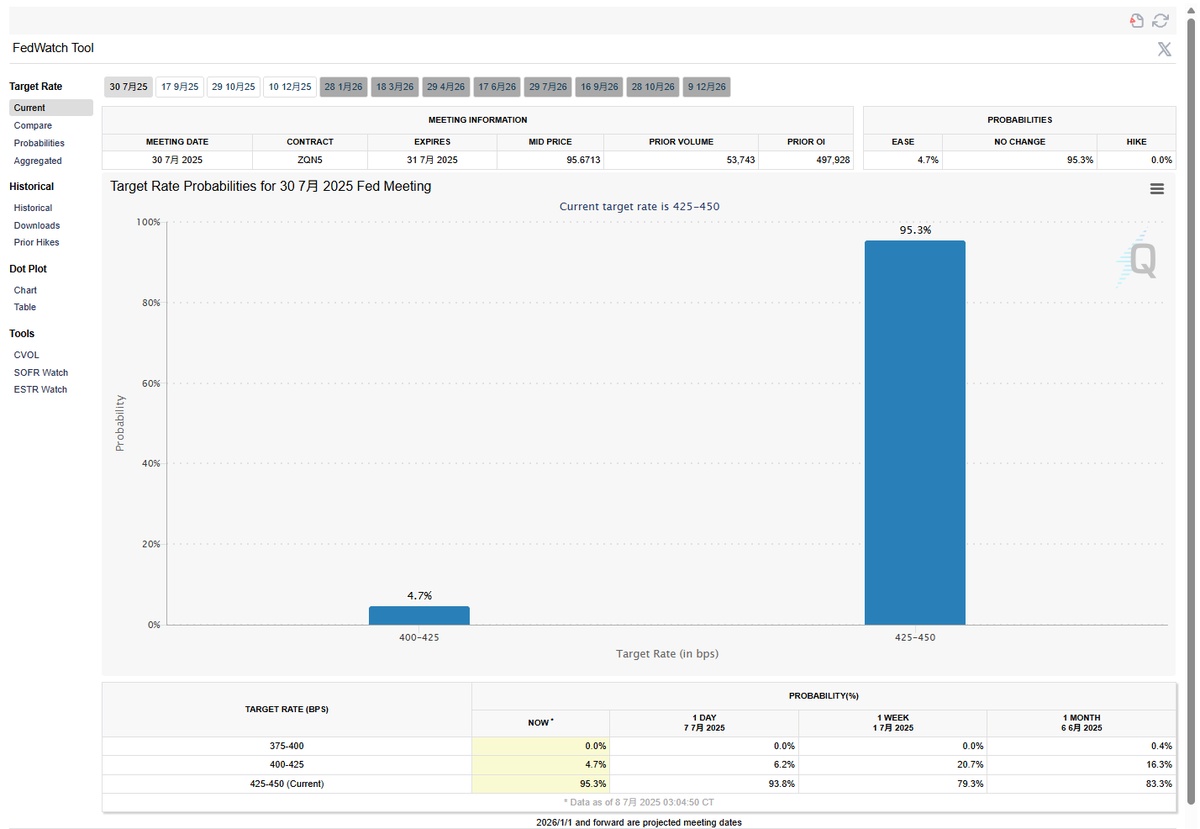

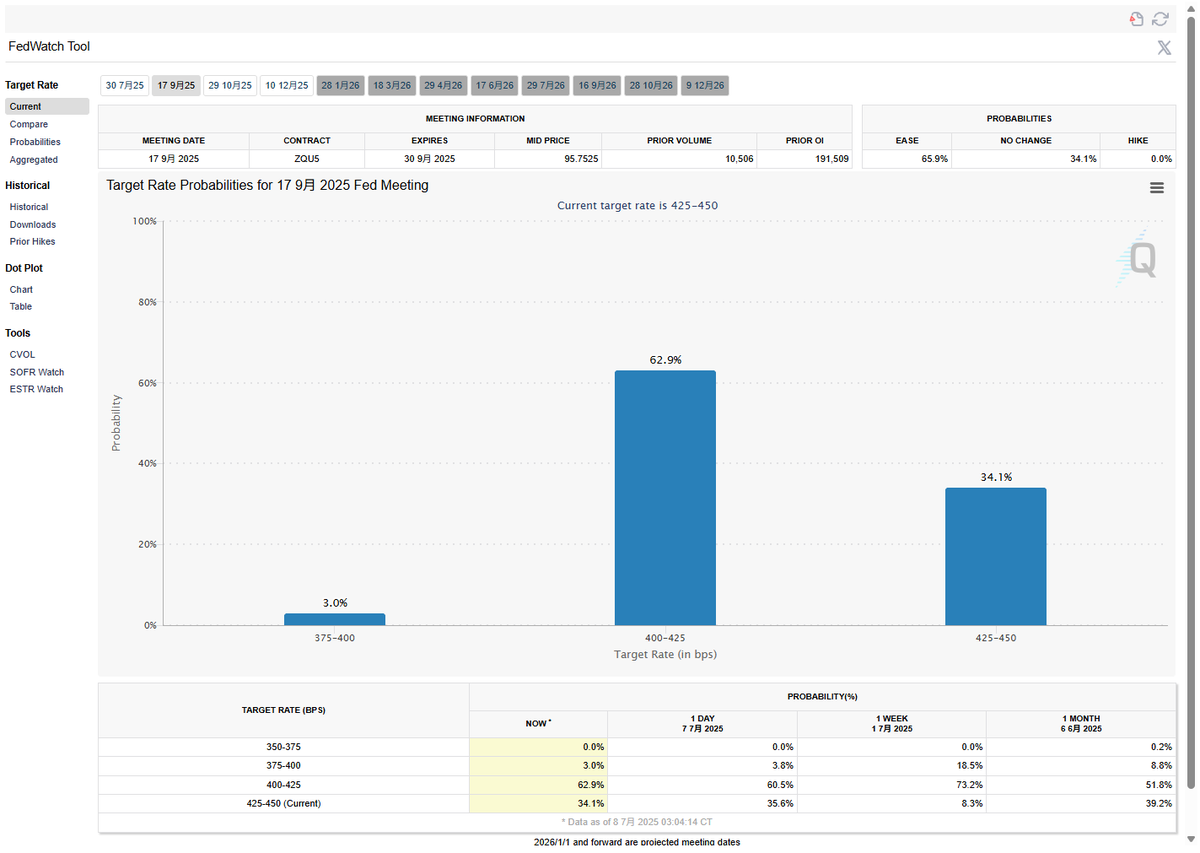

Although Trump has been calling for interest rate cuts, market expectations for rate cuts in July and September have continued to weaken. Last week's data showed that the probability of no rate cut in July was 80%, and it has now risen to 95%. The probability of no rate cut in September has also increased from 6.8% to 34.1%. The reason is the rising inflation, declining unemployment rate, and recovering employment numbers, indicating that the U.S. economy remains resilient, and inflationary pressures have not been resolved. As a result, investors do not have high expectations for the Federal Reserve's short-term easing.

This is not good news for Trump. As previously analyzed, interest rate cuts are key to the smooth advancement of his fiscal and trade policies, but Powell is unlikely to cooperate under the current circumstances, especially as a rate cut in July is almost hopeless.

Therefore, Trump is very likely to nominate a new Federal Reserve Chair this month. Although Bessenet, who is currently being considered, is pro-Trump, he is not a Federal Reserve governor and would find it difficult to influence the internal structure of the Fed. If someone like Bowman or Waller, who are current governors, were appointed, it could potentially create new support within the Fed, gradually changing the policy inclination towards easing.

This personnel arrangement not only increases the internal competition within the Federal Reserve but may also raise market expectations for future rate cuts. If a signal of easing is not released soon, the U.S. fiscal pressure will continue to drain market liquidity through high interest rates.

Therefore, Trump is very likely to appoint a new chair to provide monetary policy checks and support for his tariff policies and the Great Beautiful Plan.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。