Written by: Fintax

1. The OKX Compliance Controversy

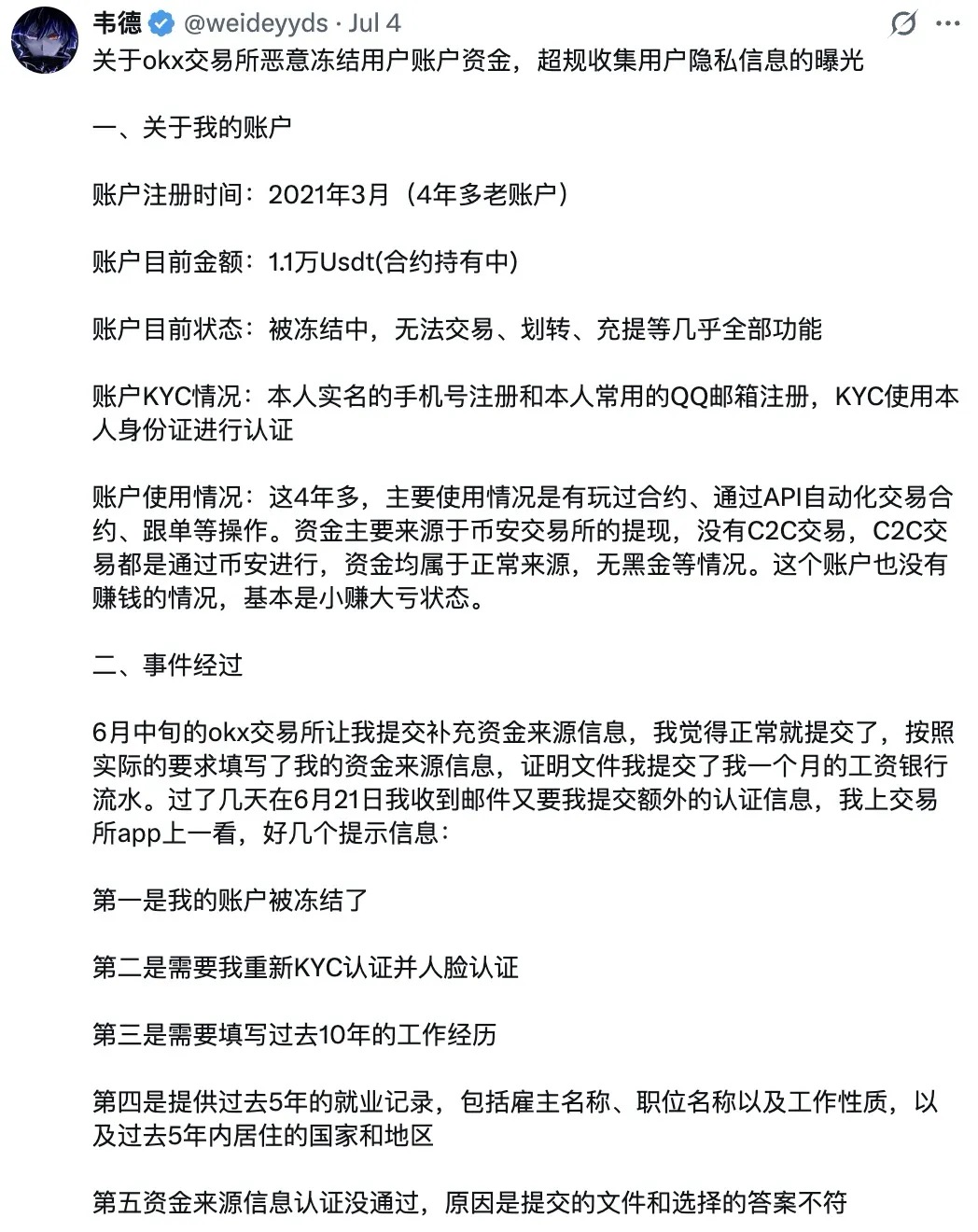

Recently, the compliance controversy surrounding OKX has been a hot topic on social media. On July 4, OKX user Wade @weideyyds posted a lengthy article on X titled "Exposing OKX Exchange's Malicious Freezing of User Account Funds and Excessive Collection of User Privacy Information." In the article, he stated that since mid-June, OKX had requested him to submit additional information regarding the source of his funds and to provide his salary statements. After the verification of the source of funds information failed, OKX froze his account and demanded that he provide his work history for the past 10 years, employment records for the past 5 years, including employer names, job titles, and job nature, as well as the countries and regions he had lived in during the past 5 years. The user repeatedly submitted the required documentation, but his applications were rejected. After consulting customer service with no results, he believed that the platform was maliciously freezing his account.

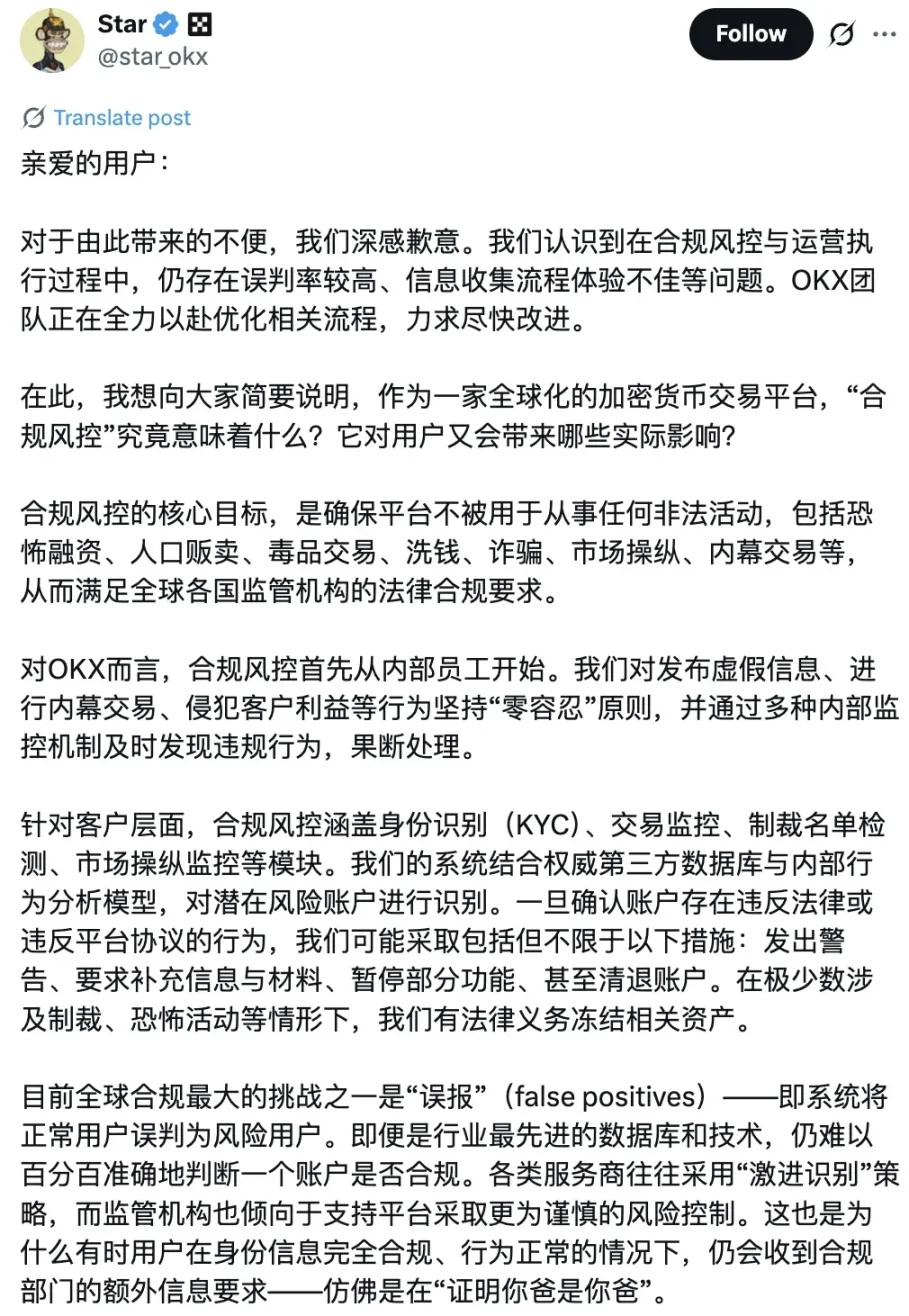

The post spread widely on X, resonating with many users who reported similar experiences with OKX. The original post's view count skyrocketed, exceeding 1 million within 24 hours. Due to the massive response, OKX immediately intervened, with the official account commenting that they would expedite the verification process and quickly resolve the user's account issue, but this did not calm the emotions of other users. On July 5, after a night of fermentation, OKX CEO Star (Xu Mingxing) personally engaged in public relations, referencing the tweet and providing an explanation, shifting the topic from "OKX's Malicious Account Freezing" to "Compliance Risk Control," using the concept of "false positives" to explain why the platform was collecting additional information from many users, and introduced OKX's compliance team and related work.

As of now, discussions regarding OKX's compliance controversy are still ongoing.

2. The Long Road to CEX Compliance

OKX is not the first centralized exchange to fall into compliance controversies. For example, in September 2024, a Binance user claimed on social media that Binance restricted his account because he used cryptocurrency assets as his only source of income and demanded that he provide proof of annual income and tax documents, which also sparked heated discussions.

Binance was established in 2017 and rapidly rose in the early cryptocurrency market, which was not yet under strict regulation. Between 2017 and 2020, Binance did not establish a headquarters or a clearly defined registered jurisdiction, opting instead for a strategy of "decentralized operations" and "keeping a distance from regulation" to achieve rapid growth. In a sense, Binance was formed as a super-large trading network in a regulatory vacuum, with a user base and trading volume far exceeding traditional compliant financial institutions. However, starting in 2021, as global attention on cryptocurrency asset regulation intensified, Binance gradually became a focal point for regulatory agencies worldwide. In mid-2021, the UK's Financial Conduct Authority (FCA) explicitly prohibited Binance Markets Limited from conducting any regulated activities in the UK, followed by warnings or restrictions from regulatory agencies in Japan (FSA), Germany (BaFin), Italy (CONSOB), and others. Such regulatory actions not only restricted Binance's fiat channels but also severely impacted its payment and clearing capabilities within the traditional financial system. In response to regulatory pressure, Binance began transitioning to a compliance-oriented international institution in 2022, obtaining virtual asset service provider (VASP) or equivalent licenses in France, Spain, Italy, the UAE, Kazakhstan, and other locations, attempting to establish a global legal business structure through a "regional split + local compliance" model. By the end of 2023, following the U.S. Department of Justice's criminal lawsuit against Binance and a $4.3 billion settlement agreement, its founder Changpeng Zhao announced his resignation as CEO, with former FinCEN director Richard Teng taking over. This personnel change is widely seen as a key step for Binance to appease regulators and accelerate compliance.

In contrast, OKX's internationalization and compliance transformation started noticeably later. OKX was spun off from OKCoin in 2017, initially focusing on the mainland China and East Asia markets, later relocating its headquarters to Malta to attempt to integrate into the local compliance framework. For a long time, OKX did not obtain licensing in mainstream countries in Europe and the U.S., with its user base primarily in Asia and emerging markets. In recent years, OKX has launched an internationalization strategy, applying for and obtaining some compliance qualifications in Dubai, Singapore, the Bahamas, and other locations, and in 2023 became one of the applicants for a virtual asset trading platform license in Hong Kong. However, its overall pace and scope of compliance advancement appear somewhat conservative compared to Binance. In terms of user management and risk control, OKX has begun to strengthen its KYC and AML processes over the past two years, with official documents indicating that its KYC is divided into three levels: binding identification, address verification, and facial recognition as basic compliance elements. Additionally, OKX has integrated with on-chain monitoring agencies like Chainalysis for its anti-money laundering policies and has established a trading behavior risk control system.

However, OKX still operates in a gray area in some markets, such as South Korea, where the Financial Intelligence Unit accused OKX in 2024 of providing services to South Korean residents without permission, violating the Specific Financial Transaction Information Act. Similar situations have also been observed in Japan, the U.S., and other regions. In early 2025, OKX's Seychelles subsidiary reached a settlement with the U.S. Department of Justice, admitting to providing remittance services to U.S. users without permission and paying a $84 million fine, while forfeiting approximately $421 million in related revenue. Although no specific employee or customer liability was involved, and no criminal charges were triggered, this incident also prompted adjustments in OKX's compliance efforts. In response to regulatory concerns, OKX announced it would significantly strengthen its KYC, customer risk rating (CRR), and anti-money laundering (AML) systems, claiming to have formed an on-chain investigation and compliance team of over 150 people. Thus, OKX's compliance journey has entered a new phase.

3. Is Compliance a Dead End for CEX?

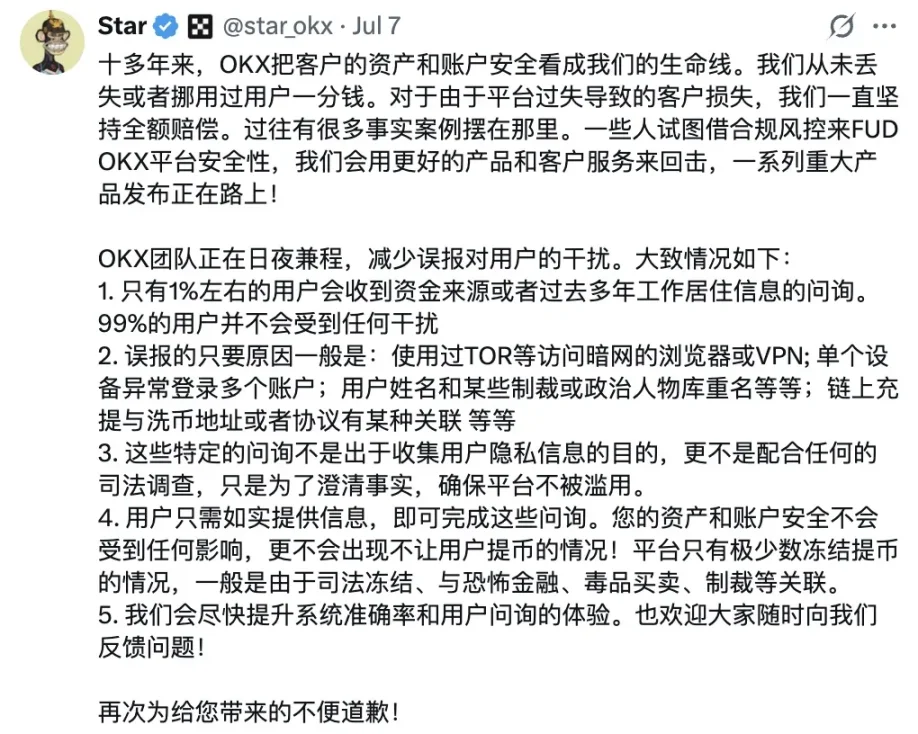

As cryptocurrency assets continue to evolve, compliance is an unavoidable trend. On July 7, Xu Mingxing reiterated that OKX is enhancing its technical capabilities to reduce the interference of false positives on users, noting that only about 1% of users would receive inquiries about the source of funds or their work and residence information from previous years. 99% of users would not be affected at all, and he listed the main reasons for false positives. He also emphasized that specific inquiries are merely to clarify facts, ensuring that the platform is not abused and that users' assets and account security are not compromised, and that there would be no situation where users are prevented from withdrawing funds. Despite Xu Mingxing posting 7 tweets in just three days, he still could not quell the public outrage.

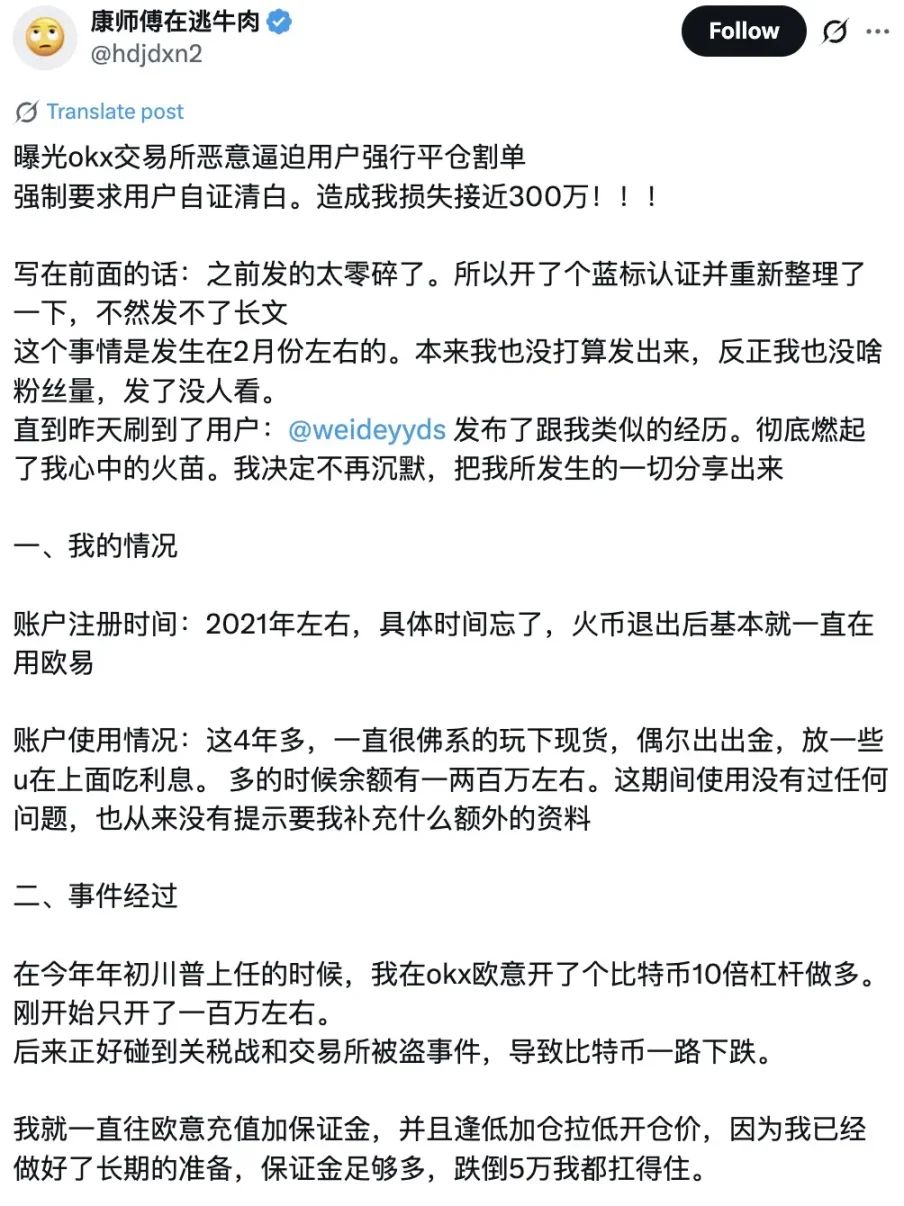

In terms of compliance, any CEX must cooperate with regulators, which is a common requirement of laws in various countries and is not inherently problematic. What truly made OKX a target of criticism is the trust crisis among users triggered by compliance issues. From the first exposure, OKX was suspected of maliciously freezing accounts, followed by multiple reports of OKX forcibly liquidating positions, insufficient contract depth, and malicious price manipulation. These scandals, which are "commonplace" for exchanges, erupted all at once, and some KOLs began to "dig up old accounts," bringing back past incidents involving OKX, including the event in 2020 when all user assets were restricted from withdrawal for a month. OKX has, to some extent, fallen into a trust crisis, with many users preparing to exit OKX for other CEXs or even DEXs due to concerns about asset security, only to find that they could not deactivate their accounts. This "no way out" situation further ignited user emotions.

Regarding why OKX has taken such urgent and aggressive compliance measures, some KOLs speculate that the main reason may be that OKX is planning to go public in the U.S. OKX has previously signaled its intention to go public multiple times and has been laying the groundwork for years, from shelling out for a Hong Kong stock listing to reducing the empowerment of $OKB, and pushing for business compliance during the critical moments of the wallet war. Is OKX really becoming conservative for the sake of going public? Certainly, as a globally renowned exchange, OKX has a very bright fundamental outlook and can achieve a relatively high valuation. If it can clarify past controversies through SEC scrutiny and successfully go public to gain entry into the mainstream financial circle, it can be said to be all benefits with no harm. However, the corresponding direct cost is the high expense of complying with strict regulatory frameworks.

From another perspective, an important aspect of CEX compliance work is to build a communication bridge between CEX and regulatory authorities, coordinating the relationship between its business model and regulatory requirements. Shifting compliance responsibilities solely onto users is not the proper way to fulfill this task. Perhaps, if OKX hopes to truly establish a credible compliance system in the future, it should find a balance between user experience and regulatory cooperation, especially by clarifying the boundaries of its compliance measures and providing users with adequate information and guarantees regarding data storage and fund custody.

4. What Ordinary Investors Can Do

For ordinary investors, cooperating with KYC, asset source verification, and other systems has become a routine requirement of centralized exchanges. After completing basic identity verification, ordinary investors should pay special attention to preparing proof materials for the source of their assets. For example, tax documents, bank statements, transaction records, deposit records, and proof of work income are commonly used forms of verification in compliance checks. Among these, "tax documents" serve as an effective proof with both official recognition and completeness of information. If investors have declared and paid taxes on profits from trading cryptocurrencies, their tax returns can directly support the legitimacy of their income sources.

This also raises an important but often overlooked issue: Do profits from cryptocurrency trading need to be taxed? The answer is yes. According to the standards commonly adopted by tax authorities in various countries, profits from buying and selling cryptocurrency are generally considered "capital gains" or "property income" and should be reported and taxed according to the law. In the United States, the tax issue surrounding cryptocurrencies caught the attention of the IRS as early as 2014. In recent years, with the booming cryptocurrency market in the U.S., the IRS's tax regulations have been continuously refined. Notable figures in the crypto space, such as "Bitcoin Jesus" Roger Ver and MicroStrategy CEO Michael Saylor, have faced IRS accusations due to tax issues, resulting in hefty fines and even potential prison time. Even in mainland China, where cryptocurrencies are prohibited, tax authorities have been closely monitoring profits from cryptocurrency trading. Recently, there were concerns in the crypto community when a resident in Zhejiang was required by tax authorities to pay back taxes on their USDT earnings. It was verified that the relevant earnings of this mainland resident were discovered by the tax department through the CRS (Common Reporting Standard), as there was a sum of money in their account that was derived from their cryptocurrency trading profits. Although the tax authority's investigation was not specifically targeting the act of "trading cryptocurrencies," once the trading profits flowed back into the bank account, they naturally fell under the purview of financial regulation. Additionally, it should be noted that since exchanges like CEX are considered illegal in mainland China, tax authorities cannot obtain user trading information on a large scale. Compared to cryptocurrency-to-cryptocurrency exchanges, the focus is more on tracking fiat currency funds.

Tax evasion from cryptocurrency trading is not an act that exists in a "gray area," nor is it a small issue that can be ignored in the long term. Major countries around the world have already begun to pay attention to the tax issues arising from cryptocurrency assets. Although the timing, methods, and intensity of actions taken by different countries vary, the reality that profits from cryptocurrency trading need to be taxed is undeniable and unavoidable. For ordinary investors, the optimal solution in the face of tax or other regulatory issues is not to evade but to prepare and cooperate. Investors should consider actively keeping records of their trading activities, fiat currency inflow and outflow statements, the flow of funds, and various proofs during the profit calculation process, so that they have evidence to rely on and can clearly defend themselves in future tax inquiries. Otherwise, if they are required to pay back taxes without being able to trace the source of their assets, they may not only face additional tax burdens but also suffer greater financial losses due to difficulties in providing evidence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。