This time, some stand outside the system, while others are within it. Which side do you stand on?

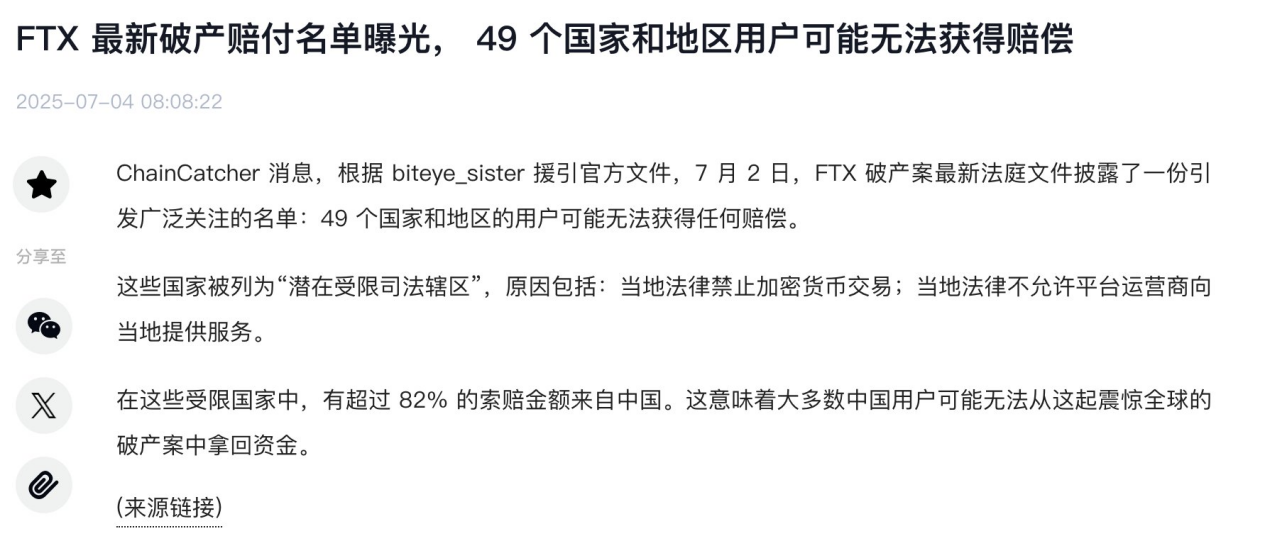

On July 4, 2025, FTX creditor representative Sunil confirmed in a post that in the upcoming FTX compensation plan, Chinese users may be excluded from the main compensation scope due to regulatory jurisdiction issues. This news sparked widespread discussion and emotional fluctuations within the Chinese crypto community.

According to BlockBeats, 82% of the claims assets from countries restricted by FTX come from Chinese users. If the judicial ruling classifies them as a "restricted jurisdiction," these users may not only miss out on the main compensation but could also face the possibility of their assets being ultimately confiscated. This news has caused a stir in the Chinese crypto community—some are angry, some are helpless, and others are beginning to reassess a critical question: If the platform encounters issues, can I really get my money back?

We can be angry, we can feel regret, but more importantly, we must calmly see clearly—that this "exclusion" actually reflects a more critical issue: Is the platform's compensation mechanism based on "user location" or on "the platform's compliance boundaries"?

Exclusion from compensation is not the first time, but FTX exposes the biggest problem

Although there have been no large-scale public claims of "country-based exclusion" in compensation cases, in recent years, some DeFi protocols and centralized platforms have set compliance thresholds (such as mandatory KYC or restrictions on anonymous wallets) in their compensation mechanisms, leading to ongoing debates about "who can receive compensation."

FTX's approach this time is more like the first instance of directly using "country/region" as a criterion to exclude an entire category of users from the compensation pool. As a result, creditors from mainland China may completely lose hope of recovering their funds, even if they are ordinary users who merely stored funds on the platform and never participated in illegal operations.

This method of delineation is challenging our understanding of "platform responsibility."

The real distinction lies not in nationality, but in the platform's system and structure

We should not interpret this incident merely as "users from a certain country being targeted." The real questions are:

When a crisis arises, is a platform willing to take responsibility for its users?

Has it prepared risk contingency plans in advance?

In governance, does it respect users' asset rights, rather than just avoiding responsibility by operating in "legal gray areas"?

In other words, the relationship between the platform and users is one of "service and trust," rather than "contract and exemption." Some platforms define "eligible users" under the guise of compliance, yet aggressively recruit users during market expansion, only to abruptly sever user groups when risks emerge.

WEEX is not a bystander; we recognized this point earlier. The compensation mechanism is not just a slogan, but a matter of execution!

When the FTX incident broke out in 2022, the WEEX platform immediately launched a user asset protection strategy, establishing a "Trader Protection Fund" of 1000 BTC and publishing its transparent address for community verification at any time. We did not set a "country threshold"—any user who has traded on our platform and meets the protection trigger conditions can apply for compensation.

Since then, we have continued to promote compliance processes, actively expanding in regions such as Europe, America, Latin America, and Southeast Asia, striving for institutional pathways while respecting the integrity of users' assets.

We do not claim to be the "safest" platform, but we always believe:

⟶ Risks are unavoidable, but systems can have warmth.

⟶ After a disaster, the most important thing is not to assign blame, but to deliver on promises.

What is left for users is not just judgment, but choice

The bankruptcy liquidation of FTX is about to enter its final stage, but the warning it brings is very clear: The platform's promises to you must remain valid "when it encounters problems" to be considered a true promise.

When we talk about compensation, responsibility, and user fate today, we are also asking ourselves a deeper question: When you entrust your assets to a platform, what you receive is "service" or "trust"? Are you speculating on a trend, or participating in a system?

This is not about which country you are in, nor about whether you trade cryptocurrencies, but about what kind of service platform you choose.

Next time you open an exchange to place an order, it might be worth asking: If something goes wrong one day, to what extent will this platform take responsibility? Is compensation a statement or a result?

This time, some stand outside the system, while others are within it. Which side do you stand on?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。