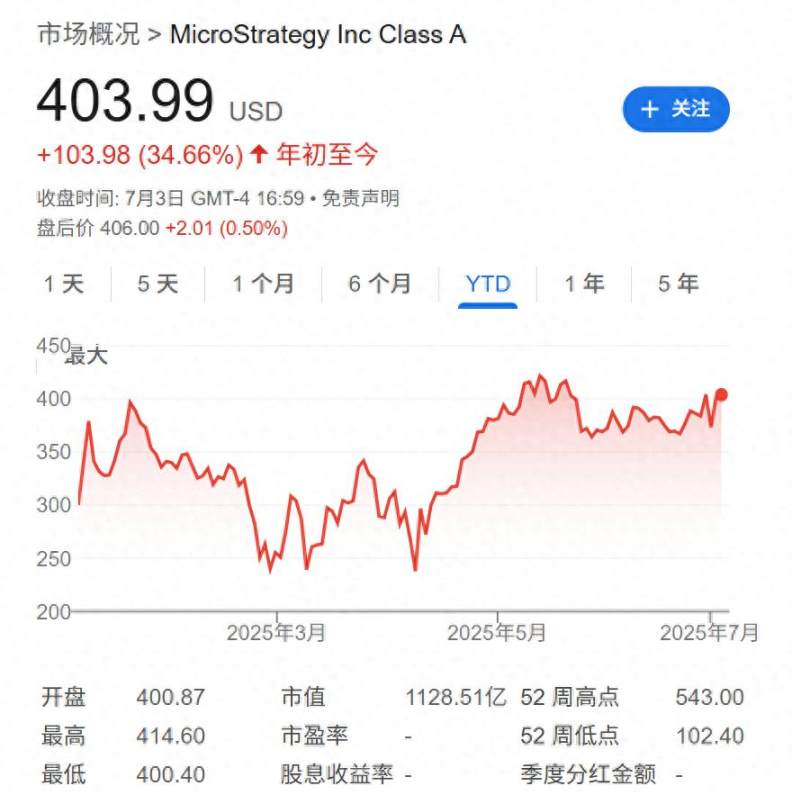

So far, the market performance seems to side with Saylor.

Source: Wall Street News

A fierce debate about corporate strategy, asset value, and financial innovation is unfolding on Wall Street. At the center of the argument is Strategy (MSTR), led by Michael Saylor, and its aggressive strategy of accumulating Bitcoin in large quantities through high leverage.

On one side of this clash is the legendary short-seller Jim Chanos, who gained fame for shorting Enron, denouncing this move as "financial nonsense"; on the other side is Saylor, who is reshaping the company into a crypto giant, viewing it as a revolution that utilizes other people's capital to achieve thousandfold returns.

Chanos recently stated in a media podcast that Strategy's business model "makes no sense." He repeatedly emphasized his core point: as a company holding Bitcoin, its stock price should not enjoy a premium above the value of its held assets. This viewpoint directly challenges the market frenzy that has driven Strategy's stock price up by 210% over the past year.

In stark contrast is Saylor's strong rebuttal. He believes that for many investors, buying shares of Strategy is a more convenient and compliant way to invest in Bitcoin than directly purchasing Bitcoin or related ETFs. More importantly, he paints a picture for the market of a blueprint for amplifying returns through leverage:

"If you want to make 10 times, you buy Bitcoin. If you want to make 100 times, you buy Bitcoin with other people's money. If you want to make 1000 times, you buy Bitcoin with other people's money and then leverage it with Bitcoin."

So far, the market performance seems to side with Saylor. Strategy's stock price has risen far more than Bitcoin's approximately 80% increase and the S&P 500's 13% increase during the same period. According to data provider S3 Partners, short-sellers of Strategy have suffered losses of up to $3.6 billion in just the past month. However, this debate is not just about the views of two individuals; it reveals a new trend spreading in the business world and its potential risks.

The Core Argument of the Shorts: The Premium Mystery of MSTR

Jim Chanos's skepticism towards Strategy centers on its high valuation premium. As an investor known for discovering and shorting companies with valuation mismatches, Chanos believes that investors would be better off buying Bitcoin directly rather than purchasing shares of a company that holds Bitcoin at an inflated price.

Data shows that as of June 30, Strategy has accumulated 597,325 Bitcoins on its balance sheet through stock and convertible bond issuances, valued at approximately $64 billion, making it the largest corporate holder of Bitcoin globally. However, its stock price performance has far exceeded the growth of its underlying assets. This phenomenon is the focus of market skeptics like Chanos, who argue that this premium lacks solid logical support.

Saylor's Rebuttal: The Crypto Revolution Leveraged

In response to the criticism, Michael Saylor and his supporters present two core arguments.

First is compliance and convenience; they argue that shares of Strategy provide a compliant avenue for regulated investors to invest in Bitcoin. Secondly, supporters believe that due to Bitcoin's capped supply of 21 million coins, Strategy's ongoing accumulation will allow it to capture a larger share of this scarce asset, thereby supporting its stock price premium.

Saylor himself is more straightforward in promoting his leverage strategy. He publicly stated that he dismisses Chanos's criticisms, saying, "I think he doesn't understand our business model," and predicts, "If our stock goes up, he will be liquidated and out."

Chanos, on the other hand, defines Saylor's remarks as "financial nonsense," stating that he "is a great salesman, but that's all." This media clash has become a hot topic on Wall Street.

Growing Concerns and Legal Headwinds

Despite the heavy losses for short-sellers, Chanos is not alone. In May and June of this year, a federal court in Virginia heard two investor lawsuits against Strategy. According to media reports, both lawsuits accuse the company of misleading investors regarding the potential impact of Bitcoin price fluctuations on its stock price.

Some analysts have also expressed concerns. Analysts at Monness, Crespi, Hardt & Co, led by Gustavo Gala, pointed out in a recent series of reports to clients that due to limited interest from fixed-income investors in the convertible bonds and preferred stock used by the company to purchase Bitcoin, Strategy's premium may decline. He wrote in early June that the company's runway for continuing its current strategy is "limited."

A Wave of Imitators and a New Battleground

Strategy's strategy is spawning a wave of imitators. From media companies controlled by the Trump family to the popular meme stock GameStop, dozens of companies have begun to emulate Saylor's "Bitcoin treasury" blueprint. Gala warned in a report on Tuesday that "all these companies are competing for a seemingly similar pool of funds," intensifying the competition.

According to data provider Bitcoin Treasuries, in the first half of 2025, publicly traded companies added a total of 245,191 Bitcoins to their balance sheets, more than double the increase in Bitcoin ETF holdings during the same period. The latest heavyweight entrant is Tom Lee, founder of Fundstrat, who will serve as chairman of Bitcoin mining company BitMine Emersion Technologies (BMNR), after helping the company raise $250 million to launch an Ethereum-centric treasury strategy. Since the announcement on June 30, BitMine's stock price has soared more than 30 times.

Interestingly, short-sellers have found success on another battleground. Data from S3 Partners shows that shorting Saylor's imitators has been far more profitable than shorting Saylor's own company. In June alone, short-sellers made $549 million by shorting four major imitators of Strategy. This indicates that while the market is enthusiastic about the leader, it holds a more cautious and skeptical attitude towards its followers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。