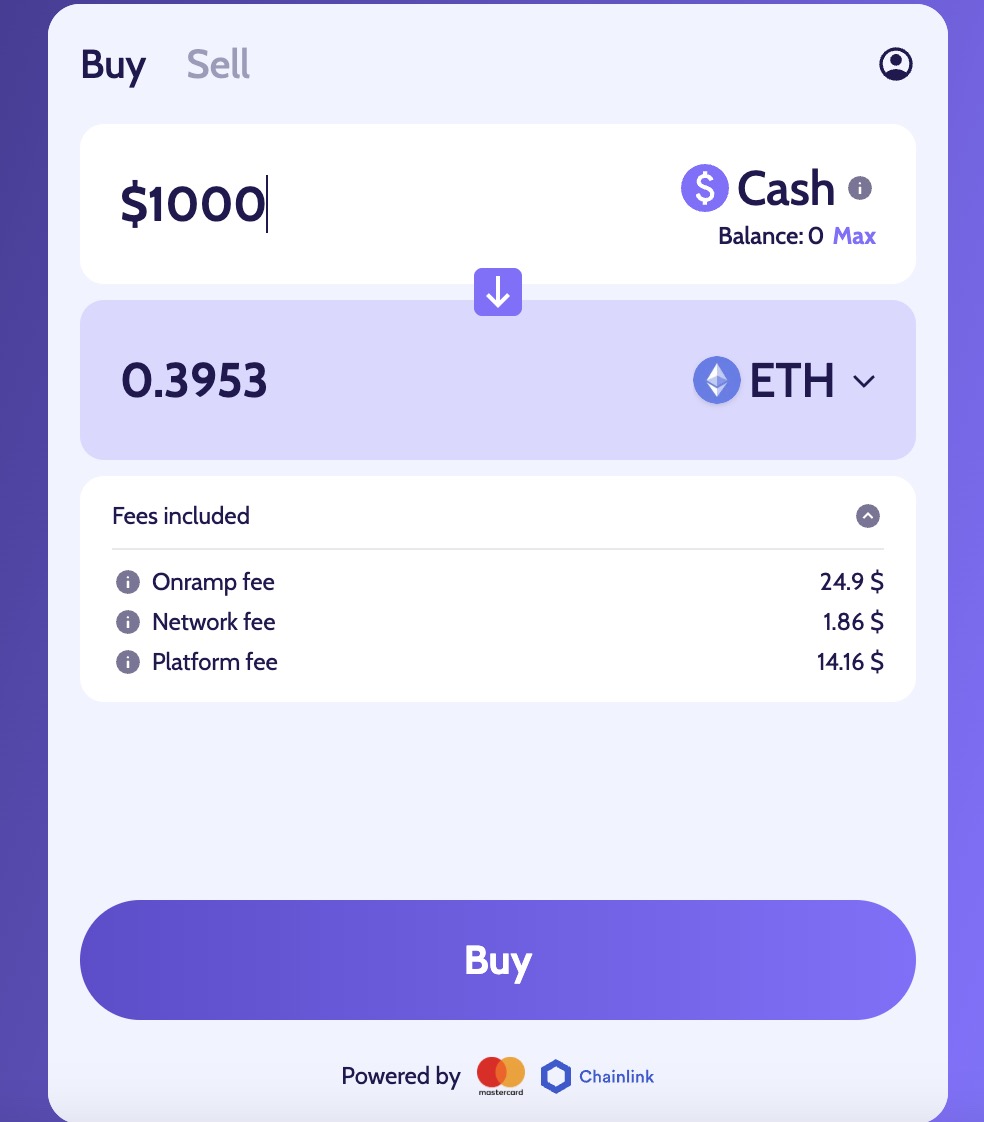

Swapper Finance Purchase Transaction Fee Structure

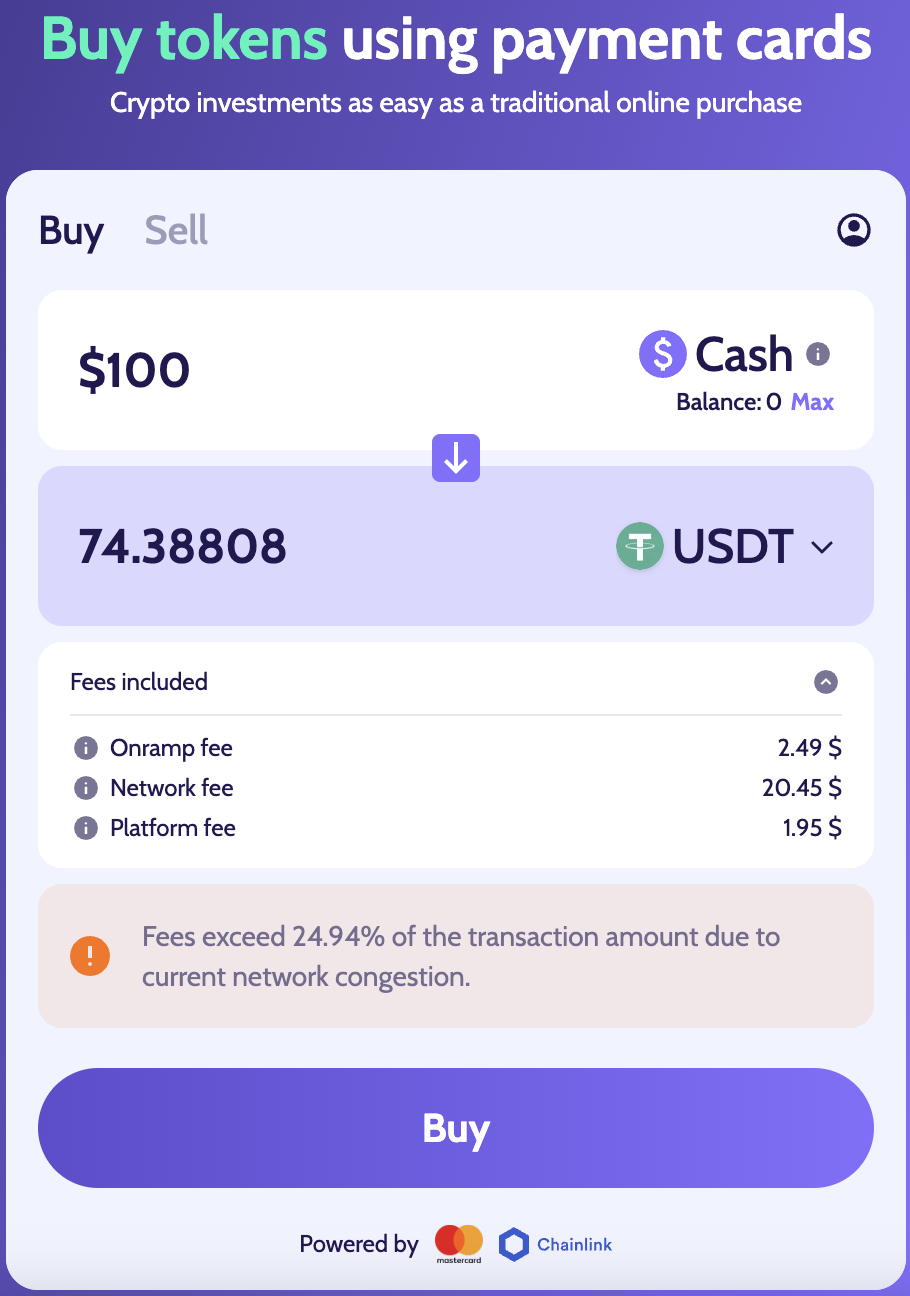

It is worth noting that when using Mastercard to buy coins on Swapper Finance, users will see three types of service fees: Onramp fee, Network fee, and Platform fee.

· Onramp fee: The fiat-related service fees incurred when swiping a card for payment through bank or credit card channels. This fee mainly occurs when using a credit card for payment and is charged by the payment channel (Shift4) and the clearing institution (Mastercard). It covers credit card transaction fees, cross-border settlement fees, currency conversion fees, etc. Additionally, service providers like Zerohash are responsible for converting the fiat swiped by users into on-chain stablecoins and will also charge a portion of the service fee.

· Network fee: This includes the Gas consumed for executing on-chain transactions (such as stablecoin to ETH exchanges), determined by the blockchain network where the user-initiated on-chain transaction occurs.

· Platform fee: This involves the fees charged by the platform. This portion is collected by Swapper Finance itself and its partners such as XSwap and Chainlink, to cover costs related to transaction matching, user interface, oracle verification, technical security, and more. For example, Chainlink verifies whether the user's transaction request matches, while XSwap completes the actual asset exchange on-chain through DEXs like Uniswap. The platform packages these functions through a unified interface, providing a streamlined experience for card purchases, but each layer of service behind it incurs costs.

In cases of network congestion, purchasing $100 worth of USDT on the platform can result in a fee ratio as high as 26%, with the highest fee stemming from the Gas fees generated by network congestion ($20.45).

Figure 3. Swapper trading page. Source: https://swapper.finance/

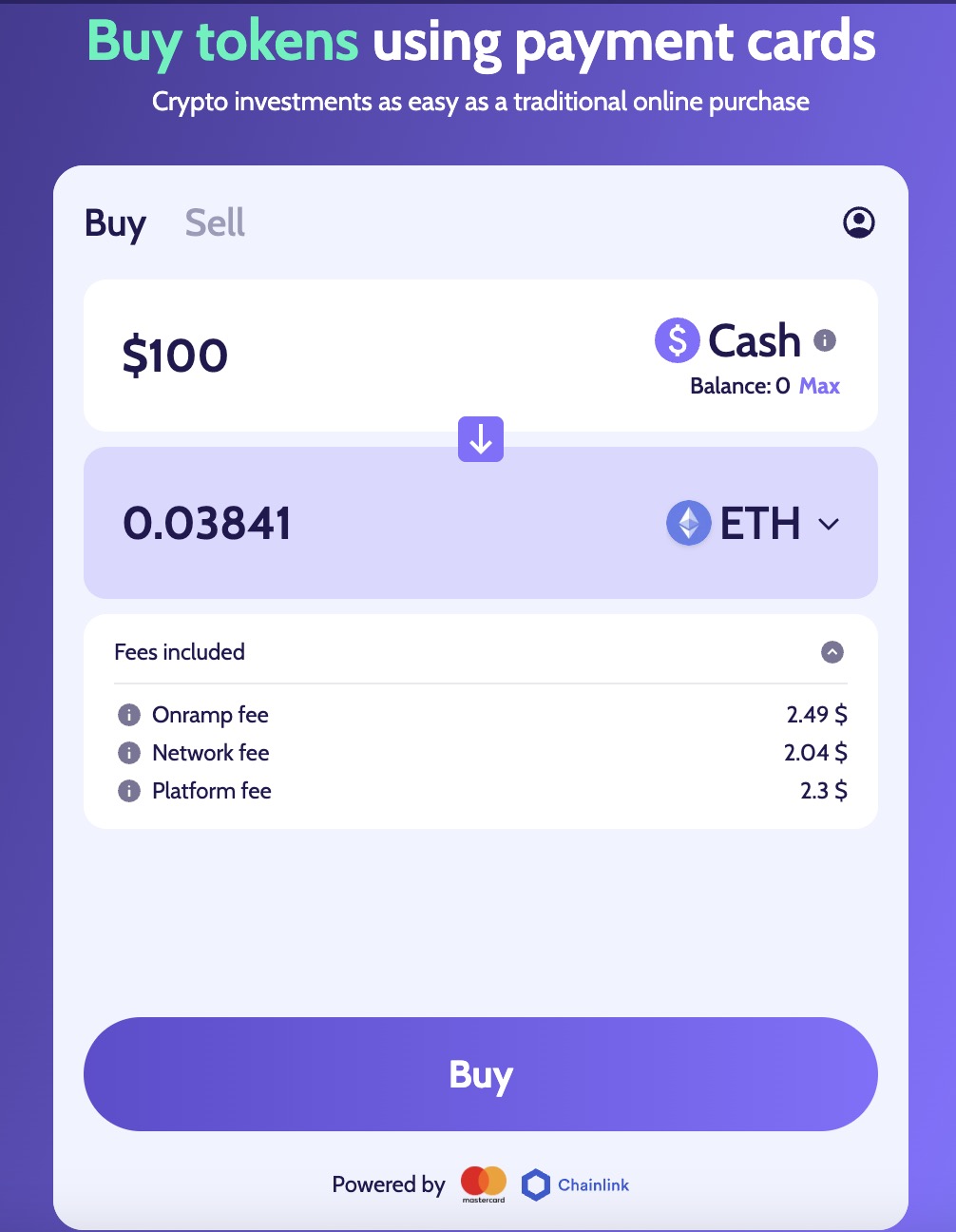

In non-congested network conditions, the fee incurred when purchasing $100 worth of ETH is approximately $6.8, which is about 6.8% of the transaction. Under the same network conditions, when purchasing $1,000 worth of ETH, the fee incurred is about $40.92, or approximately 4.09%. It is evident that the fee fluctuates in real-time based on network congestion and the size of the purchase amount. Under the same network conditions, the smaller the purchase amount, the higher the fee ratio.

Figure 4. Fees when buying $100 worth of ETH. Source: https://swapper.finance/

Figure 5. Fees when buying $1,000 worth of ETH. Source: https://swapper.finance/

Account Registration and Identity Verification Required to Meet Compliance Requirements

Although Swapper Finance is a decentralized trading platform, its card purchase process still involves KYC (Know Your Customer) procedures similar to those of centralized exchanges (CEX) to meet its fiat payment and compliance requirements.

While the final transaction on Swapper is completed on-chain, the initial payment is made using fiat currency through a credit card, which involves regulatory requirements from the traditional financial system. To ensure these transactions comply with legal regulations (especially anti-money laundering (AML) and KYC requirements), the platform must verify user identities. This process is typically handled by its compliance service partner Zerohash, which requires users to register an email address and upload identification documents (such as a passport or ID card).

However, compared to centralized exchanges, Swapper Finance still embodies strong Web3 principles in user experience and asset control. First, transactions are completed entirely on decentralized exchanges (DEXs) like Uniswap, rather than reconciling within the platform's internal database. Second, the digital assets purchased by users go directly into their on-chain wallets; Swapper does not custody users' funds and does not involve withdrawal steps. Moreover, it uses Chainlink's oracles to execute and verify orders, ensuring that the transaction process is open, transparent, and decentralized.

Advantages and Disadvantages of Swapper Finance

As an innovative service connecting the Web2 payment system with Web3 on-chain transactions, Swapper Finance indeed has many highlights but also some limitations.

Swapper Finance allows users to directly purchase on-chain assets using Mastercard credit cards, without needing to custody assets with the platform or go through the cumbersome withdrawal process of a CEX. Users simply connect their wallets, verify their identities, and swipe their cards to receive digital currency directly into their on-chain wallets. For users new to the crypto world, this is a very friendly and straightforward entry point.

Its greatest advantages lie in convenience and compliance. Transactions are completed through decentralized exchanges like Uniswap, and assets are not held by the platform, ensuring security and transparency; at the same time, it relies on compliance institutions like Mastercard, Zerohash, and Shift4 to achieve a seamless connection between fiat payments and on-chain transactions. The overall process is clean and efficient, making it very suitable for early users.

However, Swapper also has some obvious limitations. For instance, the fees are relatively high, including fiat exchange fees (onramp), Gas fees, and platform service fees. Additionally, to meet regulatory compliance, the platform requires users to complete KYC (upload identification), which makes it not much different from CEXs in terms of privacy.

Furthermore, the current selection of on-chain assets and chains supported by Swapper is not rich enough, and due to its high fees and on-chain transaction delays, it is more suitable for small entry amounts and first-time buyers. For professional trading users seeking privacy or low transaction fees, it may not be the best choice.

The Significance of Swapper Finance's Launch for Mastercard

The birth of Swapper addresses the long-standing issue of new users entering the market. Swapper Finance makes it possible to directly swipe a card to buy coins on-chain by integrating multiple compliance infrastructures such as Mastercard, Chainlink, and Zerohash, truly handing the entry point of decentralized finance to ordinary users and bringing a huge potential new user base to the crypto market. It is evident that traditional financial institutions are significantly increasing their acceptance of blockchain technology, accelerating their entry into the on-chain world.

2.1.2 Other Layouts of Mastercard Regarding Stablecoins

Promoting Deep Cooperation with Fiserv to Integrate FIUSD into the Global Payment Network

On June 24, 2025, Mastercard announced a formal deep cooperation with Fiserv to integrate its upcoming stablecoin FIUSD into the Mastercard global payment network. This means that over 150 million merchants worldwide will support payments in FIUSD, providing users and merchants with more diverse payment options and marking the official entry of stablecoins into the mainstream payment system.

One of the key focuses of the collaboration is to optimize the bi-directional exchange experience between fiat currency and FIUSD. In the future, users will be able to more easily convert dollars in their bank accounts to FIUSD and quickly exchange FIUSD back to fiat currency, enhancing flexibility and liquidity.

At the same time, Mastercard plans to support global acquirers to settle with merchants in FIUSD. This means that regardless of how consumers pay, merchants can choose to settle in FIUSD. In the current mainstream payment system, whether through WeChat, Alipay, or Visa, merchants typically cannot choose their settlement currency. For example, with WeChat Pay, even if users pay with an overseas credit card or foreign currency account, the system will automatically convert the foreign currency to RMB, and the final settlement to the merchant will still be in RMB. Merchants cannot say, "I want to receive dollars" or "I only accept stablecoins"; this choice is not in the hands of the merchants. The same mechanism exists in international card organizations; for instance, if you use Visa to make a purchase abroad, the merchant receives their local currency, and the acquirer and clearing bank complete the exchange and settlement in the background. In cross-border payment scenarios, this single fiat currency settlement mechanism can be even more cumbersome. Consumers using dollars or euros may find that after multiple intermediaries (acquirers, issuers, card organizations, etc.) settle, the merchant ultimately receives local currency, with the settlement period often requiring 2-3 business days, and the exchange rate losses and settlement fees incurred in the process are difficult to estimate, leaving merchants in a completely passive position.

The new mechanism that Mastercard is promoting in collaboration with payment technology company Fiserv will bring about an important change: merchants will be able to choose to settle in the stablecoin FIUSD for the first time. This means that in the future, regardless of whether consumers swipe credit cards, debit cards, Apple Pay, or on-chain assets like USDC, merchants can set "I only accept FIUSD," and the system will automatically convert the received funds into FIUSD and deposit them into the merchant's account after payment is completed. This not only simplifies the exchange and settlement process but also increases the speed of funds arriving (on-chain settlement can be near real-time) and significantly reduces costs.

Additionally, both parties plan to launch a stablecoin co-branded card based on the Mastercard network. This card will allow users to integrate FIUSD with credit and debit card accounts, be globally available, and support flexible switching of payment methods (credit, debit, stablecoin balance) through Mastercard's One Credential system.

This cooperation marks Mastercard's formal embrace of stablecoin applications, moving beyond merely holding or issuing stablecoins to deeply embedding them into payment, settlement, and user experience applications. Mastercard and Fiserv are working to make stablecoins as reliable and widespread as the dollar for payment and settlement methods.

Expanding the Integration of Multi-Currency Stablecoin Ecosystems

In addition to FIUSD, Mastercard also announced that it will integrate multiple mainstream stablecoins into its global payment network, including PYUSD launched by PayPal, USDG led by Paxos, and USDC. This integration means that in the future, regardless of which stablecoin consumers use, whether PYUSD, USDC, or the upcoming FIUSD, they can make seamless payments at merchants within the Mastercard network. Merchants can also choose the stablecoin they prefer for final settlement, such as opting to receive FIUSD, USDC, or directly convert to fiat currency.

By supporting multiple stablecoins, Mastercard is building a multi-currency, cross-platform payment and settlement system, achieving compatibility between the familiar experience of Web2 users and the flexibility of Web3 assets. This high level of interoperability not only enhances the payment freedom of users and merchants but also creates a unified infrastructure for the future widespread adoption of stablecoins globally.

Launching Stablecoin Consumption Cards and Wallet Payment Solutions

In April 2024, Mastercard reached a strategic partnership with the crypto payment infrastructure platform MoonPay, allowing users to link stablecoins (such as USDC, USDT, etc.) from their digital wallets to Mastercard cards and use them directly for offline or online purchases. Users do not need to convert stablecoins into fiat currency in advance; the system automatically completes the settlement during the card swipe, truly enabling on-chain funds to be spent in the real world.

The technical logic behind this service is to map the on-chain stablecoin balance to a virtual or physical card within the Mastercard network, with payments processed through the interfaces of MoonPay and Mastercard for automatic deduction of stablecoins and fiat settlement. The entire process is nearly imperceptible to users, providing an experience similar to traditional credit cards, but the source of funds comes from on-chain crypto assets.

At the same time, Mastercard is accelerating its integration with crypto platforms and has already established partnerships with mainstream wallets and trading platforms such as OKX, MetaMask, Kraken, and Binance, promoting the ability for digital wallets to connect directly to merchant payments. This direct connection means that in the future, users can simply click to pay with Mastercard directly from these platforms' wallets, completing the consumption of on-chain assets without intermediaries or cumbersome operations.

This strategy significantly lowers the barriers to crypto payments while providing a pathway for traditional merchants to seamlessly access Web3, showcasing Mastercard's strong commitment to the future of stablecoin payments. In simple terms, Mastercard has transformed the familiar act of swiping a card into an entry point connecting on-chain assets with real-world consumption.

Mastercard's Strategy and Ambition

From Mastercard's series of actions in the stablecoin field, it is clear to see its strategic layout and ambition. It not only hopes to keep pace with the wave of the crypto era but also aims to firmly grasp the dominant position in the future global payment infrastructure.

Firstly, it integrates multiple stablecoins into its payment network, including PayPal's PYUSD, Paxos' USDG, Circle's USDC, and Fiserv's FIUSD, allowing users and merchants to choose which stablecoin to use for payment or settlement as needed. This represents Mastercard's effort to create a highly compatible, globally universal multi-currency payment system, making stablecoins mainstream currencies for consumption and settlement.

Additionally, by collaborating with wallets and platforms like MoonPay, MetaMask, OKX, and Kraken, Mastercard enables users to spend stablecoins directly from their wallets, as simply as using a bank card. This integration bridges Web3 users' wallets with real-life merchant scenarios, greatly reducing the barriers to crypto payments and providing merchants with the ability to seamlessly access Web3 payments.

Overall, Mastercard is transforming itself from a traditional payment giant into a bridge linking Web2 and Web3. Its goal is not merely to access the crypto world but to become a key hub for the global circulation and settlement of stablecoins in the future, mastering the rules, standards, and channels, so that every card can serve as an entry point to the blockchain.

2.2 Fiserv Plans to Launch FIUSD

Fiserv is a global fintech giant headquartered in the United States, serving over 10,000 financial institutions and 6 million merchants, with an annual transaction processing volume of up to 90 billion transactions. It has long provided backend clearing, payment systems, risk control services, and core banking infrastructure for banks, credit unions, and POS merchants. Against the backdrop of accelerating financial digitization, Fiserv is actively embracing blockchain and stablecoin technology, stepping into the Web3 era.

In June 2025, Fiserv announced that it would launch its own dollar stablecoin, FIUSD, with plans for a full rollout by the end of the year. FIUSD will initially be deployed on the Solana blockchain, focusing on high performance, low fees, and around-the-clock on-chain settlement experiences. Unlike the mass-market USDT or USDC, FIUSD is clearly positioned as a "compliance stablecoin" for institutional use, primarily serving the payment and settlement needs between banks, merchants, and financial service providers.

The goal of FIUSD is to enable banks and merchants to use stablecoins for on-chain settlements as smoothly as they would use dollars. Fiserv provides SDKs and interface support, allowing clients to integrate FIUSD into existing banking systems or merchant backends without needing to develop blockchain applications from scratch. This means that even small and medium-sized banks or non-tech merchants can easily gain on-chain payment capabilities. Through FIUSD, traditional financial institutions can migrate settlement processes that originally relied on bank ledgers to be completed on-chain, such as merchant collections, transfers, and corporate payments, improving efficiency while retaining existing risk control systems and customer experiences.

From the outset, FIUSD's design has been closely tied to compliance. The issuer, Fiserv, is itself a publicly listed payment giant in the U.S., naturally operating under a strict financial regulatory framework. The use of FIUSD must go through identity verification, anti-money laundering checks, and other processes to ensure that every transaction complies with regulatory requirements. This also makes it a trusted stablecoin specifically designed for institutions, not open for direct buying, selling, or investment by ordinary users, but rather serving as a medium for settlement between financial institutions.

It is worth mentioning that FIUSD has received full support from Mastercard. Mastercard announced that it would incorporate FIUSD into its global payment network, allowing not only users to spend FIUSD but also merchants to choose to settle in FIUSD, even if customers pay with credit cards, debit cards, or other methods. This is the first time a traditional payment network has opened up the option for merchants to choose stablecoin payments and settlements, which is expected to significantly enhance the flexibility of payment systems and global circulation efficiency.

For ordinary users, FIUSD will not be presented as a wallet balance but will be automatically completed in the background by banks, payment platforms, or wallet service providers. For example, when you swipe your Mastercard, the backend may automatically convert fiat currency to FIUSD and complete the payment on-chain. The entire process is seamless, compliant, and offers good traceability and security.

2.3 JD.com Actively Layouts Stablecoin Track

On June 18, 2025, JD.com founder Liu Qiangdong revealed that JD.com is applying for stablecoin issuance licenses in several major countries, aiming to launch stablecoins pegged to the U.S. dollar and Hong Kong dollar, with the goal of reducing cross-border payment costs by 90% and shortening the time to within 10 seconds. In terms of regulation, JD Coin Chain Technology (Hong Kong) entered the Hong Kong Monetary Authority's stablecoin issuer sandbox in July 2024 and is officially testing a JD stablecoin pegged 1:1 to the Hong Kong dollar.

According to JD.com’s response in May 2025, this move is primarily aimed at addressing the low efficiency and high costs of cross-border payments, supporting the real economy and enterprise-level usage, including logistics, supply chains, and overseas merchants. At the same time, Hong Kong is set to introduce regulatory legislation for stablecoins in August 2025, paving the way for JD.com to issue legally.

Overall, JD.com’s stablecoin layout is clearly positioned and logically sound, leveraging its advantages in cross-border e-commerce and logistics, gradually building infrastructure through compliance sandbox testing, and seeking licenses through the Hong Kong government’s policy window to ultimately achieve the goal of optimizing global payments. If regulatory progress goes smoothly, JD.com is expected to launch formal stablecoin products by the end of 2025 for e-commerce payments, supply chain finance, and overseas scenarios.

2.4 Ant Group Plans to Issue Stablecoins in Multiple Locations

Ant Group is actively advancing its plans to issue stablecoins, primarily through its two subsidiaries, Ant International and Ant Digital Technologies. Ant International, headquartered in Singapore, is responsible for international business and plans to apply for a stablecoin issuance license pegged to the Hong Kong dollar, with this application expected to be submitted after the new "Stablecoin Regulations" in Hong Kong take effect on August 1, 2025. At the same time, they also plan to apply for corresponding stablecoin issuance licenses in Singapore and Luxembourg, aiming to support cross-border payments and corporate treasury management, creating more efficient on-chain payment and settlement tools.

Ant Digital Technologies is mainly responsible for local business in China and is also advancing the application for a stablecoin license in Hong Kong, having completed relevant regulatory sandbox testing and engaged in multiple rounds of communication with regulatory authorities. Ant Group hopes to introduce stablecoins to the market in a compliant manner, reducing the costs and time of traditional cross-border payments, achieving near-instant settlements, and thereby building a digital payment ecosystem covering millions of merchants and users.

Technically, Ant Group utilizes its self-developed blockchain platform "Whale" to support the stablecoin payment system, combined with the AI-driven foreign exchange model "Falcon" to optimize exchange rates and fund flow efficiency. It is understood that this system has already supported transaction volumes in the hundreds of billions of dollars. Overall, Ant Group's stablecoin strategy relies on compliant licenses to lay out digital currency businesses in multiple countries and regions, aiming to promote the deep integration of traditional finance and digital finance.

2.5 Eight Major National Banks in South Korea Form a Korean Won Stablecoin Alliance

Major banks in South Korea are actively advancing plans to issue a Korean won stablecoin, aiming to build a local digital payment system and enhance the competitiveness of international trade finance. This plan is jointly initiated by eight leading banks, including the National Bank of Korea, Shinhan Bank, Woori Bank, Hana Bank, IBK Industrial Bank, Jeonbuk Bank, Suhyup Bank, and Toss Bank. These banks have jointly established a joint venture focused on developing and issuing a Korean won stablecoin.

The core goal of the plan is to lower cross-border payment costs, improve settlement efficiency, and provide more convenient international trade finance services for small and medium-sized enterprises through the issuance of a Korean won stablecoin. Additionally, the introduction of stablecoins will help enhance South Korea's international competitiveness in the digital currency space and promote the development of financial technology.

Currently, the project is still in its early stages, and specific issuance timelines and technical details have not been disclosed. However, as the South Korean government gradually improves its regulatory framework for digital currencies, it is expected that the plan will be realized in the coming years.

2.6 Meta Explores Integrating Stablecoins into Social Platforms

Meta, the parent company of Facebook, Instagram, and WhatsApp, is researching the integration of stablecoins into its social platforms. This time, Meta does not plan to issue a new coin but rather aims to directly integrate mainstream stablecoins like USDC.

Meta's goal is to enable users to perform tipping, transfers, and payments within chat applications as simply as sending a message. This would not only make cross-border remittances faster and cheaper but also allow content creators to receive payments more conveniently, without relying on intermediary platforms or bank transfers.

This plan began to advance around May 2025. Although Meta has not officially announced it yet, it has not denied it, stating that it is exploring existing stablecoin mechanisms and emphasizing that there are currently no plans to issue its own stablecoin, with multiple foreign media outlets reporting that they are in talks with stablecoin issuers.

Overall, Meta is taking a pragmatic approach by not issuing its own coin but choosing to directly integrate existing stablecoins. If this is officially implemented in the future, it could make payments and tipping on social platforms as simple and quick as sending an emoji.

3. The Significance and Value of Stablecoins for Traditional Enterprises

In recent years, with the rapid development of blockchain technology and the digital economy, stablecoins have become an important bridge connecting traditional finance and digital assets. Traditional and tech giants like Mastercard with its Swapper platform, JD.com, Ant Group, Fiserv, and Meta are all laying out their strategies for stablecoins, hoping to enhance payment efficiency and reduce costs, especially in cross-border payments and international trade, where stablecoins can achieve near-instant settlements and significantly shorten the time for fund transfers.

At the same time, stablecoins also help these companies drive digital transformation and explore new business scenarios. JD.com can innovate the e-commerce payment experience through stablecoins, while Meta plans to integrate USDC into Facebook and WhatsApp, bringing convenient digital payment features to social platforms. Through stablecoins, traditional enterprises can better meet user demands for digital assets and convenient payments, enhancing user loyalty and market competitiveness.

Additionally, the gradually clarifying global regulatory environment provides legal assurance for the development of stablecoins. Companies like Ant Group and Fiserv are actively applying for stablecoin licenses in multiple locations to ensure compliant operations and reduce risks. This allows traditional enterprises to confidently engage in stablecoin business and expand their international market presence.

The entry of traditional companies into the stablecoin space is both a result of technological maturity and growing user demand, as well as an inevitable choice in the face of competitive pressure and transformation needs. Through collaboration and innovation, they can not only enhance the efficiency of financial services but also seize new opportunities brought by the digital economy, building core competitiveness for the future.

4. Summary and Reflection

Types of Stablecoin Layouts by Web2 Companies

Web2 companies' layouts for stablecoins are mainly reflected in several directions. Firstly, some enterprises are actively applying for compliance licenses and planning to issue their own compliant stablecoins, such as JD.com, Fiserv, Ant Group, and the alliance of eight major banks in South Korea. These stablecoins target specific markets or business scenarios to ensure compliance with legal and regulatory requirements. Secondly, stablecoins are widely used for optimizing cross-border payments and settlements, leveraging their advantages of near-instant arrival and 24/7 service to significantly reduce the time and cost of traditional cross-border remittances, enhancing fund transfer efficiency.

Thirdly, many companies are directly integrating stablecoins into their platforms for payments and settlements, such as JD.com exploring stablecoin checkouts in e-commerce scenarios, and Mastercard supporting cardholders to directly purchase crypto assets and promoting stablecoin consumption settlement services. Fourthly, payment service providers like Fiserv and Mastercard help merchants realize stablecoin payments and also support merchants in choosing stablecoins as a settlement method, increasing payment flexibility and efficiency. Finally, social platforms are beginning to leverage stablecoins for rewarding creators and revenue sharing, with companies like Meta exploring ways to provide creators with more transparent and faster incentive mechanisms, promoting the healthy development of the content ecosystem.

Overall, Web2 companies are promoting the deep application of stablecoins across multiple scenarios such as payments, settlements, and incentives through multidimensional layouts, accelerating the integration of the digital economy with the traditional economy.

Potential Impacts of Traditional Companies Entering Stablecoins on Web3

As traditional giants like Mastercard, Meta, JD.com, and Ant Group actively lay out stablecoins and on-chain payments, Web3 is gradually moving beyond the realm of insiders and into the daily lives of ordinary people. This not only allows more users to purchase Web3 token assets without needing to understand blockchain technology but also promotes the industry to become more compliant, secure, and standardized. At the same time, the funding, technology, and user resources brought by traditional enterprises may provide more practical scenarios and innovative collaborations for the Web3 ecosystem, accelerating industry development. In the face of competition from large enterprises, Web3 projects must also enhance product experience and quality, leading to a survival of the fittest in the industry, making it healthier and more mature.

Reflections

From the perspective of enterprises, traditional companies' layouts for stablecoins represent their desire to seize future opportunities in the digital economy. Stablecoins can help enterprises enhance cross-border payment efficiency, reduce transaction costs, and simplify settlement processes, which is crucial for improving their competitiveness. Additionally, compliant stablecoins can help enterprises better respond to regulatory requirements and reduce legal risks. Furthermore, through stablecoins, enterprises can explore more innovative business scenarios, such as digital tipping and on-chain financing, enhancing user stickiness and business diversity.

From the user's perspective, the entry of traditional companies into the stablecoin field means that more people can use digital assets more conveniently and securely. Stablecoins provide a choice of digital currency that is stable in value and easy to circulate, allowing users to conduct payments and transfers without worrying about price fluctuations. At the same time, the compliance guarantees and technical support from enterprises also provide users with a safer usage environment. Users can also enjoy more innovative services, such as directly using credit cards to buy coins through digital wallets and shopping or tipping with stablecoins, lowering the barriers to access and use.

Overall, both enterprises and users are looking forward to stablecoins becoming a bridge connecting traditional finance and the digital economy. Enterprises hope to enhance efficiency and innovation capabilities through this, while users anticipate a more convenient, secure, and rich digital currency experience. In the future, the active interaction between both parties will promote the healthy and rapid development of the entire ecosystem.

References

Mastercard and Chainlink enable on-chain crypto purchases using Mastercard's 3.5 billion cards. Link: https://www.mastercard.com/us/en/news-and-trends/press/2025/june/mastercard-chainlink-crypto.html

Mastercard partners with Fiserv to accelerate mainstream stablecoin adoption. Link: https://www.mastercard.com/us/en/news-and-trends/press/2025/june/mastercard-fiserv-stablecoin-adoption.html

Fiserv Plans FIUSD Stablecoin on Solana for 10,000 Banks. Link: https://deepnewz.com/regulation/fiserv-plans-fiusd-stablecoin-on-solana-10000-banks-76f5e8d7

Meta’s Stablecoin Ambitions: Is Crypto Integration Coming to Facebook and WhatsApp? Link: https://www.raininfotech.com/blogs/metas-stablecoin-facebook-whatsapp/

JD.com expands into global stablecoin licensing, targeting the trillion-dollar cross-border payment market. Link: https://cn.cointelegraph.com/news/jdcom-expands-into-global-stablecoin-licensing

Eight South Korean Banks Join to Establish Won-Backed Stablecoin, Plan Two Key Models. Link: https://cryptonews.com/news/eight-south-korean-banks-join-to-establish-won-backed-stablecoin-plans-two-key-models/

Ant unit plans to apply for stablecoin issuer license in Hong Kong. Link: https://www.reuters.com/world/asia-pacific/ant-unit-plans-apply-stablecoin-issuer-license-hong-kong-2025-06-12/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。