Unlike the past, which mainly relied on retail investors, the current round of price increases is characterized by structural inflows of institutional funds.

Written by: Bao Yilong, Wall Street Insights

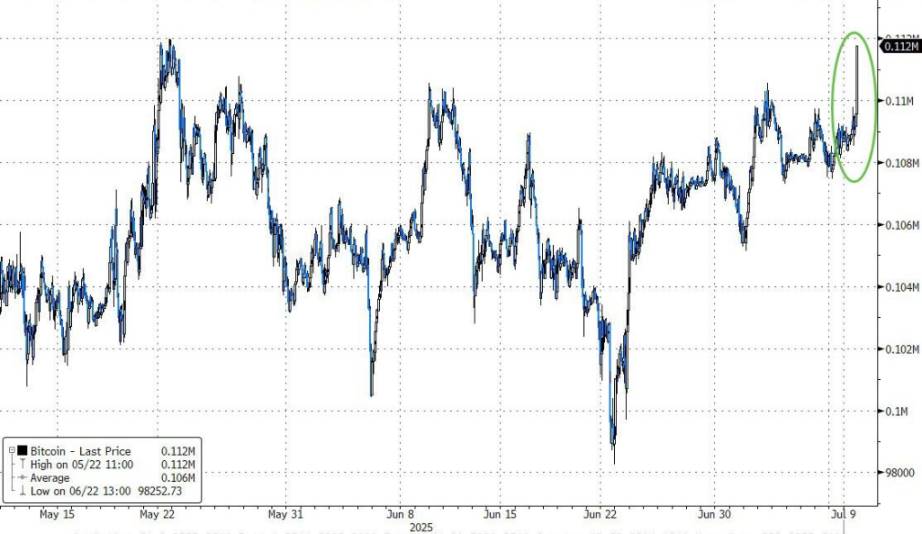

Bitcoin's price has first broken through $112,000, setting a new historical high. This milestone reflects the current market's heightened speculative sentiment, with institutional funds continuously flowing in, driving a comprehensive rise across the entire risk asset sector.

On July 9, during the late trading hours in New York, Bitcoin's price suddenly surged, breaking through the $110,000 mark and the May 22 high, reaching a peak of $112,009, an increase of 3.1%, bringing its cumulative increase this year close to 20%.

Analysts believe that the demand for traditional financial instruments like ETFs is reshaping the Bitcoin market landscape. Unlike previous cycles that primarily relied on retail investors, the current round of price increases is characterized by structural inflows of institutional funds. Data from cryptocurrency trading firm GSR shows that institutional investors are continuously buying Bitcoin through various financial instruments, and this demand pattern is more stable compared to historical speculative buying.

Adam Guren, Chief Investment Officer of Hunting Hill, pointed out that Bitcoin's breakthrough of $112,000 reflects a compound effect of ETF inflows, rising institutional adoption, and a favorable macro environment:

Unlike previous cycles, the current demand is structural, regulated, and sticky.

Short-term options show optimistic sentiment, with macro environment providing support

Derivatives market data further confirms the market's optimistic expectations.

On cryptocurrency exchanges, call options expiring at the end of July show high open interest at strike prices of $115,000 and $120,000.

Vincent Liu, Chief Investment Officer of a cryptocurrency trading firm, stated that traders should remain vigilant about potential profit-taking or macroeconomic changes, as these factors could trigger a pullback, but the current trend remains decisively bullish.

Additionally, according to media reports, the current macroeconomic environment provides favorable conditions for risk assets like Bitcoin. The rise in global political instability, coupled with a renewed market expectation for interest rate cuts, has prompted investors to seek hard asset allocations.

Analysts point out that Bitcoin is benefiting from two dimensions: it is gaining a safe-haven asset positioning similar to gold, while also enjoying the momentum brought by rising risk appetite. This dual attribute makes it stand out in the current market environment.

Despite the Trump administration announcing a new round of tariff measures, speculative sentiment continues to dominate the market. Nvidia briefly surpassed a $4 trillion market cap, and technology stocks generally rose, creating a favorable market atmosphere for risk assets, including Bitcoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。