Stripe currently primarily operates as a payment gateway and acquirer, but if it launches Stripe L1, it will enable the company to take on roles traditionally held by issuing banks and card networks, marking a significant milestone in the history of the payment industry.

Author: 100y.eth

Compiled by: Deep Tide TechFlow

Key Points:

There are rumors in the crypto community that Stripe may launch its own Layer 1 blockchain (L1). Given its recent acquisitions of Bridge and Privy, launching its own blockchain may be a logical next step.

As a leading global payment service provider (PSP), Stripe connects merchants, acquirers, card networks, and issuing banks on a technical level, ensuring smooth and secure transactions.

If Stripe does launch L1, it is expected to support stablecoin payments and integrate Stripe L1 for customer payments and merchant settlements; optimistically, it could revolutionize the payment system through the following features:

Enabling direct payments that bypass issuing institutions and networks;

Supporting micro-subscription services that are not feasible in traditional systems;

Generating revenue from short-term deposit balances on Stripe L1.

Stripe currently primarily operates as a payment gateway and acquirer, but if it launches Stripe L1, it will enable the company to take on roles traditionally held by issuing banks and card networks, marking a significant milestone in the history of the payment industry.

Will Stripe Really Launch Its Own Blockchain Network?

Recently, there have been rumors in the crypto community that global payment infrastructure company @Stripe may be preparing to launch a Layer 1 blockchain (L1). Another rumor is related to Paradigm's recent secret hiring campaign, which some speculate is part of Stripe's L1 blockchain plans.

While no one outside of insiders knows for sure if Stripe will launch L1, the recent surge of interest in blockchain and stablecoin industries within traditional U.S. finance, along with card networks (like Visa and Mastercard) increasingly integrating blockchain, and Robinhood's announcement to tokenize stocks via Arbitrum, have quickly drawn community attention to the rumors surrounding Stripe's potential L1 launch.

Stripe's mission is to "accelerate the GDP of the internet." The company focuses on building global economic infrastructure to help businesses of all sizes, from startups to large enterprises, manage payments, operations, and growth online. From this perspective, blockchain technology is highly attractive to Stripe.

In fact, Stripe has been actively expanding its blockchain-related business in recent years. In February 2025, Stripe acquired stablecoin infrastructure company Bridge (@Stablecoin) for approximately $1.1 billion, strategically solidifying its position in stablecoin-based financial infrastructure. Building on this, Stripe launched its Stablecoin Financial Accounts service at the Stripe Sessions event in May 2025.

Stripe's Stablecoin Financial Accounts service now covers 101 countries, providing businesses with the following features:

Holding USDC issued by Circle and USDB issued by Bridge;

Facilitating USD transfers via ACH/wire and EUR transfers via SEPA, enabling stablecoin deposits and withdrawals;

Supporting deposits and withdrawals of USDC across multiple blockchain networks, including Arbitrum, Avalanche C-Chain, Base, Ethereum, Optimism, Polygon, Solana, and Stellar.

This means that businesses in 101 countries can easily access dollar-based stablecoins through Stripe and seamlessly integrate with traditional banking systems for convenient dollar deposits and payments.

Additionally, in June 2025, Stripe acquired Web3 wallet infrastructure startup @privy_io. This company offers various features, including wallet creation via email or single sign-on (SSO), transaction signing, key management, and gas abstraction services.

Combining these actions, the rumors of Stripe potentially launching a Layer 1 blockchain (L1) do not seem unfounded. In other words, Stripe currently possesses stablecoin infrastructure and wallet infrastructure, and launching a blockchain network that can synergize with these resources may be a natural next step in its blockchain business expansion.

What Possibilities Would Arise If Stripe Launched a Layer 1 Blockchain (L1)?

Of course, there is currently no concrete evidence that Stripe will launch L1; this is merely a rumor. However, we can boldly speculate on how Stripe might be used if it truly launched its own L1 and what services it could provide that traditional payment systems cannot. The ideas listed below are entirely my personal conjectures, and readers can take them lightly, considering them as thoughts on "oh, so this is how blockchain can be used in payment services."

2.1 Stripe's Role as a Payment Service Provider (PSP)

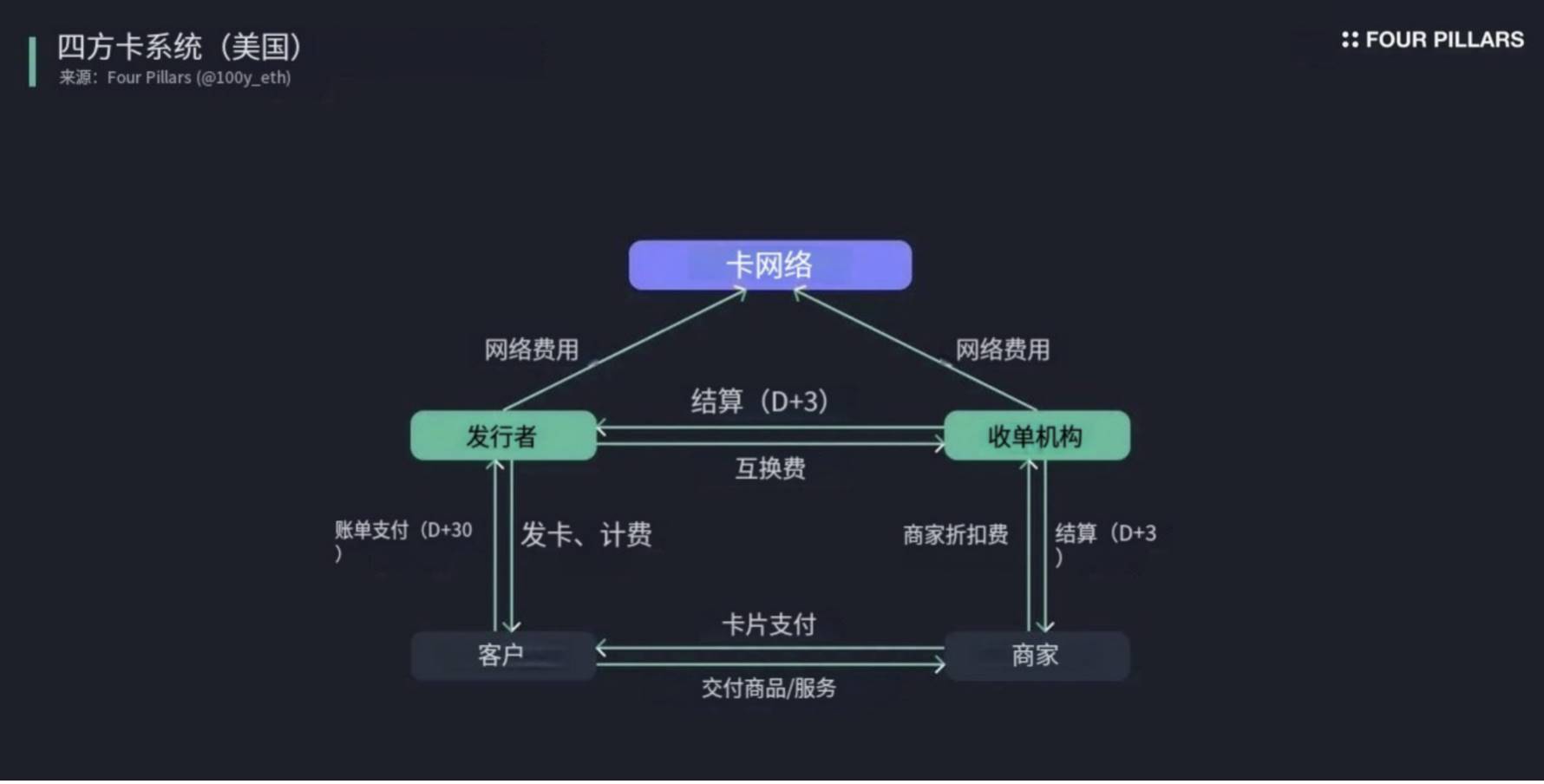

To understand how blockchain can improve certain aspects, we first need to understand the types of services Stripe provides. As one of the most well-known payment service providers (PSP) globally, Stripe acts as a technical bridge between merchants, acquirers, card networks, and issuing banks, ensuring a smooth and secure payment process. Specifically, Stripe takes on the following roles:

Payment Gateway: When customers pay online or offline using a credit card, Stripe securely collects card information, encrypts it, and transmits it to the card network and issuing bank.

Multi-Payment Method Support: Integrating various payment options, including credit cards, digital wallets, bank transfers, and local payment methods, providing convenience for customers and merchants.

Fraud Detection and Security Assurance: Preventing fraudulent transactions through a machine learning-based fraud detection system and PCI-DSS compliant security measures.

Multi-Currency and International Payment Support: Offering automatic currency conversion services, supporting multi-currency transactions, and facilitating international sales.

Reporting and Analytics: Providing merchants with detailed transaction history, success rates, and customer behavior analysis to help optimize business operations.

Technical Integration and Operational Support: Assisting businesses in easily building payment systems through APIs and SDKs while handling customer support, regulatory compliance, refunds, and billing management.

Enhancing Customer Experience: Offering a fast and smooth payment process while supporting various scenarios such as subscription billing, installment payments, and refunds.

Merchant Settlement Intermediary: The PSP collaborates with acquirers or acts directly as an acquirer to settle funds received from issuing banks to merchants.

Without the existence of a PSP, merchants would have to support various payment methods themselves and enter into complex contracts directly with acquirers. This would not only increase the technical and operational burden on merchants but also significantly diminish the payment experience for both merchants and customers.

2.2 What Changes Would Stripe L1 Bring?

If Stripe launches a Layer 1 blockchain (L1), how might it optimize existing services and create new functionalities? Here are some speculations:

2.2.1 Basic Scenarios

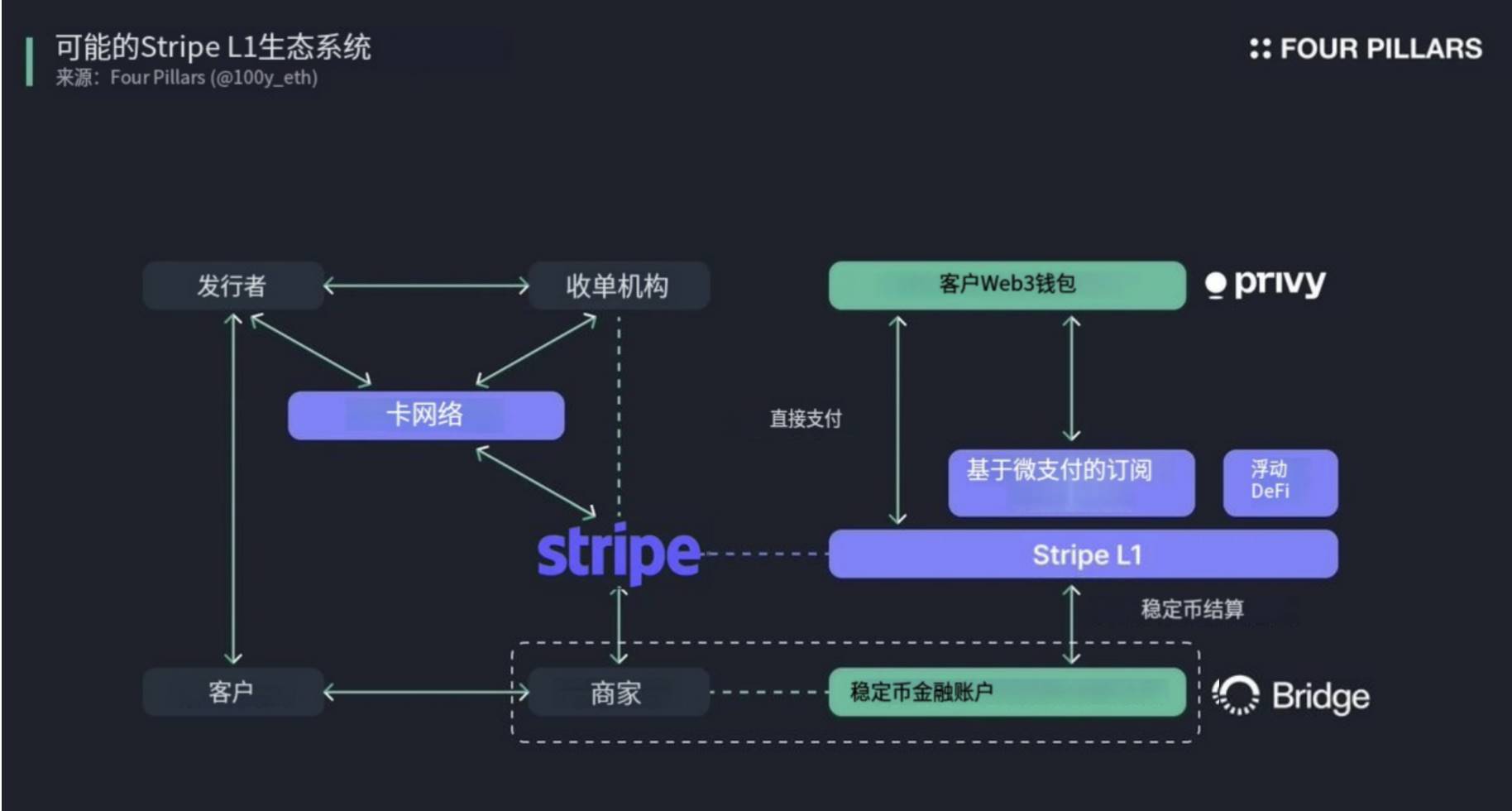

Integration of Merchant Stablecoin Financial Accounts with Stripe L1

Currently, Stripe provides stablecoin financial account services for merchants in 101 countries, allowing them to hold USDC and USDB stablecoins and conduct deposits and withdrawals through traditional banking systems (like ACH, SEPA) and multiple blockchain networks.

If Stripe L1 goes live, it is expected that the stablecoin financial account service will also support deposits and withdrawals via Stripe L1. Additionally, merchants could leverage their stablecoin balances on Stripe L1 to participate in various financial activities.

Merchant Stablecoin Settlement Options

As a payment service provider (PSP), Stripe typically collaborates with acquirers or acts directly as an acquirer to process merchant sales revenue settlements. If Stripe L1 goes live, merchants may be able to choose to settle in dollar-based stablecoins. This would be a significant advantage for merchants with high demand for dollars but limited access channels.

Customer Wallet Services

Stripe previously acquired Privy, a company providing wallet infrastructure, which allows users to easily create and use wallets. While Stripe primarily serves merchants and businesses and has not yet provided wallet services for individual users, if Stripe L1 utilizes Privy's technology, it may support individual users in easily creating Web3 wallets on Stripe L1, using stablecoins for payments, and participating in various financial activities within the Stripe L1 ecosystem.

Customer Stablecoin Payment Options

Currently, when customers make online payments through Stripe, they are limited to using credit cards, bank accounts, and other traditional payment methods. If Stripe L1 goes live, it may allow users to connect Web3 wallets (potentially provided by Stripe or third parties) and choose stablecoins as a payment method.

2.2.2 Bull Market Cases

Direct Payments Between Customers and Merchants

Traditional payment systems (like credit cards or bank accounts) rely on conventional financial networks, such as card networks and banks. However, if Stripe L1 allows customers to pay merchants directly using stablecoins, it could eliminate the involvement of issuing banks and card networks, significantly speeding up settlement times and reducing costs. Of course, since payments settled on the blockchain are difficult to reverse or refund, appropriate protective measures would need to be established to ensure transaction security.

Micro-Payment Based Subscription Services

Blockchain can support micro-payments and streaming subscription models that traditional systems cannot achieve. Currently, subscriptions processed through Stripe mostly follow a monthly or annual renewal model, while Stripe L1 could potentially enable subscription services billed by the minute. Users would pay based on actual usage, and all payments could be automatically executed through smart contracts. This new subscription model would provide development space for various services built on this system.

DeFi Applications of Short-Term Deposits

One reason for settlement delays in current payment systems is the need to prepare for issues such as fraud, cancellations, or refunds. Therefore, even if Stripe L1 supports customers paying merchants directly with stablecoins, these funds may be temporarily held in Stripe L1 rather than immediately released to the merchants.

The scale of these short-term deposits is expected to be substantial, potentially becoming a significant liquidity pool for Stripe L1. For example, these funds could be supplied as liquidity to DeFi protocols for lending markets or invested in bonds to earn interest, thereby significantly improving capital efficiency.

Summary Thoughts

After conducting long-term research on stablecoins and observing industry and ecosystem developments, the rumors surrounding Stripe L1 are indeed intriguing. So far, payment companies like Visa, Mastercard, and PayPal have only viewed blockchain and stablecoins as additional features. However, if Stripe truly launches its own Layer 1 blockchain (L1), it could mark a historic moment in the field of payment systems, signaling the beginning of a paradigm shift.

Stripe has always played the role of a payment gateway or acquirer, but the introduction of Stripe L1 could allow it to simultaneously take on the functions of card networks and issuing banks. Additionally, leveraging blockchain technology could significantly enhance payment efficiency and enable functionalities that were previously unattainable, such as micro-payment subscription services and automated management of short-term deposits.

We are in an era of payment system innovation driven by blockchain. Whether Stripe will indeed launch L1 as rumored remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。