Crypto Market Update: Bitcoin Hits ATH, GMX Hacked, Trump Targets Fed

Today was a big day for the crypto world. From new record highs for Bitcoin to a massive exchange hack and pre-launch trading excitement, a lot happened in just 24 hours. Political pressure, global tariffs, and new trading tools all played a part. Let’s break down the top stories that moved the crypto markets today.

The crypto market cap stands at $3.47 Trillion with an increase of 3% within the last 24 hours. Trading volume increased by 42%.

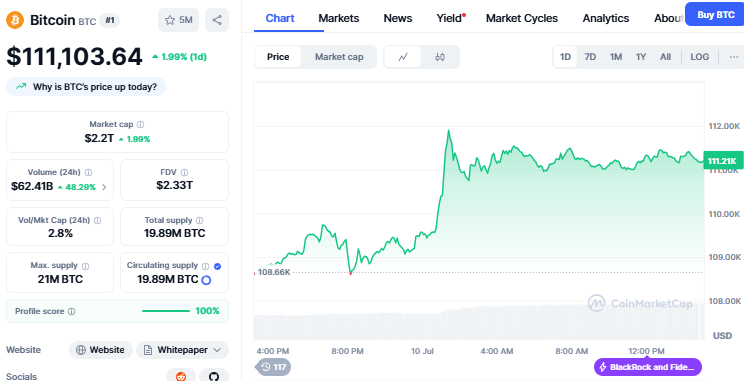

Bitcoin Hits All-Time High After Fed Rate Cut Hints

Bitcoin surged to a new high of nearly $112,000 following the U.S. Federal Reserve release of its most recent FOMC meeting minutes. The Fed indicated it will not reduce interest rates as of now, but some minor cuts will later follow in 2025. Even the possibility of lower rates prompted traders to be more optimistic, causing Bitcoin to surge past its previous record. Despite international tensions escalating, crypto's long-term prospects look good.

Source: CoinMarketCap

New Trump Tariffs Threats Put Crypto in the Spotlight

President Trump has issued tariff threats to more than 30 nations, including Japan, Brazil, and Indonesia. The new trade threats jolted the world's markets. But while conventional finance frets, crypto is attracting attention as a more secure alternative. Some analysts assume that trade tensions would increase the use of Bitcoin, particularly in nations targeted by U.S. policy. With an August 1 deadline looming, the price strength of Bitcoin demonstrates increasing confidence in decentralized systems.

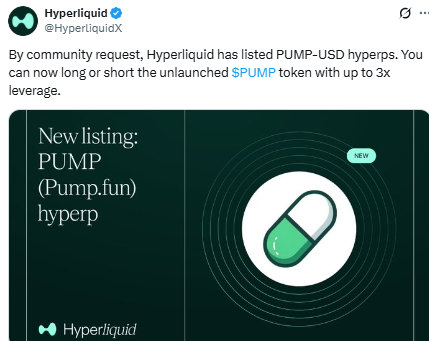

Hyperliquid Opens PUMP Token Pre-Listing Trading

Decentralized derivatives platform Hyperliquid recently opened trading on USD-PUMP hyperps. These new instruments allow users to trade the PUMP token ahead of its official July 12 debut. You can trade with a maximum 3x leverage, and you trade on an 8-hour moving average, not external oracles. Early trading had robust demand with prices briefly spiking. But there's risk as well, such as low liquidity and abrupt price fluctuations. After PUMP is listed on a centralized exchange, the hyperp will become a standard perpetual contract.

Source: Hyperliquid

GMX Exchange Hacked for $42 Million, Market Reacts

GMX Exchange was hit with a huge $42 million hack from its GLP pool on Arbitrum and Avalanche. The attacker utilized Tornado Cash and Circle's CCTP to transfer stolen funds, causing panic. GMX promptly suspended trading and put out a 10% bounty to retrieve the assets. Tokens such as WETH, WBTC, and USDC were some of the stolen assets. The hack made the GMX token fall by more than 10% and raised new fears about DeFi security in 2025.

Source: Wu Blockchain

Trump Urges Historic 3% Rate Reduction as Bitcoin Surges

President Trump is calling for a 3% cut from the Fed, the largest in U.S. history to provide relief to the economy. He attributes the nation's financial stress to high rates, not tariffs. Although the market does not anticipate the Fed acting at the July 30 meeting, Trump's request generated headlines. Meanwhile, Bitcoin reached another record around $119,360, demonstrating how investors are turning towards crypto as faith in traditional systems erodes.

Source: The Kobeissi Letter

Conclusion

The cryptocurrency market is responding quickly to political actions, economic indicators, and security threats. Bitcoin's all-time highs indicate that investors have faith in its resilience, no matter how volatile the markets are. Hacks such as the GMX hack serve as a reminder that security still requires significant improvements. At the same time, initiatives such as Hyperliquid are experimenting with new means of trading yet-to-launch tokens.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。