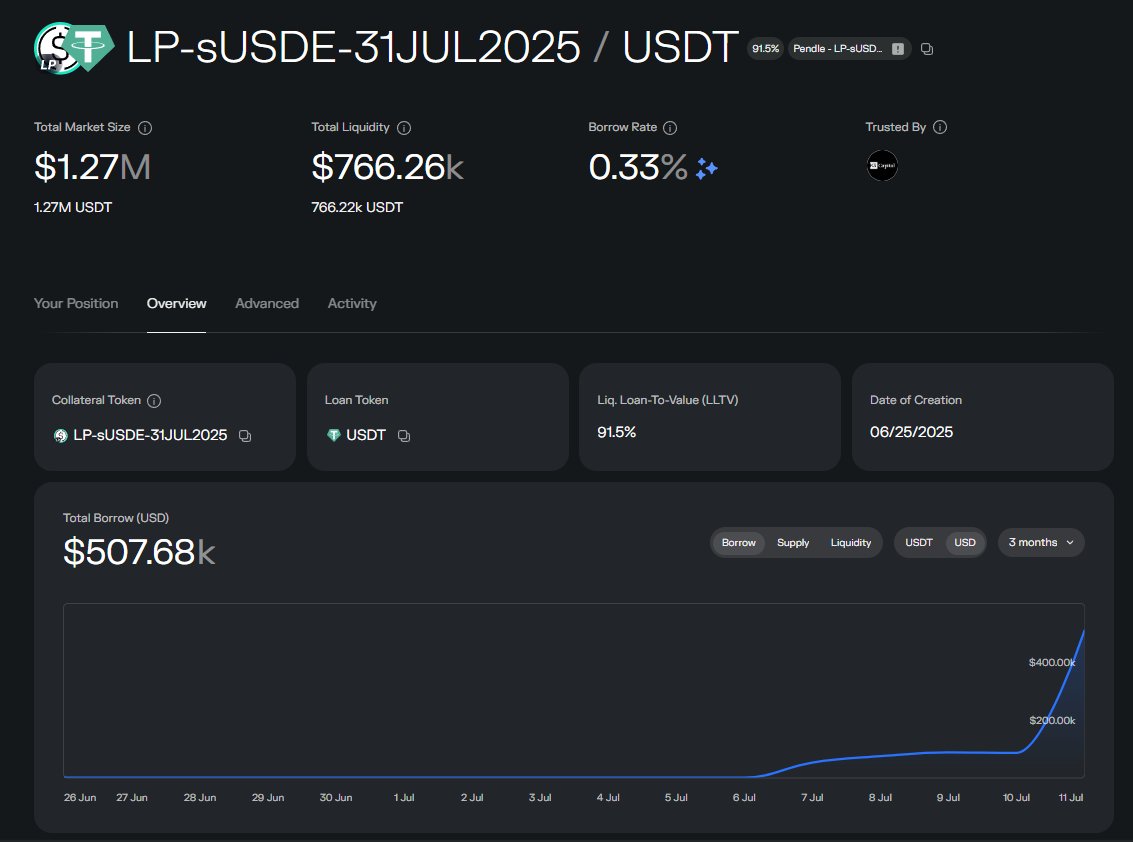

⚡️Shocked by Morpho, the borrowing rate of 0.33% is insane——

Following Silo, the larger @MorphoLabs has also launched support for Pendle LP, currently opening three LP collateral pools for @ethena_labs assets:

🔹LP-sUSDe (25 Sep 2025) / USDT

🔹LP-sUSDe (31 Jul 2025) / USDT

🔹LP-eUSDe (14 Aug 2025) / USDT

The borrowing rate for LP-sUSDe (31 Jul 2025) is only 0.33%, a great arbitrage opportunity! The principle and operation are the same as the previous PT collateral——

1⃣ Purchase LP-sUSDe (31 Jul 2025) on @pendle_fi, with an APY of 7.66%.

2⃣ Use the Tool on Pendle to wrap the LP into Wrapped LP.

3⃣ Collateralize your wrapped LP on Morpho to borrow USDT (with an LTV cap of 87%).

4⃣ Use the borrowed USDT to buy LP on Pendle, and repeat the cycle.

After some calculations, if you invest 1000u and do 2 rounds of the cycle, the annualized return can be increased to 22.5%, and you can earn 25X sats points from Ethena, doubling the returns compared to simply holding PT or LP!

However, there are still risks involved. If extreme volatility occurs (for example, ETH plummets → sUSDe unpegs → PT premiums), it could trigger risks.

So, for those playing with looped loans, remember two points:

It is strongly recommended to limit to a maximum of two layers and keep a liquidation buffer of 5%-10%, do not borrow to the max.

The borrowing rate will fluctuate, so set up a monitoring system; if the rate spikes, you need to close your position in time to prevent liquidation penalties!

@tn_pendle

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。