Author: Shew, Xianrang

Liquidity is an important topic in financial markets, whether in DeFi, centralized trading platforms, or traditional finance. When designing any type of trading market, it is essential to consider how to acquire and efficiently utilize liquidity.

In the DeFi space, the success of many projects is attributed to their provision of sufficient liquidity to users. A considerable amount of research suggests that Pump.fun's use of Bonding Curves to provide liquidity for early token issuance is one of the core reasons for its success. Future DeFi innovations will undoubtedly revolve around further optimization of liquidity utilization.

In this article, we will focus on liquidity utilization methods and discuss the following sections:

The basic rules of liquidity. In traditional finance, discussions about liquidity are quite rich. This section will briefly introduce some conclusions, such as the contradiction between liquidity and price discovery, as well as the impossible triangle related to liquidity in the DeFi space.

The current state of liquidity provision within DeFi systems. As the DeFi space continues to innovate, we have seen market participants like intent solvers, which were previously not discussed, now become major liquidity providers in the market.

Potential future liquidity provision solutions, such as the liquidity availability framework proposed by Injective.

The Trade-off of Liquidity

In traditional finance, there is a field that deeply studies market liquidity called "micro market structure," which has an interesting conclusion: "There is an antagonistic relationship between liquidity and the price that contains information."

In simple terms, if we want asset prices to be better discovered, we will lack liquidity; when we give up price discovery, we will have better liquidity. An extreme case here is insider trading. Theoretically, insider trading makes it easier to control prices at appropriate levels, but the huge profits gained by insider traders actually come from liquidity providers in the market, so insider trading severely depletes liquidity, which is one reason regulatory authorities restrict it.

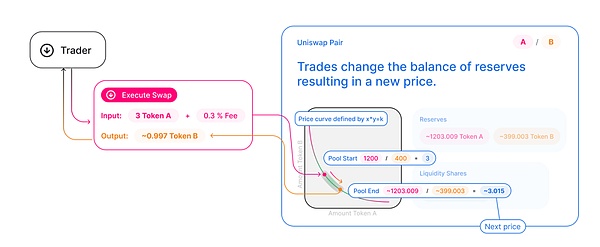

In the DeFi space, many previous projects did not consider the antagonistic relationship between price discovery and liquidity. For example, in Uniswap V2, everyone only focused on the x*y=k pricing formula, which ensures that asset prices can change after each transaction while ensuring that any amount of trading will not exhaust the AMM's liquidity.

However, regarding how to improve liquidity within trading platforms, Uniswap V2 only used the most passive mechanism, relying on transaction fee incentives to drive LPs to inject liquidity into the AMM. Of course, we can also observe that the changes caused by price discovery constitute a large part of slippage loss. Another part of slippage loss is due to MEV attacks, but since this article mainly discusses liquidity issues, we will not delve further into MEV.

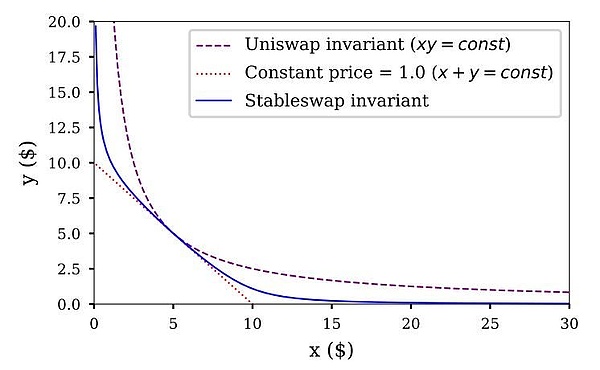

Curve, which aims to facilitate stablecoin exchanges, employs some more interesting curves that smooth price changes to enhance liquidity and reduce slippage. We can consider this a trade-off of reducing price discovery to improve liquidity. Since the price fluctuations between stablecoins are relatively small, the benefits of this trade-off are high with few downsides, making Curve the largest stablecoin exchange protocol within the Ethereum ecosystem.

The Stableswap invariant shown in the figure below is Curve's price curve. We can see that compared to Uniswap V2's curve, Curve more smoothly reduces slippage, but insufficient price discovery brings another problem: when the price within the AMM deviates from the actual market price, due to low price discovery efficiency, arbitrageurs need to spend a significant amount of capital to adjust the asset price within the AMM to the correct position.

With the further development of the AMM field, Uniswap V3 eventually introduced a self-selected range liquidity provision scheme, where liquidity is inconsistent across different price ranges, and the price discovery capability is also inconsistent. LPs can add liquidity based on their price predictions.

Uniswap V3 can be considered the culmination of AMM. Paradigm has pointed out that the liquidity provision model of Uniswap V3 can simulate any AMM curve. Theoretically, we can view its liquidity distribution as the final trade-off result of all LPs regarding price discovery and slippage. The figure below shows the liquidity distribution in the BTC/USDC market, where the liquidity injected by LPs in different ranges reflects their views on the trade-off between price discovery and slippage.

We can see that for the trade-off between liquidity and price discovery, current protocols have two solutions:

Based on the specificity of the service market, protocol designers directly provide the final trade-off. For example, Curve focuses on stablecoin exchanges, so the designers directly chose a mechanism that favors liquidity.

Design an open mechanism where liquidity providers weigh the trade-offs themselves. For instance, Uniswap V3 leaves the trade-off between liquidity and price discovery to LPs, while order books in traditional financial exchanges are also determined by the order placers.

Another interesting question regarding liquidity is the impossible triangle of trading markets, which states that any trading market must make trade-offs between trading price, trading volume, and trading time. If users want to execute trades at the best price and the fastest speed, they will certainly be unable to complete large transactions; if users wish to conduct large transactions and execute them at the best price, they will need to spend a lot of time splitting orders and completing trades across different platforms; if users want to trade quickly and meet a large trading volume, they will not be able to execute at the best price, and slippage will inevitably be significant.

Interestingly, increasing liquidity can largely solve the impossible triangle problem. Clearly, when the liquidity of a trading market is sufficiently large, any trade can be completed at the best price, fastest speed, and largest amount.

However, currently, all AMMs can almost only ensure trading time and trading volume, which is due to the peculiarities of blockchain, as users must complete token exchanges within a single transaction, making the trading time approach infinitesimally small. Additionally, due to complexity and transaction fee considerations, almost all AMMs allow for nearly unlimited token exchanges to be completed in a single transaction, which inevitably leads to high slippage.

For smart contracts, the atomicity of AMM token exchanges is crucial, making AMMs an important part of DeFi Lego. For example, stablecoin protocols directly interact with AMMs to stabilize prices. However, the main users in the market are often non-smart contract accounts, which do not care about the atomicity of transactions and can tolerate transactions taking several minutes to complete rather than requiring immediate execution.

Thus, intent protocols have emerged, sacrificing transaction speed for better execution prices and larger trading volumes. In the next section, we will detail the main on-chain liquidity provision protocols and their trade-offs in the impossible triangle, with a particular focus on some emerging protocols, such as intent.

Liquidity Provision Protocols

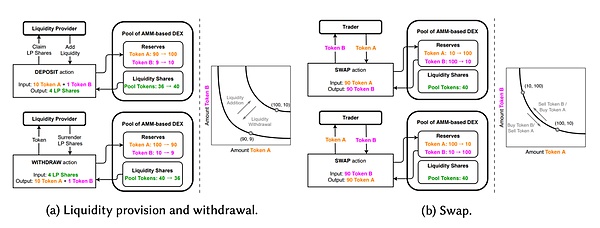

Regarding liquidity provision protocols, they are not the same concept as liquidity providers (LPs). For example, AMM is a type of liquidity provision protocol, where anyone can complete token buying and selling using the liquidity within the AMM, while users who inject assets into the AMM's liquidity pool are the LPs. Since we are primarily discussing the design at the protocol level, we will temporarily ignore the actual LPs behind the protocols.

AMM

AMM is a groundbreaking innovation that makes on-chain token buying and selling truly possible. Most AMMs often adopt mathematical methods based on invariants, and there are three different roles within the system:

Liquidity providers, who provide liquidity to the AMM.

Traders, who initiate transactions to complete token buying and selling.

Arbitrageurs, who arbitrage between the AMM and other platforms, indirectly smoothing out price differences.

The figure below is taken from SoK: Decentralized Exchanges (DEX) with Automated Market Maker (AMM) Protocols. It illustrates the basic process of liquidity addition and trading in AMMs.

It can be said that AMM is a protocol that balances price discovery and liquidity. In its design, it considers trading time (any token exchange can be completed in a single transaction) and trading volume (theoretically, an unlimited number of tokens can be exchanged) but weakens control over trading prices.

Generally, the larger the amount a user initiates for a transaction, the slippage loss will increase super-linearly. Of course, in any type of trading platform, quickly buying and selling large amounts of assets will significantly impact market prices, while the advantage of AMM in this regard is that it can predict the impact of a transaction on prices based on the curve in advance.

Moreover, the atomicity of transactions provided by AMM is an important feature for on-chain protocols, allowing on-chain protocols to intervene in transactions for the first time. For instance, the liquidation process of lending protocols almost entirely relies on the AMM system, where liquidators often use flash loans to obtain collateral from liquidated positions and then directly sell the collateral on the AMM to repay the flash loan.

Since flash loans are realized based on the atomicity of AMM transactions, without AMMs, large position liquidations in on-chain lending protocols would be nearly impossible.

Additionally, the price discovery capability of AMMs is also very useful for on-chain systems, making asset pricing possible. After the emergence of ERC-20, issuing on-chain assets is no longer a problem. However, before AMMs appeared, directly pricing tokens on-chain was a challenging issue.

After the emergence of AMMs, we can price on-chain tokens through AMMs. For asset issuers, they only need to inject initial liquidity into the AMM, and with the development of DeFi, liquidity mining and other more convenient liquidity provision methods have emerged.

The price discovery and atomic token exchange provided by AMMs have laid a solid foundation for the development of DeFi. However, due to the inherent latency issues of blockchain, more assets choose to conduct real-time trading on CEXs, where the trading volume of these tokens on CEXs is often much larger than that on AMMs. In other words, these tokens primarily undergo price discovery on CEXs rather than on AMMs.

The problem caused by this is that asset prices within AMMs lag behind those on CEXs, allowing arbitrageurs to profit from the price differences, but such arbitrage may adversely affect normal traders.

In simple terms, for DeFi protocols, AMMs are still an indispensable part of the DeFi ecosystem due to their atomicity. The price discovery function of AMMs also makes them the core platform for pricing after the issuance of new assets. However, on the other hand, due to the limitations of AMM price discovery, such as block delays, when tokens go live, AMMs cannot dominate the price discovery process. At this point, trading on AMMs may result in worse conditions than on CEXs for traders.

Aggregators

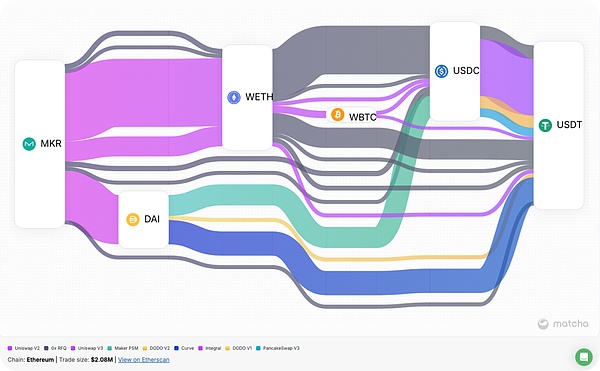

Although AMMs constitute a core part of the DeFi ecosystem, their shortcomings cannot be ignored, one of the most obvious being the issue of fragmented liquidity. Different AMMs use different liquidity pools, and even different token pairs within a single AMM have their own independent pools, leading to highly dispersed liquidity.

Currently, trading across multiple AMMs and token pairs requires a lot of optimization strategies, such as splitting large orders into multiple smaller ones and then trading them across different AMMs, or finding intermediary assets as a bridge. The result of this approach is a significant increase in trading costs.

Regarding the splitting and routing of large orders, it often requires professional solution providers to offer the optimal token exchange paths, and this is the role that aggregators fulfill. The figure below shows the token exchange path obtained by the 0x aggregator for a single transaction. We can see that in the process of exchanging MKR for USDT, 0x used various intermediary assets for the exchange.

For on-chain traders, trading with an aggregator is often more efficient compared to simply using an AMM. Aggregators typically solve paths using no-arbitrage strategies, meaning that all pools interacted with during the trading process do not have arbitrage paths after the transaction is completed. Therefore, aggregators do not have price discovery functions; they purely consider whether there is sufficient liquidity at a certain price.

In simple terms, aggregators sacrifice price discovery to achieve better liquidity. In the trade-offs of the impossible triangle, aggregators and AMMs are essentially consistent, both sacrificing trading time while preserving trading volume and execution price. Aggregators use AMMs at their core but aggregate the fragmented liquidity within the AMM system, resulting in lower slippage than ordinary AMMs.

However, the problem with aggregators is that they are only suitable for on-chain traders and cannot be directly adopted by smart contract accounts. This is because aggregators respond to trading requests using APIs, and this process is not completed on-chain. When users find the quotes provided by the aggregator's API reasonable, they then execute trades based on the aggregator's trading path.

Clearly, this asynchronous method lacks atomicity, so aggregators cannot be directly called by contracts.

Intent

Aggregators only respond to individual user transactions, but theoretically, batch execution of transactions can yield better results, which is where the intent protocol comes in.

The so-called intent refers to users sending their expected token buy and sell results to the aggregator in a manner similar to limit orders, where the solver will attempt to process the orders in the optimal way.

Unlike aggregators that solve multiple orders in isolation, the intent's solver will batch solve a group of transactions, executing certain strategies based on the order flow. For example, order internalization—where two orders in opposite directions may appear within the order flow—can allow for direct matching of these two orders without needing to rely on third-party liquidity from AMMs.

Additionally, the solver can also leverage liquidity within CEXs when executing the order flow, such as directly buying tokens on Binance to fill user orders.

The benefit of intent also lies in its ability to reduce potential MEV losses. Since the final execution of transactions is handled by the solver, it generally performs deterministic batch execution of transactions through MEV infrastructure, which can greatly avoid being targeted by MEV attacks.

Essentially, we can consider intent as a more advanced aggregator. Traditional aggregators like 1inch have also launched their own intent solutions. However, compared to aggregators, intent has achieved the use of off-chain liquidity for the first time, further optimizing the trading experience.

Similar to aggregators, the intent protocol does not possess price discovery functions. It is difficult to use the intent protocol to price a new asset. In terms of the impossible triangle trade-offs, intent is more akin to traditional order book models, where the protocol chooses better execution prices and larger trading volumes but sacrifices the pursuit of trading time. In CoWSwap, user-submitted trades are only on-chain every three blocks. If the quotes provided by users are too stringent, the transaction may not receive a response from the solver and thus cannot be executed on-chain for a long time.

INJ Public Chain's "Liquidity Availability" Solution

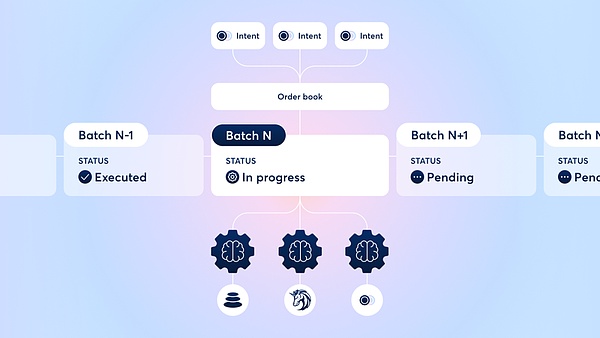

We have analyzed AMMs, aggregators, and intents in sequence. The next question is whether it is possible to design a better trading market that can achieve better results regarding liquidity issues. Injective has proposed its own solution, namely the liquidity availability framework.

The AMM liquidity mentioned earlier is a typical dApp-exclusive liquidity. AMMs must maintain their own liquidity within the protocol. For example, Uniswap V2 accumulated a large amount of liquidity through liquidity mining; however, this liquidity cannot be used by other AMMs.

The biggest drawback of dApp-exclusive liquidity is liquidity fragmentation, which is also the reason for the emergence of aggregators and intents. In addition, an obvious solution is to build liquidity at the chain level, i.e., full-chain liquidity, where all dApps obtain liquidity from the native modules of the public chain.

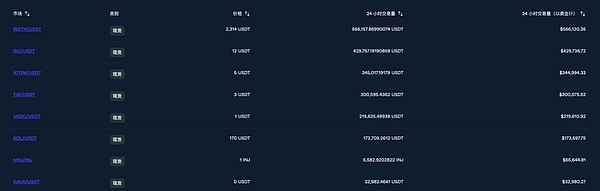

Injective has provided its own solution based on the full-chain liquidity availability framework. It has embedded a module called Exchange at the bottom layer of the chain, which has an order book matching engine that any user or dApp can interact with. The figure below shows the liquidity provided by Injective at the bottom layer for some trading pairs.

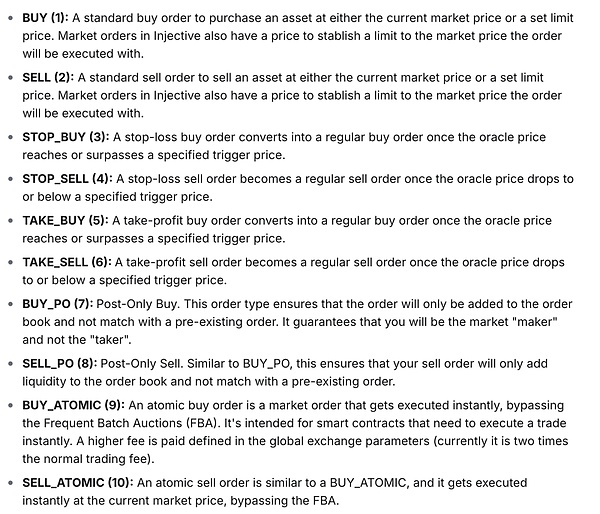

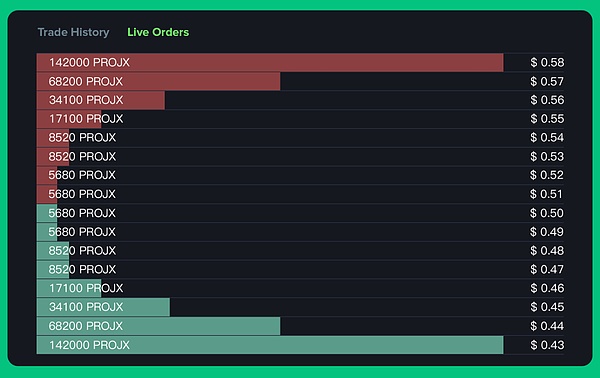

Compared to the traditional dApp-exclusive liquidity model, using a unified order book to obtain liquidity has many advantages. First, the order book itself is an intent system, allowing users to express their expectations for token buy and sell results using different order instructions. The figure below shows the ten types of orders currently supported by Injective's Exchange module, meaning that dApps on Injective can provide users with an experience similar to intent without needing any intent protocol.

At the same time, Injective also allows smart contracts to use the Exchange module for order placement, giving smart contracts the opportunity to access the intent system. For example, the Helix platform on the INJ chain is actually constructed based on smart contracts, allowing users to directly interact with the order book by calling the Helix contract.

For aggregators, with Injective referencing full-chain liquidity, there is no longer a need for aggregators to exist, as users can directly interact with the Exchange module to obtain the best prices without needing to call an aggregator.

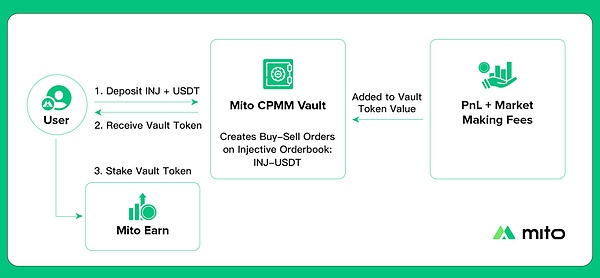

Additionally, as mentioned earlier, one of the core functions of AMMs is to provide price discovery for newly issued tokens. As a widely accepted tool, many LPs hope to use tools similar to AMMs to provide liquidity. To bridge the gap between AMMs and order books, Injective has launched the Mito protocol, which provides automated market-making functions to address the aforementioned issues, simulating the liquidity provision methods within AMMs using order placements.

The Mito protocol continuously adjusts the funds provided by users for market-making, essentially similar to Hyperliquid's HLP. The introduction of this mechanism allows LPs to avoid using customized strategies on the order book; they only need to inject liquidity into the AMM. This reduces the difficulty of providing liquidity.

For pricing during early token issuance, Mito also provides a Launchpad function, pre-selling tokens to raise initial market-making funds, which are then injected into Mito's CPMM automated market-making protocol to solve the early pricing issues of tokens.

We can see that after Injective adopts the full-chain liquidity architecture, many existing protocols in the DeFi space no longer need to exist, as users can trade directly on the order book, significantly reducing trading complexity and no longer needing to rely on aggregators or other third parties to initiate trades to obtain optimal liquidity. For dApps, once the native order book is introduced, dApps can leverage the order book to implement more complex functions, providing dApp creators with more expressive financial primitives.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。