Markets Push Back as Trump Pressures Fed Rate Cut up to 3%

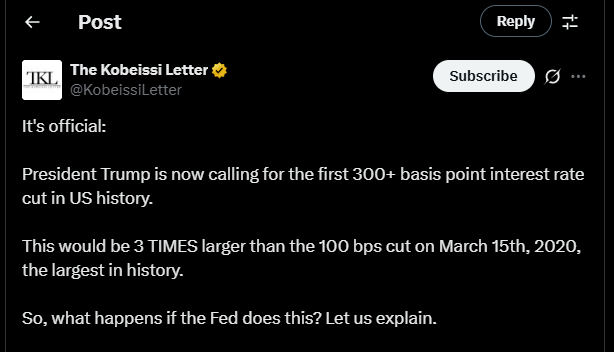

President Trump now is requesting the largest interest fee reduction in American history — an enormous 300 basis point reduction.

The biggest price reduction the Federal Reserve has ever initiated was 100 basis points (1%) on March 15, 2020, in the COVID-19 crisis.Trump is requesting a slash three times larger than that. So, what would happen if the Fed rate cut actually does make action? Here's what it would mean in simple terms.

Trump Demands Massive 3% Fed rate cut for Better Economy

President Donald Trump is calling on the Federal Reserve to cut rates of interest by 3%, lowering them from their present 4.25% - 4.50% to about 1.25% - 1.50%. The charge that the U.S. has not experienced in three years. He thinks this is an essential measure to stimulate the economy and reduce the financial strain.

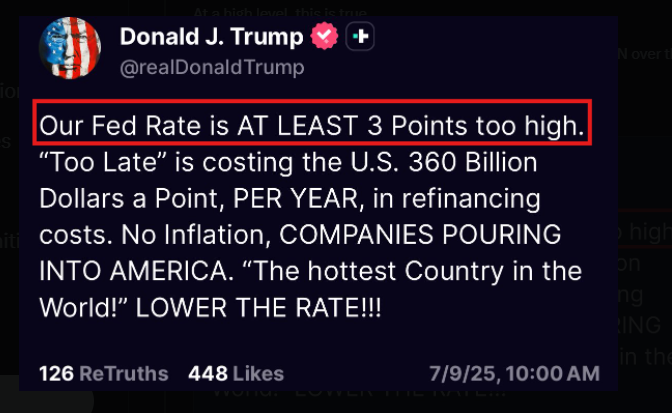

Trump Claims U.S. Is Losing Nearly $1 Trillion a Year Due to High Rates

Trump criticized Powell by saying that the reluctance in Fed rate cut is imposing a huge burden on the U.S. economy, deducting almost $1 trillion annually. He mentioned the growing burden of high interest costs and decelerating investments as important factors in the loss. In his view, each 1% rise in interest generates around $360

billion in extra expenses involved in refinancing every year, putting additional pressure on the Reserve's Chairman Jerome Powell to act quickly.

Source: X

Trump Uses CEA Report to Refute Tariff-Inflation Claims

While the Fed Chair pointed out the risks of Trump's ongoing and proposed tariffs on countries such as Japan and South Korea, Trump pushed back against Powell’s inflation concerns by citing a Council of Economic Adviser (CEA) report, claiming it shows that tariffs are not to blame for rising prices. Instead , he pointed to the monetary policy missteps as the real issue.

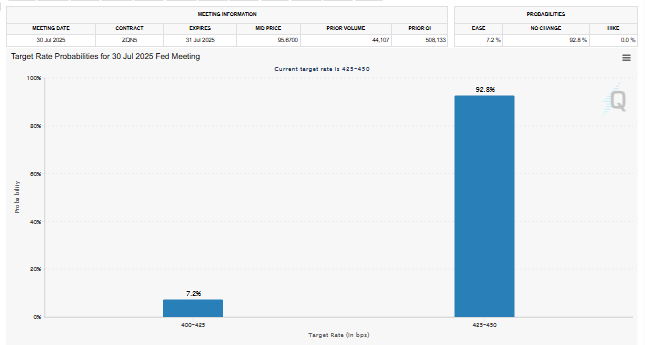

Markets Expect No Major Move in July Despite Trump Pressure

Despite cooling inflation and steady capital inflows, there is unlikely to happen major ups and downs in Fed rate cut policy in July , especially after strong job numbers and ongoing concerns about inflation. Flow seems steady ahead of this month’s FOMC meeting in spite of Trump's demand.

According to the FedWatch, the chart portrays the various probabilities regarding the rates in the U.S. Federal Reserve scheduled for the meeting on 30 July 2025. It has a very strong possibility (92.8%) that the Central Bank will hold interest rates steady from the then-current target range of 425–450 BPS.

A relative percentage (7.20%) of the market is expecting it to be reduced to 400–425 BPS. This implies that the market consensus is overwhelming in suggesting its sustainability in the present monetary policy position for this upcoming meeting. If the Board holds at 4.25-4.50%, then the crypto market would suffer a lot.

Source: cmegroup

Bitcoin: Leading the Way

While the reserve holds its ground despite Trump's Fed rate cut demand, Bitcoin seems to be one step ahead. Today Bitcoin hit an all life time high near $11,936. As investors try to anticipate what’s next for interest percentages, government spending, and the broader economy. Many in the crypto space believe that Bitcoin is already pricing it all in, reflecting confidence that the market understands the bigger picture, even before the Fed rate cut approaches.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。