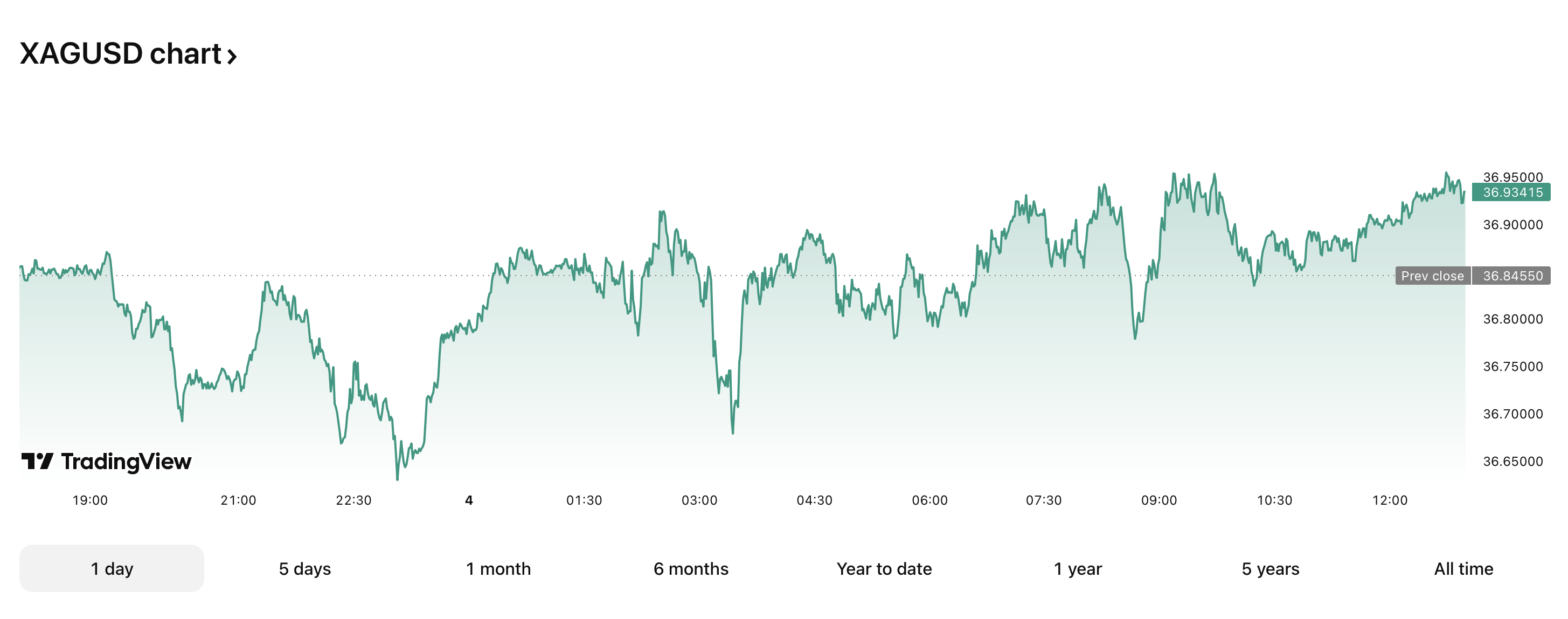

Silver is currently trading between $36 and $37 per ounce in early July 2025, based on the latest market data from JM Bullion, Tradingeconomics, and Tradingview. For silver enthusiasts, this range looks like a launchpad for big moves ahead.

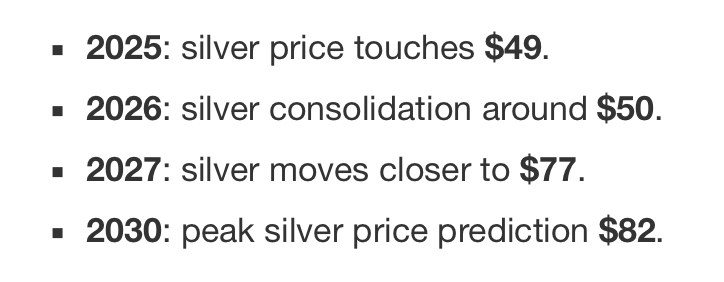

This weekend’s boldest call comes from Investinghaven, a forecasting site known for its in-depth projections. The firm now pegs silver’s target at $48.20 to $50.25 per ounce by Dec. 2025—a potential 40% jump that could put silver back within striking distance of its all-time high.

Other well-known sources are also leaning bullish, albeit with slightly tamer expectations. Coinpriceforecast, in its latest update on July 3, 2025, sees silver landing at $42.78. The brokerage Just2Trade puts its year-end target at $42.44 per ounce.

A cluster of more cautious predictions hovers around $40. These include outlooks from Citigroup, Saxo Bank, and Goldsilver’s lead analyst Alan Hibbard. Meanwhile, Priceprediction.net comes in a bit lower, forecasting $38.87 by year’s end.

Source: Investinghaven

The spread—from about $38.87 to $50.25—reflects just how unpredictable the market can be. Still, the general mood among analysts suggests upward momentum is in the cards.

Much of the optimism hinges on solid industrial demand, especially from solar panel makers and electric vehicle producers—both key players in the ongoing global shift to greener tech.

On top of that, tight supply conditions and economic stressors are adding fuel to the fire. Analysts flag persistent inflation and global political unrest as reasons investors are turning to safe-haven assets like silver.

The prediction models draw from a mix of technical analysis, economic indicators, and real-world supply-demand trends. Investinghaven, for instance, leans on decades of market research to shape its calls.

Silver has a track record of holding up when the economy gets rocky. Back in 2020, the metal rallied 47% amid a global crisis—an echo some analysts think could repeat as military tensions flare today.

While the $50.25 forecast is the highest on the board, the range of predictions suggests widespread anticipation that silver will head higher through the end of 2025, buoyed by real-world demand and economic pressures.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。