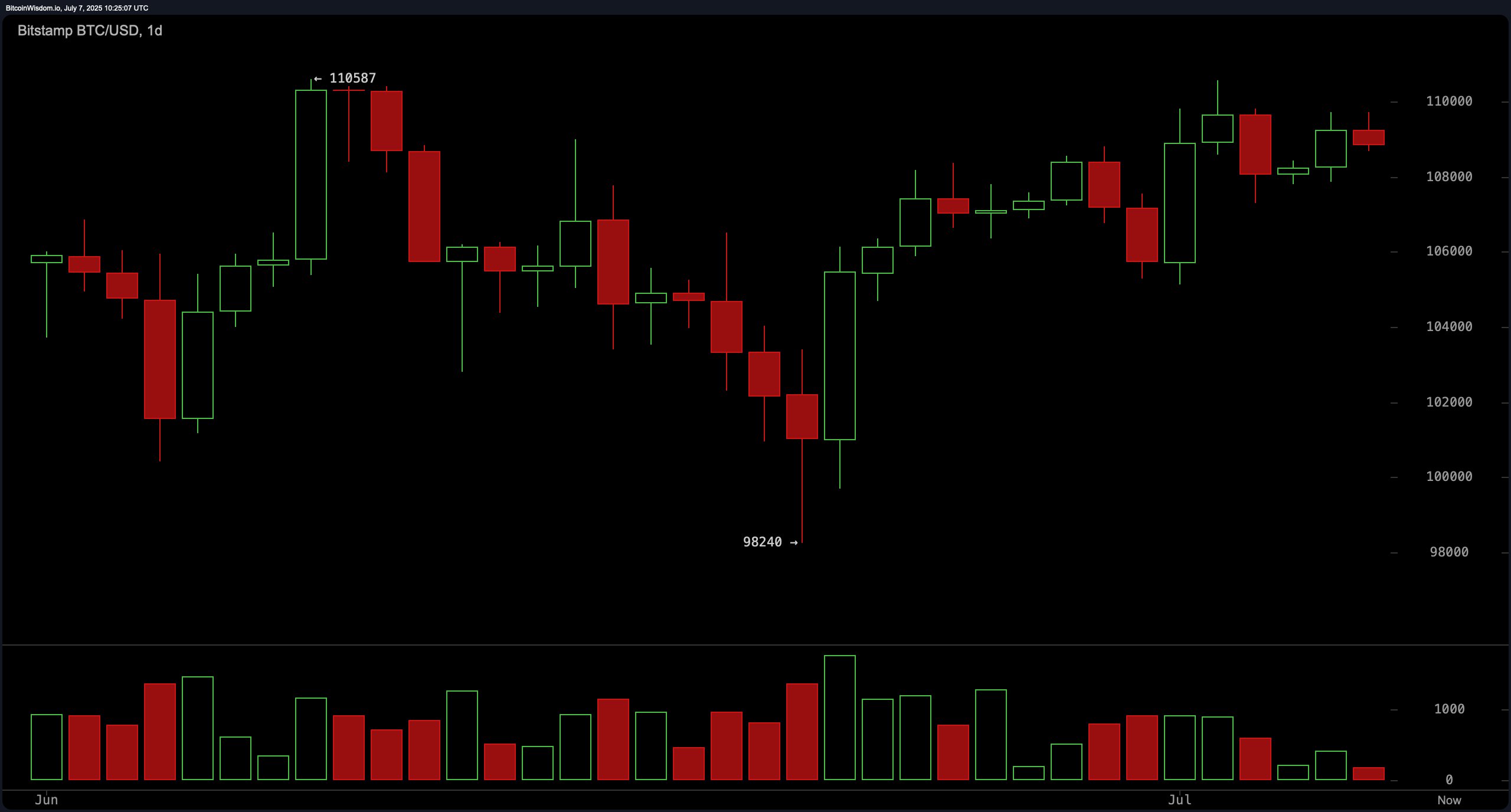

Across the daily chart, bitcoin continues to ride a well-supported uptrend that began in mid-June from lows of approximately $98,240, now challenging resistance around $110,500. The formation of bullish engulfing candles and rising volume reinforces the positive sentiment, especially as price structure aligns with a double-bottom formation at the June low. However, traders are closely monitoring the $105,000–$106,000 pullback zone for potential long entries, as a failure to hold this support could weaken the current setup. Key moving averages such as the exponential moving average (EMA) and simple moving average (SMA) across 10, 20, and 30 periods all point to buy signals, solidifying the bullish outlook on a trend-following basis. Exit strategies remain focused on the $110,000–$110,500 zone, which has been tested but not yet breached.

BTC/USD 1-day chart via Bitstamp on July 7, 2025.

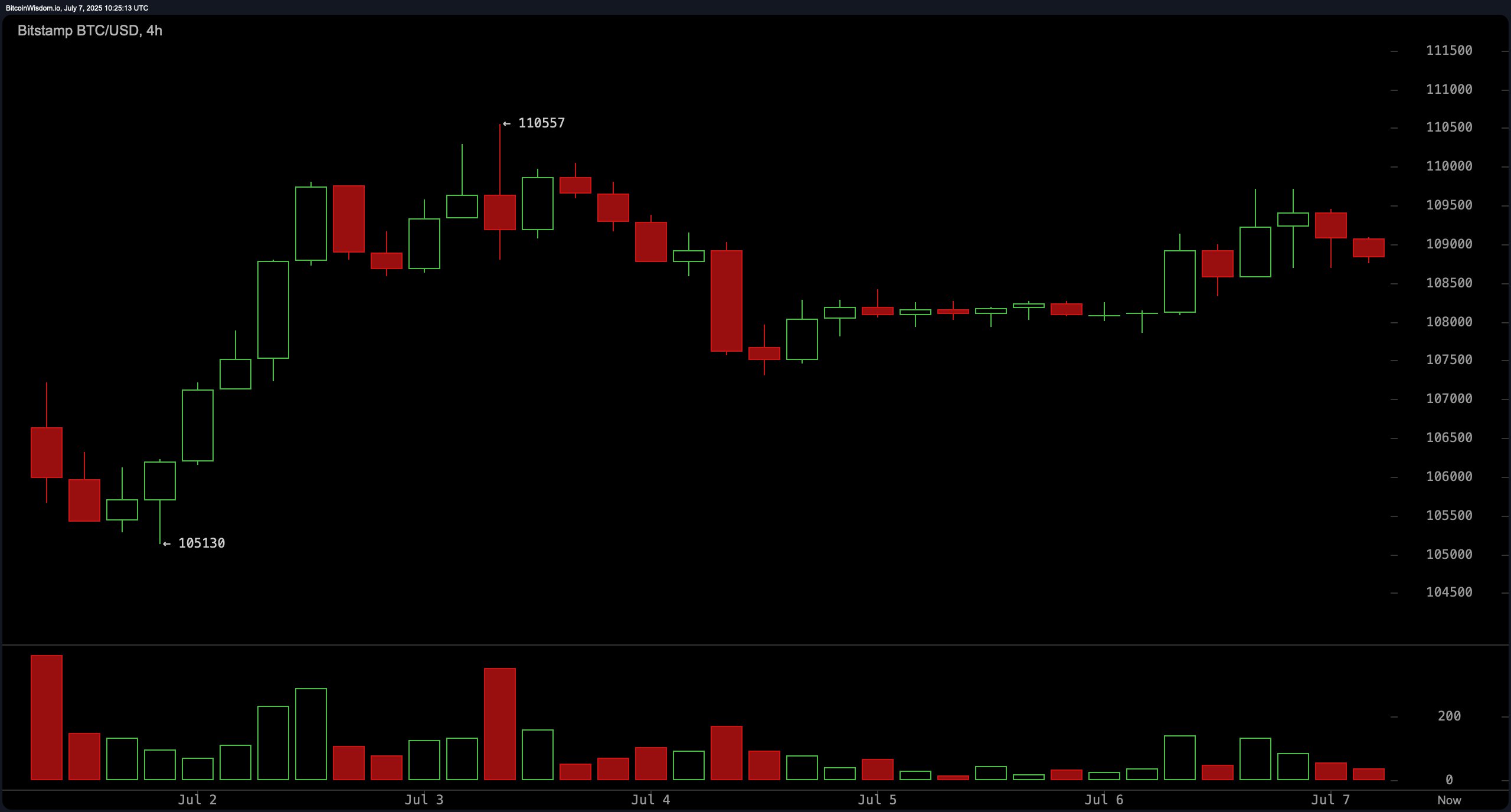

On the 4-hour chart, bitcoin shows a clear uptrend from $105,130 to $110,557 before entering a consolidation zone between $108,000 and $109,000. This range-bound activity since July 4 suggests either accumulation or distribution near resistance. Volume has tapered off during this phase, indicating market indecision. A breakout above $110,000 backed by strong volume would likely extend the rally, while a failure to hold $107,800 could invalidate the short-term bullish bias. Traders eyeing breakout entries may consider reclaiming $109,200 with accompanying volume as a strategic point for reentry.

BTC/USD 4-hour chart via Bitstamp on July 7, 2025.

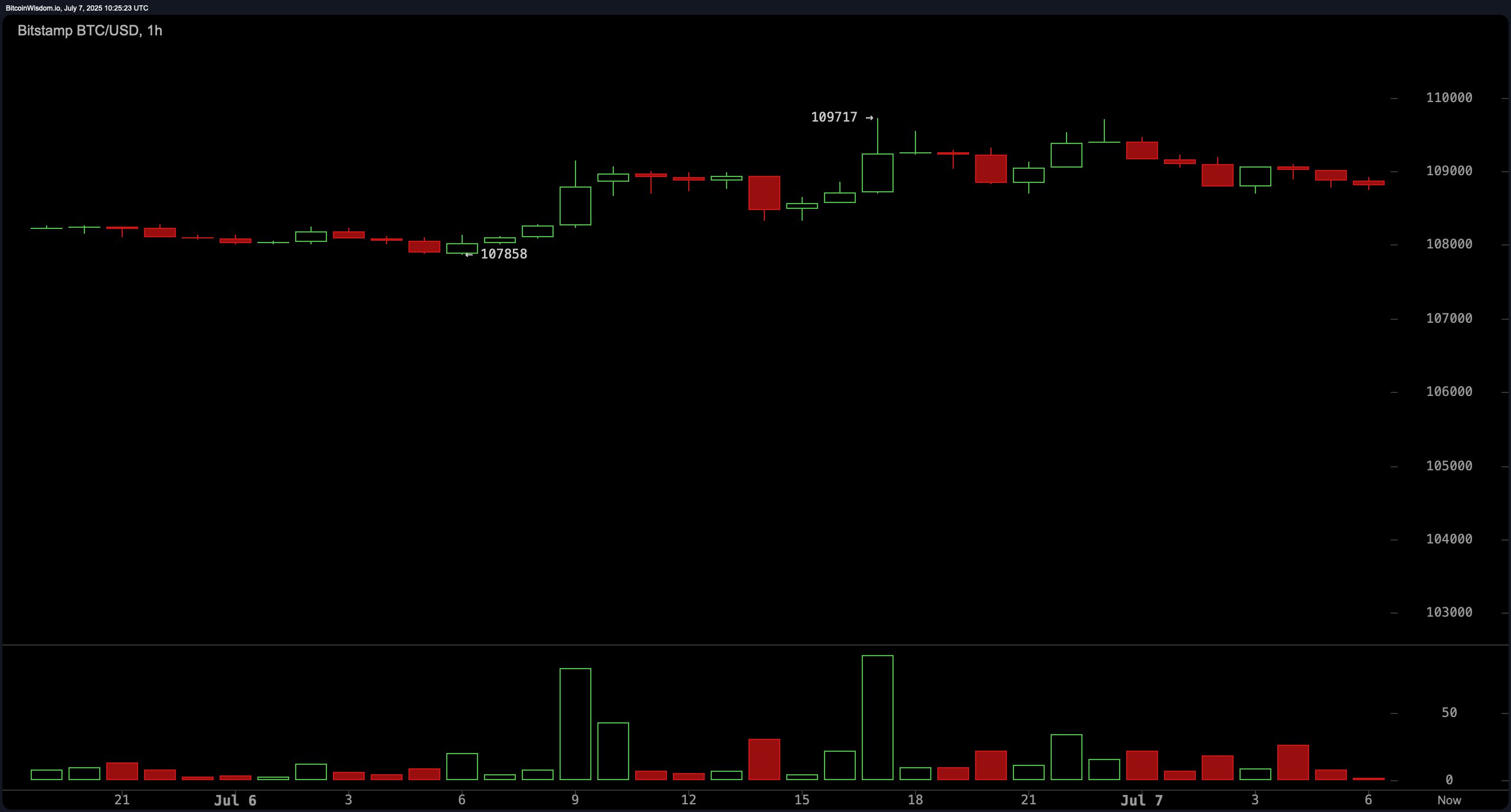

The 1-hour BTC/USD chart reveals a tight consolidation between $108,500 and $109,700, with price holding above short-term support at $107,858. Volume has declined considerably, pointing toward a potential volatility squeeze scenario. In such setups, breakouts tend to be sharp; a move above $109,700 with increased volume could present a scalp opportunity toward $110,200. Conversely, a breakdown below $108,000 would serve as a short-term stop-loss trigger for intraday positions. Despite the micro-trend neutrality, the structure supports cautious optimism with strict risk management.

BTC/USD 1-hour chart via Bitstamp on July 7, 2025.

Among oscillators, the relative strength index (RSI), Stochastic, commodity channel index (CCI), average directional index (ADX), and Awesome oscillator all register neutral signals, highlighting a balanced momentum environment. The momentum oscillator shows a sell indication, suggesting weakening thrust in price direction. However, the moving average convergence divergence (MACD) indicator shows a bullish signal, in line with the prevailing upward price trend. The divergence in oscillator readings signals the possibility of range-bound behavior before the next directional move is confirmed.

From a broader strategy perspective, traders are advised to watch for volume-backed breakouts above $110,000 while respecting the downside invalidation levels across all timeframes. The macro bias remains bullish, supported by consistently positive moving averages across 50-, 100-, and 200-period EMAs and SMAs. However, the failure to pierce $110,500 after multiple attempts could set the stage for a double-top formation, providing short-term bearish traders with opportunities. Market participants should remain vigilant, with clear entry and exit signals tied closely to structural levels and volume patterns.

Bull Verdict:

The current technical setup favors the bulls, with bitcoin holding above key moving averages and showing consistent support across multiple timeframes. A confirmed breakout above $110,000, backed by rising volume, could catalyze further upside toward new yearly highs.

Bear Verdict:

Despite the upward momentum, bitcoin faces persistent resistance near $110,500 and declining volume suggests waning buying pressure. Failure to break this ceiling, combined with potential bearish formations like a double-top, could prompt a retracement toward the $104,500–$105,000 support range.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。