Deeply understand the products, market strategies, and next steps behind Pendle's sustainable growth.

Written by: Deep Tide TechFlow

This week, Pendle co-founder TN LEE published a post reviewing Pendle's key achievements in the first half of 2025:

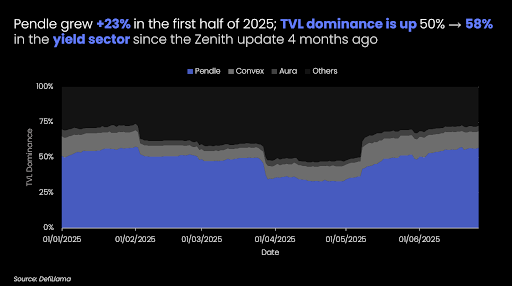

TVL grew by 23%, reaching a new high of $5.29 billion;

Over 70,000 new users were added;

Trading volume exceeded $16 billion;

vePENDLE holders continue to directly benefit from Pendle's growth, earning $13.1 million in fees…

As a leader in the yield trading space, Pendle continues to solidify its dominance with a series of growth metrics, capturing over 58% of the market share.

Based on this important opportunity to review the achievements of the first half of the year and look forward to the plans for the second half, we had an in-depth conversation with TN LEE to discuss the core logic behind Pendle's success and its future development direction.

When discussing the core value that attracts users to participate in Pendle behind the impressive data, TN LEE answered without hesitation:

Yield. I believe the core competitiveness of all protocols comes from strong and sustainable yields. Currently, advanced strategies for participating in different pools can achieve triple-digit APY. One of Pendle's functions as the world's largest yield trading platform is to allow users to freely participate in yield trading of the most popular protocols in the market, thus earning money in a smarter way.

Amid the stablecoin boom, many have also noticed that Pendle's TVL composition is highly inclined towards stablecoins, with over 87% of the TVL denominated in stablecoins. When discussing his views on stablecoins, TN LEE candidly stated:

Currently, Pendle's primary focus is on stablecoins. If DeFi wants to continue to grow, it must connect with traditional finance. Stablecoins not only help DeFi develop more maturely but also serve as one of the few important bridges to connect with traditional finance. Currently, Pendle has launched over 100 stablecoin pools. After accelerating the community listing mechanism, Pendle also hopes to launch more stablecoin pools.

In this issue, let us follow TN LEE's sharing to deeply understand the products, market strategies behind Pendle's sustainable growth, and more of Pendle's next steps under the trend of accelerating integration between on-chain finance and traditional finance.

DeFi is maturing, and users increasingly need yield trading

Deep Tide TechFlow: It’s a pleasure to have the opportunity for an in-depth conversation with you. First, could you please introduce yourself briefly?

TN LEE:

Thank you for the visit, Deep Tide.

I am TN LEE, one of the co-founders of Pendle. My team and I founded the Pendle protocol in 2021.

Deep Tide TechFlow: How would you quickly explain what Pendle does in one sentence to a three-year-old or an eighty-year-old?

TN LEE:

Pendle is the world's largest yield trading platform. Imagine you have a house; Pendle separates the "ownership of the house (the principal)" from the "future rent (the yield)." You can choose to hold the house (the principal part) or turn the future rent (the yield) into a contract to rent it out to others for cash, or conversely, buy someone else's rent to earn yield.

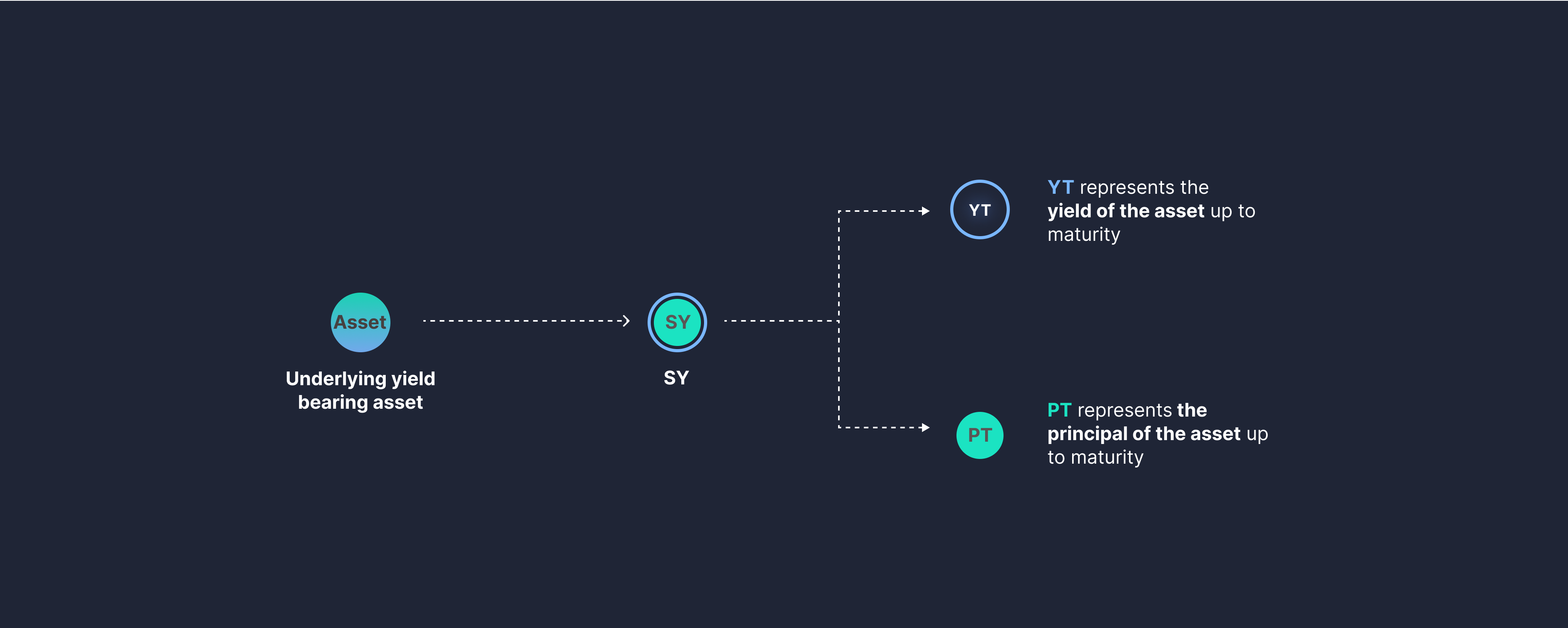

This is how Pendle works — it splits assets into PT (Principal Token) and YT (Yield Token), allowing users to participate in the most popular protocols in the market in a way that suits their investment style.

Deep Tide TechFlow: In the space where Pendle operates, there have not been many competitors. What do you think is the reason for this? For ordinary users, there is indeed a certain understanding threshold in the yield trading market, but Pendle has still developed into the TVL leader (according to DeFi Llama data). From a product design perspective, what do you think Pendle has done right?

TN LEE:

First of all, we have always maintained great confidence in the yield trading space. In traditional finance, almost 100% of yields can be traded, but in DeFi, it's only about 3%. This space may have been overlooked by many before, but as DeFi gradually enters a more mature stage, users will increasingly need more mature and reliable investment tools, strategies that align with individual investment styles, and more flexible and diverse choices.

Rome wasn't built in a day, and Pendle didn't succeed overnight. Moving yield trading to DeFi also requires very sophisticated and efficient product design to better apply this concept. Before the familiar Pendle V2, Pendle also went through a trial-and-error phase.

Since founding Pendle in 2021, we have been working hard to optimize our products and protocols. The team has always maintained a "humble attitude towards the market" and a firm belief and passion for this space, striving to seize the best opportunities at the right time. The previous LRTs and points narrative gave us the first explosive growth opportunity.

Currently, Pendle has also accelerated the pace of community listings, further moving towards Permissionless, allowing users to participate in the yield trading of all good protocols in the market.

At the same time, we expect more protocols to participate in building the trading space, together raising the proportion of yield trading in DeFi to 10%, 20%, 50%, or even more.

Deep Tide TechFlow: On social media, you often see DeFi OGs praising Pendle, and many people say that most of those who can navigate Pendle are financial elites. How do you view this perspective? Why do you think people have this impression?

TN LEE:

Users with experience in traditional finance may understand Pendle more quickly, as yield trading is very common in traditional finance. However, the growth of DeFi also requires a certain process, especially in accepting a relatively new and unique trading model.

But good wine needs no bush, we have also put a lot of effort into community building and education.

At every stage of Pendle's growth, we have observed that more and more new users are willing to take the time to learn and think, investing in a more rational way.

At the same time, we will continue to optimize our products, develop new features, and continue to nurture our community, conducting more detailed user education work so that more people can enjoy the dividends brought by yield trading.

Yield is the core competitiveness, Pendle can achieve triple-digit APY

Deep Tide TechFlow: Based on what Pendle is doing, what is the core value that attracts users to participate?

TN LEE:

Yield.

I believe the strongest competitiveness of all protocols comes from strong and sustainable yields. Through the yield trading model, Pendle users can not only freely choose investment models that better suit their understanding and risk control but also utilize different strategies to optimize their final yields.

Deep Tide TechFlow: If someone is new to DeFi and has been exploring for less than a month, how would you suggest they take their first step in exploring Pendle? After completing the beginner's exploration, could you share what the highest yield in the Pendle ecosystem can currently reach? How can one achieve the highest yield?

TN LEE:

For beginners, seriously studying Pendle's educational materials before starting to invest is an important first step. After gradually familiarizing themselves with various operational processes, they can formulate the strategy that best suits their risk preferences and capital size.

In addition to the various official educational materials prepared by Pendle, there are also many impressive KOLs on Twitter who frequently share their investment insights: from the simplest fixed yield provided by PT, to providing liquidity to pools, to staking YT, and then to more advanced PT leverage cycling strategies, etc.

The highest yield in the Pendle ecosystem has evolved from the initial double digits to now achieving triple-digit APY through advanced strategies in different pools.

For users at different stages, the most important thing is, of course, to find the strategy that best suits their own investment preferences.

Focusing on stablecoins, Boros combines the advantages of CeFi and DeFi

Deep Tide TechFlow: Stablecoins have also been an important topic this year, and recently Pendle has been more active in collaborations around stablecoins. What are the strategic considerations behind this, and what are your plans?

TN LEE:

Following the success of Ethena, stablecoins have become one of the most popular and increasingly mature tracks in recent years.

Currently, Pendle has launched over 100 stablecoin pools. In the current volatile market environment, we also believe that the stablecoin track will be one of the most important narratives in this market cycle. This competitive track not only helps DeFi develop more maturely but also serves as one of the few important bridges to connect with traditional finance.

Pendle, as the world's largest yield trading platform, allows users to freely participate in yield trading of the most popular protocols in the market, enabling them to earn money in a smarter way.

Currently, after accelerating the community listing mechanism, we also hope to launch more stablecoin pools in a more efficient manner.

Deep Tide TechFlow: We know that Pendle's explosive growth is closely related to the Restaking boom at that time. As we enter a new cycle, what do you think will be the next opportunity to drive Pendle's explosive growth? In the current market environment, more and more people and teams are focusing on on-chain activities. In your view, as a crypto finance project, what preparations should be made to seize the opportunity for institutions to go on-chain? What new industry landscape changes do you foresee under this trend?

TN LEE:

Currently, the track we are most focused on is stablecoins.

The market is difficult to predict, but our team is always attentive to the trends of every narrative.

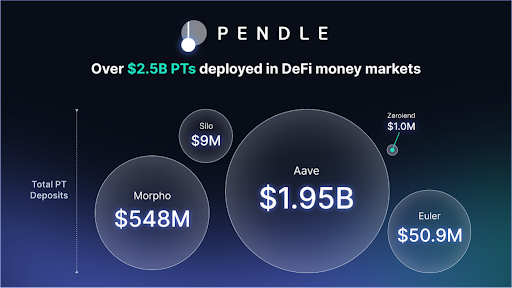

Regarding institutional connections, one of the key tasks in Pendle's 2025 Roadmap is the layout of the Citadels initiative. This work includes our development plan for Pendle PT as the most robust fixed-income product. Currently, Pendle PT has reached an ATH of $2.5 billion across major lending ecosystems, and we are actively developing more institutional products to allow different types of institutional investors to participate.

We believe that if DeFi wants to continue to grow, it must connect with traditional finance, and the entry of institutions has raised higher demands for various DeFi protocols and products, from capital depth to security and compliance, all of which are necessary preparations for each protocol's next steps.

Deep Tide TechFlow: I heard that Boros is currently in a small-scale testing phase. What kind of product is it?

TN LEE:

In simple terms, Boros, like Pendle, is a yield trading product.

The biggest reform brought by Boros is the combination of the advantages of CeFi and DeFi, unlocking and utilizing funding rates as a source of yield, providing users with a trading platform. The fluctuations and reliability of funding rates also make it one of the largest sources of yield in crypto.

Boros will also be a simpler and more understandable product. In simple terms: if users believe that funding rates will rise, they can go long; conversely, they can go short.

We are currently in the final stages of smart contract auditing and internal testing, hoping to open it up to more users soon.

Behind the growth: Firm belief in DeFi, maintaining a sense of hunger, and enhancing adaptability

Deep Tide TechFlow: From the perspective of macroeconomics such as tariffs and interest rate cuts, do you have concerns about the future development of DeFi, or are you more confident? What keeps you committed to building in the industry?

TN LEE:

I have always had faith in DeFi.

During this period of market and political turbulence, we certainly need to be more cautious, but my team and I firmly believe that yield trading is a very important track for the future development of DeFi, and we have great expectations for future growth.

DeFi has always had various narratives; shiny things come and go. I believe that as long as our PMF (Product-Market Fit) is right, and as long as we maintain a proactive pace and respect for the market, Pendle will continue to grow steadily.

Anxiety cannot change market trends; all we can do is to work diligently, adjust our mindset flexibly, and actively respond to every challenge ahead.

Deep Tide TechFlow: Sometimes, I hear friends who have known Pendle for a long time say that it has not been easy to get to where you are today. You have faced many difficulties but have persisted, leading to your current brilliance. Could you share some of the challenges Pendle has faced during its development and your thoughts at different stages?

TN LEE:

Indeed, from the initial creation of Pendle in 2021 to today, we have encountered many trials. We also know that a protocol's growth requires considering and solving different challenges at different stages: from the survival game of a new protocol to how a mature protocol maintains excellent performance, we cannot relax for a moment. During Pendle's toughest times, I sometimes wondered how we managed to get through those years, especially during exceptionally harsh market conditions.

Now, the cost of creating a protocol is getting lower, and almost anyone can start a company to create a protocol. However, when facing difficulties, the ability to solve problems is more important; not everyone can persist and survive. Sometimes, it’s not about how complex the difficulties are, but how to adjust one’s mindset to face challenges head-on during hardships.

Pendle has always maintained a lean team model, being very frugal with company expenses to ensure we have enough funds to continue supporting our future growth.

Deep Tide TechFlow: As a DeFi OG and an entrepreneur who has been steadfast in building in the industry, what do you think are the most important qualities for starting a business in the crypto industry?

TN LEE:

Perseverance.

When Pendle first launched in 2021, we did not immediately find our product PMF. We continued to spend over two years until Pendle V2 truly gained traction in the early stages of LST. But beyond personal qualities, I believe the key to entrepreneurship is to deeply embed this spirit into the DNA of the entire team — the team must maintain a sense of hunger, pursue excellence, and work collaboratively towards a common mission. Only in this way can we continue to be unstoppable.

Another quality that is particularly important in the crypto industry is adaptability. This industry develops rapidly, with its own unique rules, rhythms, and culture. Being able to quickly change direction, whether optimizing products based on current narratives or adjusting market strategies to appeal to crypto-native users, these seemingly small actions often determine success or failure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。