"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. Based on the extensive coverage of real-time information each week, the Planet Daily also publishes many high-quality in-depth analysis pieces, but they may be hidden among the information flow and trending news, passing you by.

Therefore, our editorial team will select some quality articles worth spending time reading and saving from the content published in the past 7 days every Saturday, providing you with new insights from the perspectives of data analysis, industry judgment, and opinion output, as you navigate the crypto world.

Now, let's read together:

Investment and Entrepreneurship

In the previous era, the "on-chain synthetic asset mechanism" was popular, but price anchoring does not equal asset ownership. The US stocks minted and traded under the synthetic asset model do not represent real ownership of the stocks in reality; they are merely "betting" on prices. Once the oracle fails or the collateral assets collapse (as Mirror did during the UST crash), the entire system faces risks of liquidation imbalance, price decoupling, and user confidence collapse.

At the same time, an easily overlooked long-term factor is that US stock tokens under the synthetic asset model are destined to be a niche market in Crypto—funds only circulate within the on-chain closed loop, with no institutions or brokers involved. This means it will always remain at the "shadow asset" level, unable to integrate into the traditional financial system, establish real asset access and funding channels, and few are willing to launch derivative products based on this, making it difficult to leverage structural inflows of incremental funds.

This time, the tokenization of US stocks has adopted a new approach. On a micro level, this allows global users to buy and sell US stocks more freely, but from a macro perspective, this is actually the US dollar and the US capital market, using Crypto as a low-cost, high-elasticity, 7 × 24 pipeline to attract global incremental funds—after all, under this structure, users can only go long, cannot short, and there are no leverage or non-linear return structures (at least for now).

A series of "new/old" narratives surrounding Crypto are being designed into a distributed financial infrastructure, specifically for American financial services: US Treasury stablecoins → global currency liquidity pool; US stock tokenization → entry point for Nasdaq traffic; on-chain trading infrastructure → global transit hub for US brokers. This may be a flexible way of siphoning global funds.

For DeFi, this may be the real turning point.

Investors buying MSTR stock are not just buying Bitcoin; they are buying the "ability to continuously increase Bitcoin holdings in the future."

This model relies on a self-reinforcing cycle: stock price premium supports fundraising ability → fundraising used to increase Bitcoin holdings → Bitcoin accumulation strengthens the company narrative → narrative value maintains stock price premium. If the premium disappears, the cycle will be broken: financing costs rise, Bitcoin accumulation slows, and narrative value weakens.

Currently, Bitcoin reserve companies still enjoy advantages in capital market access and investor enthusiasm, but their future development will depend on financial discipline, transparency, and the ability to "increase Bitcoin holdings per share" (rather than simply piling up total Bitcoin). The "option value" that gives these stocks attractiveness in a bull market may quickly turn into a burden in a bear market.

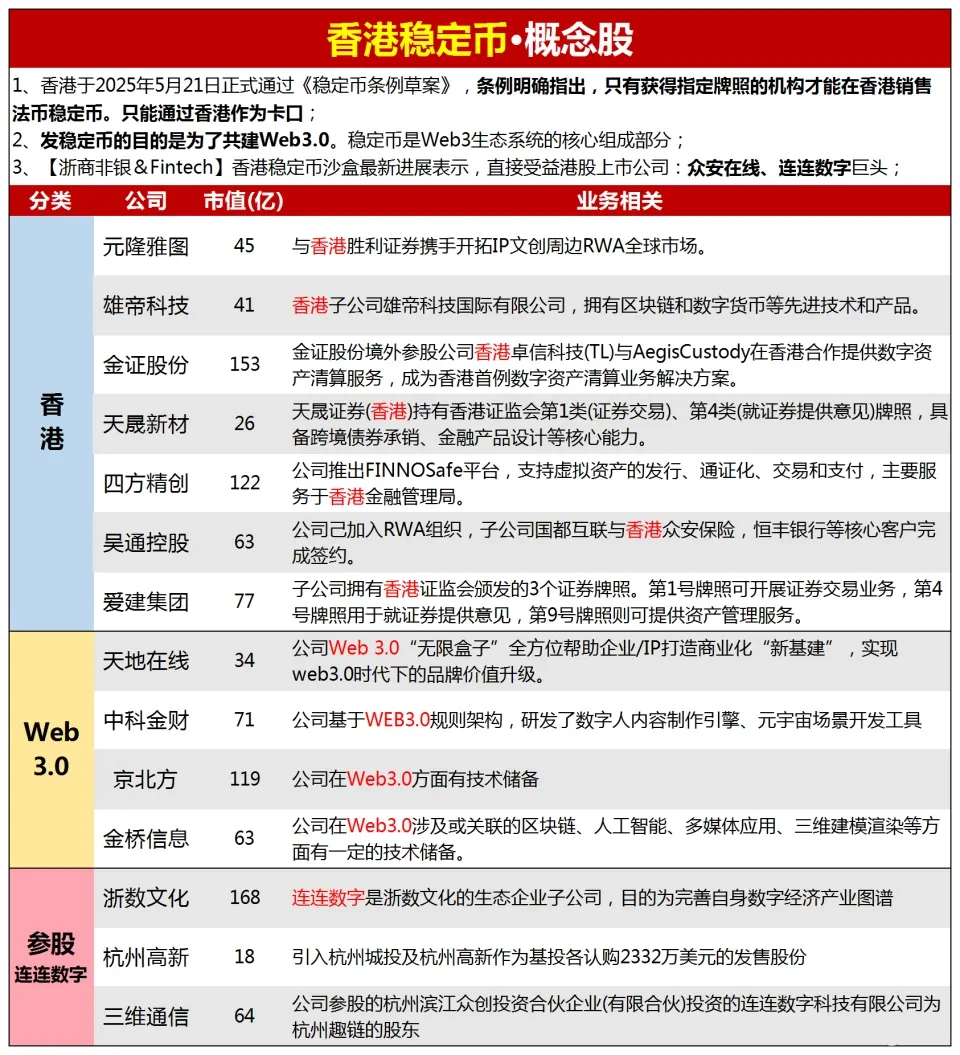

The Arrival of the Hong Kong Stock Clone Season: Can Crypto Concept Stocks Support the Bull Market?

Looking closely at the arrival of this crypto Hong Kong stock clone season, it mainly experienced three phases of emotional rises—from the initial "Circle concept stocks," to later "stablecoin concept stocks," and finally to "brokerage crypto concept stocks." However, mining for gold in Hong Kong stocks still faces issues such as increased thresholds for new listings and hard limits on funds and trading volume.

95% of surveyed VCs consider the founder or founding team the most important factor in their investment decisions, which makes sense from a risk management perspective. However, this can lead to systemic bias: favoring founders who are good at communicating with investors rather than those who excel at communicating with customers. The so-called "product-market fit" often merely attaches some revenue figures to "founder-investor fit," existing only in the boardroom.

True product-market fit is reflected in user behavior: people will use your product without prompts, feel frustrated when the product malfunctions, actively recommend your product, and be willing to pay more over time.

The most successful founders know how to create genuine product-market fit while maintaining the ability to communicate this fit to investors in a way they can understand and get excited about. This often means translating customer insights into investor language: showing how user behavior translates into revenue metrics, how product decisions create competitive advantages, and how market understanding drives strategic positioning.

The new regulatory environment provides an opportunity for entrepreneurs to redefine the reasonable relationship between tokens and equity: tokens should capture on-chain value, while equity corresponds to off-chain value. Entrepreneurs need to abandon the mindset of using tokenized governance as a shortcut to regulatory compliance. Instead, governance mechanisms should only be activated when necessary and should remain minimal and orderly. Entrepreneurs can also ensure effective governance mechanisms through customized legal frameworks and on-chain tools. Additionally, maximizing token holders' ownership of on-chain infrastructure is essential.

To address regulatory risks, tokens must be clearly distinguished from securities.

The "single asset" model (anchoring all value on-chain and belonging to the token) has two core advantages: first, it aligns the incentives of the enterprise and token holders; second, it allows entrepreneurs to focus on enhancing protocol competitiveness. With a minimalist design logic, leading projects like Morpho have already pioneered this model.

Interview with Robinhood Co-Founder: Why Are We Creating Our Own Chain?

Robinhood is moving away from being seen as a single trading tool, shifting towards a user lifecycle-centered "operating system" layout. From private equity tokenization, integrating CFTC-compliant prediction markets, launching Cortex and Strategies covering AI strategy advisory and options strategy construction, to introducing "cash delivery" style Robinhood Banking and a unified multi-chain wallet architecture, the pace of its financial expansion far exceeds traditional expectations of a FinTech company.

Also recommended: 《10 Questions with xStocks: What Are We Really Trading When We Trade US Stock Tokens?》《Interview with Tether CEO: Unveiling the "Four Stability" Vision and $14 Billion Investment Map》。

Policy

Crypto Wins Again? An In-Depth Analysis of Trump's "Big and Beautiful Act"

On the surface, the widely known provisions of the Big and Beautiful Act may weaken federal court power, severely impact the healthcare system, increase debt burdens, intensify immigration enforcement, restrict foreign investment, worsen air pollution, and raise defense budgets. Although the impact is broad, it is indeed unrelated to crypto.

However, the reality may not be so. The passage of the "Big and Beautiful" Act (OBBBA) is likely to have profound implications for the cryptocurrency and financial industries. The tax reduction policies and fiscal stimulus measures in the act create a more favorable macro environment for crypto assets. The preferential capital gains tax policy encourages investors to hold digital assets for the long term, injecting long-term funds into the cryptocurrency market and further solidifying the US's position as a global cryptocurrency hub.

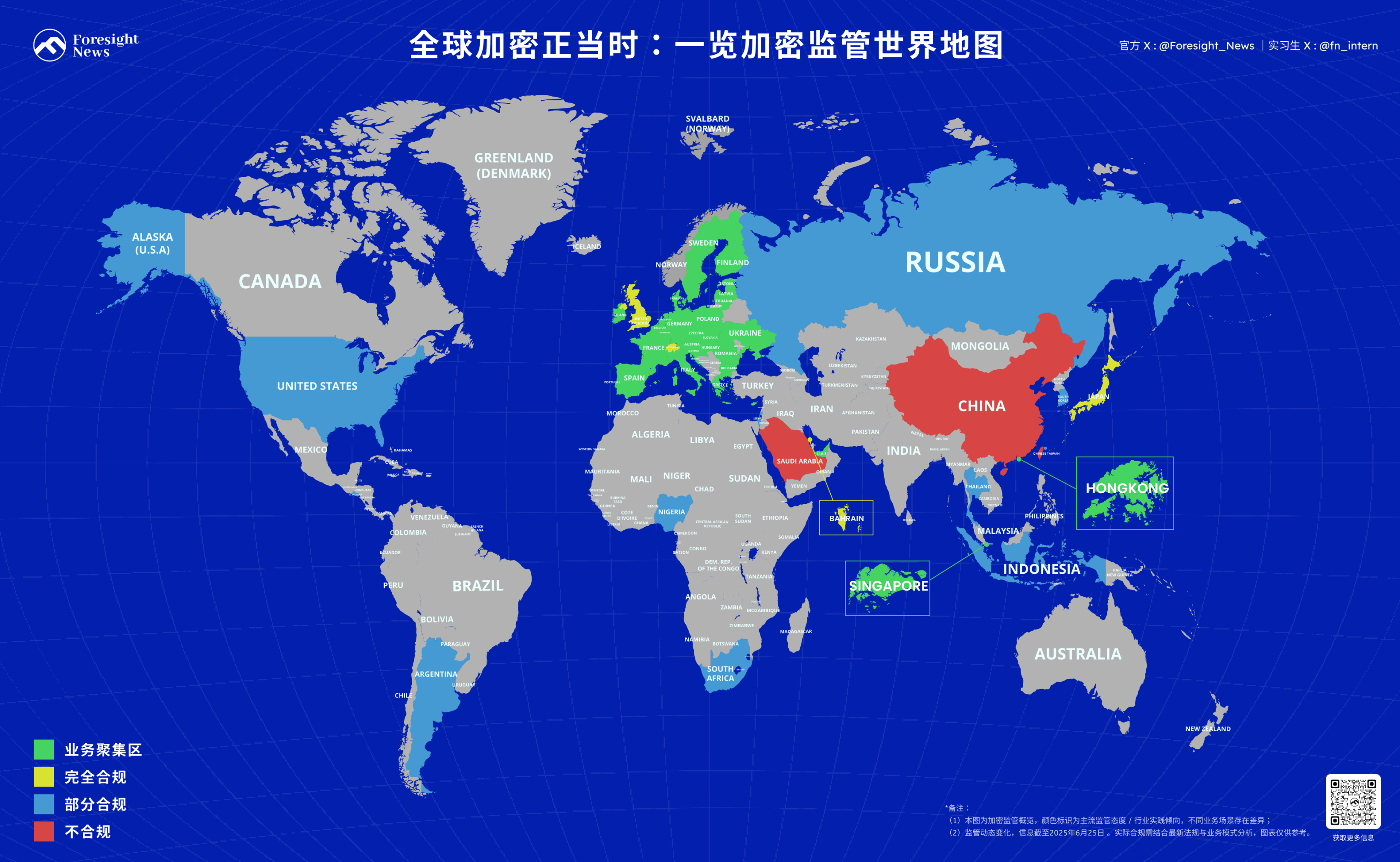

Crypto Regulatory World Map: Policies and Evolution Trends in 20+ Jurisdictions Worldwide

Airdrop Opportunities and Interaction Guide

This Week's Featured Interactive Projects: vooi trading experience, Elympics and Surf earning points

Ethereum and Scaling

Trend Research: Storm Clouds Gathering, Market Forces Will Drive ETH to Discover Value

Stablecoins are the most important underlying foundation for traditional finance to integrate on-chain, making currency programmable and decentralized, serving as the basis for the circulation and settlement of all on-chain financial assets.

The rapid development of RWA in this round benefits from institutions continuously exploring new integration methods and promoting legislation for digital asset market structure. Once the stablecoin and market structure legislation is completed, a large number of assets will be quickly pushed on-chain, with transactions, yields, and settlements operating on the native blockchain, using stablecoins as the basic currency unit and value carrier.

After a large number of assets are on-chain, DeFi will begin to play a role, integrating newly on-chained assets with increasingly mature DeFi protocols to achieve efficiency, automation, and compliance.

The process of accelerating ETH's repricing is underway: demand is surging, native crypto yield demand is accelerating, and strategic accumulation of ETH is occurring, with ETH becoming an institutional asset. The rise of ETH is not driven by the purchases or promotions of one or two institutions; it is a collective choice of mainstream institutions during a transformative layout, and the critical point of trend change is approaching.

Multi-Ecosystem

SOL ETF Approved: Who is Playing the Solana Version of MicroStrategy in the US Stock Market?

The Solana spot staking ETF launched in collaboration with REX-Osprey has been approved.

Since the beginning of this year, several publicly listed companies in the US have announced their intention to incorporate Solana into their financial strategies, even making the SOL token a core reserve on their balance sheets, including: DeFi Development Corporation (Ticker: DFDV), SOL Strategies Inc. (Canadian Securities Exchange Ticker: HODL, US OTC Ticker: CYFRF), Classover Holdings, Inc. (Nasdaq Ticker: KIDZ), Upexi, Inc. (Nasdaq Ticker: UPXI).

The ecological hotspots that have risen with the good news mainly focus on the DEX and staking tracks, such as Raydium (RAY), Jupiter (JUP), and Jito (JITO).

CeFi & DeFi

Web3 & AI

Security

A Decade-Long Cybersecurity Expert Almost Fell for It: The Latest Phishing Attacks Are Spreading

Be aware of danger signals: Coordinated false alarms create chaos and urgency, mixing short codes with regular phone numbers, requiring operations through unofficial or unfamiliar domains, unsolicited calls and follow-up communications, unsolicited emergency situations and consequence warnings, requests to bypass official channels, unverified case numbers or support tickets, mixing true and false information, using real company names in alternative solution suggestions, excessive enthusiasm without verification.

Proactive protective measures and recommendations include: enabling trading-level verification on exchanges, always contacting service providers through legitimate, verified channels, exchange customer service personnel will never ask you to move, access, or protect funds, consider using multi-signature wallets or cold storage solutions, bookmark official websites and avoid clicking links from unsolicited information, use password managers to identify suspicious websites and maintain strong passwords, regularly review associated applications, API keys, and third-party integrations, enable real-time account alerts where available, report all suspicious activities to the official support team of the service provider.

Also recommended: 《Beosin Heavyweight | Analysis of Web3 Blockchain Security Situation in the First Half of 2025》。

Weekly Hotspot Recap

In the past week, the US House of Representatives voted to pass the "Big and Beautiful" Act; Robinhood plans to launch a Layer 2 blockchain and offer "stock token" services in the EU (details); Opinion: If Robinhood succeeds, it will eliminate 90% of financial intermediaries; OpenAI angrily criticized Robinhood for tokenizing stocks without authorization (interpretation); Several tech billionaires, including PayPal co-founder and Silicon Valley venture capital giant Peter Thiel, are jointly launching a new bank called Erebor, aimed at filling the banking service gap for the cryptocurrency industry after the collapse of Silicon Valley Bank (introduction); Circle applied for a national bank charter in the US, intending to manage USDC reserves independently (details); Ripple abandons its cross-appeal against the SEC and accepts a $125 million fine, potentially bringing a long-standing legal battle to a close; Nate Geraci: The end of the Ripple-SEC dispute clears the way for a spot XRP ETF; Ripple applies for a US bank charter following Circle, planning to offer more crypto services; The L1 public chain Stable, supported by USDT, has officially launched (interpretation); The Hong Kong Stock Exchange implements a new stock trading fee structure;

In addition, regarding opinions and statements, Trump: If I had known that being the President of the United States is a "high-risk profession", I might not have run; Musk: 80% of people believe a new political party should be created; Trump: Musk knew long before he strongly supported my presidential campaign that I strongly oppose electric vehicle mandates; Cathie Wood: Bitcoin holders may be able to transfer BTC to Coinbase to mortgage for buying a house; The Wall Street Journal: Bhutan bets on Bitcoin mining; TD Cowen: maintains a "buy" rating for Strategy; Analyst: the Bitcoin bull market may end in October; Huaxia Fund Hong Kong: Predicts that future fiat currency will turn into stablecoins, with only a few universal stablecoins worldwide; JD.com: Currently, JD Coin Chain Technology has not started issuing stablecoins; Vitalik: Zero-knowledge proof identity still poses risks; FTX creditor representative Sunil: Creditors from 49 jurisdictions, including China, may lose their claims (interpretation);

Regarding institutions, large companies, and leading projects, Trump's phone T1 removed the introduction of "Made in America" and changed it to "Proudly Designed in America"; UK-listed company Cel AI has raised £10 million to purchase Bitcoin; Ethereum Community Foundation (ECF) established; Pioneer Pharmaceuticals Biotechnology plans to acquire all shares of Conflux to expand in the blockchain technology field; Hong Kong-listed company Yisou Technology plans to explore RWA tokenization products, stimulating a nearly 70% rise in stock prices; Jupiter launched its own Launchpad platform Jupiter Studio; Fragmetric has opened airdrop claims;

In terms of data, the Trump family recently profited $620 million from crypto projects; 27% of the 20-50 age group in South Korea hold crypto assets, with 70% planning to increase their investments; Bitcoin's volatility has dropped to its lowest level since 2023, a phenomenon that has only occurred 7 times in history; Analysis: Ethereum, ZKsync Era, and Aptos rank among the top three public chains for RWA assets; On June 27, Binance's Alpha trading volume of $487 million has decreased by 70% from its peak;

In terms of security, Resupply incident review: hackers remain at large, users are forced to fill the gaps, and the security incident has evolved into a racial discrimination scandal; SlowMist founder: Resupply protocol calls out hackers on-chain, hoping to communicate through Blockscan; SlowMist CISO: Security company Koi disclosed that over 40 counterfeit crypto wallet extensions appeared in the official Firefox browser plugin store; Backpack experienced a sudden failure; ZachXBT: USDC has become the main payment tool for North Korean IT workers, and Circle has not frozen related activities… Well, it has been another tumultuous week.

Attached is the Weekly Editor's Picks series.

See you next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。