The transformation journey of stablecoins has begun.

Author: Poopman

Translated by: Deep Tide TechFlow

Stablecoins have recently become the focus of the industry, with a flurry of related news:

The passage of the Genius Act

Stripe acquires Privy and Bridge

$crcl stock price has increased 7 times from its IPO price

Plasma rapidly completes a $1 billion deposit cap

Tether becomes the 19th largest entity investing in U.S. Treasury bonds

Mastercard partners with Chainlink to allow users to purchase stablecoins on decentralized exchanges

Banks, large tech companies, and regions in Asia are rushing to launch their own stablecoins

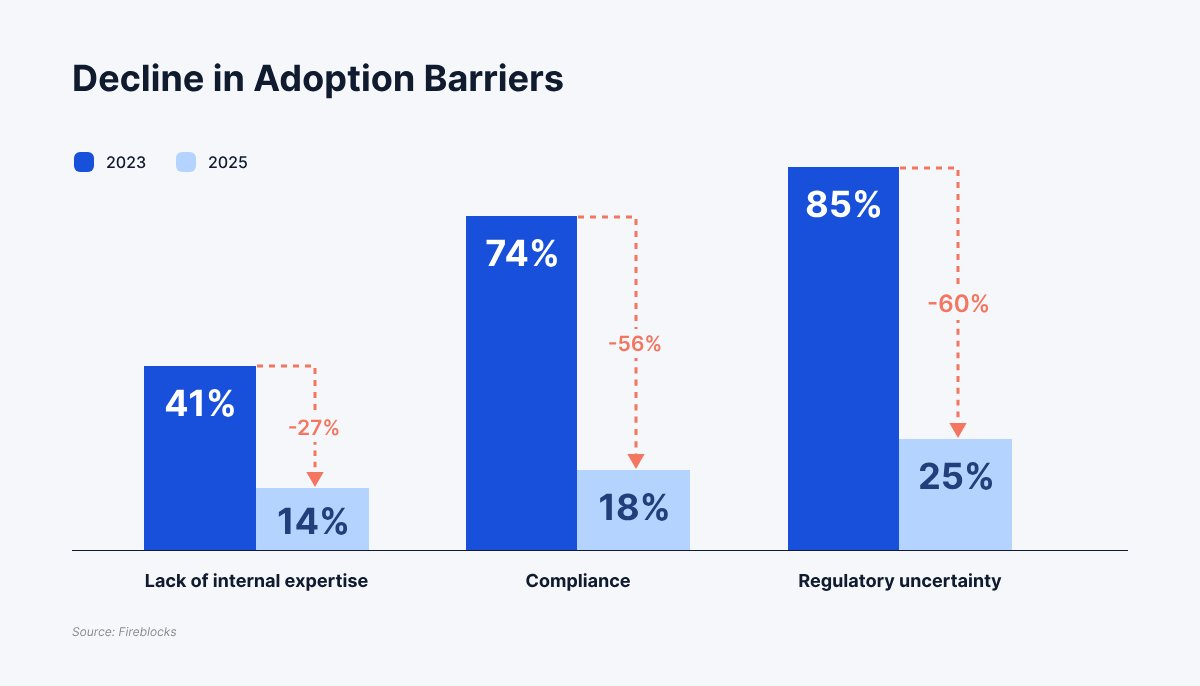

Regulatory issues, once seen as obstacles to the development of stablecoins, have now become a driving force. Practitioners in the traditional finance (TradFi) sector were previously hesitant about the stablecoin space due to a lack of understanding, consensus, and compliance tools. However, as the regulatory framework for stablecoins becomes clearer, the original resistance has turned into a catalyst.

According to data from Fireblock, the regulatory framework has increased corporate confidence in stablecoins by 80%. At the same time, 86% of companies have established stablecoin infrastructure, indicating that banks and institutions are already prepared for this shift.

Why have stablecoins suddenly become the focus of the industry?

The answer is simple: they solve real problems. The significant advantages of stablecoins include:

Instant and low-cost cross-border transactions: Providing emerging markets with permissionless access to U.S. dollars, while potentially leading to a more efficient on-chain foreign exchange market.

Driving demand for Treasury bonds: Stablecoins can increase demand for U.S. Treasury bonds, which the U.S. is happy to strengthen the dollar's dominance and sell its debt through this means.

Thanks to the public attention attracted by the Genius Act, I believe we are entering a new era—the next wave of payment-focused stablecoin applications will be driven by non-crypto-native communities, known as "mass adoption."

The Next Step for Stablecoins

As the expected growth of stablecoins in payments, cross-border transactions, and personal banking increases, related businesses will encounter numerous opportunities. Today, let's explore the next steps in the development of stablecoins.

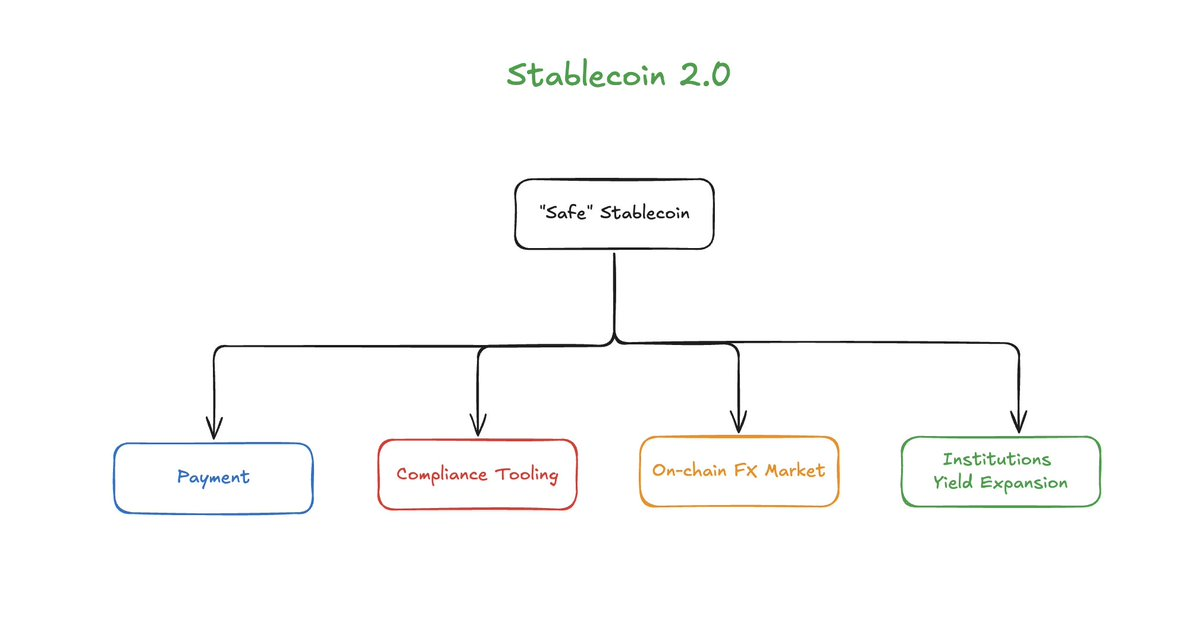

In my view, the stablecoin ecosystem may develop in the following four directions: Payments, Compliance, On-chain Foreign Exchange, Institutional Yield Expansion

Beyond Transactions: Stablecoins are moving towards mainstream markets. From now on, their uses will extend far beyond trading pairs, including payments, savings, and even new types of businesses previously constrained by T+1 settlement delays.

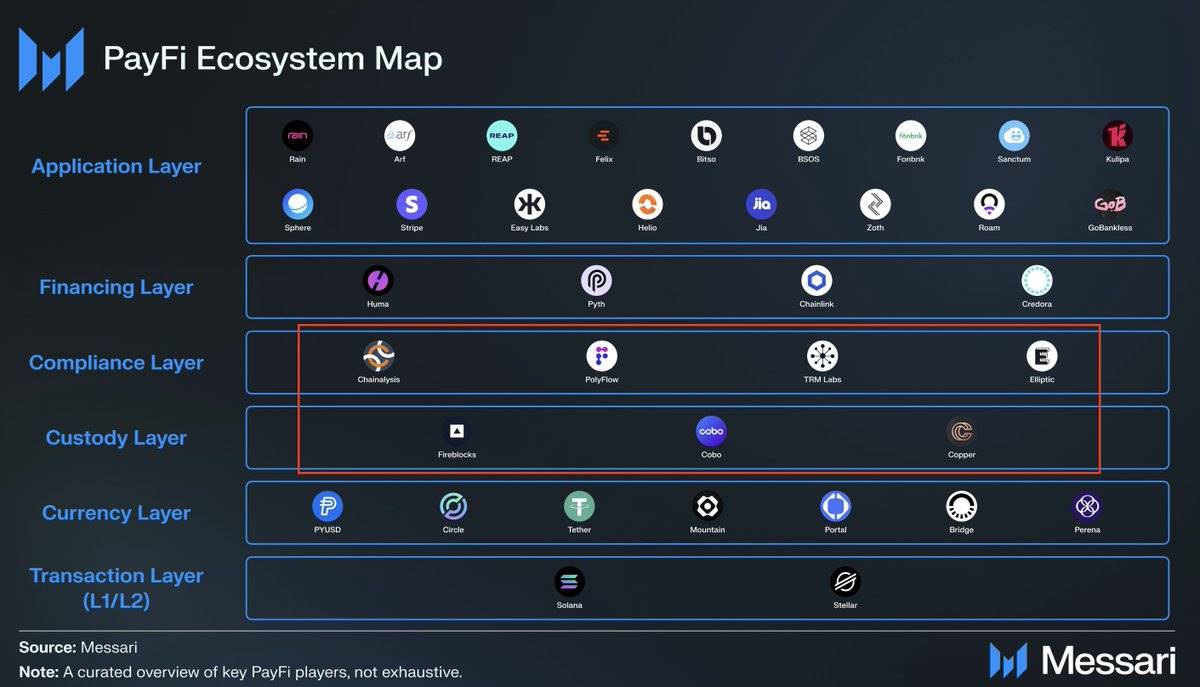

Compliance Tools: More mature and user-friendly compliance solutions (such as tax, fraud reporting, etc.) to help issuers comply with anti-money laundering (AML) and related policies.

24/7 On-chain Foreign Exchange Market: A more efficient 24/7 foreign exchange market enabling instant settlement.

Growing Demand for Yields: As the ecosystem becomes increasingly fragmented, more real-world asset (RWA) strategies, fixed-income products, and aggregation products (such as indices) will emerge.

Beyond Transactions

The mission of stablecoins is simple: to provide crypto traders with volatility hedging tools and a safe haven for holding crypto assets. Fully reserved stablecoins, represented by USDT, have become the main trading pairs on major exchanges due to their first-mover advantage. USDC follows closely as the second most popular choice. In the early stages, the core function of stablecoins was to serve trading and hedging needs.

New Trends

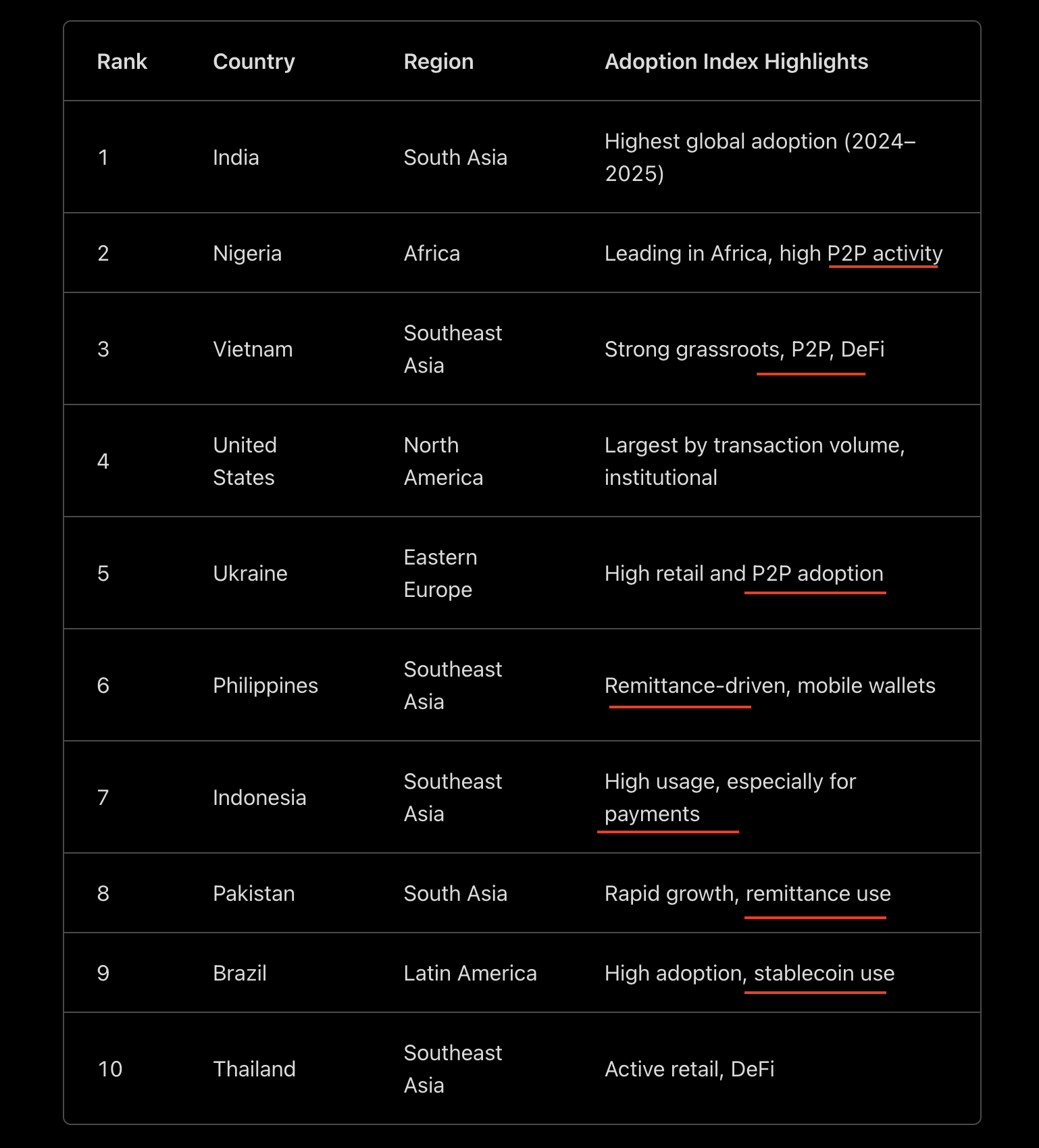

Beyond trading, payments have become another core function of stablecoins. This trend has become increasingly evident in recent years. The 2025 Cryptocurrency Adoption Index report shows that among the 10 countries with the fastest-growing crypto adoption globally, 8 of them are actually driven by peer-to-peer (P2P) trading and remittance demand.

This growth is primarily concentrated in emerging markets, where stablecoins provide a permissionless access channel to U.S. dollars—something that is often difficult to achieve in low-income countries. For businesses in these regions, dollar-backed stablecoins offer necessary protection, helping them hedge against severe fluctuations in local currencies. With increasing market confidence, I expect the adoption rate of stablecoins to further grow.

Trading View

Cross-Border Payments and E-commerce with Stablecoins

Cross-border payments are another important application scenario for stablecoins, with clear advantages: instant settlement, lower costs, greater transparency, and permissionless access to U.S. dollars. These features address the slow and opaque issues of traditional cross-border transfer systems, freeing up capital that was previously trapped for businesses.

A typical case is @ConduitPay, a cross-border payment solution supported by @dragonfly_xyz, which reports a surge in demand for their import/export business in Latin America and Africa, driving a 16-fold increase in platform transaction volume and helping them achieve an annual payment milestone of $10 billion. This growth reflects the rapidly rising demand for stablecoin solutions in the cross-border payment sector.

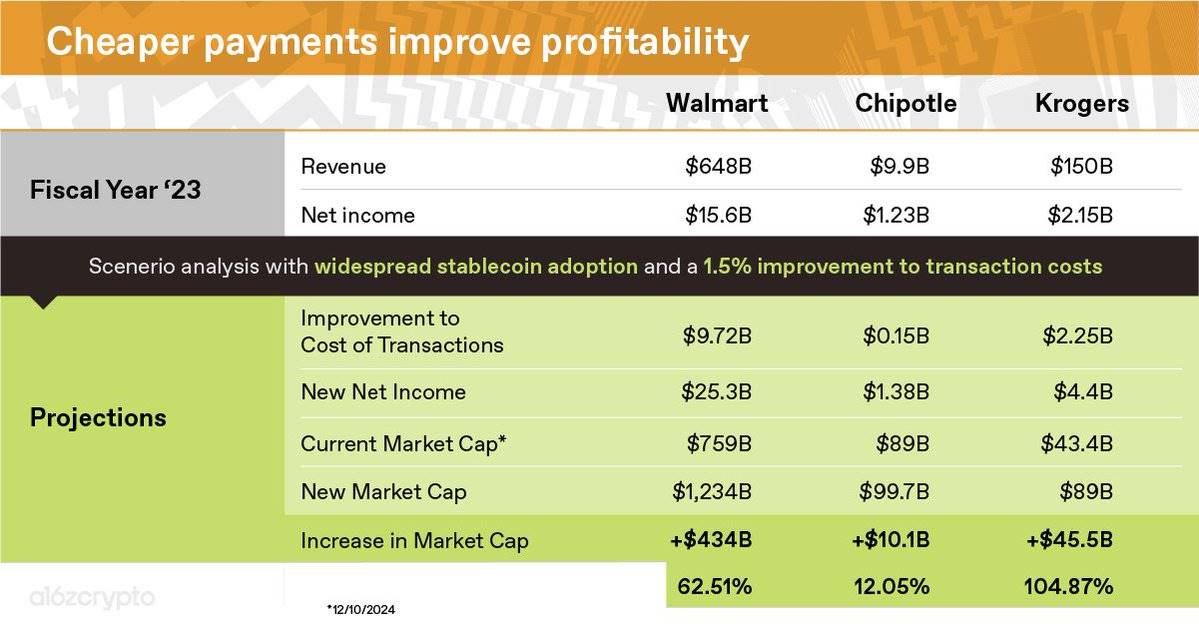

Meanwhile, the e-commerce sector is also opening new doors for stablecoins, primarily due to their ability to enhance profits for merchants and payment processors. According to data from a16z crypto, retail giants like Walmart can reduce network fees by adopting stablecoin payments, increasing revenues by up to 62%. Payment processors like Stripe can also achieve higher profit margins from stablecoin payments, which may further incentivize them to integrate stablecoin payment features.

Stablecoins are unleashing potential in cross-border payments and e-commerce, injecting new vitality into the global business ecosystem.

https://a16zcrypto.com/posts/article/how-stablecoins-will-eat-payments/

Web2 payment giants are not just watching; they have already begun to act, and stablecoin payments are about to become ubiquitous. Here are a few typical cases:

Shopify: Accepts USDC payments through Stripe.

Paypal: Launches a stablecoin pyUSD with a market value of $1 billion, which can be used as a payment channel.

Walmart and Amazon: Plan to develop their own stablecoins.

As regulatory barriers gradually dissolve, stablecoins are indeed ready for explosive growth. In the future, we will see:

A surge in cross-border stablecoin transfer volumes in emerging markets;

More payments conducted via USDC on chains like SOL/Base, using CEX wallets, Phantom, Neo banks, or fintech applications;

Stablecoin payments in the e-commerce sector driving more sales.

This stablecoin revolution has just begun.

Compliance Tools

Trust is key for businesses adopting stablecoins. With the GENIUS Act establishing a regulatory framework for U.S. stablecoin issuance, I expect the demand for compliance tools to continue to grow as new issuers enter the market.

To understand the role of compliance tools in the stablecoin ecosystem, let’s review some basics and background knowledge.

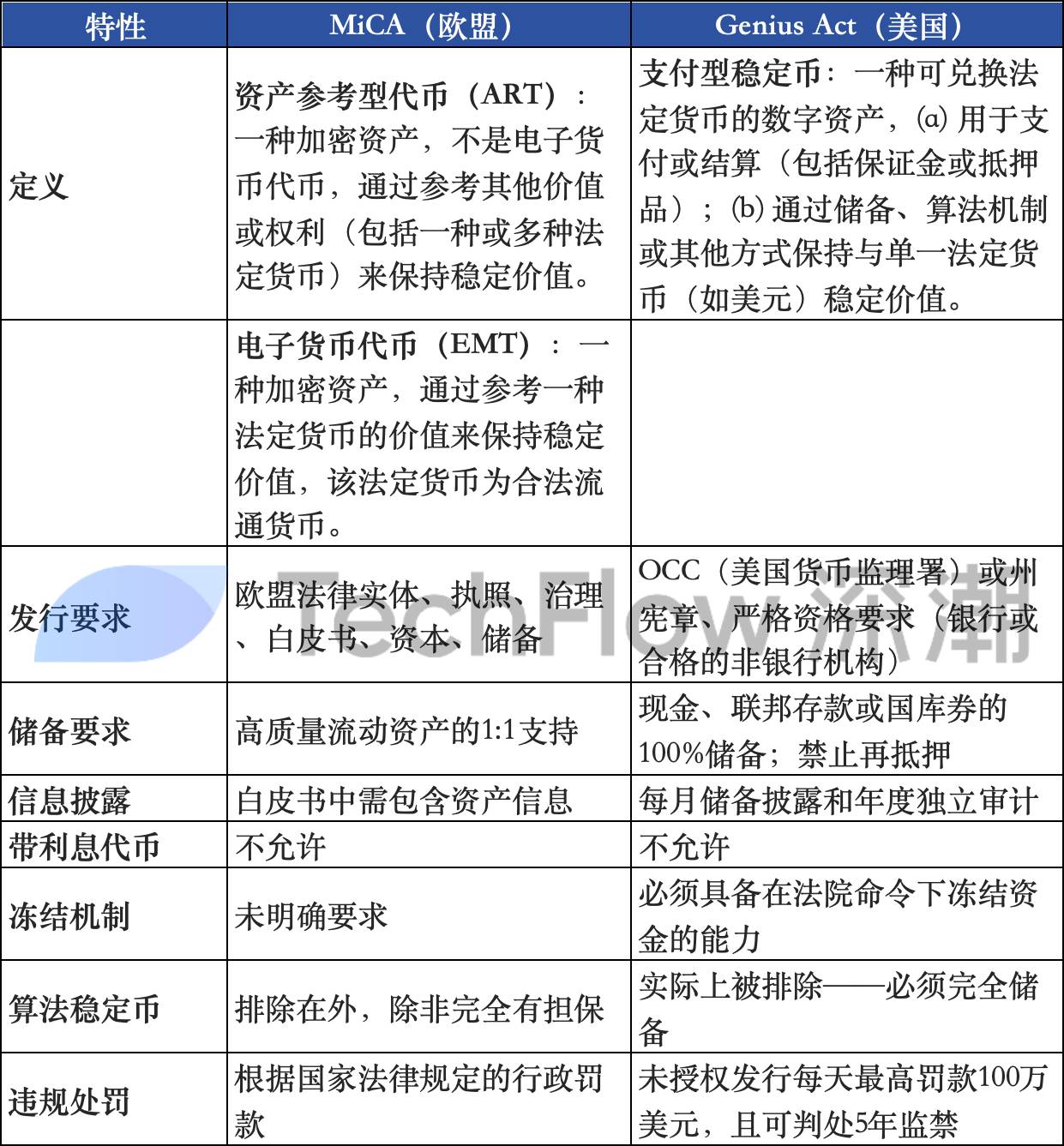

Although regulatory requirements may vary by state, two main regulatory frameworks are shaping the future of stablecoins: MICA and the GENIUS Act. Below is a table comparing these two frameworks (specific details are not elaborated in this article).

https://eu.ci/mica-vs-genius-act-2025/

The newly introduced GENIUS Act regulatory framework primarily serves two key purposes: Consumer Protection and National Security. Chainalysis summarizes this succinctly, and here are the basics:

- Consumer Protection

Reserve Requirements: Must be fully backed by highly liquid assets (such as Treasury bills with a maturity of no more than 93 days or cash).

Disclosure: Monthly public disclosure of reserve composition, redemption policies, and related fees on the official website.

Restrictions: Prohibits the use of "USG" or any "legal" currency in marketing or promotional materials.

Bankruptcy Protection: In the event of bankruptcy, stablecoin holders have priority claims.

Prohibition of Yields: Issuers cannot provide yields or interest for 1:1 backed stablecoins.

- National Security Provisions

Compliance with Bank Secrecy Act: Including anti-money laundering (AML), customer identification, transaction monitoring, record-keeping, and reporting any suspicious activities.

Technical Execution Capability: Issuers must have the ability to freeze and destroy tokens and prevent non-compliant foreign issuers from entering the U.S. market.

Coordination of Sanctions Enforcement: Before blocking foreign entities from trading, the Treasury Secretary must coordinate with stablecoin issuers as much as possible.

Businesses must have the following capabilities to become "certified" stablecoin issuers: identify, freeze, track, and publicly disclose reserves while being able to communicate effectively with affected parties.

Compliance tool providers play a crucial role in this process. For example, Chainalysis Sentinel can monitor 35 types of risky transaction behaviors in real-time. This platform provides APIs that allow issuers to freeze addresses, blacklist, halt transactions, mint, or destroy tokens when suspicious activities are detected.

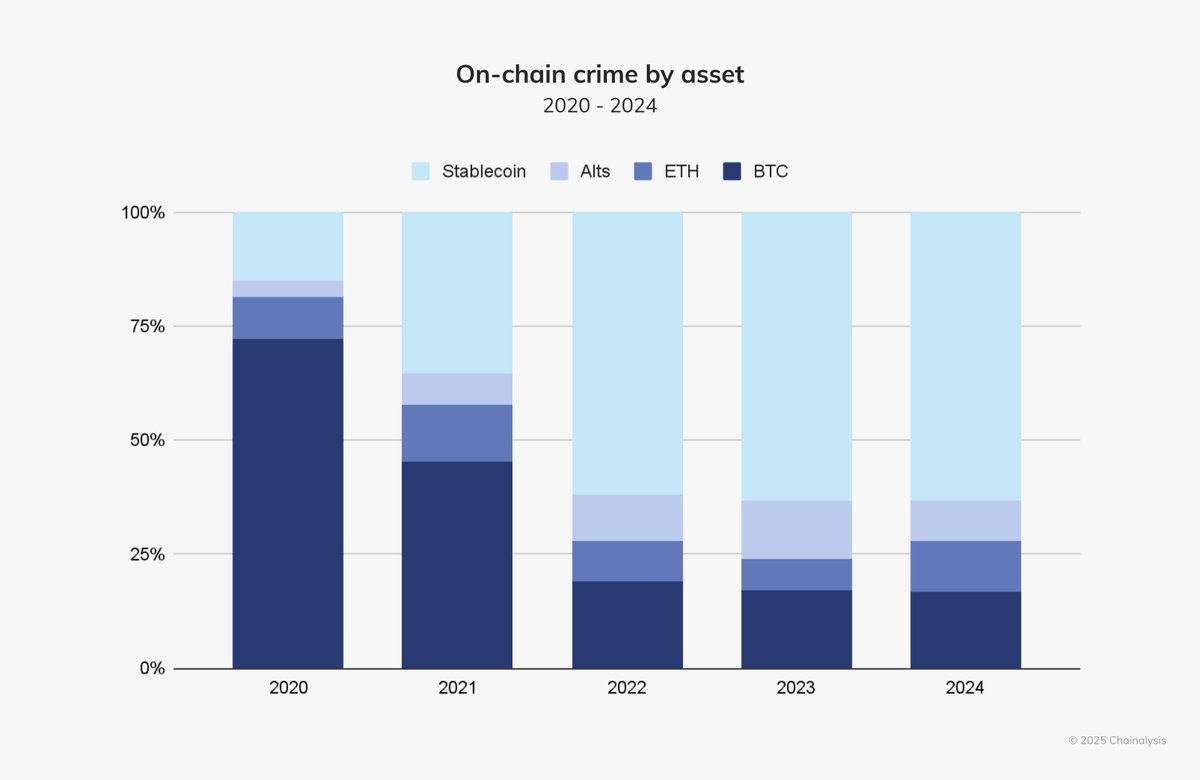

In recent years, the importance of compliance layers for stablecoins has become increasingly prominent. Some sanctioned entities, unable to access U.S. dollars through traditional banking systems, have begun to turn to stablecoins as a medium for fund transfers.

Additionally, due to the stable prices of stablecoins, funds from fraud and money laundering are also partially stored in stablecoins. Data shows that the proportion of stolen funds stored in stablecoins has surged from 20% a few years ago to over 50% today.

For this reason, a robust compliance layer is crucial for the stablecoin ecosystem. It can help identify, filter, and report suspicious transactions, providing the confidence that businesses and new users need in the system.

Chainanalysis Crime Report

The application of compliance tools is not limited to existing infrastructure; all platforms involved with stablecoins need to gradually transition to compliance-friendly models.

For example, Coinbase recently acquired Liquifi Finance. Liquifi is a platform that handles token ownership, airdrops, and even payroll in the form of stablecoins. They have begun to provide tax reporting tools and ensure that their tools comply with the regulatory requirements of different countries.

Similarly, Fireblocks has developed a suite of tools similar to Chainalysis, but with more features, including configurable compliance policies, integrated KYT (Know Your Transaction), AML (Anti-Money Laundering), and travel rule compliance functions. Additionally, other industry participants such as TRM Labs, Elliptic, and Polyflow are also building compliance layers for stablecoins.

As stablecoins are applied and popularized globally, compliance tools will become the cornerstone of industry development. They can not only address the challenges of sanctions and illegal funds but also provide a solid trust foundation for the widespread adoption of stablecoins. The compliance ecosystem for stablecoins is rapidly evolving and will become safer and more standardized in the future.

On-chain Foreign Exchange Market

With U.S. regulators approving the use of stablecoins, more countries are bound to follow suit, promoting the digitization of stablecoins and their national currencies. This transformation will naturally give rise to the on-chain foreign exchange market (Onchain FX Market), bringing two significant advantages: a 24/7 market and increased retail participation due to high accessibility.

In my view, the on-chain foreign exchange market can be divided into two main levels: issuers and trading platforms. To simplify the discussion, we will not address the conversion between fiat currencies and stablecoins (on/off ramp), as this topic requires separate analysis based on the specific circumstances of different countries.

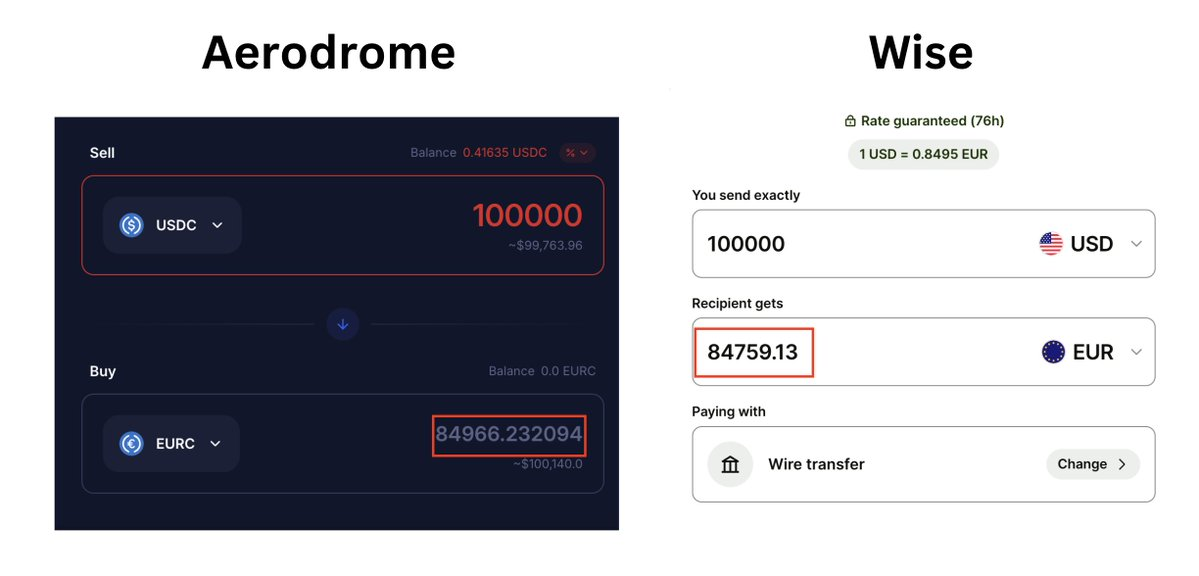

Currently, U.S. dollar stablecoins dominate the market, accounting for 99.79% of the share, while euro stablecoins (EURC) only account for 0.2%. Major non-dollar asset issuers include Circle, Paxos, and Tether. However, in the near future, compliant banks and institutions may also launch their own stablecoins, bringing more options to the market.

As demand changes, the market for non-dollar stablecoin trading is gradually expanding. Most dollar/non-dollar transactions occur on automated market maker (AMM) platforms, particularly Aerodrome and Pancakeswap. Notably, exchanging USDC for EURC on Aerodrome is even more competitive than the rates offered by traditional cross-border payment platforms like Wise—even when considering slippage and transaction fees (excluding the costs of converting fiat to stablecoins), the exchange cost on Aerodrome is still about 30 basis points cheaper.

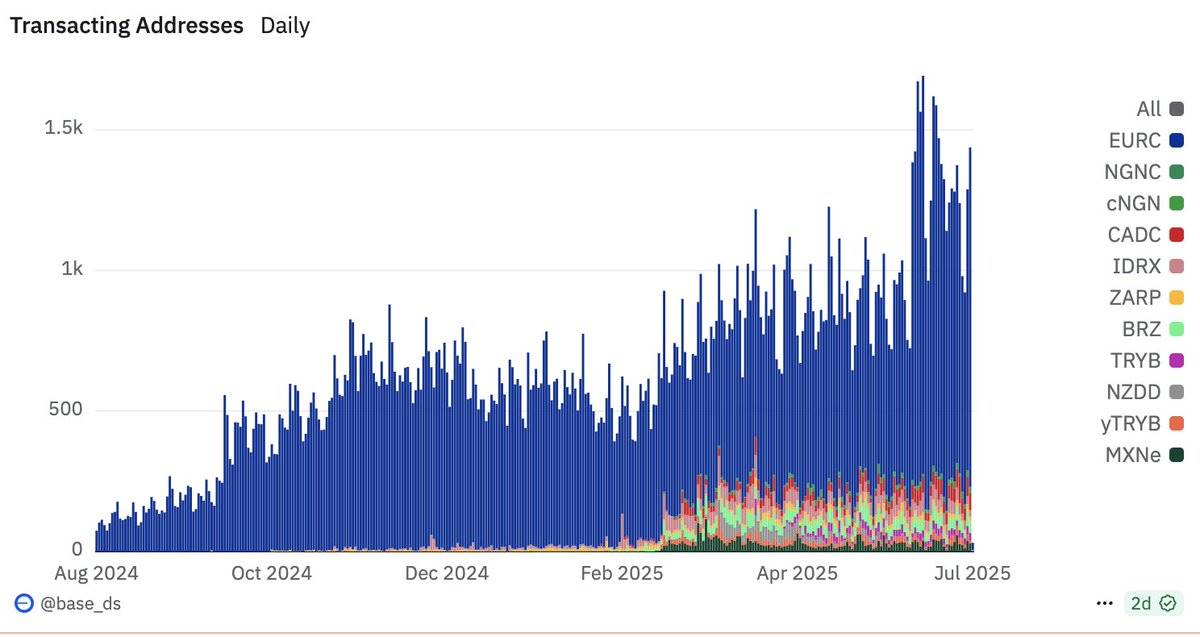

Due to competitive exchange rates and economic uncertainties (such as the impacts during the Trump era), we are beginning to see a growth trend for EURC, with its daily active addresses doubling from 600 in February of this year to 1,300. At the same time, new stablecoins such as the Canadian dollar (CAD) and Brazilian real (BRZ) are also entering the market. Although their current market share is small, they have begun to establish influence.

With the digitization of the global economy and the compliance of stablecoins, the on-chain foreign exchange market is expected to become an important complement to traditional financial markets. It can not only provide 24/7 trading services but also attract more retail users to participate, further promoting the digitization of global currencies and improving circulation efficiency. The future of stablecoins will not be limited to the U.S. dollar but will gradually expand to include more national currencies, achieving true globalization.

On-chain Foreign Exchange Market

As stablecoin issuers (such as Tether, Circle, Paxos), banks, and fintech companies promote the adoption of stablecoins, some on-chain projects are also attempting to integrate "DeFi" elements into the foreign exchange trading space, driving innovation.

For example, Injective offers a 24/7 market and supports trading in euros (EUR) and pounds (GBP) with leverage of up to 100 times; while MentoLabs utilizes CDP (Collateralized Debt Position) technology, allowing users to hold underlying assets while achieving multi-currency exposure. These innovations not only provide users with more trading opportunities but also open up new yield farming avenues.

Despite the promising outlook for the on-chain foreign exchange market, it currently faces two major obstacles:

Insufficient on-chain liquidity: Currently, on-chain liquidity remains relatively thin, with the largest single pool containing only about $1.3 million in EURC, which is clearly not healthy for large-scale trading.

Conversion friction between fiat and stablecoins: The inefficiency of converting between fiat (banking systems) and stablecoins remains a major barrier for the on-chain foreign exchange market to compete with traditional foreign exchange systems.

The Era of High-Yield Stablecoins

Whether in DeFi or personal finance, the yield market for stablecoins is becoming a focal point in the crypto space. In the future, anyone holding USDC may consider how to generate returns on idle capital. Although regulations primarily benefit payment-type stablecoins, the growth of yield markets driven by stablecoins is also significant.

In the past year, yield-bearing stablecoins (YBS) such as Ethena and Sky have seen their market capitalization grow sixfold to $6 billion. Meanwhile, the demand for leveraged exposure and yield farming has become a major catalyst for lending protocols (such as Aave, Euler, and Syrup) to reach all-time highs in total locked value (TVL).

Looking back at DeFi summer, we enjoyed high returns brought by flywheel token economic designs, but their sustainability often depended on the token price itself. When token prices fall, protocols may stop operating or even collapse entirely.

With the success of Ethena, the CeDeFi (a combination of centralized and decentralized finance) model is gradually gaining popularity. Depositors lend stablecoins to teams, who generate actual trading returns through off-chain strategies. This model has opened the prosperous era of YBS, where projects create returns by running both on-chain and off-chain strategies. While this approach frees itself from the limitation of token prices being the sole reason for protocol usage, it also reduces the value accumulation of the tokens themselves.

Currently, the most common yield generation strategies in the market mainly take three forms:

Short-term Treasury bills (T-bills)

Delta-neutral strategies

Money market strategies

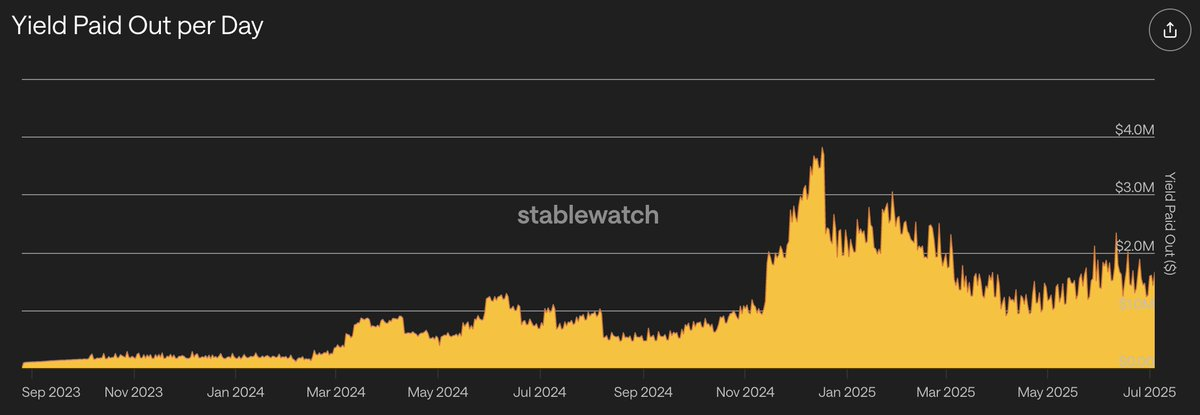

While there are many other strategies, these are considered the "classic yield" methods that have been validated in the market. Yield-bearing stablecoin strategies generate approximately $1.5 million in returns daily, and this trend continues to show healthy growth.

RWA Strategies and Money Markets

Yield-bearing stablecoins (YBS) are just the tip of the iceberg.

In the next phase of the yield market, traditional finance (TradFi) RWA (real-world asset) strategies combined with DeFi elements (such as circular investments) will attract significant interest from institutions and funds.

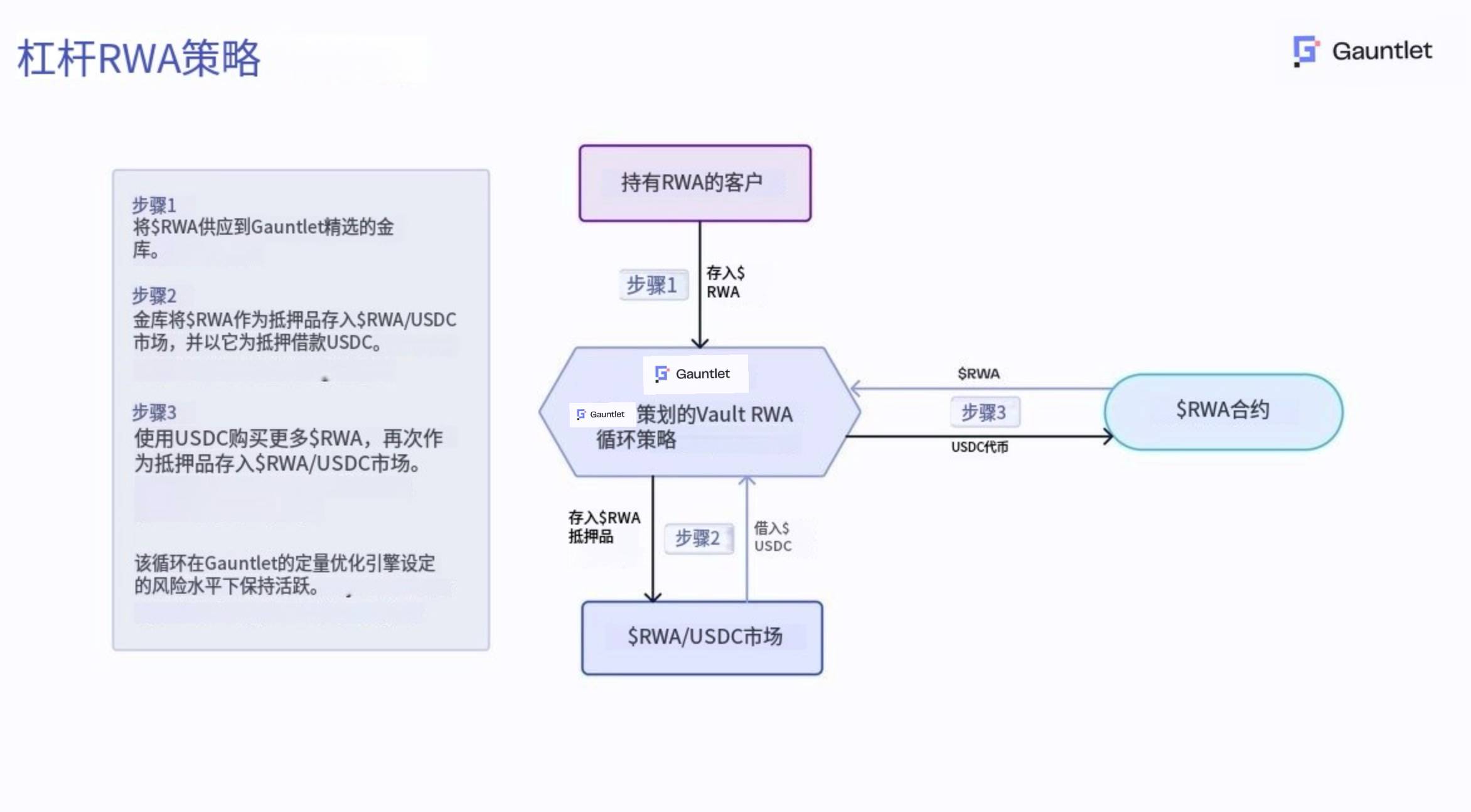

For example, in a recent case: ACRED (Apollo Diversified Credit Securitize Fund) investors can deposit $ACRED into the Morpho Blue market and use it as collateral to borrow USDC. Borrowers can then reinvest the borrowed USDC back into ACRED, creating a leveraged cycle. In this setup, ACRED investors enjoy leveraged returns, while USDC providers (retail users or funds) earn interest paid by ACRED.

Here is a great example provided by Gauntlet and @redstone_defi.

RWA Strategies

This is just one example. As traditional financial institutions gradually realize that they can bring complex yield strategies and asset tokenization products on-chain and borrow stablecoins in the process, the market size is expected to continue expanding. As long as the underlying assets (such as USCC with an annual yield of 7.7%) can provide sustainable and attractive returns for qualified investors, the market potential is virtually limitless.

This new source of yield is generated by tokenized RWA assets and relies on leverage for expansion.

However, for new users, directly providing liquidity for different strategies may seem complex. Therefore, I believe the most suitable vault platforms for setting up these strategies include:

@upshift_fi

@MorphoLabs

@eulerfinance

@veda_labs

@maplefinance

@NestCredit

These platforms are working hard to maintain compliance while meeting institutional demands. However, the legal guidance surrounding these products remains unclear, and legal and compliance risks continue to be one of the main obstacles.

Fragmentation

As the number of yield strategies and projects increases (with over 50 projects and growing daily), the market is becoming increasingly complex and fragmented.

New users often do not know where to deploy stablecoins for optimal yields, nor do they understand how to allocate their portfolios based on risk adjustments. Additionally, many excellent strategies lack public exposure and urgently need more attention.

In this context, an aggregation platform or a unified "yield" page (preferably with a risk disclosure dashboard) could connect yield farm users with robust yield strategies.

We need a product similar to Binance Earn, but on-chain, with higher transparency and detailed risk disclosures.

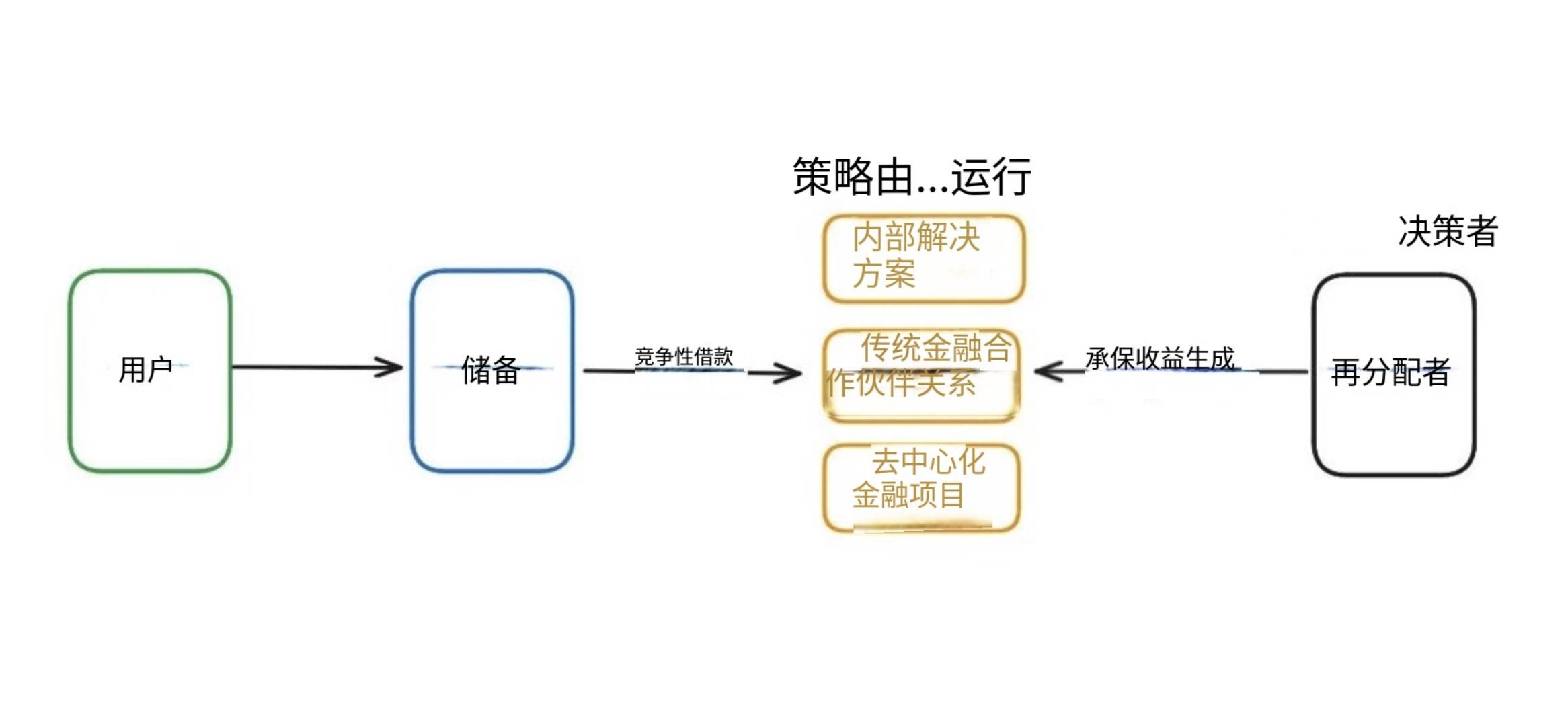

Currently, projects like @capmoney, @Perena, and strategy curator @gauntletxyz are building such aggregation platforms. These platforms abstract complex yield strategies, helping users easily find, manage, and deploy funds for yield farming. Users can access the best yields (whether on-chain or off-chain) with just "one click," paying only a small management fee.

Cap Money

Cap Money integrates all top on-chain and off-chain yield strategies on the megaeth platform, unifying their exposures into a single stablecoin or pegged asset. This asset is not only compatible with any DeFi protocol but also achieves high composability.

The allocation of funds depends on the performance of the strategies, forming a self-reinforcing market where only the most competitive yield strategies can survive. This mechanism ensures that capital flows to the best-performing strategies, optimizing the user yield experience.

However, the widespread adoption of stablecoins relies on trust mechanisms. To this end, Cap Money has created a new market that allows asset holders (restakers) to delegate their assets to strategy providers through EigenLayer, providing "trust" for stablecoin holders. In return, these asset holders receive a portion of the yield to compensate for the trust they provide.

A very interesting idea that can "safely" aggregate yields.

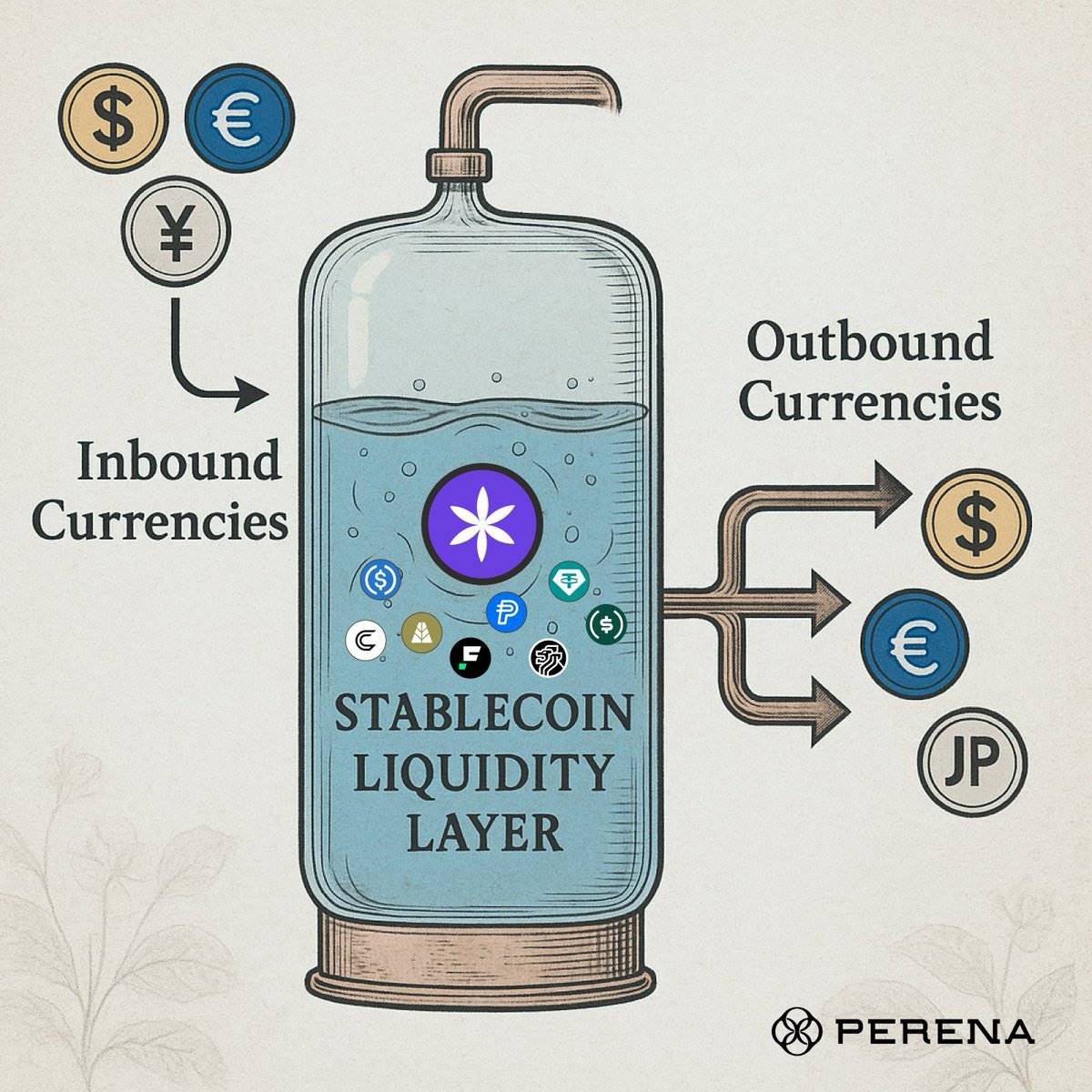

Perena

SOL is known for its fast and low-cost transactions, making it an ideal blockchain for everyday stable payments and the on-chain foreign exchange market.

Perena leverages the high-speed, low-cost advantages of the SOL blockchain to build a unified stablecoin liquidity layer—StableBank. By integrating the on-chain liquidity of branded stablecoins such as USDC, USDT, PYUSD, BENJI, and AUSD into an automated market maker (AMM) and representing it with receipt tokens USD*, Perena provides optimal exchange rates for stablecoin swaps on the SOL chain.

In the upcoming Perena v2, they will introduce smart routing features that scan all liquidity pools and over-the-counter (OTC) platforms to ensure users receive the best exchange rates (even including non-SOL chains). Additionally, Perena will support multiple currencies (such as EURC, GBP, etc.) and cross-chain exchange functions, preparing for the large-scale adoption of stablecoins.

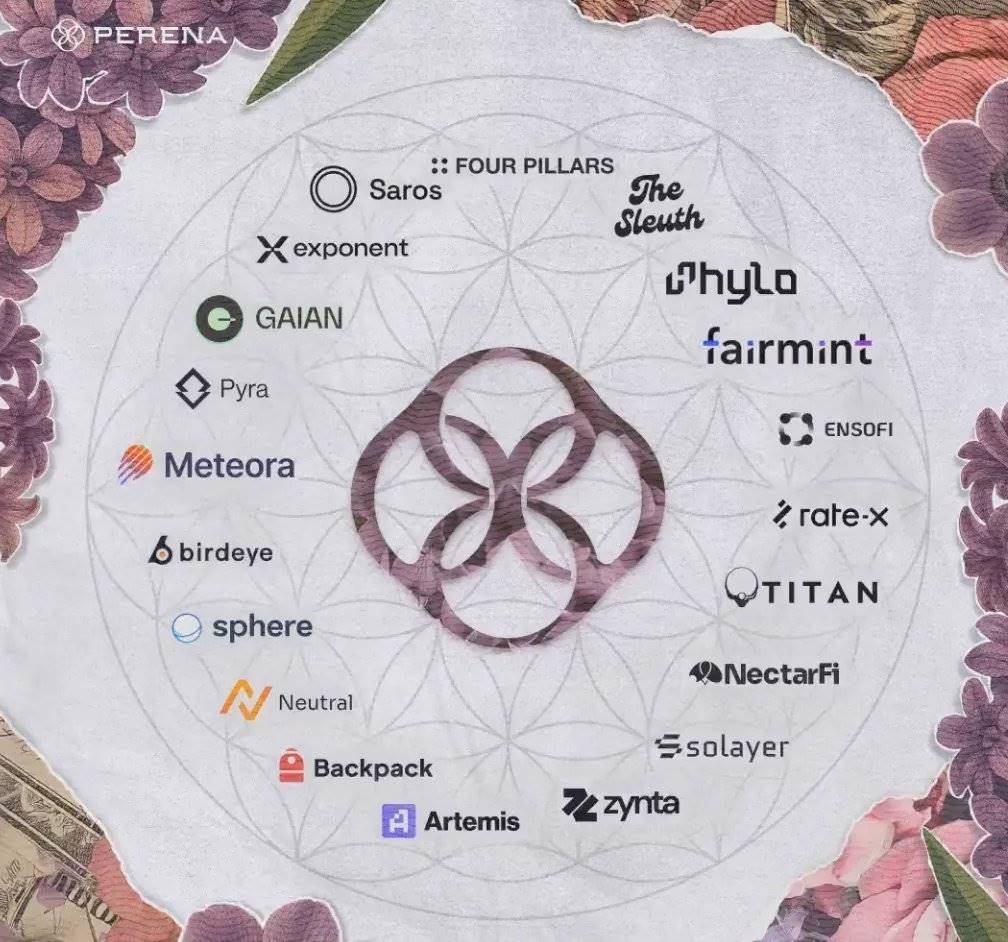

But USD is not just an exchange engine; it is also a platform that combines savings and yields. By collaborating with over 20 projects, Perena's StableBank network offers USD holders the best yields and strategies, connecting strategies that need public attention with stablecoin farm users seeking yields through a single interface.

Stablecoin Network

Gauntlet USD Alpha

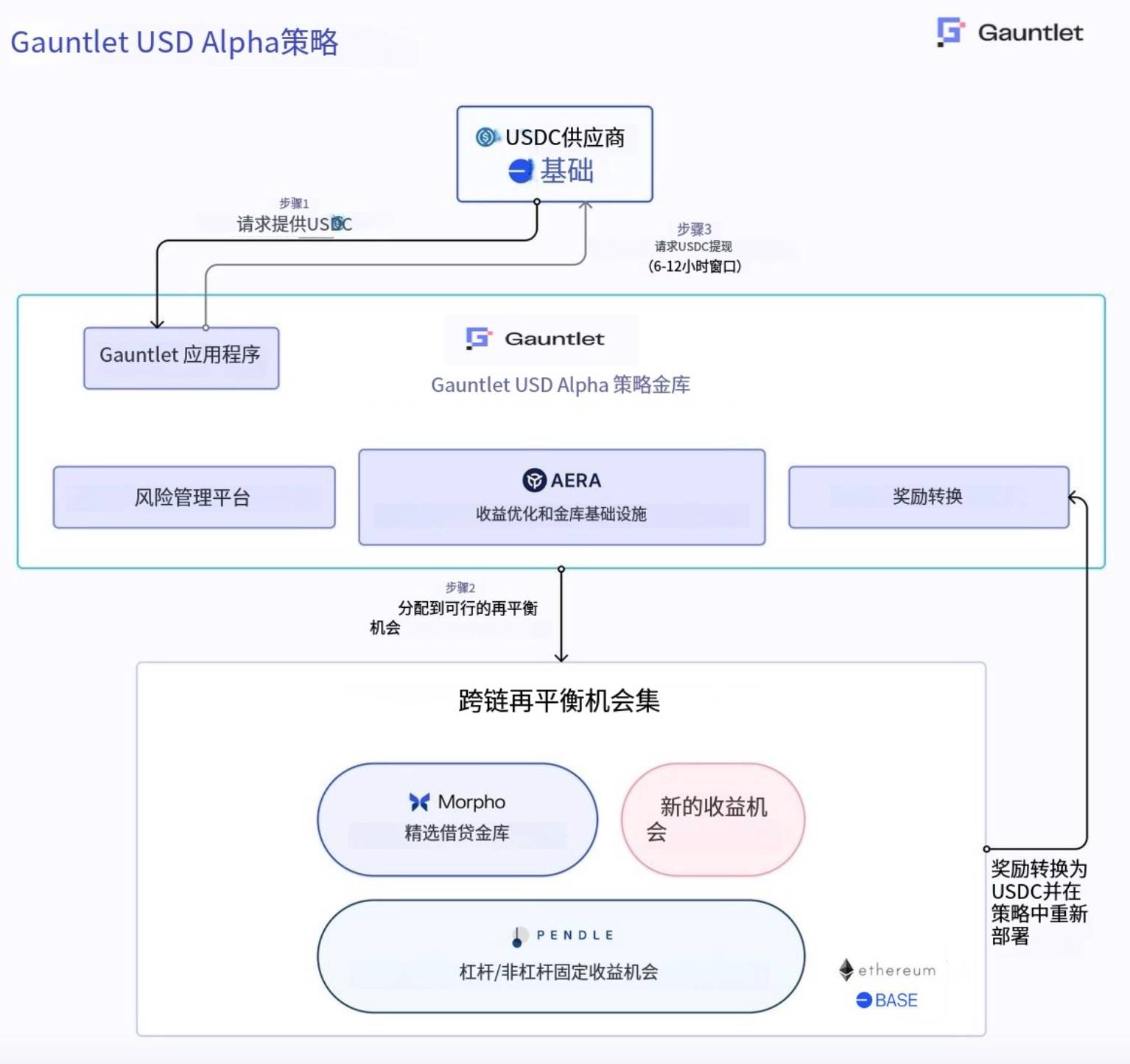

Gauntlet USD Alpha ($gtUSDa) is a new product launched by the Gauntlet team, implementing off-chain strategies on-chain through the vault infrastructure developed by Aera Finance. This vault is managed by a "Guardian" (designated executor) and aims to help users achieve on-chain yield goals.

The core goal of Gauntlet USD Alpha is to dynamically allocate depositors' stablecoins to the highest-yielding lending markets and automatically adjust positions based on risk guidelines.

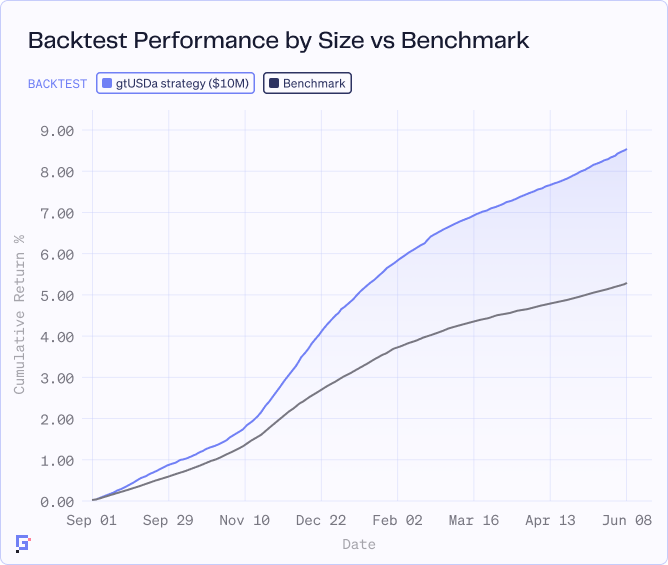

In backtesting, Gauntlet's risk-adjusted strategy based on Morpho outperformed the benchmark yield of Vaults.fyi (7.76% Alpha yield vs. 4.46% benchmark yield). Currently, the vault is live and generating a 7.2% yield, primarily allocated to $midasUSD and $gtusdcf.

Gauntlet USD Alpha provides an efficient platform for passive farm users seeking risk-adjusted yields by abstracting complex yield discovery and risk management. This innovation not only optimizes stablecoin yield strategies but also promotes transparency and user-friendliness across the entire DeFi ecosystem.

Disclaimer: The author has invested in Cap and Perena.

Conclusion

Stablecoins are experiencing unprecedented development opportunities, becoming an important part of the global financial ecosystem.

As regulatory frameworks improve, the mainstreaming of stablecoins is accelerating. For example, the Genius Act has provided a clear compliance framework for traditional finance (TradFi), fintech, and payment systems, enhancing their confidence in integrating with stablecoins.

At the same time, emerging countries will continue to adopt stablecoins for cross-border transactions and U.S. dollar exposure management. Additionally, more countries are beginning to tokenize their currencies, which will naturally form a 24/7 foreign exchange market compatible with DeFi.

For more ambitious enterprises, on-chain stablecoin liquidity supports the implementation of real-world asset (RWA) strategies (such as circular investments), while retail users can earn yields by providing liquidity. Furthermore, the large-scale adoption of stablecoins will stimulate demand for on-chain personal finance, driving the growth of yield-generating products.

Projects like Cap, Perena, and Gauntlet are working to address the fragmentation issues within the stablecoin ecosystem, providing users with more efficient and centralized solutions.

Today, stablecoins are no longer "just another internet currency"; they have become a powerful testament to the integration of blockchain technology with the real world—achieving 24/7 instant settlement.

The transformative journey of stablecoins has already begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。