The Blockchain Group Buys 116 BTC, Total Holdings Reach 1,904 BTC

The Blockchain Group boosts its Bitcoin strategy, now holding 1,904 BTC and showing over 1,300% gains this year.

The Blockchain Group Buys 116 More Bitcoin in Bold Strategic Move

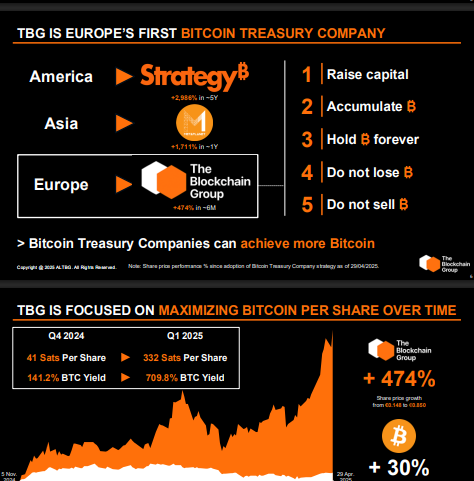

The Blockchain Group has made another big move by buying 116 BTC, worth about €10.7 million. This new purchase brings its total holdings to 1,904 BTC, making it the first company in Europe fully focused on holding this cryptocurrency as part of its financial strategy. With this buying it comes closer to reaching the top 20 largest BTC holding companies.

Source: The Blockchain Group

The company has seen a huge return on its investments on this crypto, up 1,348.8% just this year. That’s a strong sign that its long-term plan to collect and hold Bitcoin is working well. While other firms may still be cautious, The organisation is moving ahead with full confidence.

Capital Raise with TOBAM Supports Further Accumulation

The company recently raised about €1 million through a capital increase deal with TOBAM. The price per share was around €5.251. That funding helped company buy an extra 11 coins as part of this round.

This is just one step in a much bigger plan to build up their cryptocurrency reserves over time. The company’s strategy shows they’re thinking long term, not just trying to make quick profits.

Global Institutions Are Turning to this Digital Asset

Major institutions across the world are starting to back this digital asset. BlackRock’s ETF IBIT launch has been the most successful in ETF history. In Asia, Metaplanet is leading the way. Today only, Metaplanet bought 2205 BTC . In the U.S., some experts are calling for Bitcoin to be part of the national reserve. The currency is now trading at 108,731.

The organisation stands as Europe’s answer to this global trend. It’s not just buying this digital asset, it’s building its entire model around it.

Right now, we’re seeing a clear pattern:

-

America has Strategy (previously microstrategy) holding the largest amount of this cryptocurrency

-

Asia has companies like Metaplanet going all in

-

Now Europe has The Blockchain Group leading the charge

This shows that this crypto isn’t just a trend, it’s becoming part of the global financial system.

A Simple, Strong Bitcoin Strategy

The Blockchain Group’s roadmap is clear:

-

Raise Capital

-

Use it to buy more BTC

-

Hold it forever

-

Do not loose

-

Never sell it

Instead of selling or trading, the company wants to grow its Bitcoin per share (BPS), a new way to measure value for investors.

Why Maximizing Bitcoin Per Share Matters?

Since this cryptocurrency has a fixed supply of 21 million coins, getting in early matters. In Q4 of 2024 the organisation achieved a BTC yield of 141.2% , while in 2025 they achieved a yield of 709.8%. The yield jumped by 474%.

Source: The Blockchain Group

The organisation believes that by focusing on BPS, it’s giving shareholders more value over time, kind of like earning more gold per share.

Bitcoin’s Rise as a Treasury Reserve Asset

It is showing that this digital currency can be a strong asset on company balance sheets.

As market risks and inflation persist, more companies can begin to tread this route. It will perhaps become the safe haven for company value, as it was with gold.

Final Thoughts

With already 1,904 BTC stored, The Blockchain Group is emerging as a giant in Europe's crypto market. Their strategy of keeping BTC forever may become the benchmark for other firms that aim to create long-term value with digital assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。