Original Title: "The Upgrade of the Stablecoin Dark War: Circle Joins Forces with Trading Platforms to Build a USDC 'Shadow Alliance'"

Original Source: Bitpush

Circle has taken new actions. On July 9, CoinDesk reported, citing sources, that Circle has quietly reached a USDC revenue-sharing agreement with Bybit, the world's second-largest cryptocurrency exchange. This is another deal for Circle in expanding the use cases of USDC, following agreements with Coinbase and Binance.

At the same time, Circle announced a partnership with OKX to provide a one-to-one USDC fiat exchange channel for its 60 million users. Just a few weeks ago, Circle completed its IPO and was listed on the New York exchange, with a current market capitalization exceeding $44 billion. Behind this series of high-frequency actions is Circle's ambition to play a larger role in the stablecoin market. However, in a market long dominated by Tether, where the compliance path remains unclear, it is still too early to conclude whether Circle's strategy truly has advantages.

Bybit Agreement: Continuing the Old Path of "Revenue for Promotion"

According to informed sources, the general model of the agreement between Circle and Bybit is: the more USDC Bybit holds, the more it can receive from Circle's reserve interest sharing. This approach is not new. Circle has already bound itself to Coinbase in a similar way and paid over $60 million in cooperation fees to Binance, with monthly earnings linked to USDC balances, calculated based on a certain SOFR interest rate standard. At first glance, Circle's use of "interest" to buy "market share" seems like a win-win. However, upon closer inspection, this is essentially a trade-off of sharing profits for growth, with the interest source being U.S. Treasury yields rather than user transaction fees.

This incentive mechanism also has some issues:

· Sustainability of Growth in Doubt: Current U.S. Treasury rates are above 5%, giving Circle enough room to share profits. But once rates decline and profit margins shrink, will platforms still be willing to promote USDC?

· Fragile Cooperative Relationships: Binance has previously adjusted its support for USDC due to regulatory risks, indicating that such cooperative relationships are not solid.

· Control of Traffic Not in Circle's Hands: The real customers are in the hands of the trading platforms, leaving Circle in a relatively passive position.

Using revenue to "buy channels" somewhat indicates that USDC has not yet formed a true market inertia.

OKX Cooperation: Strengthening Key Infrastructure for "Dollar Going Abroad"

The cooperation between Circle and OKX involves providing a one-to-one USDC to USD deposit channel. This partnership is not just about convenience at the exchange level; it is a core piece of Circle's construction of a "global dollar router":

· In countries without local dollar accounts, USDC becomes a tool for non-U.S. users to access dollar assets;

· OKX serves as a local traffic entry point, handling fiat deposits and on-chain circulation;

· Circle acts as the "stablecoin central bank" for clearing and reserves.

When USDC becomes a globally interchangeable expression of the dollar, its network effects and the speed of reduced transaction friction will grow exponentially.

A more practical question is: Do users really need to exchange USDC for dollars? Within trading platforms, USDC is essentially a "pricing unit." Most users hold it to participate in crypto trading rather than for frequent exchanges with fiat currencies.

Therefore, the cooperation with OKX is part of a "compliance narrative," rather than a key factor in directly increasing USDC's market share.

Stable Stock Performance, but Valuation Implies Risks

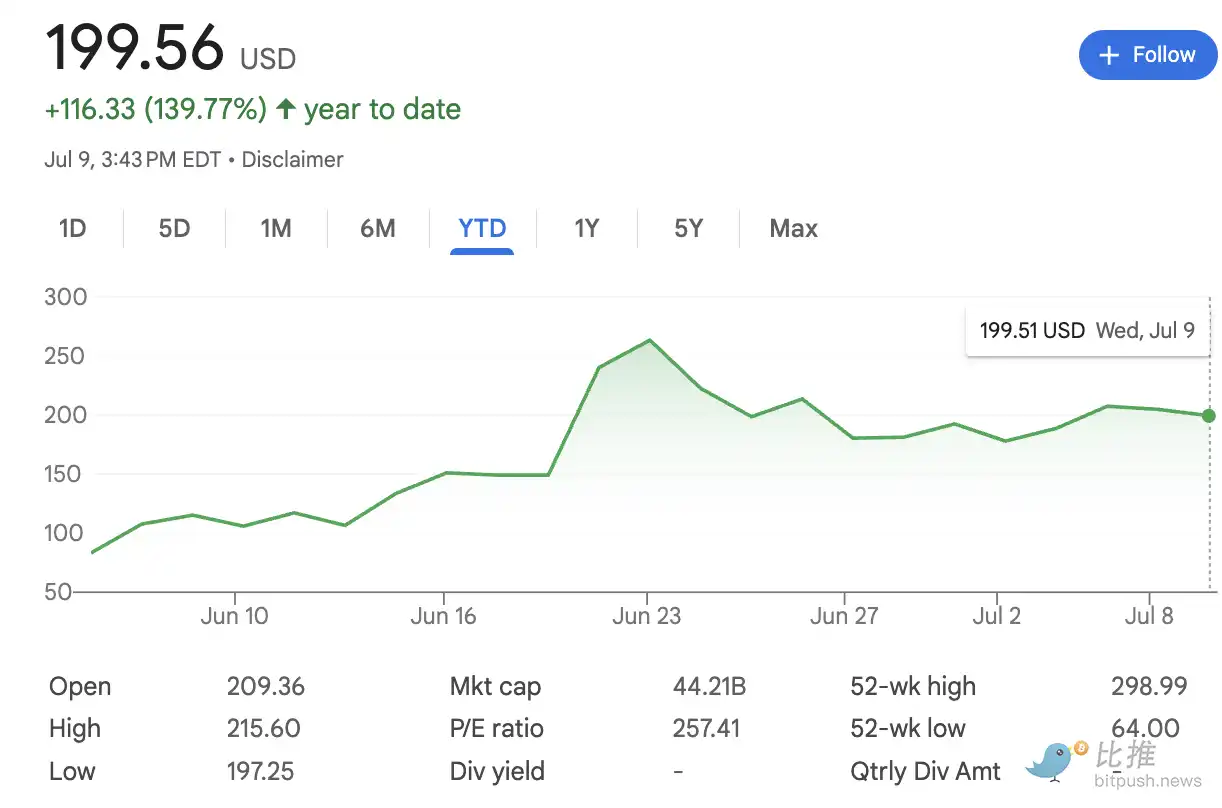

Currently, CRCL's stock price is about $199, with a nearly 80% increase over the past 30 days. Analysts have differing views on its future trajectory.

Seaport Research rated it as a "strong buy" on June 20, with a target price between $215 and $250. However, analysts from institutions like JPMorgan, Goldman Sachs, and Mizuho predict that its stock price may fall back to the $80 to $85 range, citing increasing market competition and the potential challenges posed by the global adoption of central bank digital currencies (CBDCs) to Circle's international expansion. Nevertheless, 12 analysts on Wall Street generally give it a "hold" rating, reflecting the market's complex sentiment about its prospects.

It is worth noting that the current market valuation of Circle resembles a bet on the future regulatory framework for stablecoins. If the Federal Reserve or the Treasury tightens regulations, or if a competitor finds a breakthrough, Circle's business model could still face pressure. Moreover, Circle's high valuation includes expectations of its "becoming the global infrastructure for stablecoins," which is not a story that can be realized in the short term.

Intense Competition in the Stablecoin Market

For Circle, the biggest competitor is undoubtedly Tether (USDT). According to the latest data, Tether's USDT remains the market leader. A report from Finery Markets shows that despite a significant gap with USDT, USDC's institutional OTC trading volume grew 29 times in the first half of 2025, indicating a strong trend of institutional adoption.

At the same time, new stablecoin projects, including Global Dollar (USDG) supported by Robinhood, have emerged in the market, also promoting their adoption through built-in revenue-sharing mechanisms. USDG was launched in the EU on July 1, 2025, and has partnered with numerous industry players like Kraken, Mastercard, and Paxos to create an open network that rewards participants.

In the face of competition, Circle is not only relying on its existing advantages but is also actively exploring diversified revenue sources, such as the Circle Payments Network launched earlier this year, aimed at providing instant stablecoin settlement services for banks, neobanks, and digital wallets to reduce reliance on reserve interest income.

If Tether is the dominant player born from the gray market, Circle is building a new order of stablecoins as financial infrastructure. In the future, this competition may ultimately not be about "which stablecoin is bigger," but rather who can become the core router of the dollar internet, thus holding the power of global transactions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。