In July 2025, the Office of the Special Task Force for the Prevention and Crackdown on Illegal Financial Activities in Shenzhen issued a notice warning the public to be vigilant against the risks of illegal fundraising conducted under the guise of "stablecoins" and "digital assets." The notice emphasized that such activities may involve illegal fundraising, fraud, money laundering, and other criminal activities, posing a threat to economic financial order and public safety. This article will analyze the risks of stablecoins in illegal fundraising, regulatory measures, and industry background in conjunction with relevant announcements and authoritative information from Shenzhen, aiming to provide the public with rigorous and factual references.

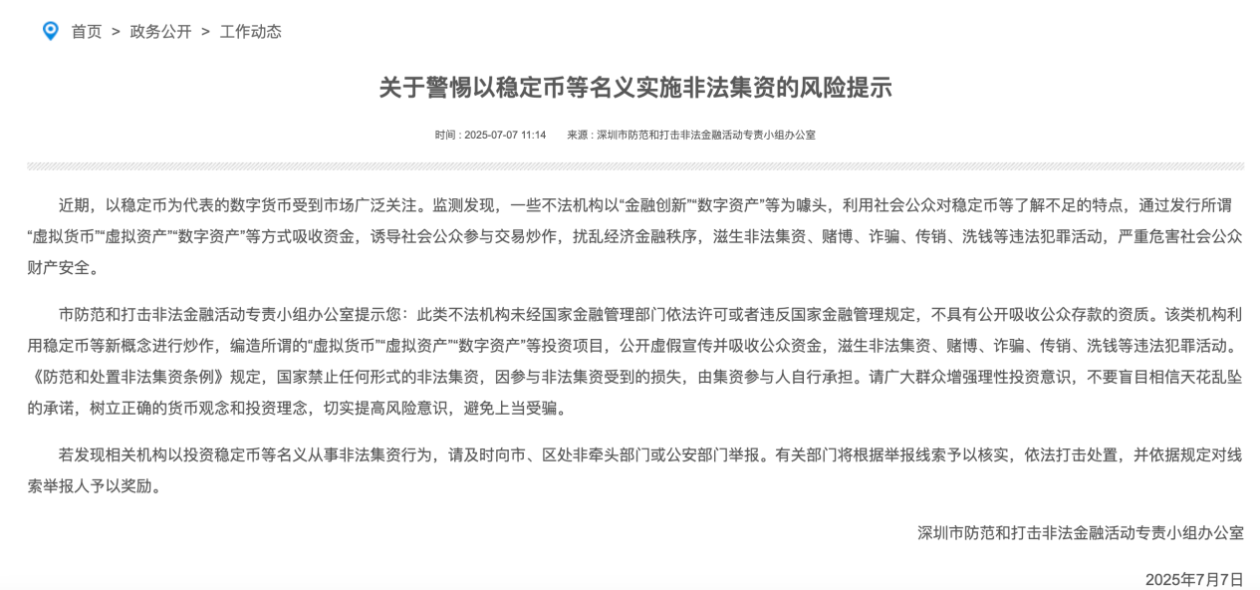

Warning from the Shenzhen Special Action Office

According to the announcement from the Office of the Special Task Force for the Prevention and Crackdown on Illegal Financial Activities in Shenzhen, some illegal organizations have recently been illegally absorbing public funds under the pretext of "stablecoins" and "digital assets," suspected of illegal fundraising, fraud, and money laundering. Most of these organizations have not obtained permission from financial regulatory authorities and exhibit high-risk characteristics, such as promising "capital preservation with high returns," using new concepts like "blockchain" and "virtual currency" to package projects, holding promotional events, or displaying false "government approvals" to attract investments, ultimately leading to investors losing all their money due to broken funding chains or fleeing with the funds.

The announcement specifically pointed out that stablecoins play a core role in these illegal activities. Because their value is usually pegged to fiat currencies or other assets, stablecoins are exploited by criminals to create a false impression of "low risk and high returns," enticing the public to invest. The Shenzhen special task force urged the public to enhance their risk awareness, approach investment opportunities involving stablecoins with caution, and encouraged reporting of related illegal activities to maintain legitimate financial order and public safety.

Risks of Stablecoins in Illegal Financial Activities

Stablecoins, as a type of cryptocurrency aimed at maintaining value stability, have garnered attention due to their potential applications in cross-border payments and transaction settlements. However, their anonymity, decentralized characteristics, and cross-border liquidity also make them tools for illegal fundraising, money laundering, and other criminal activities. Jordan Wain, a policy advisor at Chainalysis, pointed out, "Stablecoins remain the most prominent type of on-chain crypto crime." Criminals exploit the characteristics of stablecoins to attract investors through false project promotions and promises of high returns, often involving pool operations or Ponzi schemes, ultimately leading to significant losses for investors.

For example, some illegal fundraising activities use buzzwords like "blockchain" or "tech coins," claiming that investing in stablecoins can achieve "only gains, no losses," attracting investors lacking professional knowledge. Such scams typically follow these steps: first, attract attention through high-profile project packaging; second, create hype through promotional events or false qualifications; third, allow investors to taste "sweetness" through initial dividends, inducing larger investments; finally, the funding chain breaks or the perpetrators flee. These actions not only disrupt financial order but may also trigger social instability.

Regulatory Background of Cryptocurrency in China

The regulatory history of cryptocurrency in China provides important context for current measures. Since 2013, the People's Bank of China and other departments have issued notices prohibiting financial institutions from providing services for Bitcoin, clearly stating that it does not have the status of legal tender. In 2017, regulatory authorities further halted initial coin offerings (ICOs) and the operation of domestic cryptocurrency exchanges. The 2021 notice on "Further Preventing and Addressing Risks of Virtual Currency Trading Speculation" explicitly prohibited activities related to virtual currencies, emphasizing their nature as illegal financial activities. As of 2025, China's regulation of cryptocurrencies has tightened further, completely prohibiting the holding and trading of virtual assets like Bitcoin, reflecting ongoing vigilance against the potential risks of digital assets.

Against this backdrop, the warning regarding stablecoin risks in Shenzhen is an important part of the national campaign to prevent illegal financial activities during the month of June 2025, aiming to curb the spread of illegal financial activities through a combination of education and law enforcement. The National Financial Supervision and Administration also emphasized at the 2025 regulatory work meeting that it will continue to focus on risk prevention, strong regulation, and promoting development, firmly maintaining the bottom line of preventing systemic financial risks.

Global Trends and Insights in Stablecoin Regulation

Globally, stablecoin regulation is becoming a hot topic. In May 2025, Hong Kong passed the "Stablecoin Regulation Bill," becoming the first region in the world to establish a special regulatory framework for fiat-pegged stablecoins (FRS). The bill balances innovation and risk prevention by clarifying the "payment tool" nature of stablecoins, implementing a licensing system, and introducing dynamic monitoring through smart contracts. The United States, on the other hand, passed the "Stablecoin Transparency and Accountability Act" in April 2025, requiring issuers to hold highly liquid reserve assets and prohibiting algorithmic stablecoins to reduce systemic risks.

In contrast, mainland China's regulation of cryptocurrencies is stricter, prohibiting the provision of related services to residents in the mainland. However, in practice, there are still issues of evading regulation through identity nesting and other means. The legal team of lawyer Zeng Zheng from Shanghai Jintiancheng Law Firm suggests that the mainland can learn from Hong Kong's dynamic pricing mechanism, compliant disposal pilot programs, and cross-border cooperation experiences to promote the legal classification of asset attributes and disposal procedures, aiming to build a regulatory system that balances innovation and safety.

Recommendations from Industry Experts

Industry experts, including those from Coincu, emphasize that stablecoin regulation needs to find a balance between preventing illegal use and supporting technological innovation. Strict compliance measures, such as real-name authentication, tracing the source of funds, and regular audits, can effectively reduce the risks of illegal fundraising. At the same time, regulatory agencies should collaborate with the industry to establish clear norms and support the legitimate application of blockchain technology to enhance market confidence and investor protection.

Additionally, experts call on the public to improve their financial literacy and be wary of false advertising claiming "high returns with no risk." Investors should verify whether institutions hold legal financial licenses, carefully assess project backgrounds and risk disclosures before participating in any stablecoin-related projects, and avoid property losses due to blind investments.

The warning from the Office of the Special Task Force for the Prevention and Crackdown on Illegal Financial Activities in Shenzhen reflects China's tough stance on the illegal use of stablecoins and other virtual assets. The abuse of stablecoins in illegal fundraising not only threatens financial order but may also pose challenges to social stability. The public should remain highly vigilant and follow these recommendations:

Invest Cautiously: Avoid being easily swayed by promises of "capital preservation with high returns," verify the qualifications of investment institutions, and choose legal and compliant financial products.

Enhance Learning: Improve understanding of blockchain and stablecoins, and be aware of their risks and legitimate uses.

Report Actively: If illegal fundraising, fraud, or other suspicious activities are discovered, report them promptly to financial regulatory authorities or public security agencies.

Stay Informed on Policies: Keep a close eye on national and local financial regulatory developments and comply with relevant laws and regulations.

Through the joint efforts of regulatory agencies, the industry, and the public, it is possible to effectively curb illegal financial activities related to stablecoins and maintain a healthy financial ecosystem. In the future, as global regulatory frameworks improve and technology advances, stablecoins are expected to play a greater role in a compliant environment, supporting the development of the digital economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。