The BIS clearly points out that stablecoins are not true currencies, and behind their seemingly prosperous ecosystem lies systemic risks that could shake the entire financial system.

Written by: AiYing Research

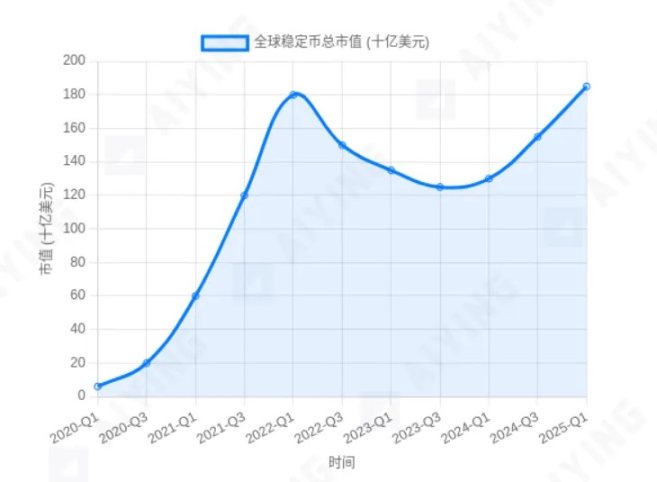

In the wave of digital assets, stablecoins are undoubtedly one of the most striking innovations in recent years. With their promise of being pegged to fiat currencies like the US dollar, they have built a "safe haven" for value in the volatile world of cryptocurrencies and are increasingly becoming important infrastructure in decentralized finance (DeFi) and global payments. Their market value has skyrocketed from zero to hundreds of billions of dollars, seemingly heralding the rise of a new form of currency.

Chart 1: Global Stablecoin Market Value Growth Trend (Illustrative). Its explosive growth sharply contrasts with the cautious attitude of regulators.

However, just as the market is celebrating, the Bank for International Settlements (BIS), known as the "central bank of central banks," issued a stern warning in its economic report in May 2025. The BIS explicitly stated that stablecoins are not true currencies, and behind their seemingly prosperous ecosystem lies systemic risks that could shake the entire financial system. This conclusion is like a bucket of cold water, forcing us to re-examine the essence of stablecoins.

The AiYing research team aims to deeply interpret the BIS report, focusing on its proposed "triple gate" theory of currency—namely, that any reliable currency system must pass through three tests: Singleness, Elasticity, and Integrity. We will analyze the dilemmas faced by stablecoins at these three gates with specific examples and supplement the realities beyond the BIS framework, ultimately exploring the future direction of currency digitization.

First Gate: The Dilemma of Singleness—Can Stablecoins Ever Be "Stable"?

The "singleness" of currency is the cornerstone of the modern financial system. It means that at any time and place, the value of one unit of currency should precisely equal the face value of another unit. In simple terms, "one dollar is always one dollar." This constant uniformity of value is the fundamental premise for currency to fulfill its three major functions: unit of account, medium of exchange, and store of value.

The core argument of the BIS is that the value anchoring mechanism of stablecoins has inherent flaws that cannot fundamentally guarantee a 1:1 exchange with fiat currencies (like the US dollar). Their trust does not come from national credit but relies on the commercial credit of private issuers, the quality and transparency of reserve assets, which exposes them to the risk of "decoupling" at any time.

The BIS cites the historical "Free Banking Era" (approximately 1837-1863 in the United States) as a mirror. At that time, the United States had no central bank, and privately chartered banks in each state could issue their own banknotes. These banknotes were theoretically redeemable for gold or silver, but in reality, their value varied based on the issuing bank's credibility and solvency. A $1 bill from a remote bank might only be worth 90 cents in New York, or even less. This chaotic situation led to extremely high transaction costs, severely hindering economic development. Today’s stablecoins, in the view of the BIS, are a digital replica of this historical chaos—each stablecoin issuer acts like an independent "private bank," and whether their issued "digital dollars" can truly be redeemed remains an unresolved question.

We need not look too far back in history; recent painful lessons are sufficient to illustrate the problem. The collapse of the algorithmic stablecoin UST (TerraUSD) saw its value drop to zero within days, erasing hundreds of billions in market value. This event vividly demonstrated how fragile the so-called "stability" is when the trust chain breaks. Even asset-backed stablecoins have faced ongoing scrutiny regarding the composition, auditing, and liquidity of their reserve assets. Thus, stablecoins are already struggling at the first gate of "singleness."

Second Gate: The Wound of Elasticity—The "Beautiful Trap" of 100% Reserves

If "singleness" pertains to the "quality" of currency, then "elasticity" pertains to the "quantity." The "elasticity" of currency refers to the financial system's ability to dynamically create and shrink credit based on the actual demand of economic activities. This is the key engine that allows modern market economies to self-regulate and sustain growth. When the economy is booming, credit expansion supports investment; when the economy cools, credit contraction controls risk.

The BIS points out that stablecoins, especially those claiming to have 100% high-quality liquid assets (such as cash and short-term government bonds) as reserves, actually represent a "narrow bank" model. This model uses users' funds entirely to hold safe reserve assets without engaging in lending. While this sounds very safe, it comes at the complete expense of currency "elasticity."

We can understand the difference through a scenario comparison:

- Traditional Banking System (with Elasticity):

Assume you deposit 1,000 yuan in a commercial bank. Under a fractional reserve system, the bank may only need to keep 100 yuan as reserves, while the remaining 900 yuan can be loaned to entrepreneurs in need of funds. This entrepreneur uses the 900 yuan to pay a supplier, who then deposits this money back into the bank. This cycle continues, and the initial 1,000 yuan deposit generates more currency through the bank's credit creation, supporting the operation of the real economy.

- Stablecoin System (lacking Elasticity):

Assume you purchase 1,000 units of a stablecoin for 1,000 US dollars. The issuer promises to deposit this 1,000 US dollars entirely in a bank or purchase US government bonds as reserves. This money is "locked" and cannot be used for lending. If an entrepreneur needs financing, the stablecoin system itself cannot meet this demand. It can only passively wait for more real-world US dollars to flow in, rather than creating credit based on endogenous economic demand. The entire system resembles a "stagnant pool," lacking the ability to self-regulate and support economic growth.

This "inelastic" characteristic not only limits its own development but also poses potential shocks to the existing financial system. If a large amount of funds flows out of the commercial banking system to hold stablecoins, it will directly reduce the funds available for lending, shrinking the credit creation capacity (similar to the nature of balance sheet reduction). This could trigger credit tightening, raise financing costs, and ultimately harm small and medium-sized enterprises and innovative activities that need funding the most. Refer to AiYing's recent article "The Profit Inquiry Under the Halo of 'Stability': Insights from the Losses of Hong Kong's Virtual Banks, Simulating the Dilemmas of Stablecoin Business Models."

Of course, it should be noted that in the future, with the large-scale use of stablecoins, stablecoin banks (lending) will emerge, and this credit generation will flow back into the banking system in new forms.

Third Gate: The Lack of Integrity—The Eternal Game Between Anonymity and Regulation

The "integrity" of currency is the "safety net" of the financial system. It requires that payment systems must be secure, efficient, and capable of effectively preventing illegal activities such as money laundering, terrorist financing, and tax evasion. This requires a sound legal framework, clear division of responsibilities, and strong regulatory enforcement capabilities to ensure the legality and compliance of financial activities.

The BIS believes that the underlying technological architecture of stablecoins—especially those built on public chains—poses a severe challenge to financial "integrity." The core issue lies in the anonymity and decentralization characteristics, which make traditional financial regulatory measures difficult to implement.

Let us envision a specific scenario: a stablecoin worth millions of dollars is transferred from one anonymous address to another via a public chain, a process that may take only a few minutes and incur low fees. Although the transaction record is publicly traceable on the blockchain, correlating these randomly generated addresses with real-world individuals or entities is exceptionally challenging. This opens the door for the cross-border flow of illegal funds, rendering core regulatory requirements such as "Know Your Customer" (KYC) and "Anti-Money Laundering" (AML) virtually ineffective.

In contrast, traditional international bank transfers (such as through the SWIFT system), while sometimes appearing inefficient and costly, have the advantage of each transaction being within a tightly regulated network. The remitting bank, receiving bank, and intermediary banks must comply with their respective national laws and regulations, verify the identities of both parties, and report suspicious transactions to regulatory authorities. Although this system is cumbersome, it provides a foundational guarantee for the "integrity" of the global financial system.

The technological characteristics of stablecoins fundamentally challenge this intermediary-based regulatory model. This is precisely why global regulatory agencies remain highly vigilant and continuously call for their inclusion in a comprehensive regulatory framework. A currency system that cannot effectively prevent financial crime, no matter how advanced its technology, cannot gain the ultimate trust of society and government.

AiYing's perspective adds: attributing the "integrity" issue entirely to the technology itself may be overly pessimistic. With the increasing maturity of on-chain data analysis tools (such as Chainalysis, Elliptic) and the gradual implementation of global regulatory frameworks (such as the EU's Markets in Crypto-Assets Regulation, MiCA), the ability to track stablecoin transactions and conduct compliance reviews is rapidly improving. In the future, fully compliant, transparently reserved, and regularly audited "regulatory-friendly" stablecoins are likely to become mainstream in the market. At that time, the "integrity" issue will largely be alleviated through the combination of technology and regulation, rather than being seen as an insurmountable obstacle.

Supplement and Reflection: What Else Should We See Beyond the BIS Framework?

The BIS's "triple gate" theory provides us with a grand and profound analytical framework. However, this section is not intended to criticize or refute the real value of stablecoins, but rather the AiYing research team's style has always been to position itself as a cool reflection on industry trends, envisioning various possibilities for the future with risk avoidance as a premise. We hope to provide our clients and industry practitioners with a broader, constructive, and supplementary perspective to refine and extend the BIS's discourse, exploring some crucial real-world issues that the report has not delved into deeply.

1. The Technological Vulnerability of Stablecoins

In addition to the three major challenges at the economic level, stablecoins are not without flaws at the technological level. Their operation heavily relies on two key infrastructures: the internet and the underlying blockchain network. This means that in the event of a large-scale network outage, submarine cable failure, widespread power outage, or targeted cyberattack, the entire stablecoin system could come to a standstill or even collapse. This absolute dependence on external infrastructure is a significant weakness compared to traditional financial systems. For instance, during the recent two-hundred-million-dollar war, Iran experienced a nationwide internet shutdown, and even some areas faced power outages; such extreme situations may not have been considered.

Longer-term threats come from the disruption of cutting-edge technologies. For example, the maturity of quantum computing could pose a fatal blow to most existing public key encryption algorithms. Once the encryption system that protects the security of blockchain account private keys is cracked, the foundational security of the entire digital asset world will cease to exist. Although this may seem distant at present, it is a fundamental security risk that must be acknowledged for a currency system aimed at facilitating global value flows.

2. The Real Impact of Stablecoins on the Financial System and the "Ceiling"

The rise of stablecoins has not only created a new asset class but has also directly competed with traditional banks for the most core resource—deposits. This trend of "disintermediation" could weaken the core position of commercial banks in the financial system, thereby affecting their ability to serve the real economy.

A more in-depth discussion is warranted regarding a widely circulated narrative—that "stablecoin issuers support their value by purchasing U.S. Treasury bonds." This process is not as simple and direct as it sounds, as there is a key bottleneck behind it: the reserves of the banking system. Let us understand this flow of funds through the following diagram:

Chart 2: Flow and Constraints of Funds in Stablecoin Purchases of U.S. Treasuries

The process is analyzed as follows:

Users deposit U.S. dollars into a bank and then transfer them to the stablecoin issuer (such as Tether or Circle) through the bank.

The stablecoin issuer receives this dollar deposit in its partner commercial bank.

When the issuer decides to use these funds to purchase U.S. Treasury bonds, it needs to instruct its bank to make the payment. This payment process, especially during large-scale operations, will ultimately go through the Federal Reserve's settlement system (Fedwire), resulting in a decrease in the reserve account balance of the issuer's bank at the Federal Reserve.

Correspondingly, the bank of the party selling the Treasury bonds (such as a primary dealer) will see an increase in its reserve account balance.

The key point here is that the reserves of commercial banks at the Federal Reserve are not unlimited. Banks need to hold sufficient reserves to meet daily settlements, respond to customer withdrawals, and comply with regulatory requirements (such as the Supplementary Leverage Ratio, SLR). If the scale of stablecoins continues to expand, and large purchases of U.S. Treasuries lead to excessive consumption of bank reserves, banks will face liquidity and regulatory pressures. At that point, banks may limit or refuse to provide services to stablecoin issuers. Therefore, the demand for U.S. Treasuries by stablecoins is constrained by the adequacy of bank reserves and regulatory policies, and it cannot grow indefinitely.

In contrast, traditional money market funds (MMFs) return funds to commercial banks through the repurchase market, increasing the bank's deposit liabilities (MMF deposits) and reserves. This portion of deposits can be used for the bank's credit creation (such as issuing loans), directly restoring the deposit base of the banking system. Let us understand this flow of funds through the following diagram:

Chart 3: Flow and Constraints of Funds in MMFs Purchasing U.S. Treasuries

Between "Encirclement" and "Reconciliation"—The Future Path of Stablecoins

Considering the BIS's cautious warnings and the real demands of the market, the future of stablecoins seems to be at a crossroads. They face pressure from global regulatory agencies for "encirclement," while also seeing the possibility of being integrated into the mainstream financial system through "reconciliation."

Summary of Core Contradictions

The future of stablecoins is essentially a game between their "wild innovative vitality" and the core requirements of the modern financial system for "stability, safety, and controllability." The former brings possibilities for efficiency improvements and inclusive finance, while the latter is the cornerstone of maintaining global financial stability. Finding a balance between these two is a common challenge faced by all regulators and market participants.

BIS's Solution: Unified Ledger and Tokenization

In the face of this challenge, the BIS has not chosen to completely deny stablecoins but has proposed a grand alternative: a "Unified Ledger" based on central bank currency, commercial bank deposits, and government bond "tokenization."

"Tokenised platforms with central bank reserves, commercial bank money and government bonds at the centre can lay the groundwork for the next-generation monetary and financial system." — BIS Annual Economic Report 2025, Key Takeaways

The AiYing research team believes this is essentially a "reconciliation" strategy. It aims to absorb the advantages brought by tokenization technology, such as programmability and atomic settlement, while firmly placing it on a trust foundation led by central banks. In this system, innovation is guided to operate within a regulated framework, allowing for the enjoyment of technological benefits while ensuring financial stability. Stablecoins, at most, can only play a "strictly limited, auxiliary role."

Market Choices and Evolution

Although the BIS has outlined a clear blueprint, the path of market evolution is often more complex and diverse. The future of stablecoins is likely to present a differentiated landscape:

- Compliance Path:

Some stablecoin issuers will actively embrace regulation, achieving complete transparency of reserve assets, undergoing regular third-party audits, and integrating advanced AML/KYC tools. These "compliant stablecoins" are expected to be integrated into the existing financial system, becoming regulated digital payment tools or settlement mediums for tokenized assets.

- Offshore/Niche Market Path:

Other stablecoins may choose to operate in regions with relatively loose regulations, continuing to serve the needs of decentralized finance (DeFi), high-risk cross-border transactions, and other specific niche markets. However, their scale and influence will be strictly limited, making it difficult for them to become mainstream.

The "triple gate" dilemma of stablecoins not only profoundly reveals their structural flaws but also serves as a mirror reflecting the existing global financial system's shortcomings in efficiency, cost, and inclusiveness. The BIS report serves as a wake-up call, reminding us that we cannot pursue blind technological innovation at the expense of financial stability. At the same time, the real demands of the market suggest that the path to the next generation of financial systems may not be black and white. True progress may lie in prudently integrating "top-down" design with "bottom-up" market innovation, finding a middle path toward a more efficient, safer, and more inclusive financial future between "encirclement" and "reconciliation."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。