On July 7, cryptocurrency mining company Bit Digital (stock code: BTBT) made a shocking decision that rattled the market—selling 280 Bitcoin holdings and transferring all cryptocurrency assets to Ethereum. This company, which once thrived on Bitcoin mining, now holds over 100,000 ETH. Following the news, BTBT's stock price surged 18.37% on the same day, closing at $3.48.

The company stated on social media that it is fully betting on the long-term value of Ethereum, actively increasing its Ethereum holdings, and positioning itself in the most influential digital asset of this generation—ETH.

This move raises a thought-provoking question: Is the direction of the cryptocurrency market truly undergoing a fundamental shift? Bitcoin, as "digital gold," has been the anchor of the entire industry. However, an increasing amount of capital and narrative is shifting towards Ethereum. Bit Digital's "turnaround" may not only represent a change in asset allocation but could also signify a deep structural adjustment in the cryptocurrency industry.

Why Did Bit Digital Abandon BTC and Go All-In on ETH?

The "Survival Crisis" of BTC Mining

Bit Digital's "complete pivot" is not due to a lack of love for Bitcoin, but rather the harsh reality.

The Bitcoin "halving" in April 2024 will cut miner rewards in half to 3.125 BTC, while the network's hash rate continues to soar, intensifying competition. On May 1, 2025, the hash rate reached a historical high of 831 EH/s, while the hash price had already dropped to $0.049/TH—almost halving compared to the same period last year. Transaction fees have not compensated for this loss. Additionally, Bitcoin mining companies consume between 67 to 240 terawatt-hours of electricity annually, with the energy consumption per transaction around 830 kilowatt-hours. This not only brings environmental issues but also forces miners to bear high electricity costs and investments in specialized hardware, continuously squeezing their profit margins.

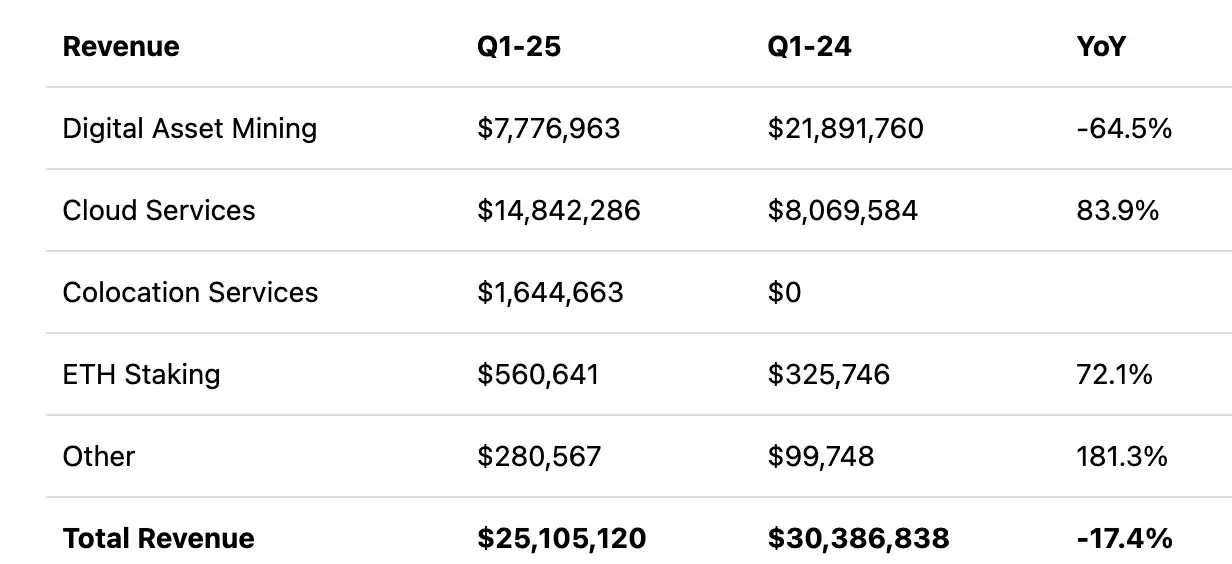

The company's financial report corroborates this predicament: Bitcoin mining revenue in the first quarter of 2025 plummeted 64% year-on-year, with Bitcoin output sharply reduced by 80%, producing only 126.5 Bitcoins. Under the dual pressure of high energy consumption and hardware expenses, even when Bitcoin prices briefly surpassed $100,000, miners experienced a structural misalignment of "price increase, profit decline."

Another company that has also completed a pivot—SharpLink Gaming (stock code: SBET)—has partially remedied this model dilemma by staking Ethereum. Currently, SharpLink has staked all of its 198,167 ETH and has earned 222 ETH in on-chain rewards since June 2. Compared to the sharp decline in Bitcoin mining revenue, this PoS-driven passive cash flow is not only more predictable but also effectively alleviates the company's operational pressure and cash flow tightness.

Bit Digital is not the first company to exit Bitcoin mining, but it may be the first publicly traded company to pivot so thoroughly. Selling 280 Bitcoins and reallocating all assets to Ethereum is a decision that resembles a "self-reboot" with no turning back.

The "Strategic Value" of ETH

If Bit Digital's departure from Bitcoin was driven by survival pressure, then choosing Ethereum represents a well-considered strategic bet.

Since 2022, Bit Digital has begun to lay the groundwork for Ethereum staking and has now become one of the largest institutional ETH validator operators globally. Meanwhile, Bit Digital is further increasing its holdings through capital operations. The company has signed an underwriting agreement with B. Riley Securities to issue 75 million shares of common stock at $1.90 per share, with total fundraising expected to reach $162.9 million—including over-allotment options—all to be used for purchasing ETH. According to the latest data, the amount of ETH held by the company has surged from 24,434 at the end of March this year to approximately 100,603 now, with a total value close to $189.2 million, placing it among the top global ETH corporate holdings.

So why did Bit Digital choose ETH as its transformation target instead of other altcoins?

First, the PoS (Proof of Stake) mechanism adopted after Ethereum's "merge" demonstrates remarkable energy efficiency. The PoS system eliminates energy-intensive computational demands by allowing validators to stake tokens to participate in network security and transaction validation. As a result, Ethereum's energy consumption has decreased by 99.95%, with the energy consumption per transaction only 50 kilowatt-hours.

Additionally, the PoS mechanism offers a more attractive profit model: stakers earn passive income by contributing to network security, similar to bank deposit interest. The annualized yield for Ethereum staking typically ranges from 4% to 7%, providing companies with more stable and predictable cash flow. The emergence of liquid staking derivatives (LSDs) has further improved efficiency, enhanced capital efficiency, and lowered the barriers to entry for staking, significantly increasing the appeal of the Ethereum ecosystem to institutional capital.

On a broader ecological level, Ethereum has become the main battleground for key innovations such as stablecoin settlement, DePIN, RWA, and Restaking. These growing on-chain applications not only generate continuous transaction fees but also directly enhance the demand and value of ETH, further solidifying its position as "digital financial infrastructure." In its prospectus, Bit Digital also specifically pointed out that the gradual clarity of U.S. regulations regarding stablecoins—such as the recently passed "GENIUS Act"—is strengthening its long-term confidence in Ethereum. The company stated, "ETH is seen as a means of storing digital native value and is the core infrastructure for stablecoins and decentralized applications. We will continue to gradually expand our ETH holdings through staking rewards."

Bit Digital's CEO Sam Tabar explicitly stated in the company's public announcement: "We believe Ethereum has the ability to rewrite the entire financial system. Ethereum's programmable features, increasing adoption rate, and staking yield model represent the future of digital assets."

Related Reading: "30-Fold Surge in Four Days, BitMine Sparks ETH Reserve Trend in U.S. Stocks"

Conclusion

Bit Digital is not an isolated case. Companies like SharpLink Gaming (stock code: SBET) and BitMine (stock code: BMNR) have also seen significant rebounds in stock prices after shifting to Ethereum reserve strategies, escaping previous performance slumps.

Now, the "ETH Microstrategy" is quietly becoming a new narrative in the U.S. stock crypto sector. The consecutive surges in "ETH Microstrategy" stocks indicate that the market is beginning to recognize this path: using ETH as a corporate reserve asset may be gradually forming a consensus.

Of course, whether this upward trend can be sustained and whether there are elements of short-term emotional speculation remains to be further validated by time and the market. However, it is certain that Ethereum is becoming the "core asset" in the crypto world and is rewriting the way capital is allocated in this era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。