In the cryptocurrency space, KOLs (Key Opinion Leaders) who achieve "big results" and gain numerous followers often generate a strong following effect on certain tokens through their tweets and on-chain transactions, but they are always accompanied by much controversy.

This time, two KOLs have been thrust into the spotlight. One is likely only familiar to meme players in the Chinese community, while the other is a well-known veteran KOL in the crypto space. What incident has pushed these two KOLs into the limelight?

Lexapro: "Water Pipe Gang" Peripheral Member Falls Out with Moonshot

The English name of "水烟帮" is "LA Vape Cabal," which originated from a Texas Hold'em live stream organized by the prominent English KOL @notthreadguy. Members include FaZe Clan co-founder FaZe Banks, DeGods founder Frank, Malcolm from deLabs (the parent company of DeGods), and crypto KOLs including threadguy, rasmr, and OGshoots.

There has always been much controversy surrounding the "Water Pipe Gang." They have been accused of using their fans to exit liquidity and manipulating the meme coin market, particularly during the "Argentinian Coin" $LIBRA, when players questioned their involvement in insider trading.

(For detailed background on the "Water Pipe Gang," refer to the article by Rhythm BlockBeats: “A Man Named Threadguy Disappeared”)

Lexapro is seen as a member of the "Water Pipe Gang," a belief shared by both Chinese and English-speaking players. Some say he chats in a small group of the "Water Pipe Gang":

"He" here refers to Lexapro.

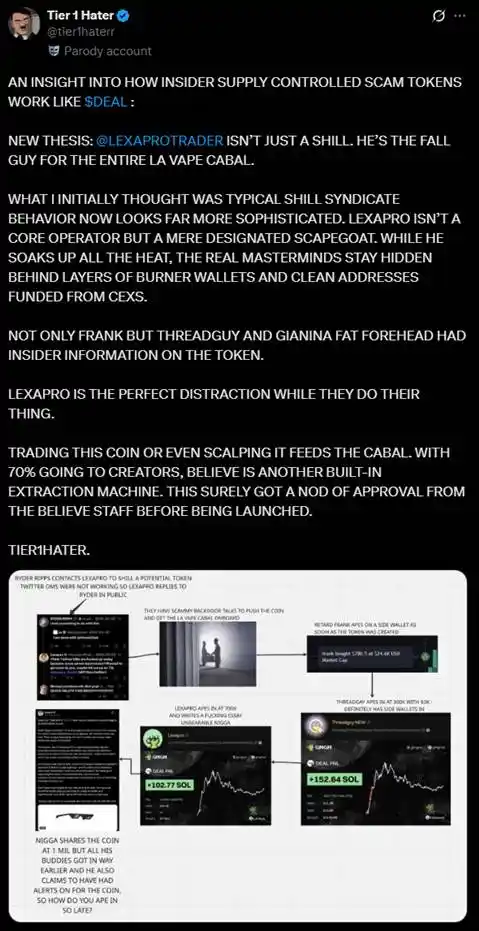

In early June, @tier1haterr accused Lexapro and the "Water Pipe Gang" of bundling sales on the token $DEAL launched by the Believe ecosystem:

He presented a chain of evidence he collected through an image:

First, the initial contact between RYDER RIPPS and Lexapro was made public due to a malfunction in Twitter's direct messaging feature, leading Lexapro to respond on Twitter. After the deal was completed, Frank, the founder of the NFT project DeGods, purchased $780.5 when the token's market cap was only $24,600. Threadguy bought $3,000 when the market cap was $300,000 (this address ultimately profited about $13,000). Lexapro purchased $4,720 when the market cap was $700,000 (and subsequently increased his position at market caps of $1.5 million and $1.26 million, totaling about $16,700) and published a long tweet promoting the token when its market cap reached $1 million.

On-chain data shows that Lexapro's holdings were eventually transferred to another wallet and sold off, resulting in a loss of about 57%. @tier1haterr believes that in this instance of wrongdoing by the "Water Pipe Gang," Lexapro played the role of a "scapegoat," as 70% of the profits from the Believe ecosystem belong to the creators (this portion of the profit may have been colluded) and that the members of the "Water Pipe Gang" did profit, so he does not consider Lexapro innocent.

The market cap of $DEAL peaked at $2 million before plummeting, and it is currently valued at only $97,000.

Earlier, Lexapro was also accused of manipulating $HOUSE, and because he always defended himself, when the debacle involving $RICH and Moonshot occurred, there was a sense of "this time we have solid evidence against you" in the English-speaking community—

"You still don't hate these people enough."

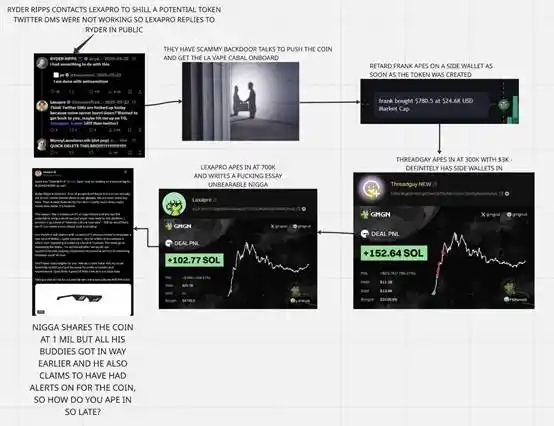

In the leaked chat records below, Lexapro and Moonshot employee sidewinder engaged in a "blame-shifting" farce.

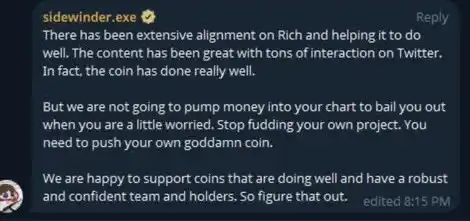

First, according to the content of the conversation, both parties had previously communicated about the conspiracy to pump $RICH launched by Moonshot. In the image above, Lexapro first attacked sidewinder—stating that he believed they had not fulfilled their prior commitments, and that the rise and fall of $RICH depended on Moonshot, not him.

Sidewinder retorted—no, this is not Moonshot's coin; this is your coin. You have bundled it and controlled the supply, and you brought people in.

Lexapro got heated— I think you are very disrespectful to me; watch your tone; your next sentence will determine the fate of Moonshot Launchpad.

Sidewinder's final remark emphasized that Moonshot would not pump for him; he should handle it himself.

During a brief rebound after $RICH fell from its peak to a market cap of $11 million, Lexapro heavily promoted $RICH:

"Many big players/institutions are getting involved; this is a critical moment for Moonshot Launchpad. If you believe Moonshot can succeed, then buy $RICH, targeting a market cap of $100 million. The project team is working, and a large marketing campaign will be launched soon; this should be the bottom." (Image source: @tier1haterr)

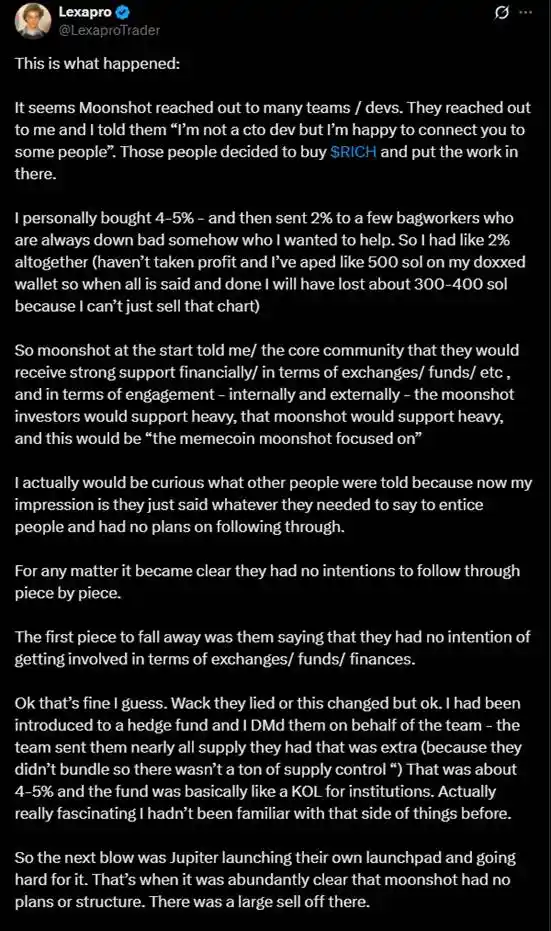

Lexapro's response was lengthy, and one screenshot could not contain it all, but the gist was that he was also losing money, Moonshot did not fulfill their promise to pump, they did nothing, so it was not Lexapro's fault; it was Moonshot that messed everything up:

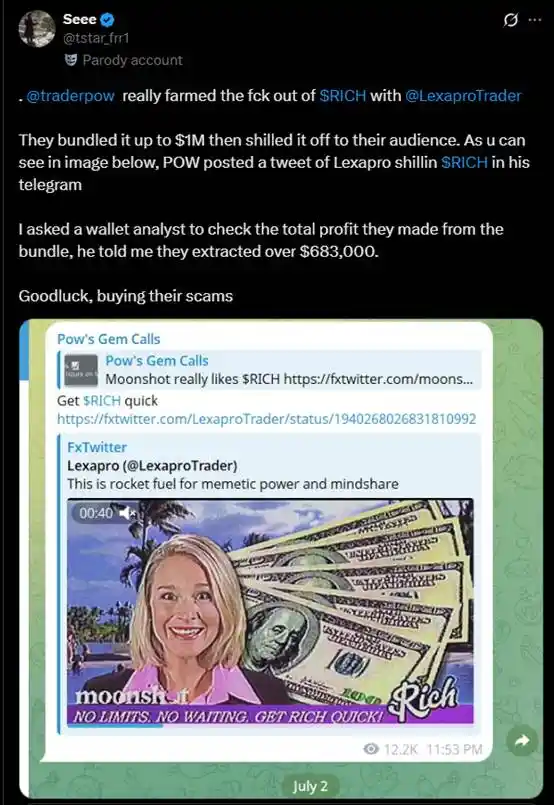

His response was not well received. A tweet from @tstar_frr1 even dragged another foreigner, pow, into the mix:

"They will pump $RICH to a market cap of $1 million through bundling and then start promoting it to their fans. According to this screenshot, pow shared Lexapro's tweet promoting $RICH in his Telegram channel and stated 'get rich quick.' I asked a wallet analyst, and he said these people profited over $683,000 through $RICH. If you continue to buy their scam tokens, I can only wish you good luck." (Image source: @tstar_frr1)

Although the disclosed information cannot help us piece together the complete picture of the events, it is certain that $RICH was once a "conspiracy scheme" that Moonshot and at least Lexapro wanted to execute. In the end, they fell out, and the unfortunate ones were the retail investors.

The most affected by this incident are the $RICH community and the entire Crypto community. In a market where liquidity for meme coins is already poor and narratives are hardly acknowledged, such incidents being confirmed is yet another significant blow to the confidence of meme coin players—they always tell us to build diligently, they always tell us to believe in certain things, but can the trust and effort we invest truly lead us to the other side?

Why are players so angry? Because everyone has their favorite meme coins and stories they believe in, many people think or hope to achieve their results through their beliefs. Regardless of who is right or wrong, it is always the retail investors who get hurt, and the reason for their injury is the absurd uneven distribution of spoils between KOLs and project parties, even though they have already taken the "shortcut."

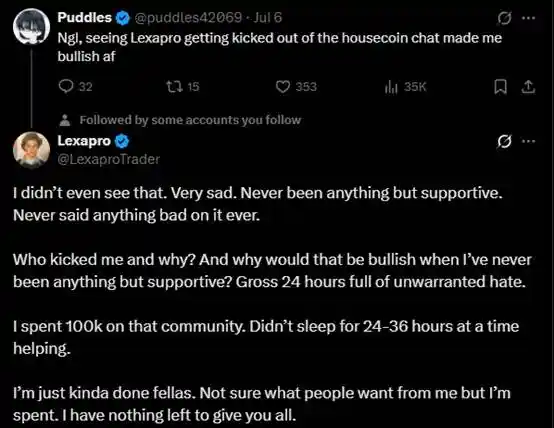

To conclude the Lexapro scandal with a small episode—he was kicked out of the $HOUSE large group. He expressed in a tweet reply that he was completely unaware and that he had helped them so much, and he was very sad.

GCR: Accused of Bribing Binance Listing Team and Hacking Palm Beach Research Servers to Obtain Reports in Advance

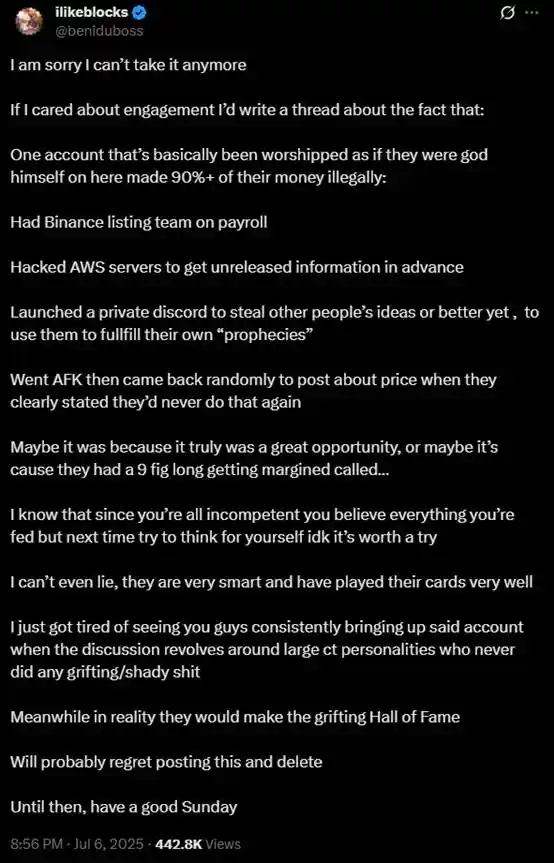

Just as the situation with Lexapro was settling down, another wave arose in the Crypto circle. On the evening of July 6, @beniduboss tweeted accusations against GCR:

"I can no longer tolerate a KOL (GCR) being worshipped like a god, while over 90% of the money is earned illegally. They bribed the Binance listing team for insider information, hacked into Palm Beach Research's AWS servers to know in advance which coins their next report would mention, established a private Discord channel to steal others' ideas to fulfill their own 'prophecies,' disappeared, and then occasionally returned to make price predictions, simply because they have a nine-figure long position."

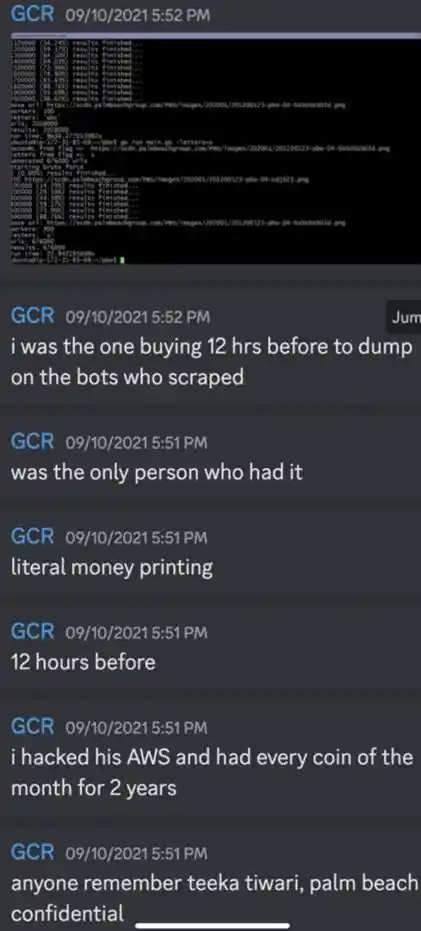

This accusation currently lacks evidence, with only some suspected chat records of GCR in Discord shared by @beniduboss:

A user suspected to be GCR claimed to have obtained report content 12 hours in advance by hacking into Palm Beach Research's AWS servers and bought in, subsequently dumping it to bots. Palm Beach Research, led by Teeka Tiwari's crypto research group, sold its research reports to crypto users and was influential years ago. Currently, the Palm Beach Research website is inaccessible, and their official Twitter has not been updated since April last year.

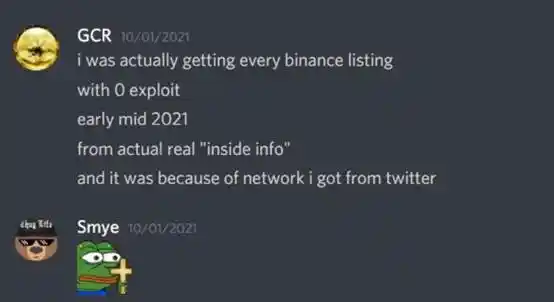

A user suspected to be GCR stated that he was able to obtain every Binance listing news in the first half of 2021.

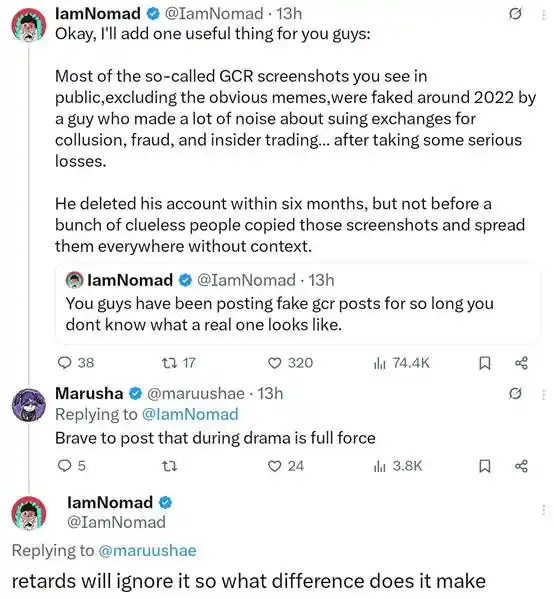

Subsequently, tweets emerged to help GCR counter the accusations:

@IamNomad stated that the above Discord screenshot was made around 2022 by a user who attempted to launch fraud/insider trading accusations against the exchange after suffering significant losses, and that user deleted their Twitter account about six months later. This tweet has since been deleted by @IamNomad, who stated he did not want to stir up more controversy.

In summary, the current accusations against GCR lack strong evidence. However, yesterday, whistleblower @beniduboss tweeted that he received doxxing and death threats in Twitter DMs, stating that this was unrelated to GCR but could be the work of an overzealous GCR fan. Previously, his related tweets also faced a barrage of bot comment attacks.

Conclusion

The KOL group always reminds me of my favorite drink, "Monster"—it can be refreshing and energizing when you're tired, but when you're really sleepy, you still need to go to bed. Who would truly rely on energy drinks to say goodbye to sleep?

When investing, you can look at KOLs' statements for psychological comfort during confusion, or enjoy their interesting remarks for a laugh, but to truly make money, you still have to rely on yourself; only you can be trusted.

Any KOL could "collapse," but I hope that doesn't mean "collapse" for you, because in your heart, KOLs have never had a "house."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。